World Acceptance Corporation (NASDAQ: WRLD) today reported

financial results for its third quarter of fiscal 2025.

Third fiscal quarter highlights

During its third fiscal quarter, World Acceptance Corporation

achieved improved loan growth while continuing to focus on credit

quality. Management believes that continuing to carefully invest in

our best customers and closely monitoring performance has

strengthened the Company's financial position and positioned us

well for the remainder of the fiscal year.

Highlights from the third quarter include:

- Increase in total revenues to $138.6 million, including a 208

basis point yield increase compared to the same quarter in the

prior year

- Net income of $13.4 million

- Diluted net income per share of $2.45

- Recency delinquency on accounts 90+ days past due improved to

3.4% at December 31, 2024, from 3.7% at December 31, 2023

Portfolio results

Gross loans outstanding were $1.38 billion as of December 31,

2024, a 1.4% decrease from the $1.40 billion of gross loans

outstanding as of December 31, 2023. During the most recent

quarter, gross loans outstanding increased sequentially 6.6%, or

$85.6 million, from $1.30 billion as of September 30, 2024,

compared to an increase of 1.5%, or $21.1 million, in the

comparable quarter of the prior year.

During the most recent quarter, we saw improvement in borrowing

from new, former and existing customers compared to the same

quarter of fiscal year 2024. Specifically, new, former and

refinance loan customer volume during the quarter increased 22.6%,

13.9% and 1.5%, respectively, compared to the same quarter of

fiscal year 2024. Our customer base increased by 3.7% during the

twelve-month period ended December 31, 2024, compared to a decrease

of 2.4% for the comparable period ended December 31, 2023. During

the quarter ended December 31, 2024, the number of unique borrowers

in the portfolio increased by 6.2% compared to an increase of 2.4%

during the quarter ended December 31, 2023. We continued to improve

the gross yield to expected loss ratio for all new, former and

refinance customer originations and will continue to monitor

performance indicators and adjust underwriting accordingly.

The following table includes the volume of gross loan

origination balances by customer type for the following comparative

quarterly periods:

Q3 FY 2025

Q3 FY 2024

Q3 FY 2023

New Customers

$57,332,913

$46,768,269

$28,909,629

Former Customers

$109,982,248

$96,582,426

$94,505,522

Refinance Customers

$609,851,426

$600,866,594

$664,382,650

As of December 31, 2024, the Company had 1,035 open branches.

For branches open at least twelve months, same store gross loans

decreased 0.2% in the twelve-month period ended December 31, 2024,

compared to a decrease of 8.2% for the twelve-month period ended

December 31, 2023. For branches open throughout both periods, the

customer base over the twelve-month period ended December 31, 2024,

increased 4.9% compared to a decrease of 0.8% for the twelve-month

period ended December 31, 2023.

Three-month financial results

Net income for the third quarter of fiscal 2025 decreased to

$13.4 million compared to $16.7 million for the same quarter of the

prior year. Net income per diluted share decreased to $2.45 per

share in the third quarter of fiscal 2025 compared to $2.84 per

share for the same quarter of the prior year. Although net income

was negatively impacted by an increase in provision for credit

losses, primarily related to our new growth, we expect solid

returns on our third quarter originations given early payment

performance and yield.

Total revenues for the third quarter of fiscal 2025 increased to

$138.6 million, a 0.6% increase from $137.7 million for the same

quarter of the prior year. Interest and fee income increased 3.1%,

from $118.7 million in the third quarter of fiscal 2024 to $122.4

million in the third quarter of fiscal 2025. Insurance income

decreased by 14.1% to $12.5 million in the third quarter of fiscal

2025 compared to $14.5 million in the third quarter of fiscal 2024.

The large loan portfolio decreased from 55.2% of the overall

portfolio as of December 31, 2023, to 48.2% as of December 31,

2024. Interest and insurance yields for the quarter ended December

31, 2024, increased 332 and 208 basis points compared to the

quarters ended March 31, 2024 and December 31, 2023, respectively.

Other income decreased $0.8 million, or 17.3%, to $3.8 million in

the third quarter of fiscal 2025 compared to $4.6 million in the

third quarter of fiscal 2024. The decrease in other income is the

result of lower motor club sales driven by fewer large loan

customers.

The Company accrues for expected losses with a current expected

credit loss ("CECL") methodology, which requires us to create a

provision for credit losses on the day we originate the loan. The

provision for credit losses increased $3.5 million to $44.1 million

from $40.6 million when comparing the third quarter of fiscal 2025

to the third quarter of fiscal 2024. The table below itemizes the

key components of the CECL allowance and provision impact during

the quarter.

CECL Allowance and Provision (Dollars

in millions)

Q3 FY 2025

Q3 FY 2024

Difference

Reconciliation

Beginning Allowance - September 30

$114.5

$128.9

$(14.4)

Change due to Growth

$7.6

$2.0

$5.6

$5.6

Change due to Expected Loss Rate on

Performing Loans

$(5.6)

$(10.0)

$4.4

$4.4

Change due to 90 day past due

$(0.3)

$0.2

$(0.5)

$(0.5)

Ending Allowance - December 31

$116.2

$121.1

$(4.9)

$9.5

Net Charge-offs

$42.4

$48.4

$(6.0)

$(6.0)

Provision

$44.1

$40.6

$3.5

$3.5

Note: The change in allowance for the

quarter plus net charge-offs for the quarter equals the provision

for the quarter (see above reconciliation).

The provision was negatively impacted by higher growth and a

smaller decrease in expected loss rates compared to the same

quarter of the prior year. Specifically, expected loss rates were

negatively impacted by an increase in our 0-5 month customers, our

riskiest customers, as a percentage of the portfolio during the

current quarter.

Net charge-offs for the quarter decreased $6.0 million, from

$48.4 million in the third quarter of fiscal 2024 to $42.4 million

in the third quarter of fiscal 2025. Net charge-offs as a

percentage of average net loan receivables on an annualized basis

decreased to 17.2% in the third quarter of fiscal 2025 from 19.1%

in the third quarter of fiscal 2024.

Accounts 61 days or more past due decreased to 5.7% on a recency

basis at December 31, 2024, compared to 5.8% at December 31, 2023.

Our allowance for credit losses as a percent of net loans

receivable was 11.4% at December 31, 2024, compared to 11.8% at

December 31, 2023. We also experienced improvement in recency

delinquency on accounts at least 90 days past due, improving from

3.7% at December 31, 2023, to 3.4% at December 31, 2024.

The table below is updated to use the customer tenure-based

methodology that aligns with our CECL methodology. After

experiencing rapid portfolio growth during fiscal years 2019 and

2020, primarily in new customers, our gross loan balance

experienced pandemic related declines in fiscal 2021 before

rebounding during fiscal 2022. Over the last two and a half years,

we have tightened our lending to new customers substantially. The

tables below illustrate the changes in the portfolio weighting.

Gross Loan Balance By Customer

Tenure at Origination

As of

Less Than 2 Years

More Than 2 Years

Total

12/31/2019

$489,940,306

$882,877,242

$1,372,817,548

12/31/2020

$413,509,916

$851,073,804

$1,264,583,720

12/31/2021

$527,433,398

$1,078,703,853

$1,606,137,251

12/31/2022

$421,291,725

$1,132,819,599

$1,554,111,324

12/31/2023

$315,059,832

$1,085,605,652

$1,400,665,484

12/31/2024

$310,926,501

$1,070,584,174

$1,381,510,675

Year-Over-Year Growth

(Decline) in Gross Loan Balance by Customer Tenure at

Origination

12 Month Period Ended

Less Than 2 Years

More Than 2 Years

Total

12/31/2019

$63,055,397

$50,856,512

$113,911,909

12/31/2020

$(76,430,390)

$(31,803,438)

$(108,233,828)

12/31/2021

$113,923,482

$227,630,049

$341,553,531

12/31/2022

$(106,141,673)

$54,115,746

$(52,025,927)

12/31/2023

$(106,231,893)

$(47,213,947)

$(153,445,840)

12/31/2024

$(4,133,331)

$(15,021,478)

$(19,154,809)

Portfolio Mix by Customer

Tenure at Origination

As of

Less Than 2 Years

More Than 2 Years

12/31/2019

35.7%

64.3%

12/31/2020

32.7%

67.3%

12/31/2021

32.8%

67.2%

12/31/2022

27.1%

72.9%

12/31/2023

22.5%

77.5%

12/31/2024

22.5%

77.5%

General and administrative (“G&A”) expenses increased $1.3

million, or 2.0%, to $67.2 million in the third quarter of fiscal

2025 compared to $65.9 million in the same quarter of the prior

fiscal year. As a percentage of revenues, G&A expenses

increased from 47.8% during the third quarter of fiscal 2024 to

48.5% during the third quarter of fiscal 2025. G&A expenses per

average open branch increased by 3.3% when comparing the third

quarter of fiscal 2025 to the third quarter of fiscal 2024.

Personnel expense increased $1.2 million, or 3.0%, during the

third quarter of fiscal 2025 as compared to the third quarter of

fiscal 2024. Salary expense increased approximately $0.4 million,

or 1.1%, during the quarter ended December 31, 2024, compared to

the quarter ended December 31, 2023. Our headcount as of December

31, 2024, decreased 3.1% compared to December 31, 2023. Benefit

expense decreased approximately $0.7 million, or 8.8%, when

comparing the quarterly periods ended December 31, 2024 and 2023.

Incentive expense increased $1.9 million, in the third quarter of

fiscal 2025 compared to the third quarter of fiscal 2024. The

increase in incentive expense is mostly due to an increase in

bonuses paid.

Occupancy and equipment expense increased $0.2 million, or 1.7%,

when comparing the quarterly periods ended December 31, 2024 and

2023.

Advertising expense increased $0.7 million, or 19.5%, in the

third quarter of fiscal 2025 compared to the third quarter of

fiscal 2024 due to increased spending on customer acquisition

programs.

Interest expense for the quarter ended December 31, 2024,

decreased by $0.4 million, or 3.4%, from the corresponding quarter

of the previous year. Interest expense decreased due to a 5.8%

decrease in average debt outstanding for the quarter and a 2.4%

decrease in the effective interest rate from 8.6% to 8.4%. The

average debt outstanding decreased from $567.1 million to $534.0

million when comparing the quarters ended December 31, 2024 and

2023. The Company’s debt to equity ratio decreased to 1.3:1 at

December 31, 2024, compared to 1.4:1 at December 31, 2023. As of

December 31, 2024, the Company had $559.9 million of debt

outstanding, net of unamortized debt issuance costs related to the

unsecured senior notes payable. The Company repurchased and

canceled $15.7 million of its previously issued bonds for a

purchase price of $15.6 million during the third quarter of fiscal

2025.

Other key return ratios for the third quarter of fiscal 2025

included a 7.5% return on average assets and a return on average

equity of 19.2% (both on a trailing twelve-month basis).

The Company repurchased 9,465 shares of its common stock on the

open market at an aggregate purchase price of approximately $1.0

million during the third quarter of fiscal 2025. This is in

addition to repurchases of 165,167 shares during the first half of

fiscal 2025 at an aggregate purchase price of approximately $21.1

million. As of December 31, 2024, the Company had $9.0 million in

aggregate remaining repurchase capacity under its current share

repurchase program and approximately $32.2 million under the terms

of our debt facilities (subject to further board approval). The

Company repurchased 295,201 shares during fiscal 2024 at an

aggregate purchase price of approximately $36.2 million. The

Company had approximately 5.4 million common shares outstanding,

excluding 352,620 unvested restricted shares, as of December 31,

2024.

Nine-Month Results

Net income for the nine months ended December 31, 2024,

increased $3.2 million to $45.5 million compared to $42.3 million

for the same period of the prior year. This resulted in a net

income of $8.23 per diluted share for the nine months ended

December 31, 2024, compared to $7.17 per diluted share in the

prior-year period. Total revenues for the first nine months of

fiscal 2025 decreased 3.5% to $399.6 million, compared to $413.9

million during the corresponding period of the previous year due to

a decrease in loans outstanding. Annualized net charge-offs as a

percent of average net loans decreased from 17.4% during the first

nine months of fiscal 2024 to 17.1% for the first nine months of

fiscal 2025.

About World Acceptance Corporation (World Finance)

Founded in 1962, World Acceptance Corporation (NASDAQ: WRLD), is

a people-focused finance company that provides personal installment

loan solutions and personal tax preparation and filing services to

over one million customers each year. Headquartered in Greenville,

South Carolina, the Company operates more than 1,000

community-based World Finance branches across 16 states. The

Company primarily serves a segment of the population that does not

have ready access to credit; however, unlike many other lenders in

this segment, we strive to work with our customers to understand

their broader financial pictures, ensure they have the ability and

stability to make payments, and help them achieve their financial

goals. For more information, visit www.loansbyworld.com.

Third quarter conference call

The senior management of World Acceptance Corporation will be

discussing these results in its quarterly conference call to be

held at 10:00 a.m. Eastern Time today. A simulcast of the

conference call will be available on the Internet at

https://event.choruscall.com/mediaframe/webcast.html?webcastid=1DhfUuWc.

The call will be available for replay on the Internet for

approximately 30 days.

During the conference call, the Company may discuss and answer

questions concerning business and financial developments and trends

that have occurred after quarter-end. The Company’s responses to

questions, as well as other matters discussed during the conference

call, may contain or constitute information that has not been

disclosed previously.

Cautionary Note Regarding Forward-looking Information

This press release may contain various “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, that represent the Company’s current

expectations or beliefs concerning future events. Statements other

than those of historical fact, as well as those identified by words

such as “anticipate,” “estimate,” intend,” “plan,” “expect,”

“project,” “believe,” “may,” “will,” “should,” “would,” “could,”

“probable” and any variation of the foregoing and similar

expressions are forward-looking statements. Such forward-looking

statements are inherently subject to risks and uncertainties. The

Company’s actual results and financial condition may differ

materially from those indicated in the forward-looking statements.

Therefore, you should not rely on any of these forward-looking

statements. Important factors that could cause actual results or

performance to differ from the expectations expressed or implied in

such forward-looking statements include the following: recently

enacted, proposed or future legislation and the manner in which it

is implemented, including pursuant to policies of the new U.S.

administration; changes in the U.S. tax code; the nature and scope

of regulatory authority, particularly discretionary authority, that

is or may be exercised by regulators, including, but not limited

to, U.S. Consumer Financial Protection Bureau, and individual state

regulators having jurisdiction over the Company; the unpredictable

nature of regulatory examinations, proceedings and litigation;

employee misconduct or misconduct by third parties; uncertainties

associated with management turnover and the effective succession of

senior management; media and public characterization of consumer

installment loans; labor unrest; the impact of changes in

accounting rules and regulations, or their interpretation or

application, which could materially and adversely affect the

Company’s reported consolidated financial statements or necessitate

material delays or changes in the issuance of the Company’s audited

consolidated financial statements; the Company's assessment of its

internal control over financial reporting; changes in interest

rates; the impact of inflation; risks relating to the acquisition

or sale of assets or businesses or other strategic initiatives,

including increased loan delinquencies or net charge-offs, the loss

of key personnel, integration or migration issues, the failure to

achieve anticipated synergies, increased costs of servicing,

incomplete records, and retention of customers; risks inherent in

making loans, including repayment risks and value of collateral;

cybersecurity threats or incidents, including the potential or

actual misappropriation of assets or sensitive information,

corruption of data or operational disruption and the cost of the

associated response thereto; our dependence on debt and the

potential impact of limitations in the Company’s amended revolving

credit facility or other impacts on the Company's ability to borrow

money on favorable terms, or at all; the timing and amount of

revenues that may be recognized by the Company; changes in current

revenue and expense trends (including trends affecting delinquency

and charge-offs); the impact of extreme weather events and natural

disasters; changes in the Company’s markets and general changes in

the economy (particularly in the markets served by the

Company).

These and other factors are discussed in greater detail in Part

I, Item 1A,“Risk Factors” in the Company’s most recent annual

report on Form 10-K for the fiscal year ended March 31, 2024, as

filed with the SEC and the Company’s other reports filed with, or

furnished to, the SEC from time to time. World Acceptance

Corporation does not undertake any obligation to update any

forward-looking statements it makes. The Company is also not

responsible for updating the information contained in this press

release beyond the publication date, or for changes made to this

document by wire services or Internet services.

WORLD ACCEPTANCE CORPORATION

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(unaudited and in thousands,

except per share amounts)

Three months ended December

31,

Nine months ended December

31,

2024

2023

2024

2023

Revenues:

Interest and fee income

$

122,390

$

118,665

$

347,457

$

352,237

Insurance and other income, net

16,242

19,084

52,113

61,711

Total revenues

138,632

137,749

399,570

413,948

Expenses:

Provision for credit losses

44,103

40,632

136,191

127,697

General and administrative expenses:

Personnel

41,075

39,890

99,805

120,120

Occupancy and equipment

12,293

12,090

36,794

37,138

Advertising

4,448

3,721

8,926

8,712

Amortization of intangible assets

938

1,051

2,903

3,183

Other

8,469

9,157

26,564

27,829

Total general and administrative

expenses

67,223

65,909

174,992

196,982

Interest expense

11,294

11,690

31,520

36,475

Total expenses

122,620

118,231

342,703

361,154

Income before income taxes

16,012

19,518

56,867

52,794

Income tax expense

2,624

2,853

11,404

10,508

Net income

$

13,388

$

16,665

$

45,463

$

42,286

Net income per common share, diluted

$

2.45

$

2.84

$

8.23

$

7.17

Weighted average diluted shares

outstanding

5,464

5,860

5,527

5,897

WORLD ACCEPTANCE CORPORATION

AND SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(unaudited and in thousands)

December 31, 2024

March 31, 2024

December 31, 2023

ASSETS

Cash and cash equivalents

$

15,583

$

11,839

$

12,776

Gross loans receivable

1,381,462

1,277,149

1,400,622

Less:

Unearned interest, insurance and fees

(361,444

)

(326,746

)

(372,311

)

Allowance for credit losses

(116,111

)

(102,963

)

(121,082

)

Loans receivable, net

903,907

847,440

907,229

Income taxes receivable

7,188

3,091

1,717

Operating lease right-of-use assets,

net

78,857

79,501

80,049

Property and equipment, net

20,551

22,897

23,196

Deferred income taxes, net

31,967

30,943

37,048

Other assets, net

36,775

42,199

38,045

Goodwill

7,371

7,371

7,371

Intangible assets, net

8,301

11,070

12,107

Total assets

$

1,110,500

$

1,056,351

$

1,119,538

LIABILITIES &

SHAREHOLDERS' EQUITY

Liabilities:

Senior notes payable

$

335,949

$

223,419

$

305,089

Senior unsecured notes payable, net

223,910

272,610

279,916

Operating lease liability

81,207

81,921

82,471

Accounts payable and accrued expenses

41,264

53,974

45,043

Total liabilities

682,330

631,924

712,519

Shareholders' equity

428,170

424,427

407,019

Total liabilities and shareholders'

equity

$

1,110,500

$

1,056,351

$

1,119,538

WORLD ACCEPTANCE CORPORATION

AND SUBSIDIARIES

SELECTED CONSOLIDATED

STATISTICS

(unaudited and in thousands,

except percentages and branches)

Three months ended December

31,

Nine months ended December

31,

2024

2023

2024

2023

Gross loans receivable

$

1,381,462

$

1,400,622

$

1,381,462

$

1,400,622

Average gross loans receivable (1)

1,336,375

1,383,194

1,299,519

1,388,752

Net loans receivable (2)

1,020,018

1,028,311

1,020,018

1,028,311

Average net loans receivable (3)

987,833

1,014,113

961,767

1,015,237

Expenses as a percentage of total

revenue:

Provision for credit losses

31.8

%

29.5

%

34.1

%

30.8

%

General and administrative

48.5

%

47.8

%

43.8

%

47.6

%

Interest expense

8.1

%

8.5

%

7.9

%

8.8

%

Operating income as a % of total revenue

(4)

19.7

%

22.7

%

22.1

%

21.6

%

Loan volume (5)

777,197

744,193

2,161,632

2,133,642

Net charge-offs as percent of average net

loans receivable on an annualized basis

17.2

%

19.1

%

17.1

%

17.4

%

Return on average assets (trailing 12

months)

7.5

%

6.0

%

7.5

%

6.0

%

Return on average equity (trailing 12

months)

19.2

%

17.3

%

19.2

%

17.3

%

Branches opened or acquired (merged or

closed), net

(10

)

(1

)

(13

)

(21

)

Branches open (at period end)

1,035

1,052

1,035

1,052

_______________________________________________________

(1) Average gross loans receivable is

determined by averaging month-end gross loans receivable over the

indicated period, excluding tax advances.

(2) Net loans receivable is defined as

gross loans receivable less unearned interest and deferred

fees.

(3) Average net loans receivable is

determined by averaging month-end gross loans receivable less

unearned interest and deferred fees over the indicated period,

excluding tax advances.

(4) Operating income is computed as total

revenues less provision for credit losses and general and

administrative expenses.

(5) Loan volume includes all loan balances

originated by the Company. It does not include loans purchased

through acquisitions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250128675749/en/

John L. Calmes, Jr. Executive VP, Chief Financial & Strategy

Officer, and Treasurer (864) 298-9800

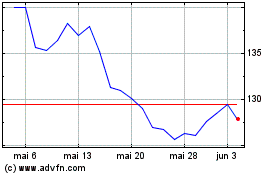

World Acceptance (NASDAQ:WRLD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

World Acceptance (NASDAQ:WRLD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025