Teleperformance: Half-Year Liquidity Contract Statement

09 Janeiro 2025 - 2:29PM

Business Wire

Regulatory News:

Under the liquidity contract entered into between

Teleperformance (Paris:TEP) and Kepler Cheuvreux, the following

assets were booked to the liquidity account as of December 31,

2024:

- 135,320 shares - €2,727,430.01 in cash -

Number of executions on buy side over the semester: 5,658 - Number

of executions on sell side over the semester: 5,034 - Traded volume

on buy side over the semester: 557,695 shares for €53,548,599.57 -

Traded volume on sell side over the semester: 545,585 shares for

€52,970,943.39

It is reminded that, as of June 30, 2024, the following assets

were allocated to the liquidity account:

- 123,210 shares - €3,233,285.54 in cash -

Number of executions on buy side over the semester: 5,616 - Number

of executions on sell side over the semester: 5,151 - Traded volume

on buy side over the semester: 529,427 shares for € 57,186,535.39 -

Traded volume on sell side over the semester: 505,477 shares for €

54,872,708.31

It is also reminded that at the time of the implementation of

the contract, the following assets were allocated to the liquidity

account:

- 14,000 shares - €6,135,798.16 in cash

The implementation of this report is carried out in accordance

with AMF Decision N°2021-01 of June 22, 2021, renewing the

implementation of liquidity contracts for shares as an accepted

market practice.

About Teleperformance Group

Teleperformance (TEP – ISIN: FR0000051807 – Reuters: TEPRF.PA

- Bloomberg: TEP FP), is a global leader in digital business

services which consistently seeks to blend the best of advanced

technology with human empathy to deliver enhanced customer care

that is simpler, faster, and safer for the world’s biggest brands

and their customers. The Group’s comprehensive, AI-powered service

portfolio ranges from front-office customer care to back-office

functions, including operations consulting and high-value digital

transformation services. It also offers a range of specialized

services such as collections, interpreting and localization, visa

and consular services, and recruitment process outsourcing

services. The teams of multilingual, inspired, and passionate

experts and advisors, spread in close to 100 countries, as well as

the Group’s local presence allows it to be a force of good in

supporting communities, clients, and the environment. In 2023,

Teleperformance reported consolidated revenue of €8,345 million

(US$9 billion) and net profit of €602 million.

Teleperformance shares are traded on the Euronext Paris market,

Compartment A, and are eligible for the deferred settlement

service. They are included in the following indices: CAC 40, STOXX

600, S&P Europe 350, MSCI Global Standard and Euronext Tech

Leaders. In the area of corporate social responsibility,

Teleperformance shares are included in the CAC 40 ESG since

September 2022, the Euronext Vigeo Euro 120 index since 2015, the

MSCI Europe ESG Leaders index since 2019, the FTSE4Good index since

2018 and the S&P Global 1200 ESG index since 2017.

For more information: www.teleperformance.com

Buy Side

Sell Side

Number of executions

Number of shares

Traded volume in EUR

Number of executions

Number of shares

Traded volume in EUR

Total

5 658

557 695

53 548 599,57

5 034

545 585

52 970 943,39

07/01/2024

15

1 601

163 446,09

108

11 700

1 203 930,00

07/02/2024

8

1 000

106 240,00

60

8 200

874 858,00

07/03/2024

-

-

-

48

5 800

639 160,00

07/04/2024

33

3 694

416 720,14

42

4 800

543 312,00

07/05/2024

46

3 756

427 808,40

30

3 000

343 710,00

07/08/2024

92

5 876

641 306,64

-

-

-

07/09/2024

52

6 000

638 400,00

2

400

43 280,00

07/10/2024

-

-

-

52

4 400

475 860,00

07/11/2024

17

1 600

172 608,00

55

7 400

814 666,00

07/12/2024

7

800

88 704,00

23

2 214

247 436,64

07/15/2024

26

2 470

276 244,80

19

2 986

335 745,84

07/16/2024

66

4 930

548 659,70

57

6 035

674 833,70

07/17/2024

118

10 600

1 138 334,00

3

400

44 840,00

07/18/2024

55

7 200

755 496,00

67

7 004

754 681,00

07/19/2024

71

6 800

712 708,00

18

1 834

192 918,46

07/22/2024

3

400

42 412,00

63

4 812

510 649,44

07/23/2024

47

5 400

567 810,00

15

1 600

169 440,00

07/24/2024

48

3 200

330 720,00

15

2 600

270 114,00

07/25/2024

30

3 600

364 464,00

22

3 000

305 610,00

07/26/2024

4

800

83 120,00

38

5 000

522 600,00

07/29/2024

19

2 000

212 440,00

38

3 800

406 030,00

07/30/2024

3

200

21 400,00

46

3 600

387 828,00

07/31/2024

-

-

-

62

8 400

973 224,00

08/01/2024

33

1 950

225 166,50

17

2 000

233 580,00

08/02/2024

40

3 600

404 172,00

-

-

-

08/05/2024

115

10 000

1 043 400,00

4

400

41 800,00

08/06/2024

38

4 400

449 240,00

18

1 406

146 659,86

08/07/2024

2

200

20 280,00

33

5 194

544 746,72

08/08/2024

77

6 600

670 098,00

3

200

20 680,00

08/09/2024

14

2 000

203 300,00

50

4 500

461 700,00

08/12/2024

36

4 000

407 360,00

29

3 400

348 364,00

08/13/2024

25

2 800

284 816,00

36

5 000

511 450,00

08/14/2024

38

5 000

518 800,00

53

5 000

523 550,00

08/15/2024

6

1 000

102 780,00

48

4 800

497 616,00

08/16/2024

18

2 000

208 900,00

19

2 600

272 636,00

08/19/2024

2

400

41 800,00

37

4 200

442 932,00

08/20/2024

39

4 100

429 926,00

11

1 000

106 440,00

08/21/2024

39

3 200

330 976,00

18

2 400

250 608,00

08/22/2024

11

1 400

145 488,00

30

4 000

416 960,00

08/23/2024

15

1 700

178 109,00

19

2 800

294 812,00

08/26/2024

19

2 600

272 038,00

27

3 200

336 416,00

08/27/2024

14

2 104

223 634,16

33

4 200

447 762,00

08/28/2024

50

5 496

581 202,00

17

2 400

254 688,00

08/29/2024

62

8 400

850 416,00

-

-

-

08/30/2024

15

1 800

179 118,00

20

700

70 567,00

09/02/2024

69

7 000

672 630,00

4

400

38 520,00

09/03/2024

15

2 000

194 360,00

69

6 600

647 130,00

09/04/2024

45

3 600

352 260,00

35

4 200

413 910,00

09/05/2024

1

200

20 090,00

35

4 600

462 346,00

09/06/2024

86

8 400

830 508,00

18

2 000

199 480,00

09/09/2024

18

1 600

156 016,00

22

2 700

265 329,00

09/10/2024

47

4 600

449 788,00

13

1 600

158 432,00

09/11/2024

52

4 931

478 701,48

40

4 500

439 200,00

09/12/2024

42

4 500

439 650,00

67

4 600

451 766,00

09/13/2024

-

-

-

48

4 800

478 080,00

09/16/2024

32

2 353

236 217,67

10

1 000

101 040,00

09/17/2024

6

647

64 887,63

29

3 200

322 496,00

09/18/2024

20

2 200

221 012,00

24

2 400

241 656,00

09/19/2024

66

7 100

713 976,00

46

7 300

740 658,00

09/20/2024

61

7 500

756 225,00

51

4 300

441 567,00

09/23/2024

48

6 200

601 276,00

9

1 000

97 940,00

09/24/2024

40

4 800

465 648,00

50

5 200

507 780,00

09/25/2024

11

1 000

96 100,00

55

6 600

649 110,00

09/26/2024

73

8 000

760 000,00

6

800

76 120,00

09/27/2024

29

4 311

417 304,80

70

7 950

774 409,50

09/30/2024

71

9 300

885 918,00

9

1 200

117 480,00

10/01/2024

84

6 800

641 988,00

57

5 700

540 246,00

10/02/2024

33

3 800

353 438,00

8

1 000

93 760,00

10/03/2024

45

4 000

369 920,00

40

5 000

465 850,00

10/04/2024

42

3 787

354 463,20

81

8 787

835 643,70

10/07/2024

57

6 400

610 112,00

39

3 600

346 428,00

10/08/2024

48

4 813

442 555,35

7

800

74 400,00

10/09/2024

40

4 400

395 428,00

20

1 700

153 884,00

10/10/2024

54

4 150

363 415,50

13

1 400

122 948,00

10/11/2024

74

8 380

732 328,20

99

10 500

921 060,00

10/14/2024

40

4 100

357 889,00

29

3 400

297 194,00

10/15/2024

32

4 200

373 590,00

60

8 200

733 326,00

10/16/2024

2

200

18 240,00

103

10 300

976 646,00

10/17/2024

94

8 000

788 800,00

68

7 000

693 560,00

10/18/2024

33

4 200

417 186,00

42

4 600

458 758,00

10/21/2024

97

7 700

756 448,00

36

4 600

454 986,00

10/22/2024

47

4 600

447 994,00

63

5 200

508 144,00

10/23/2024

77

6 400

623 616,00

55

5 700

556 605,00

10/24/2024

93

7 620

738 987,60

60

6 945

674 845,65

10/25/2024

44

4 400

424 424,00

34

3 855

372 971,25

10/28/2024

66

6 129

590 161,41

68

6 600

637 230,00

10/29/2024

68

6 000

588 120,00

97

7 600

747 080,00

10/30/2024

48

4 400

433 576,00

41

4 200

415 002,00

10/31/2024

80

6 400

620 864,00

48

5 400

524 880,00

11/01/2024

28

3 000

292 140,00

35

4 000

390 560,00

11/04/2024

51

4 200

415 128,00

50

5 200

515 944,00

11/05/2024

58

5 200

519 584,00

56

5 800

584 524,00

11/06/2024

83

8 800

886 952,00

54

4 800

491 616,00

11/07/2024

74

8 227

794 563,66

59

8 200

801 140,00

11/08/2024

73

6 473

628 398,84

19

2 600

255 762,00

11/11/2024

53

4 655

436 778,65

46

4 920

464 497,20

11/12/2024

76

5 545

511 138,10

6

800

73 840,00

11/13/2024

57

5 200

472 576,00

48

5 000

457 050,00

11/14/2024

71

6 600

595 584,00

59

6 000

542 640,00

11/15/2024

14

1 400

127 358,00

45

4 000

365 720,00

11/18/2024

74

6 000

547 740,00

68

6 600

603 372,00

11/19/2024

96

9 000

806 400,00

79

7 800

702 312,00

11/20/2024

56

5 200

474 032,00

58

4 400

405 152,00

11/21/2024

39

4 200

369 432,00

33

3 800

335 958,00

11/22/2024

60

5 800

517 650,00

59

6 200

556 760,00

11/25/2024

74

7 200

644 904,00

77

6 600

593 472,00

11/26/2024

81

6 600

586 278,00

62

6 000

534 060,00

11/27/2024

73

7 400

634 624,00

52

4 400

378 620,00

11/28/2024

-

-

-

42

4 600

406 088,00

11/29/2024

26

2 400

211 272,00

25

2 600

230 126,00

12/02/2024

63

4 800

420 720,00

36

3 400

301 308,00

12/03/2024

89

10 197

878 981,40

45

4 200

367 374,00

12/04/2024

61

4 800

410 736,00

59

5 400

463 752,00

12/05/2024

25

2 200

191 752,00

30

3 213

281 587,32

12/06/2024

49

4 615

404 735,50

47

5 387

473 678,91

12/09/2024

42

3 400

302 396,00

60

4 800

428 256,00

12/10/2024

65

5 200

463 944,00

62

5 600

501 144,00

12/11/2024

33

2 985

264 441,15

-

-

-

12/12/2024

69

6 000

521 340,00

52

4 843

421 437,86

12/13/2024

30

3 200

275 584,00

26

2 100

181 629,00

12/16/2024

49

4 400

364 716,00

1

200

16 920,00

12/17/2024

75

8 600

697 374,00

70

6 739

547 611,14

12/18/2024

54

6 600

533 940,00

73

8 661

703 273,20

12/19/2024

34

3 000

239 970,00

5

1 000

80 100,00

12/20/2024

21

2 500

201 750,00

34

7 300

598 746,00

12/23/2024

30

4 500

365 850,00

-

-

-

12/24/2024

5

1 000

81 350,00

15

4 000

326 240,00

12/27/2024

12

1 900

156 237,00

49

7 500

619 050,00

12/30/2024

37

6 900

564 075,00

35

5 900

482 915,00

12/31/2024

-

-

-

20

3 600

298 116,00

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250109233431/en/

Teleperformance

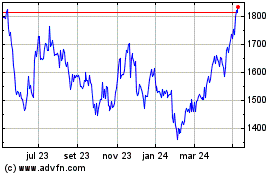

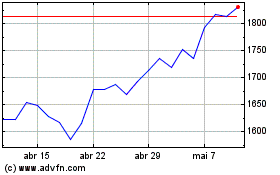

Telecom Plus (LSE:TEP)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Telecom Plus (LSE:TEP)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025