Vroom Provides Update on Common Stock Trading

21 Janeiro 2025 - 6:44PM

Business Wire

Vroom, Inc. (the “Company”), a leading automotive finance

company and a data, AI-powered analytics and digital services

platform supporting the automotive industry, today provided an

update on trading of the Company’s common stock and warrants

following the Company’s emergence from its prepackaged Chapter 11

case on January 14, 2025.

- All post-emergence shares of common stock and warrants,

reflecting the previously announced conversion ratio, were

delivered by January 15th and should be visible in shareholder

brokerage accounts.

- Vroom is working to resume trading on a national securities

exchange. While an estimated opening date is currently not

available, the Company is working expeditiously to relist the VRM

ticker as soon as possible.

About Vroom (Nasdaq: VRM)

Vroom owns and operates United Auto Credit Corporation (UACC), a

leading automotive lender serving the independent and franchise

dealer market nationwide, and CarStory, a leader in AI-powered

analytics and digital services for automotive retail. Prior to

January 2024, Vroom also operated an end-to-end ecommerce platform

to buy and sell used vehicles. Pursuant to its previously announced

Value Maximization Plan, Vroom discontinued its ecommerce

operations and wound down its used vehicle dealership business.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements, including without limitation statements

regarding the delivery of all shares of common stock and warrants,

our intention to list our common stock and warrants on a national

securities exchange, and the timing of any of the foregoing. These

statements are based on management’s current assumptions and are

neither promises nor guarantees, but involve known and unknown

risks, uncertainties and other important factors that may cause our

actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements. Factors

that could cause actual results to differ materially from the

forward-looking statements in this press release include: following

the effectiveness of the plan of reorganization contemplated by the

RSA, certain holders of claims or causes of action relating to the

unsecured Notes, if they choose to act together, will have the

ability to significantly influence all matters submitted to

stockholders of the reorganized company for approval; our business

could suffer from a long and protracted restructuring; as a result

of the prepackaged Chapter 11 case, our historical financial

information will not be indicative of our future performance; we

are subject to claims that will not be discharged in the

prepackaged Chapter 11 case, which could have a material adverse

effect on our financial condition and results of operations; the

prepackaged Chapter 11 case may cause us to experience increased

levels of employee attrition; upon our emergence from bankruptcy,

the composition of our board of directors may change; the

prepackaged Chapter 11 case raises substantial doubt regarding our

ability to continue as a going concern; our indebtedness and

liabilities could limit the cash flow available for our operations,

expose us to risks that could materially adversely affect our

business, financial condition and results of operations and impair

our ability to satisfy our debt obligations; we may be unable to

satisfy a continued listing rule from Nasdaq, and if we are

delisted, we may not be able to satisfy an initial listing rule

from Nasdaq or another national securities exchange; our tax

attributes and future tax deductions may be reduced or

significantly limited as a result of the consummation of the plan

of reorganization; there are risks associated with the

discontinuance of our ecommerce operations and wind-down of our

used vehicle dealership business; we may not generate sufficient

liquidity to operate our business; as well as the other important

risks and uncertainties identified under the heading “Risk Factors”

in our Annual Report on Form 10-K for the year ended December 31,

2023, as updated by our Quarterly report on Form 10-Q for the

quarter ended September 30, 2024, which is available on our

Investor Relations website at ir.vroom.com and on the SEC website

at www.sec.gov. All forward-looking statements reflect our beliefs

and assumptions only as of the date of this press release. We

undertake no obligation to update forward-looking statements to

reflect future events or circumstances.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250121808874/en/

Investor Relations: Vroom Jon Sandison

investors@vroom.com

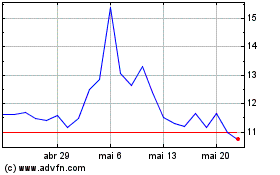

Vroom (NASDAQ:VRM)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Vroom (NASDAQ:VRM)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025