Americas Gold and Silver Corporation (TSX: USA) (NYSE American:

USAS) (“Americas” or the “Company”) is pleased to announce that it

has closed the acquisition of the remaining 40% interest in the

Galena Complex (“Galena”) in Idaho, USA (the “Transaction”) from an

affiliate of Eric Sprott ("Sprott").

Pursuant to the Transaction, shareholders of Sprott affiliates

received an aggregate of 169,999,998 common shares of the Company.

In addition, Americas paid US$10 million in cash and will provide

monthly silver deliveries of 18,500 ounces for a period of 36

months starting in January 2026 to affiliate of Sprott.

As part of the Transaction, the Company issued an aggregate of

294,999,998 shares of the Company to various parties, including

pursuant to the exchange of 125,000,000 subscription receipts (the

“Subscription Receipts”) for common shares of the Company, which

were issued on a private placement basis on October 30, 2024 for

gross proceeds of C$50 million, a portion of which was used to fund

the cash purchase price of US$10 million payable pursuant to the

Transaction. Each Subscription Receipt was automatically exchanged

in accordance with their terms, without payment of additional

consideration and without further action on the part of the holders

thereof, for one common share in the capital of the Company. The

common shares issued pursuant to the Transaction are subject to a

four-month hold period under applicable Canadian securities

laws.

“I would like to thank our shareholders for supporting the

acquisition of the remaining 40% interest in the Galena Complex. We

are very excited about the transaction as it consolidates an asset

with a tremendous team and resource base and positions the Company

to benefit in an anticipated strong silver price environment," said

Paul Andre Huet, Americas’ Chairman and Chief Executive Officer.

“With the proceeds of the private placement and the anticipated

restructuring of our existing debt obligations, I am extremely

excited for the shareholders of Americas moving forward.”

"I would like to sincerely thank outgoing Chairman Alex Davidson

and the other retiring Americas board members including Alan

Edwards, Manuel Rivera and Christine Carson for their numerous

contributions to the Company over the years; without their support,

it would have been difficult to get to the closing of this exciting

transaction," stated Darren Blasutti, Americas’ President.

Updated Governance

In connection with the Transaction, the Company’s board of

directors was reconstituted to consist of 50% new directors and 50%

existing directors of Americas. Joining the Americas board of

directors is Paul Huet (Chairman & CEO), Scott Hand (Lead

Director) and Peter Goudie (Director), who will be joined by

existing directors Gordon Pridham (Director), Brad Kipp (Director)

and Lorie Waisberg (Director). The Company’s board of directors now

consists of:

- Paul Huet (Chairman & CEO)

- Scott Hand (Lead Director)

- Peter Goudie

- Gordon Pridham

- Brad Kipp

- Lorie Waisberg

Early Warning Disclosure

Mr. Eric Sprott indirectly acquired beneficial ownership of an

aggregate of 117,441,759 common shares of the Company (the

“Acquired Shares”) at C$0.52 per Acquired Share pursuant to the

Transaction. The Acquired Shares represent approximately C$61.07

million in share consideration. Immediately prior to giving effect

to the Transaction, Mr. Sprott had beneficial ownership of, or

control or direction over, 2,818,090 common shares of the Company,

representing approximately 0.9% of the then issued and outstanding

common shares. After giving effect to the Transaction, Mr. Sprott

beneficially owns, or exercises control or direction over,

120,259,849 common shares of the Company, representing

approximately 20.3% of the issued and outstanding common shares of

the Company.

Mr. Sprott acquired the Acquired Shares for investment purposes

and in partial satisfaction of the purchase price payable by the

Company pursuant to the Transaction. Mr. Sprott has a long-term

view of the investment and may acquire additional securities of the

Company, including on the open market or through private

acquisitions, or sell securities of the Company, including on the

open market or through private dispositions, in the future subject

to resale restrictions, market conditions, reformulation of plans

and/or other relevant factors.

A copy of Mr. Sprott’s early warning report will appear on the

Company’s profile on SEDAR+ and may also be obtained by calling Mr.

Sprott’s office at (416) 945-3294 (7 King Street East, Suite 1106,

Toronto, Ontario, M5C 3C5).

Advisors

Edgehill Advisory Ltd. and TD Securities Inc. acted as financial

advisors to Americas, and Torys LLP acted as legal counsel to

Americas in connection with the Transaction.

Cormark Securities Inc. acted as financial advisor to Sprott,

and Bennett Jones LLP acted as legal counsel to Sprott in

connection with the Transaction.

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high-growth precious

metals mining company with multiple assets in North America. The

Company owns and operates the Galena Complex in Idaho, USA and the

Cosalá Operations in Sinaloa, Mexico, and is re-evaluating the

Relief Canyon mine in Nevada, USA. The Company also owns the San

Felipe development project in Sonora, Mexico. For further

information, please see SEDAR+ or www.americas-gold.com.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within

the meaning of applicable securities laws. Often, but not always,

forward-looking information can be identified by forward-looking

words such as “anticipate”, “believe”, “expect”, “goal”, “plan”,

“intend”, “potential’, “estimate”, “may”, “assume” and “will” or

similar words suggesting future outcomes, or other expectations,

beliefs, plans, objectives, assumptions, intentions, or statements

about future events or performance. Forward-looking information

includes, but is not limited to: the silver price environment; the

anticipated restructuring of existing debt obligations; use of

proceeds from the private placement; the Company’s prospects; and

Mr. Sprott’s intentions with respect to his investment in the

securities of the Company. Any guidance or outlook contained in

this press release was prepared based on current mine plan

assumptions with respect to production, development, costs and

capital expenditures, the metal price assumptions disclosed herein

(if any), and assumes no further adverse impacts to the Cosalá

Operations from blockades or work stoppages, and completion of the

shaft repair and shaft rehab work at the Galena Complex on its

expected schedule and budget and the realization of the anticipated

benefits therefrom, and is subject to the risks and uncertainties

outlined below. The ability to maintain cash flow positive

production at the Cosalá Operations, which includes the EC120

Project, through meeting production targets and at the Galena

Complex through implementing the Galena Recapitalization Plan,

including the completion of the Galena shaft repair and shaft rehab

work on its expected schedule and budget, allowing the Company to

generate sufficient operating cash flows while facing market

fluctuations in commodity prices and inflationary pressures, are

significant judgments in the consolidated financial statements with

respect to the Company’s liquidity. Should the Company experience

negative operating cash flows in future periods, the Company may

need to raise additional funds through the issuance of equity or

debt securities. Forward-looking information is based on the

opinions and estimates of Americas as of the date such information

is provided and is subject to known and unknown risks,

uncertainties, and other factors that may cause the actual results,

level of activity, performance, or achievements of Americas to be

materially different from those expressed or implied by such

forward-looking information. With respect to the business of

Americas, these risks and uncertainties include risks relating to:

widespread epidemics or pandemic outbreak; actions that have been

and may be taken by governmental authorities to contain such

epidemic or pandemic or to treat its impact and/or the

availability, effectiveness and use of treatments and vaccines

(including the effectiveness of boosters); interpretations or

reinterpretations of geologic information; unfavorable exploration

results; inability to obtain permits required for future

exploration, development or production; general economic conditions

and conditions affecting the industries in which the Company

operates; the uncertainty of regulatory requirements and approvals;

potential litigation; fluctuating mineral and commodity prices; the

ability to obtain necessary future financing on acceptable terms or

at all; the ability to operate the Company’s projects; risks

associated with the implementation of the Transaction and that the

Company may not realize the anticipated benefits; and risks

associated with the mining industry such as economic factors

(including future commodity prices, currency fluctuations and

energy prices), ground conditions, illegal blockades and other

factors limiting mine access or regular operations without

interruption, failure of plant, equipment, processes and

transportation services to operate as anticipated, environmental

risks, government regulation, actual results of current exploration

and production activities, possible variations in ore grade or

recovery rates, permitting timelines, capital and construction

expenditures, reclamation activities, labor relations or

disruptions, social and political developments, risks associated

with generally elevated inflation and inflationary pressures, risks

related to changing global economic conditions, and market

volatility, risks relating to geopolitical instability, political

unrest, war, and other global conflicts may result in adverse

effects on macroeconomic conditions including volatility in

financial markets, adverse changes in trade policies, inflation,

supply chain disruptions and other risks of the mining industry.

Although the Company has attempted to identify important factors

that could cause actual results to differ materially from those

contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated, or

intended. Readers are cautioned not to place undue reliance on such

information. Additional information regarding the factors that may

cause actual results to differ materially from this forward‐looking

information is available in Americas’ filings with the Canadian

Securities Administrators on SEDAR+ and with the United States

Securities and Exchange Commission. Americas does not undertake any

obligation to update publicly or otherwise revise any

forward-looking information whether as a result of new information,

future events or other such factors which affect this information,

except as required by law. Americas does not give any assurance (1)

that Americas will achieve its expectations, including regarding

realizing the benefits of the Transaction, or (2) concerning the

result or timing thereof. All subsequent written and oral

forward‐looking information concerning Americas are expressly

qualified in their entirety by the cautionary statements above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241219797101/en/

For more information: Stefan Axell VP, Corporate

Development & Communications Americas Gold and Silver

Corporation 416-874-1708

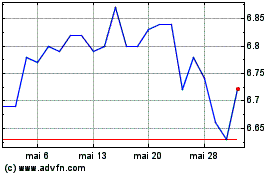

Liberty All Star Equity (NYSE:USA)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Liberty All Star Equity (NYSE:USA)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025