- Over 90 patients have received the Aeson® artificial heart

since the first implant in 2013, including 42 in 2024.

- 2024 Sales of €7 million (a 2.5-fold increase vs 2023).

- Cash burn reduced by over 20% vs 2023.

- 50 hospitals trained in Aeson® implants internationally1.

- Successful first “Aeson® User Meeting” and increasing

engagement from trained hospitals, supporting the anticipation of a

strong implants momentum in 2025.

- CARMAT expects to at least double its sales in 2025.

Webinar in English tonight at 8 pm CET.

To participate, please register by clicking on this

link

Regulatory News:

CARMAT (FR0010907956, ALCAR), designer and developer of the

world’s most advanced total artificial heart, aiming to provide a

therapeutic alternative for people suffering from advanced

biventricular heart failure (the “Company” or

“CARMAT”), announces its 2024 annual sales2 and provides an

update on its development outlook.

Stéphane Piat, Chief Executive Officer of CARMAT, stated:

“With 42 implants of our Aeson® artificial heart and €7 million in

sales, i.e. 2.5 times higher than in 2023, we delivered a very

solid commercial performance in 2024, while reducing our cash burn

by over 20%.

All our operational indicators are trending positively,

reflecting increasing interest and growing adoption of our therapy

by hospitals: 60 centers are now trained on Aeson®, including 50

internationally for commercial implants, 43% of them have already

performed at least one implant, and among those, six have performed

at least four implants. In 2024, Aeson® was sold in four European

countries, namely Germany, Italy, Spain, and Poland - and, of

course, in France as part of the EFICAS study.

The first “User Meeting” we organized in November 2024, which

brought together nearly 100 experts in cardiology to share their

experience with Aeson®, was a tremendous success. It should prompt

many European hospitals to either take the step of performing a

first implant of our artificial heart or integrate it more broadly

into their clinical practice.

All this, combined with the strong momentum in our EFICAS study

in France, makes us optimistic about the future trajectory of our

implants, and allows us to anticipate doubling our sales in 2025,

at the very least.

A well-structured supply chain, calibrated to meet the demand,

distribution agreements already in place in nine countries, a

“field” team providing best-in-class support to hospitals, and key

scientific publications on Aeson® outcomes planned in 2025, will

support this momentum. We are therefore very well-positioned to

continue and accelerate our development in the coming months and

progressively establish Aeson® as a benchmark in the treatment of

advanced heart failure.”

Strong commercial performance in 2024 with 42 Aeson® implants

and sales multiplied by 2.5

The Company’s 2024 sales amount to €7 million, corresponding to

the sale of 42 Aeson® hearts, including 17 in a commercial set-up

(in Germany, Italy, Spain, and Poland) and 25 as part of the EFICAS

clinical study in France.

This performance represents a 2.5-fold increase in Aeson®

implants and sales vs 2023.

CARMAT’s activity showed strong momentum throughout the year,

with a monthly average number of implants of 3.5, rising to nearly

5 over the last four months of the year.

Continued strong recruitment momentum in the EFICAS

study

By the end of 2024, nearly 70% of the planned recruitments in

this study had been completed.

CARMAT anticipates completing EFICAS enrolment (i.e. a total of

52 patients) in the first half of 2025, paving the way for the

publication of its results3 at the end of 2025.

As a reminder, the EFICAS study is the largest study ever

initiated by CARMAT. It is key to facilitate a broader commercial

deployment of Aeson® (“evidence-based medicine”) and obtain its

reimbursement in France; and in order to secure the authorization

to market Aeson® in the United States (“PMA”), which the Company

anticipates in 2027-20284.

The EFICAS study is currently being conducted in 10 hospitals in

France5, among which 2 have already performed 7 implants each,

demonstrating a high level of satisfaction with the therapy among

healthcare professionals.

Increasing number and activity by hospitals trained in Aeson®

implants

At the end of 2024, 60 hospitals were trained in Aeson®

implants, including:

- 50 for commercial6 implants in Europe,

Israel and Saudi Arabia (+17 vs 2023), - 10 in France as part of

the EFICAS study (+2 vs 2023).

Among these trained centers7:

- 43% have performed at least one Aeson®

implant (compared to 30% at end-2023), - 27% have already performed

several implants (compared to 15% at end-2023), and - 6 hospitals

have performed 4 or more implants.

The positive evolution of these indicators reflects the growing

interest of hospitals in Aeson®, as well as their increasing

inclination, once trained, to carry out a first implant and then to

adopt the therapy by performing additional ones.

CARMAT anticipates the acceleration of this trend, as supported

by the results of a survey conducted by the Company among the 41

hospitals represented at the first “Aeson® European User Meeting8”

in late November 2024, indicating that 100% of them intend to

perform at least one implant in 2025, with 70% planning to perform

several implants.

Further geographical expansion

In 2024, Aeson® implants were performed in 5 countries (+2 vs

2023), namely Germany, Italy, Spain, and Poland in a commercial

set-up, and France as part of the EFICAS study.

In Europe, Germany is the largest market targeted commercially

by CARMAT. The Company also aims to establish significant recurring

activity in its three other active countries (Italy, Spain and

Poland), and to initiate commercial implants in additional

countries in Europe and the Middle East, where centers are already

trained.

To this end, distribution contracts are in place to facilitate

future sales in 9 countries (Poland, Switzerland, Greece, Israel,

Slovenia, Croatia, Bosnia, Serbia, and North Macedonia).

CARMAT will continue to rely on a hybrid commercial approach,

combining direct sales in certain countries, and support from

distributors in others, when this latter model is deemed more

appropriate.

Strong added-value services provided to hospitals in terms of

clinical support and funding of the therapy

Building on a commercial and clinical organization scaled to

support the growth in implants, CARMAT provides hospitals with

best-in-class training, clinical support before, during, and after

implantation, and also assist them in securing funding or

reimbursement for the therapy.

During the fourth quarter of 2024, CARMAT’s “field” team was

able to successfully support four implants in a single week, and

two implants in a single day.

All commercial implants of Aeson® have been appropriately

funded, either through standard public and/or private reimbursement

mechanisms specific to each country or region, or through specific

funding dedicated to innovation.

Reduction of more than 20% in cash burn9 associated to

operations and investment

In line with its objective, CARMAT reduced its operating and

investment cash burn by more than 20% in 2024 compared to 2023,

achieving an average monthly cash burn of less than €3.8 million

during the year.

The Company intends to carry-on with this reduction in 2025 and

beyond.

Outlook

Based on these promising results and indicators, as well as

feedback gathered during the first “Aeson® European User Meeting”,

CARMAT anticipates significant growth in Aeson® implants in 2025,

driven particularly by the combined effect of more trained

hospitals taking the step of performing their first implant, and an

increase in the average number of implants by centers having a

recurring activity.

The Company believes that this momentum will be further

strengthened by the publication, in the first quarter of 2025, of

the results of the clinical experience with Aeson® in patients

previously supported by ECMO10, and later in the year, by the

results of the EFICAS study.

CARMAT therefore expects to, at least, double its sales in 2025

compared to 2024.

As an indication, the Company estimates that its financial

breakeven can be achieved with circa 500 Aeson® implants per year.

This threshold is expected to be reached within a few years, based

on approximately 100 Aeson® “implanting” centers in Europe and the

Middle East, performing, on average, 5 implants a year.

The Company also continues to aim for the destination therapy

indication, which would enable patients to remain on long-term

Aeson® support without a subsequent heart transplant, as well as

for the commercial launch of Aeson® in the United States.

To this end, the Company plans, in 2025, to conduct the second

cohort of patients in its EFS11 study in the United States, and to

initiate a clinical study dedicated to patients not eligible for a

heart transplant, in Europe, in order to gain clinical experience

in destination therapy.

Based on its confirmed financial resources, CARMAT can fund its

activities until February 2025 and estimates its 12-month financial

needs in the range of €40 to €45 million. The Company is working

very actively to secure, in the short-term, additional financial

resources to extend its cash runway beyond February.

About CARMAT

CARMAT is a French MedTech that designs, manufactures and

markets the Aeson® artificial heart. The Company’s ambition is to

make Aeson® the first alternative to a heart transplant, and thus

provide a therapeutic solution to people suffering from end-stage

biventricular heart failure, who are facing a well-known shortfall

in available human grafts. The world’s first physiological

artificial heart that is highly hemocompatible, pulsatile and

self-regulated, Aeson® could save, every year, the lives of

thousands of patients waiting for a heart transplant. The device

offers patients quality of life and mobility thanks to its

ergonomic and portable external power supply system that is

continuously connected to the implanted prosthesis. Aeson® is

commercially available as a bridge to transplant in the European

Union and other countries that recognize CE marking. Aeson® is also

currently being assessed within the framework of an Early

Feasibility Study (EFS) in the United States. Founded in 2008,

CARMAT is based in the Paris region, with its head offices located

in Vélizy-Villacoublay and its production site in Bois-d’Arcy. The

Company can rely on the talent and expertise of a multidisciplinary

team of circa 200 highly specialized people. CARMAT is listed on

the Euronext Growth market in Paris (Ticker: ALCAR / ISIN code:

FR0010907956).

For more information, please go to www.carmatsa.com and follow

us on LinkedIn.

Name: CARMAT ISIN code:

FR0010907956 Ticker: ALCAR

Disclaimer

This press release and the information it contains do not

constitute an offer to sell or subscribe, or the solicitation of an

order to buy or subscribe, CARMAT shares in any country.

This press release may contain forward-looking statements about

the Company's objectives and prospects. These forward-looking

statements are based on the current estimates and expectations of

the Company's management and are subject to risk factors and

uncertainties, including those described in its universal

registration document filed with the Autorité des Marchés

Financiers (AMF) under number D.24-0374, as updated by an amendment

to the 2023 universal registration document filed with the AMF on

17 September 2024 under number D. 24-0374-A01 (together the ‘2023

Universal Registration Document’), and available on CARMAT's

website.

Readers' attention is particularly drawn to the fact that the

Company's current financing horizon is limited to February 2025 and

that, given its financing requirements and the dilutive instruments

in circulation, the Company's shareholders are likely to experience

significant dilution of their stake in the Company in the short

term. The Company is also subject to other risks and uncertainties,

such as the Company's ability to implement its strategy, the pace

of development of CARMAT's production and sales, the pace and

results of ongoing or planned clinical trials, technological

developments, changes in the competitive environment, regulatory

developments, industrial risks and all risks associated with

managing the Company's growth. The forward-looking statements

contained in this press release may not be achieved as a result of

these factors or other unknown risks and uncertainties or factors

that the Company does not currently consider material and

specific.

Aeson® is an active implantable medical device commercially

available in the European Union and other countries recognising the

CE mark. The Aeson® total artificial heart is intended to replace

the ventricles of the native heart and is indicated as a bridge to

transplant in patients with end-stage biventricular heart failure

(Intermacs classes 1-4) who cannot benefit from maximal medical

therapy or a left ventricular assist device (LVAD) and who are

likely to benefit from a heart transplant within 180 days of

implantation. The decision to implant and the surgical procedure

must be carried out by healthcare professionals trained by the

manufacturer. The documentation (clinician's manual, patient's

manual and alarm booklet) must be read carefully to learn about the

characteristics of Aeson® and the information required for patient

selection and proper use (contraindications, precautions, side

effects) of Aeson®. In the United States, Aeson® is currently only

available as part of a feasibility clinical trial approved by the

Food & Drug Administration (FDA).

_____________________________ 1 Excluding the United States,

where 9 hospitals are trained as part of the EFS (Early Feasibility

Study) clinical trial, and France, where 10 centers are taking part

in the EFICAS study. 2 Unaudited data. 3 Results on 52 patients.

The primary endpoint of the study is support with Aeson® at 6

months or transplantation within 6 months, without disabling

stroke. 4 Subject in particular to the successful completion of the

EFS study in the United States, second cohort of which is planned

in 2025. 5 AP-HP GHU Pitié Salpêtrière, Hôpital Européen Georges

Pompidou, CHU de Rennes, CHU de Strasbourg, Hospices Civils de

Lyon, CHRU de Lille, Hôpital Marie-Lannelongue, CHU de Montpellier,

CHU de Nantes and CHU de Dijon. 6 Of which 21 in Germany, 9 in

Italy, 4 in Poland, 2 in Spain, 2 in Switzerland, 2 in Saudi Arabia

and 1 in Israel. 7 Cumulative data. 8 For further details, please

refer to the press release issued by the Company on November 26,

2024. 9 Unaudited data. 10 ECMO = Extracorporeal Membrane

Oxygenation. 11 EFS – Early Feasibility Study

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250108496565/en/

CARMAT Stéphane Piat Chief Executive Officer

Pascale d’Arbonneau Chief Financial Officer Tel.: +33 1

39 45 64 50 contact@carmatsas.com

Alize RP Press Relations

Caroline Carmagnol Tel.: +33 6 64 18 99 59

carmat@alizerp.com

NewCap Financial Communication & Investor

Relations

Dusan Oresansky Jérémy Digel Tel.: +33 1 44 71 94

92 carmat@newcap.eu

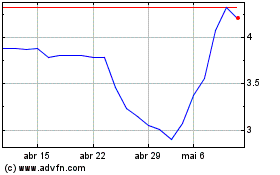

Carmat (EU:ALCAR)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Carmat (EU:ALCAR)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025