Sinclair Reports Preliminary Fourth Quarter 2024 Local Media Segment Media Revenues and Certain Expenses

27 Janeiro 2025 - 9:00AM

Business Wire

Sinclair will report Fourth Quarter 2024

Results on February 26, 2025 at 4:00 pm ET

Sinclair, Inc. (Nasdaq: SBGI), the “Company,” today released

preliminary unaudited Local Media segment fourth quarter 2024 media

revenues and certain media operating expenses.

The Company expects Local Media segment media revenues to be

$931 million to $933 million for the three months ended December

31, 2024, down modestly from the Company’s previously disclosed

guidance of $936 million to $945 million. This includes political

advertising revenue of approximately $203 million (versus

previously disclosed guidance of $204 million), core

(non-political) advertising revenue of $300 million to $301 million

(versus previously disclosed guidance of $307 million to $315

million) and distribution revenue of $392 million to $393 million

(versus guidance of $386 million to $388 million), as well as other

media revenue of approximately $37 million (versus previously

disclosed guidance of $38 million).

In addition, the Company expects fourth quarter 2024 Local Media

segment combined preliminary media programming and production

expenses and media selling, general and administrative expenses of

$580 million to $582 million, which compares favorably to the

Company’s previously disclosed guidance of a total of $589 million

to $590 million for the total of these two expense line items.

The preliminary results described in this press release are

unaudited estimates only and are subject to revision until the

Company completes its standard closing process, including the

completion of all of its controls procedures, which could identify

adjustments causing the actual results to be different from the

expectations presented in this press release.

The Company plans to report its fourth quarter 2024 earnings

results at 4:00 pm ET on Wednesday, February 26, 2025, followed by

a conference call to discuss the results at 4:30 pm ET. The call

will be webcast live and can be accessed at www.sbgi.net under the

subtitle “Investor Relations/Events and Presentations.” The dial-in

number for the earnings call is 888-506-0062, with entry code

787591.

If you plan to participate on the conference call, please call

at least two minutes prior to the start time and provide the entry

code to the conference operator; or tell the operator that you are

joining the Sinclair Earnings Conference Call.

If you are unable to listen to the live webcast or participate

in the live conference call, a replay of the call will be available

on Sinclair’s website at www.sbgi.net. This will be the only venue

through which a replay will be available. The Company’s press

release and any non-GAAP reconciliations will also be available on

the website.

Members of the news media are welcome on the call in a

listen-only mode. Key executives will be made available to members

of the news media, time permitting, following the conference call.

The Company regularly uses its website as a key source of Company

information and can be accessed at www.sbgi.net.

Forward-Looking

Statements:

The matters discussed in this news release, particularly those

in the section labeled “Outlook,” include forward-looking

statements regarding, among other things, future operating results.

When used in this news release, the words “outlook,” “intends to,”

“believes,” “anticipates,” “expects,” “achieves,” “estimates,” and

similar expressions are intended to identify forward-looking

statements. Such statements are subject to a number of risks and

uncertainties. Actual results in the future could differ materially

and adversely from those described in the forward-looking

statements as a result of various important factors, including and

in addition to the assumptions set forth therein, but not limited

to, a final determination of the Company’s fourth quarter 2024

financial results that is different than currently anticipated;

subjectivity inherent in a preliminary analysis of financial

results, the rate of decline in the number of subscribers to

services provided by traditional and virtual multi-channel video

programming distributors (“Distributors”); the Company’s ability to

generate cash to service its substantial indebtedness; the

successful execution of outsourcing agreements; the successful

execution of retransmission consent agreements; the successful

execution of network and Distributor affiliation agreements; the

Company’s ability to identify and consummate acquisitions and

investments, to manage increased financial leverage resulting from

acquisitions and investments, and to achieve anticipated returns on

those investments once consummated; the Company’s ability to

compete for viewers and advertisers; pricing and demand

fluctuations in local and national advertising; the appeal of the

Company’s programming and volatility in programming costs; material

legal, financial and reputational risks and operational disruptions

resulting from a breach of the Company’s information systems; the

impact of FCC and other regulatory proceedings against the Company;

compliance with laws and uncertainties associated with potential

changes in the regulatory environment affecting the Company’s

business and growth strategy; the impact of pending and future

litigation claims against the Company; the Company’s limited

experience in operating or investing in non-broadcast related

businesses; and any risk factors set forth in the Company’s recent

reports on Form 10-Q and/or Form 10-K, as filed with the Securities

and Exchange Commission. There can be no assurances that the

assumptions and other factors referred to in this release will

occur. The Company undertakes no obligation to publicly release the

result of any revisions to these forward-looking statements except

as required by law.

Category: Financial

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250126702253/en/

Investor Contacts: Chris King, VP,

Investor Relations Billie-Jo McIntire, VP, Corporate Finance (410)

568-1500

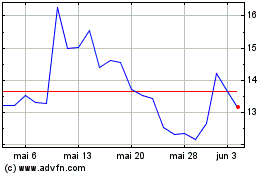

Sinclair (NASDAQ:SBGI)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Sinclair (NASDAQ:SBGI)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025