Executive Chair Mark S. Ordan to Return as

Chief Executive Officer

Company Redoubles Strategic Focus on Physician

Practices and Hospital and Health System Relationships

Pediatrix Medical Group, Inc. (NYSE: MD) (“Pediatrix” or “the

Company”), a leading provider of physician services, today

announced a leadership transition to accelerate its progress in

executing a transformational strategy designed to create value for

shareholders and other stakeholders. To best position Pediatrix to

implement the strategy, which is based on recommitting to the

highest standards in clinical excellence and strengthening the

Company’s hospital relationships, the Company’s Board of Directors

has appointed Executive Chair Mark S. Ordan to return to his former

position as Chief Executive Officer, effective immediately. James

D. Swift, M.D., a veteran Pediatrix executive who assumed the CEO

role in January 2023, will assist Mr. Ordan during the transition

period.

In the past year, led by Mr. Ordan and the Board of Directors,

the Company has instituted a number of key initiatives designed to

enable it to better execute on its core mission and drive operating

efficiency and profitability, including moving to a hybrid revenue

cycle management model, optimizing its portfolio of practices,

divesting its primary and urgent care clinics, and restructuring

its leadership team.

Guy Sansone, Lead Independent Director, commented: “We see great

opportunity ahead for Pediatrix, and based on the steps the Company

has taken, it is now time to accelerate the work to realize that

potential. Mark has spent his career transforming business

operations, including at Pediatrix where he led the Company’s

restructuring beginning in 2020, during a period of enormous

turbulence and change across the healthcare landscape. More

recently, Mark again stepped in to help execute on our strategy and

drive our return to hospital- and hospital-patient focused

activities. Now, we need to refocus Pediatrix around a successful

approach to creating superior value for shareholders and other

stakeholders, and ensure that our entire team is pulling in that

direction. We couldn’t be more pleased that Mark has agreed to step

into the Chief Executive Officer role once again.”

Mr. Ordan commented: “I am honored to return as CEO, and excited

to work with our extraordinary team to make sure that our patients

are at the center of everything that we do. This requires steady

focus on our renowned practices and a very close and collaborative

working relationship with our hospital and health system partners.

We will devote all of our time and resources to strengthening our

relationships with them and concentrating on patient-centric

activities.”

Mr. Sansone added, “We are grateful to Jim for the work that he

has done over his many years at Pediatrix, and we wish him the

best.”

The Company previously announced 2024 outlook of expected

adjusted EBITDA (net income (loss) before interest, taxes,

depreciation and amortization, transformational and restructuring

related expenses, impairment losses, and loss on disposal of

businesses) in a range of $205 million to $215 million. The Company

currently believes it will achieve the high end of the range and

that 2024 adjusted EBITDA may exceed such range. The Company will

announce its fourth quarter and full year 2024 results on February

20, 2025.

Mark S. Ordan Bio

A highly accomplished business leader with significant and

successful turnaround experience, Mr. Ordan has led the turnaround

of several complex, public companies which – in addition to

Pediatrix – include healthcare companies such as Sunrise Senior

Living, Quality Care Properties, and ManorCare. Mr. Ordan served as

CEO of Pediatrix from July 2020 to December 2022, during which he

led the Company’s restructuring. He was Executive Chair of the

Board of Directors of Pediatrix from January 2023 to June 2023 and

Chair of the Board from July 2023 to October 2024. He has served as

Executive Chair of the Board since October 2024, leading the

strategic redirection of the Company over the past year to focus on

its core hospital-based strength and its leadership in maternal

fetal medicine.

Prior to joining Pediatrix, Mr. Ordan founded and served as CEO

of Quality Care Properties after serving as founding CEO of

Washington Prime Group. Mr. Ordan also held a number of CEO roles

including at Sunrise Senior Living, The Mills Corporation, and

Balducci’s, and was founder and CEO of Fresh Fields Markets, which

he later merged with Whole Foods Markets.

Mr. Ordan serves on the Board of Directors of The Carlyle Group

and is the Board Chair of the U.S. Chamber of Commerce. Mr. Ordan

received his BA from Vassar College and his MBA from Harvard

Business School.

ABOUT PEDIATRIX MEDICAL GROUP

Pediatrix® Medical Group, Inc. (NYSE:MD) is a leading provider

of physician services. Pediatrix-affiliated clinicians are

committed to providing coordinated, compassionate and clinically

excellent services to women, babies and children across the

continuum of care, both in hospital settings and office-based

practices. Specialties include obstetrics, maternal-fetal medicine

and neonatology. The group’s high-quality, evidence-based care is

bolstered by significant investments in research, education,

quality-improvement and safety initiatives. The physician-led

company was founded in 1979 as a single neonatology practice and

today provides its highly specialized and often critical care

services through approximately 4,500 affiliated physicians and

other clinicians. To learn more about Pediatrix, visit

www.pediatrix.com or follow us on Facebook, Instagram, LinkedIn and

the Pediatrix blog. Investment information can be found at

www.pediatrix.com/investors.

Certain statements and information in this press release may be

deemed to contain forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995, Section 27A

of the Securities Act of 1933, as amended (the “Securities Act”),

and Section 21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements may include, but are not limited to,

statements relating to the Company’s expectations with respect to

its full year 2024 earnings, the Company’s objectives, plans and

strategies, and all statements, other than statements of historical

facts, that address activities, events or developments that we

intend, expect, project, believe or anticipate will or may occur in

the future. These statements are often characterized by terminology

such as “believe,” “hope,” “may,” “anticipate,” “should,” “intend,”

“plan,” “will,” “expect,” “estimate,” “project,” “positioned,”

“strategy” and similar expressions, and are based on assumptions

and assessments made by the Company’s management in light of their

experience and their perception of historical trends, current

conditions, expected future developments and other factors they

believe to be appropriate. Any forward-looking statements in this

press release are made as of the date hereof, and the Company

undertakes no duty to update or revise any such statements, whether

as a result of new information, future events or otherwise.

Forward-looking statements are not guarantees of future performance

and are subject to risks and uncertainties. Important factors that

could cause actual results, developments, and business decisions to

differ materially from forward-looking statements are described in

the Company’s most recent Annual Report on Form 10-K and its

Quarterly Reports on Form 10-Q, including the sections entitled

“Risk Factors”, as well the Company’s current reports on Form 8-K,

filed with the Securities and Exchange Commission, and include the

impact of the Company’s practice portfolio management plans and

whether the Company is able to achieve the expected favorable

impact to Adjusted EBITDA therefrom; the impact of the Company’s

termination of its then third-party revenue cycle management

provider and transition to a hybrid revenue cycle management model

with one or more new third-party service providers, including any

transition costs associated therewith; the impact of surprise

billing legislation; the effects of economic conditions on the

Company’s business; the effects of the Affordable Care Act and

potential healthcare reform; the Company’s relationships with

government-sponsored or funded healthcare programs, including

Medicare and Medicaid, and with managed care organizations and

commercial health insurance payors; the Company’s ability to comply

with the terms of its debt financing arrangements; the impact of

the divestiture of the Company’s anesthesiology and radiology

medical groups and its primary and urgent care practices; the

impact of management transitions; the timing and contribution of

future acquisitions or organic growth initiatives; the effects of

share repurchases; and the effects of the Company’s transformation

initiatives, including its reorientation on, and growth strategy

for, its pediatrics and obstetrics business.

Pediatrix Medical Group,

Inc.

Reconciliation of Net Loss to

Forward-Looking Adjusted EBITDA

(in thousands)

(Unaudited)

Year Ended December 31,

2024

Net loss

$

(110,315

)

$

(103,015

)

Interest expense

40,559

40,559

Income tax provision

1,990

4,690

Depreciation and amortization expense

31,800

31,800

Transformational and restructuring related

expenses

48,000

48,000

Goodwill and long-lived asset

impairments

182,034

182,034

Loss on disposal of businesses

10,932

10,932

Adjusted EBITDA

$

205,000

$

215,000

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250113272264/en/

Charles Lynch Senior Vice President, Finance and Strategy

954-384-0175, x 5692 charles.lynch@pediatrix.com

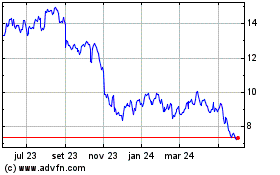

Pediatrix Medical (NYSE:MD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

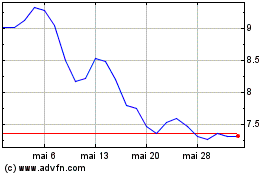

Pediatrix Medical (NYSE:MD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025