- Reported net income attributable to Valero stockholders of $281

million, or $0.88 per share, for the fourth quarter and $2.8

billion, or $8.58 per share, for the year

- Reported adjusted net income attributable to Valero

stockholders of $207 million, or $0.64 per share, for the fourth

quarter and $2.7 billion, or $8.48 per share, for the year

- Returned $601 million to stockholders through dividends and

stock buybacks in the fourth quarter and $4.3 billion in the

year

- Increased quarterly cash dividend on common stock by 6 percent

to $1.13 per share on January 16, 2025

- Progressing with a Fluid Catalytic Cracking (FCC) Unit

optimization project at the St. Charles Refinery

Valero Energy Corporation (NYSE: VLO, “Valero”) today reported

net income attributable to Valero stockholders of $281 million, or

$0.88 per share, for the fourth quarter of 2024, compared to $1.2

billion, or $3.55 per share, for the fourth quarter of 2023.

Excluding the adjustment shown in the accompanying earnings release

tables, adjusted net income attributable to Valero stockholders was

$207 million, or $0.64 per share, for the fourth quarter of 2024,

compared to $1.2 billion, or $3.57 per share, for the fourth

quarter of 2023.

For 2024, net income attributable to Valero stockholders was

$2.8 billion, or $8.58 per share, compared to $8.8 billion, or

$24.92 per share, in 2023. Excluding the adjustments shown in the

accompanying earnings release tables, adjusted net income

attributable to Valero stockholders was $2.7 billion, or $8.48 per

share, in 2024, compared to $8.9 billion, or $24.96 per share, in

2023.

Refining

The Refining segment reported operating income of $437 million

for the fourth quarter of 2024, compared to $1.6 billion for the

fourth quarter of 2023. Refining throughput volumes averaged 3.0

million barrels per day in the fourth quarter of 2024.

“2024 was our best year for personnel and process safety and one

of our best years for environmental performance,” said Lane Riggs,

Valero’s Chairman, Chief Executive Officer and President. “This is

a testament to our long-standing commitment to safe, reliable and

environmentally responsible operations.”

Renewable Diesel

The Renewable Diesel segment, which consists of the Diamond

Green Diesel joint venture (DGD), reported $170 million of

operating income for the fourth quarter of 2024, compared to $84

million for the fourth quarter of 2023. Segment sales volumes

averaged 3.4 million gallons per day in the fourth quarter of

2024.

Ethanol

The Ethanol segment reported $20 million of operating income for

the fourth quarter of 2024, compared to $190 million for the fourth

quarter of 2023. Ethanol production volumes averaged 4.6 million

gallons per day in the fourth quarter of 2024.

Corporate and Other

General and administrative expenses were $266 million in the

fourth quarter of 2024 and $961 million for the year. The effective

tax rate for 2024 was 19 percent.

Investing and Financing Activities

Net cash provided by operating activities was $1.1 billion in

the fourth quarter of 2024. Included in this amount was $119

million of adjusted net cash provided by operating activities

associated with the other joint venture member’s share of DGD.

Excluding this item, adjusted net cash provided by operating

activities was $951 million in the fourth quarter of 2024.

Net cash provided by operating activities in 2024 was $6.7

billion. Included in this amount was a $795 million favorable

impact from working capital and $371 million of adjusted net cash

provided by operating activities associated with the other joint

venture member’s share of DGD. Excluding these items, adjusted net

cash provided by operating activities in 2024 was $5.5 billion.

Capital investments totaled $547 million in the fourth quarter

of 2024, of which $452 million was for sustaining the business,

including costs for turnarounds, catalysts and regulatory

compliance. Excluding capital investments attributable to the other

joint venture member’s share of DGD and other variable interest

entities, capital investments attributable to Valero were $515

million in the fourth quarter of 2024 and $1.9 billion for the

year.

Valero returned $601 million to stockholders in the fourth

quarter of 2024, of which $339 million was paid as dividends and

$262 million was for the purchase of approximately 2.0 million

shares of common stock, resulting in a payout ratio of 63 percent

of adjusted net cash provided by operating activities. In 2024,

Valero returned $4.3 billion to stockholders, or 78 percent of

adjusted net cash provided by operating activities, consisting of

$2.9 billion in stock buybacks and $1.4 billion in dividends.

Valero defines payout ratio as the sum of dividends paid and the

total cost of stock buybacks divided by adjusted net cash provided

by operating activities.

On January 16, 2025, Valero announced an increase of its

quarterly cash dividend on common stock from $1.07 per share to

$1.13 per share, demonstrating its strong financial position.

“Our team continues to successfully execute a strategy

underpinned by operational excellence, deploying capital with an

uncompromising focus on returns, and honoring our commitment to

stockholders,” said Riggs.

Liquidity and Financial Position

Valero ended 2024 with $8.1 billion of total debt, $2.4 billion

of finance lease obligations, and $4.7 billion of cash and cash

equivalents. The debt to capitalization ratio, net of cash and cash

equivalents, was 17 percent as of December 31, 2024.

Strategic Update

The Sustainable Aviation Fuel (SAF) project at the DGD Port

Arthur plant was successfully completed in the fourth quarter of

2024 and is now fully operational, providing the plant the

optionality to upgrade approximately 50 percent of its current 470

million gallon renewable diesel annual production capacity to be

blended to SAF.

Valero is progressing with an FCC Unit optimization project at

the St. Charles Refinery that will enable the refinery to increase

the yield of high value products. The project is estimated to cost

$230 million and is expected to be completed in 2026.

Conference Call

Valero’s senior management will hold a conference call at 10

a.m. ET today to discuss this earnings release and to provide an

update on operations and strategy.

About Valero

Valero Energy Corporation, through its subsidiaries

(collectively, Valero), is a multinational manufacturer and

marketer of petroleum-based and low-carbon liquid transportation

fuels and petrochemical products, and sells its products primarily

in the United States (U.S.), Canada, the United Kingdom (U.K.),

Ireland and Latin America. Valero owns 15 petroleum refineries

located in the U.S., Canada and the U.K. with a combined throughput

capacity of approximately 3.2 million barrels per day. Valero is a

joint venture member in Diamond Green Diesel Holdings LLC, which

produces low-carbon fuels including renewable diesel and

sustainable aviation fuel (SAF), with a production capacity of

approximately 1.2 billion gallons per year in the U.S. Gulf Coast

region. See our annual report on Form 10-K for more information on

SAF. Valero also owns 12 ethanol plants located in the U.S.

Mid-Continent region with a combined production capacity of

approximately 1.7 billion gallons per year. Valero manages its

operations through its Refining, Renewable Diesel, and Ethanol

segments. Please visit investorvalero.com for more information.

Valero Contacts Investors: Homer Bhullar, Vice President

– Investor Relations and Finance, 210-345-1982 Eric Herbort,

Director – Investor Relations and Finance, 210-345-3331 Gautam

Srivastava, Director – Investor Relations, 210-345-3992

Media: Lillian Riojas, Executive Director – Media Relations and

Communications, 210-345-5002

Safe-Harbor Statement

Statements contained in this release and the accompanying

earnings release tables, or made during the conference call, that

state Valero’s or management’s expectations or predictions of the

future are forward-looking statements intended to be covered by the

safe harbor provisions of the Securities Act of 1933 and the

Securities Exchange Act of 1934. The words “believe,” “expect,”

“should,” “estimates,” “intend,” “target,” “commitment,” “plans,”

“forecast, “guidance” and other similar expressions identify

forward-looking statements. Forward-looking statements in this

release and the accompanying earnings release tables include, and

those made on the conference call may include, statements relating

to Valero’s low-carbon fuels strategy, expected timing, cost and

performance of projects, future market and industry conditions,

future operating and financial performance, future production and

manufacturing ability and size, and management of future risks,

among other matters. It is important to note that actual results

could differ materially from those projected in such

forward-looking statements based on numerous factors, including

those outside of Valero’s control, such as legislative or political

changes or developments, market dynamics, cyberattacks, weather

events, and other matters affecting Valero’s operations and

financial performance or the demand for Valero’s products. These

factors also include, but are not limited to, the uncertainties

that remain with respect to current or contemplated legal,

political or regulatory developments that are adverse to or

restrict refining and marketing operations, or that impose taxes or

penalties on profits, windfalls, or margins above a certain level,

global geopolitical and other conflicts and tensions, the impact of

inflation on margins and costs, economic activity levels, and the

adverse effects the foregoing may have on Valero’s business plan,

strategy, operations and financial performance. For more

information concerning these and other factors that could cause

actual results to differ from those expressed or forecasted, see

Valero’s annual report on Form 10-K, quarterly reports on Form

10‑Q, and other reports filed with the Securities and Exchange

Commission and available on Valero’s website at www.valero.com.

Use of Non-GAAP Financial Information

This earnings release and the accompanying earnings release

tables include references to financial measures that are not

defined under U.S. generally accepted accounting principles (GAAP).

These non-GAAP measures include adjusted net income attributable to

Valero stockholders, adjusted earnings per common share – assuming

dilution, Refining margin, Renewable Diesel margin, Ethanol margin,

adjusted Refining operating income (loss), adjusted Ethanol

operating income, adjusted net cash provided by operating

activities, and capital investments attributable to Valero. These

non-GAAP financial measures have been included to help facilitate

the comparison of operating results between periods. See the

accompanying earnings release tables for a definition of non-GAAP

measures and a reconciliation to their most directly comparable

GAAP measures. Note (d) to the earnings release tables provides

reasons for the use of these non-GAAP financial measures.

VALERO ENERGY

CORPORATION

EARNINGS RELEASE

TABLES

FINANCIAL HIGHLIGHTS

(millions of dollars, except

per share amounts)

(unaudited)

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

Statement of income data

Revenues

$

30,756

$

35,414

$

129,881

$

144,766

Cost of sales:

Cost of materials and other

27,926

31,267

116,516

123,087

Operating expenses (excluding depreciation

and amortization expense reflected below)

1,514

1,594

5,831

6,089

Depreciation and amortization expense

687

679

2,729

2,658

Total cost of sales

30,127

33,540

125,076

131,834

Other operating expenses (a)

4

15

44

33

General and administrative expenses

(excluding depreciation and amortization expense reflected

below)

266

295

961

998

Depreciation and amortization expense

11

11

45

43

Operating income

348

1,553

3,755

11,858

Other income, net (b)

110

145

499

502

Interest and debt expense, net of

capitalized interest

(135

)

(149

)

(556

)

(592

)

Income before income tax expense

(benefit)

323

1,549

3,698

11,768

Income tax expense (benefit) (c)

(34

)

331

692

2,619

Net income

357

1,218

3,006

9,149

Less: Net income attributable to

noncontrolling interests

76

16

236

314

Net income attributable to Valero Energy

Corporation stockholders

$

281

$

1,202

$

2,770

$

8,835

Earnings per common share

$

0.89

$

3.55

$

8.58

$

24.93

Weighted-average common shares outstanding

(in millions)

315

337

322

353

Earnings per common share – assuming

dilution

$

0.88

$

3.55

$

8.58

$

24.92

Weighted-average common shares outstanding

– assuming dilution (in millions)

316

338

322

353

See Notes to Earnings Release

Tables.

VALERO ENERGY

CORPORATION

EARNINGS RELEASE

TABLES

FINANCIAL HIGHLIGHTS BY

SEGMENT

(millions of dollars)

(unaudited

Refining

Renewable

Diesel

Ethanol

Corporate and

Eliminations

Total

Three months ended December 31,

2024

Revenues:

Revenues from external customers

$

29,334

$

522

$

900

$

—

$

30,756

Intersegment revenues

2

724

214

(940

)

—

Total revenues

29,336

1,246

1,114

(940

)

30,756

Cost of sales:

Cost of materials and other

27,010

919

933

(936

)

27,926

Operating expenses (excluding depreciation

and amortization expense reflected below)

1,287

88

141

(2

)

1,514

Depreciation and amortization expense

598

69

20

—

687

Total cost of sales

28,895

1,076

1,094

(938

)

30,127

Other operating expenses

4

—

—

—

4

General and administrative expenses

(excluding depreciation and amortization expense reflected

below)

—

—

—

266

266

Depreciation and amortization expense

—

—

—

11

11

Operating income by segment

$

437

$

170

$

20

$

(279

)

$

348

Three months ended December 31,

2023

Revenues:

Revenues from external customers

$

33,546

$

833

$

1,035

$

—

$

35,414

Intersegment revenues

10

801

296

(1,107

)

—

Total revenues

33,556

1,634

1,331

(1,107

)

35,414

Cost of sales:

Cost of materials and other

30,003

1,407

973

(1,116

)

31,267

Operating expenses (excluding depreciation

and amortization expense reflected below)

1,376

84

132

2

1,594

Depreciation and amortization expense

600

59

21

(1

)

679

Total cost of sales

31,979

1,550

1,126

(1,115

)

33,540

Other operating expenses

—

—

15

—

15

General and administrative expenses

(excluding depreciation and amortization expense reflected

below)

—

—

—

295

295

Depreciation and amortization expense

—

—

—

11

11

Operating income by segment

$

1,577

$

84

$

190

$

(298

)

$

1,553

See Operating Highlights by

Segment.

VALERO ENERGY

CORPORATION

EARNINGS RELEASE

TABLES

FINANCIAL HIGHLIGHTS BY

SEGMENT

(millions of dollars)

(unaudited)

Refining

Renewable

Diesel

Ethanol

Corporate and

Eliminations

Total

Year ended December 31, 2024

Revenues:

Revenues from external customers

$

123,853

$

2,410

$

3,618

$

—

$

129,881

Intersegment revenues

10

2,656

868

(3,534

)

—

Total revenues

123,863

5,066

4,486

(3,534

)

129,881

Cost of sales:

Cost of materials and other

112,538

3,944

3,558

(3,524

)

116,516

Operating expenses (excluding depreciation

and amortization expense reflected below)

4,946

350

536

(1

)

5,831

Depreciation and amortization expense

2,391

265

77

(4

)

2,729

Total cost of sales

119,875

4,559

4,171

(3,529

)

125,076

Other operating expenses (a)

17

—

27

—

44

General and administrative expenses

(excluding depreciation and amortization expense reflected

below)

—

—

—

961

961

Depreciation and amortization expense

—

—

—

45

45

Operating income by segment

$

3,971

$

507

$

288

$

(1,011

)

$

3,755

Year ended December 31, 2023

Revenues:

Revenues from external customers

$

136,470

$

3,823

$

4,473

$

—

$

144,766

Intersegment revenues

18

3,168

1,086

(4,272

)

—

Total revenues

136,488

6,991

5,559

(4,272

)

144,766

Cost of sales:

Cost of materials and other

117,401

5,550

4,395

(4,259

)

123,087

Operating expenses (excluding depreciation

and amortization expense reflected below)

5,208

358

515

8

6,089

Depreciation and amortization expense

2,351

231

80

(4

)

2,658

Total cost of sales

124,960

6,139

4,990

(4,255

)

131,834

Other operating expenses

17

—

16

—

33

General and administrative expenses

(excluding depreciation and amortization expense reflected

below)

—

—

—

998

998

Depreciation and amortization expense

—

—

—

43

43

Operating income by segment

$

11,511

$

852

$

553

$

(1,058

)

$

11,858

See Operating Highlights by

Segment.

See Notes to Earnings Release

Tables.

VALERO ENERGY

CORPORATION

EARNINGS RELEASE

TABLES

RECONCILIATION OF NON-GAAP

MEASURES TO MOST COMPARABLE AMOUNTS

REPORTED UNDER U.S. GAAP

(h)

(millions of dollars)

(unaudited)

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

Reconciliation of net income

attributable to Valero Energy Corporation stockholders to

adjusted net income attributable to Valero Energy

Corporation stockholders

Net income attributable to Valero Energy

Corporation stockholders

$

281

$

1,202

$

2,770

$

8,835

Adjustments:

Project liability adjustment (a)

—

—

29

—

Income tax benefit related to project

liability adjustment

—

—

(7

)

—

Project liability adjustment, net of

taxes

—

—

22

—

Gain on early retirement of debt (b)

—

—

—

(11

)

Income tax expense related to gain on

early retirement of debt

—

—

—

2

Gain on early retirement of debt, net of

taxes

—

—

—

(9

)

Second-generation biofuel tax credit

(c)

(74

)

6

(53

)

24

Total adjustments

(74

)

6

(31

)

15

Adjusted net income attributable to Valero

Energy Corporation stockholders

$

207

$

1,208

$

2,739

$

8,850

Reconciliation of earnings per common

share – assuming dilution to adjusted earnings per

common share – assuming dilution

Earnings per common share – assuming

dilution

$

0.88

$

3.55

$

8.58

$

24.92

Adjustments:

Project liability adjustment (a)

—

—

0.07

—

Gain on early retirement of debt (b)

—

—

—

(0.02

)

Second-generation biofuel tax credit

(c)

(0.24

)

0.02

(0.17

)

0.06

Total adjustments

(0.24

)

0.02

(0.10

)

0.04

Adjusted earnings per common share –

assuming dilution

$

0.64

$

3.57

$

8.48

$

24.96

See Notes to Earnings Release

Tables.

VALERO ENERGY

CORPORATION

EARNINGS RELEASE

TABLES

RECONCILIATION OF NON-GAAP

MEASURES TO MOST COMPARABLE AMOUNTS

REPORTED UNDER U.S. GAAP

(d)

(millions of dollars)

(unaudited)

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

Reconciliation of operating income by

segment to segment margin, and reconciliation of operating

income by segment to adjusted operating income by

segment

Refining segment

Refining operating income

$

437

$

1,577

$

3,971

$

11,511

Adjustments:

Operating expenses (excluding depreciation

and amortization expense reflected below)

1,287

1,376

4,946

5,208

Depreciation and amortization expense

598

600

2,391

2,351

Other operating expenses

4

—

17

17

Refining margin

$

2,326

$

3,553

$

11,325

$

19,087

Refining operating income

$

437

$

1,577

$

3,971

$

11,511

Adjustment: Other operating expenses

4

—

17

17

Adjusted Refining operating income

$

441

$

1,577

$

3,988

$

11,528

Renewable Diesel segment

Renewable Diesel operating income

$

170

$

84

$

507

$

852

Adjustments:

Operating expenses (excluding depreciation

and amortization expense reflected below)

88

84

350

358

Depreciation and amortization expense

69

59

265

231

Renewable Diesel margin

$

327

$

227

$

1,122

$

1,441

Ethanol segment

Ethanol operating income

$

20

$

190

$

288

$

553

Adjustments:

Operating expenses (excluding depreciation

and amortization expense reflected below)

141

132

536

515

Depreciation and amortization expense

20

21

77

80

Other operating expenses (a)

—

15

27

16

Ethanol margin

$

181

$

358

$

928

$

1,164

Ethanol operating income

$

20

$

190

$

288

$

553

Adjustment: Other operating expenses

(a)

—

15

27

16

Adjusted Ethanol operating income

$

20

$

205

$

315

$

569

See Notes to Earnings Release

Tables.

VALERO ENERGY

CORPORATION

EARNINGS RELEASE

TABLES

RECONCILIATION OF NON-GAAP

MEASURES TO MOST COMPARABLE AMOUNTS

REPORTED UNDER U.S. GAAP

(d)

(millions of dollars)

(unaudited)

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

Reconciliation of Refining segment

operating income (loss) to Refining margin (by region), and

reconciliation of Refining segment operating income (loss)

to adjusted Refining segment operating income (loss) (by

region) (e)

U.S. Gulf Coast region

Refining operating income

$

314

$

858

$

2,426

$

6,853

Adjustments:

Operating expenses (excluding depreciation

and amortization expense reflected below)

719

716

2,744

2,837

Depreciation and amortization expense

375

377

1,495

1,459

Other operating expenses

4

—

12

11

Refining margin

$

1,412

$

1,951

$

6,677

$

11,160

Refining operating income

$

314

$

858

$

2,426

$

6,853

Adjustment: Other operating expenses

4

—

12

11

Adjusted Refining operating income

$

318

$

858

$

2,438

$

6,864

U.S. Mid-Continent region

Refining operating income

$

30

$

120

$

449

$

1,627

Adjustments:

Operating expenses (excluding depreciation

and amortization expense reflected below)

194

197

753

766

Depreciation and amortization expense

79

84

333

334

Other operating expenses

—

—

3

—

Refining margin

$

303

$

401

$

1,538

$

2,727

Refining operating income

$

30

$

120

$

449

$

1,627

Adjustment: Other operating expenses

—

—

3

—

Adjusted Refining operating income

$

30

$

120

$

452

$

1,627

See Notes to Earnings Release

Tables.

VALERO ENERGY

CORPORATION

EARNINGS RELEASE

TABLES

RECONCILIATION OF NON-GAAP

MEASURES TO MOST COMPARABLE AMOUNTS

REPORTED UNDER U.S. GAAP

(d)

(millions of dollars)

(unaudited)

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

Reconciliation of Refining segment

operating income (loss) to Refining margin (by region), and

reconciliation of Refining segment operating income (loss)

to adjusted Refining segment operating income (loss) (by

region) (e) (continued)

North Atlantic region

Refining operating income

$

233

$

579

$

1,162

$

2,131

Adjustments:

Operating expenses (excluding depreciation

and amortization expense reflected below)

169

204

698

751

Depreciation and amortization expense

70

63

268

255

Other operating expenses

—

—

1

1

Refining margin

$

472

$

846

$

2,129

$

3,138

Refining operating income

$

233

$

579

$

1,162

$

2,131

Adjustment: Other operating expenses

—

—

1

1

Adjusted Refining operating income

$

233

$

579

$

1,163

$

2,132

U.S. West Coast region

Refining operating income (loss)

$

(140

)

$

20

$

(66

)

$

900

Adjustments:

Operating expenses (excluding depreciation

and amortization expense reflected below)

205

259

751

854

Depreciation and amortization expense

74

76

295

303

Other operating expenses

—

—

1

5

Refining margin

$

139

$

355

$

981

$

2,062

Refining operating income (loss)

$

(140

)

$

20

$

(66

)

$

900

Adjustment: Other operating expenses

—

—

1

5

Adjusted Refining operating income

(loss)

$

(140

)

$

20

$

(65

)

$

905

See Notes to Earnings Release

Tables.

VALERO ENERGY

CORPORATION

EARNINGS RELEASE

TABLES

REFINING SEGMENT OPERATING

HIGHLIGHTS

(millions of dollars, except

per barrel amounts)

(unaudited)

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

Throughput volumes (thousand barrels

per day)

Feedstocks:

Heavy sour crude oil

608

485

504

449

Medium/light sour crude oil

239

272

241

307

Sweet crude oil

1,508

1,517

1,501

1,496

Residuals

126

171

165

199

Other feedstocks

104

106

113

115

Total feedstocks

2,585

2,551

2,524

2,566

Blendstocks and other

410

444

388

413

Total throughput volumes

2,995

2,995

2,912

2,979

Yields (thousand barrels per

day)

Gasolines and blendstocks

1,494

1,489

1,433

1,461

Distillates

1,141

1,128

1,103

1,126

Other products (f)

393

404

406

420

Total yields

3,028

3,021

2,942

3,007

Operating statistics (d) (g)

Refining margin

$

2,326

$

3,553

$

11,325

$

19,087

Adjusted Refining operating income

$

441

$

1,577

$

3,988

$

11,528

Throughput volumes (thousand barrels per

day)

2,995

2,995

2,912

2,979

Refining margin per barrel of

throughput

$

8.44

$

12.89

$

10.62

$

17.55

Less:

Operating expenses (excluding depreciation

and amortization expense reflected below) per barrel of

throughput

4.67

4.99

4.64

4.79

Depreciation and amortization expense per

barrel of throughput

2.17

2.18

2.24

2.16

Adjusted Refining operating income per

barrel of throughput

$

1.60

$

5.72

$

3.74

$

10.60

See Notes to Earnings Release

Tables.

VALERO ENERGY

CORPORATION

EARNINGS RELEASE

TABLES

RENEWABLE DIESEL SEGMENT

OPERATING HIGHLIGHTS

(millions of dollars, except

per gallon amounts)

(unaudited)

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

Operating statistics (d) (g)

Renewable Diesel margin

$

327

$

227

$

1,122

$

1,441

Renewable Diesel operating income

$

170

$

84

$

507

$

852

Sales volumes (thousand gallons per

day)

3,356

3,773

3,530

3,539

Renewable Diesel margin per gallon of

sales

$

1.06

$

0.65

$

0.87

$

1.12

Less:

Operating expenses (excluding depreciation

and amortization expense reflected below) per gallon of sales

0.28

0.24

0.27

0.28

Depreciation and amortization expense per

gallon of sales

0.23

0.17

0.21

0.18

Renewable Diesel operating income per

gallon of sales

$

0.55

$

0.24

$

0.39

$

0.66

See Notes to Earnings Release

Tables.

VALERO ENERGY

CORPORATION

EARNINGS RELEASE

TABLES

ETHANOL SEGMENT OPERATING

HIGHLIGHTS

(millions of dollars, except

per gallon amounts)

(unaudited)

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

Operating statistics (d) (g)

Ethanol margin

$

181

$

358

$

928

$

1,164

Adjusted Ethanol operating income

$

20

$

205

$

315

$

569

Production volumes (thousand gallons per

day)

4,627

4,510

4,538

4,367

Ethanol margin per gallon of

production

$

0.42

$

0.86

$

0.56

$

0.73

Less:

Operating expenses (excluding depreciation

and amortization expense reflected below) per gallon of

production

0.33

0.32

0.32

0.32

Depreciation and amortization expense per

gallon of production

0.04

0.05

0.05

0.05

Adjusted Ethanol operating income per

gallon of production

$

0.05

$

0.49

$

0.19

$

0.36

See Notes to Earnings Release

Tables.

VALERO ENERGY

CORPORATION

EARNINGS RELEASE

TABLES

REFINING SEGMENT OPERATING

HIGHLIGHTS BY REGION

(millions of dollars, except

per barrel amounts)

(unaudited)

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

Operating statistics by region

(e)

U.S. Gulf Coast region (d) (g)

Refining margin

$

1,412

$

1,951

$

6,677

$

11,160

Adjusted Refining operating income

$

318

$

858

$

2,438

$

6,864

Throughput volumes (thousand barrels per

day)

1,829

1,816

1,763

1,791

Refining margin per barrel of

throughput

$

8.39

$

11.69

$

10.35

$

17.07

Less:

Operating expenses (excluding depreciation

and amortization expense reflected below) per barrel of

throughput

4.27

4.29

4.25

4.34

Depreciation and amortization expense per

barrel of throughput

2.23

2.26

2.32

2.23

Adjusted Refining operating income per

barrel of throughput

$

1.89

$

5.14

$

3.78

$

10.50

U.S. Mid-Continent region (d)

(g)

Refining margin

$

303

$

401

$

1,538

$

2,727

Adjusted Refining operating income

$

30

$

120

$

452

$

1,627

Throughput volumes (thousand barrels per

day)

473

462

445

461

Refining margin per barrel of

throughput

$

6.97

$

9.42

$

9.44

$

16.20

Less:

Operating expenses (excluding depreciation

and amortization expense reflected below) per barrel of

throughput

4.47

4.62

4.62

4.55

Depreciation and amortization expense per

barrel of throughput

1.81

1.99

2.05

1.98

Adjusted Refining operating income per

barrel of throughput

$

0.69

$

2.81

$

2.77

$

9.67

See Notes to Earnings Release

Tables.

VALERO ENERGY

CORPORATION

EARNINGS RELEASE

TABLES

REFINING SEGMENT OPERATING

HIGHLIGHTS BY REGION

(millions of dollars, except

per barrel amounts)

(unaudited)

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

Operating statistics by region (e)

(continued)

North Atlantic region (d) (g)

Refining margin

$

472

$

846

$

2,129

$

3,138

Adjusted Refining operating income

$

233

$

579

$

1,163

$

2,132

Throughput volumes (thousand barrels per

day)

434

452

443

460

Refining margin per barrel of

throughput

$

11.85

$

20.36

$

13.12

$

18.69

Less:

Operating expenses (excluding depreciation

and amortization expense reflected below) per barrel of

throughput

4.24

4.90

4.30

4.47

Depreciation and amortization expense per

barrel of throughput

1.78

1.51

1.65

1.52

Adjusted Refining operating income per

barrel of throughput

$

5.83

$

13.95

$

7.17

$

12.70

U.S. West Coast region (d) (g)

Refining margin

$

139

$

355

$

981

$

2,062

Adjusted Refining operating income

(loss)

$

(140

)

$

20

$

(65

)

$

905

Throughput volumes (thousand barrels per

day)

259

265

261

267

Refining margin per barrel of

throughput

$

5.80

$

14.51

$

10.26

$

21.15

Less:

Operating expenses (excluding depreciation

and amortization expense reflected below) per barrel of

throughput

8.60

10.60

7.86

8.76

Depreciation and amortization expense per

barrel of throughput

3.09

3.10

3.08

3.11

Adjusted Refining operating income (loss)

per barrel of throughput

$

(5.89

)

$

0.81

$

(0.68

)

$

9.28

See Notes to Earnings Release

Tables.

VALERO ENERGY

CORPORATION

EARNINGS RELEASE

TABLES

AVERAGE MARKET REFERENCE

PRICES AND DIFFERENTIALS

(unaudited)

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

Refining

Feedstocks (dollars per barrel)

Brent crude oil

$

73.98

$

82.72

$

79.79

$

82.27

Brent less West Texas Intermediate (WTI)

crude oil

3.62

4.36

3.95

4.60

Brent less WTI Houston crude oil

2.31

3.04

2.48

3.15

Brent less Dated Brent crude oil

(0.71

)

(1.43

)

(0.91

)

(0.44

)

Brent less Argus Sour Crude Index crude

oil

4.16

4.79

4.33

5.34

Brent less Maya crude oil

10.75

10.83

11.43

13.33

Brent less Western Canadian Select Houston

crude oil

8.34

12.01

10.36

12.15

WTI crude oil

70.36

78.36

75.84

77.67

Natural gas (dollars per million

British thermal units)

2.14

2.27

1.88

2.23

Renewable volume obligation (RVO)

(dollars per barrel) (h)

4.04

4.77

3.75

7.02

Product margins (RVO adjusted unless

otherwise noted) (dollars per barrel)

U.S. Gulf Coast:

Conventional Blendstock for Oxygenate

Blending (CBOB) gasoline less Brent

1.86

(2.41

)

6.06

8.83

Ultra-low-sulfur (ULS) diesel less

Brent

12.41

24.47

15.76

25.06

Propylene less Brent (not RVO

adjusted)

(29.18

)

(50.92

)

(37.42

)

(47.47

)

U.S. Mid-Continent:

CBOB gasoline less WTI

5.46

4.05

10.48

17.70

ULS diesel less WTI

14.63

33.10

17.87

32.37

North Atlantic:

CBOB gasoline less Brent

7.07

5.57

11.08

15.61

ULS diesel less Brent

15.10

33.31

18.32

29.47

U.S. West Coast:

California Reformulated Gasoline

Blendstock for Oxygenate Blending 87 gasoline less Brent

10.94

15.13

21.58

28.45

California Air Resources Board diesel less

Brent

16.61

36.88

18.89

32.79

See Notes to Earnings Release

Tables.

VALERO ENERGY

CORPORATION

EARNINGS RELEASE

TABLES

AVERAGE MARKET REFERENCE

PRICES AND DIFFERENTIALS

(unaudited)

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

Renewable Diesel

New York Mercantile Exchange ULS diesel

(dollars per gallon)

$

2.23

$

2.85

$

2.44

$

2.81

Biodiesel Renewable Identification Number

(RIN) (dollars per RIN)

0.66

0.84

0.59

1.35

California Low-Carbon Fuel Standard carbon

credit (dollars per metric ton)

72.27

68.71

60.19

72.42

U.S. Gulf Coast (USGC) used cooking oil

(dollars per pound)

0.45

0.47

0.43

0.58

USGC distillers corn oil (dollars per

pound)

0.48

0.57

0.48

0.63

USGC fancy bleachable tallow (dollars per

pound)

0.45

0.52

0.44

0.59

Ethanol

Chicago Board of Trade corn (dollars per

bushel)

4.27

4.75

4.24

5.65

New York Harbor ethanol (dollars per

gallon)

1.70

2.12

1.79

2.34

VALERO ENERGY

CORPORATION

EARNINGS RELEASE

TABLES

OTHER FINANCIAL DATA

(millions of dollars)

(unaudited)

December 31,

2024

2023

Balance sheet data

Current assets

$

23,737

$

26,221

Cash and cash equivalents included in

current assets

4,657

5,424

Inventories included in current assets

7,761

7,583

Current liabilities

15,495

16,802

Valero Energy Corporation stockholders’

equity

24,512

26,346

Total equity

27,521

28,524

Debt and finance lease obligations:

Debt –

Current portion of debt (excluding

variable interest entities (VIEs))

$

441

$

167

Debt, less current portion of debt

(excluding VIEs)

7,586

8,021

Total debt (excluding VIEs)

8,027

8,188

Current portion of debt attributable to

VIEs

58

1,030

Debt, less current portion of debt

attributable to VIEs

—

—

Total debt attributable to VIEs

58

1,030

Total debt

8,085

9,218

Finance lease obligations –

Current portion of finance lease

obligations (excluding VIEs)

217

183

Finance lease obligations, less current

portion (excluding VIEs)

1,492

1,428

Total finance lease obligations (excluding

VIEs)

1,709

1,611

Current portion of finance lease

obligations attributable to VIEs

27

26

Finance lease obligations, less current

portion attributable to VIEs

642

669

Total finance lease obligations

attributable to VIEs

669

695

Total finance lease obligations

2,378

2,306

Total debt and finance lease

obligations

$

10,463

$

11,524

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

Reconciliation of net cash provided by

operating activities to adjusted net cash provided by

operating activities (d)

Net cash provided by operating

activities

$

1,070

$

1,239

$

6,683

$

9,229

Exclude:

Changes in current assets and current

liabilities

—

(631

)

795

(2,326

)

Diamond Green Diesel LLC’s (DGD) adjusted

net cash provided by operating activities attributable to the other

joint venture member’s ownership interest in DGD

119

65

371

512

Adjusted net cash provided by operating

activities

$

951

$

1,805

$

5,517

$

11,043

See Notes to Earnings Release

Tables.

VALERO ENERGY

CORPORATION

EARNINGS RELEASE

TABLES

OTHER FINANCIAL DATA

(millions of dollars, except

per share amounts)

(unaudited)

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

Reconciliation of capital investments

to capital investments attributable to Valero (d)

Capital expenditures (excluding VIEs)

$

250

$

197

$

649

$

665

Capital expenditures of VIEs:

DGD

52

52

250

235

Other VIEs

1

7

8

11

Deferred turnaround and catalyst cost

expenditures (excluding VIEs)

235

281

1,079

946

Deferred turnaround and catalyst cost

expenditures of DGD

9

3

71

59

Capital investments

547

540

2,057

1,916

Adjustments:

DGD’s capital investments attributable to

the other joint venture member

(31

)

(27

)

(161

)

(147

)

Capital expenditures of other VIEs

(1

)

(7

)

(8

)

(11

)

Capital investments attributable to

Valero

$

515

$

506

$

1,888

$

1,758

Dividends per common share

$

1.07

$

1.02

$

4.28

$

4.08

Year Ending December

31, 2025

Reconciliation of expected capital

investments to

expected capital investments

attributable to Valero (d)

Expected capital investments

$

2,060

Adjustment: DGD’s capital investments

attributable to the

other joint venture member

(110

)

Expected capital investments attributable

to Valero

$

1,950

See Notes to Earnings Release

Tables.

VALERO ENERGY

CORPORATION

NOTES TO EARNINGS RELEASE

TABLES

(a)

In March 2021, we announced our

participation in a then-proposed large-scale carbon capture and

sequestration pipeline system with Navigator Energy Services

(Navigator). In October 2023, Navigator announced that it decided

to cancel this project. Under the terms of the agreements

associated with the project, we had some rights from and

obligations to Navigator, including a portion of the aggregate

project costs. As a result, we recognized a charge of $29 million

in the year ended December 31, 2024 related to our obligation to

Navigator.

(b)

“Other income, net” includes a net gain of

$11 million in the year ended December 31, 2023 related to the

early retirement of $199 million aggregate principal amount of

various series of our senior notes.

(c)

Under current tax law, producers of

second-generation biofuels that are registered with the Internal

Revenue Service (IRS) are eligible for an income tax credit of up

to $1.01 per gallon of qualified biofuel that was produced and sold

in the U.S. through December 31, 2024. The benefit of the tax

credit is recognized as a reduction of the producer’s income tax

expense.

In December 2024, the IRS approved our

application for registration as a producer of second-generation

biofuels with respect to the cellulosic ethanol produced at our

ethanol plants. As a result, “income tax expense (benefit)” for the

three months and year ended December 31, 2024 includes a current

income tax benefit of $79 million for the tax credit attributable

to volumes of cellulosic ethanol produced and sold by us in the

U.S. from 2020 through 2024. The $79 million income tax benefit

recognized in December 2024 is attributable to the following

periods (in millions):

Periods to which second-generation

biofuel tax credit is attributable

2024 tax credit:

Nine months ended September 30, 2024

$

21

Three months ended December 31, 2024

5

Total 2024 tax credit

26

2023 tax credit:

Nine months ended September 30, 2023

18

Three months ended December 31, 2023

6

Total 2023 tax credit

24

2020 through 2022 tax credits

29

Total recognized in 2024

$

79

(d)

We use certain financial measures (as

noted below) in the earnings release tables and accompanying

earnings release that are not defined under GAAP and are considered

to be non-GAAP measures.

We have defined these non-GAAP measures

and believe they are useful to the external users of our financial

statements, including industry analysts, investors, lenders, and

rating agencies. We believe these measures are useful to assess our

ongoing financial performance because, when reconciled to their

most comparable GAAP measures, they provide improved comparability

between periods after adjusting for certain items that we believe

are not indicative of our core operating performance and that may

obscure our underlying business results and trends. These non-GAAP

measures should not be considered as alternatives to their most

comparable GAAP measures nor should they be considered in isolation

or as a substitute for an analysis of our results of operations as

reported under GAAP. In addition, these non-GAAP measures may not

be comparable to similarly titled measures used by other companies

because we may define them differently, which diminishes their

utility.

Non-GAAP measures are as follows:

- Adjusted net income attributable to

Valero Energy Corporation stockholders is defined as net income

attributable to Valero Energy Corporation stockholders adjusted to

reflect the items noted below, along with their related income tax

effect. The income tax effect for the adjustments was calculated

using a combined U.S. federal and state statutory rate of 22.5

percent. We have adjusted for these items because we believe that

they are not indicative of our core operating performance and that

their adjustment results in an important measure of our ongoing

financial performance to better assess our underlying business

results and trends. The basis for our belief with respect to each

adjustment is provided below.

– Project liability adjustment

– The project liability adjustment related to the cancellation of

Navigator’s project (see note (a)) is not indicative of our ongoing

operations.

– Gain on early retirement of

debt – Discounts, premiums, and other expenses recognized in

connection with the early retirement of various series of our

senior notes (see note (b)) are not associated with the ongoing

costs of our borrowing and financing activities.

– Second-generation biofuel tax

credit – The income tax benefit from the second-generation biofuel

tax credit recognized by us in December 2024 is attributable to

volumes produced and sold from 2020 through 2024 (see note (c)).

Therefore, the adjustment reflects the portion of the credit that

is attributable to volumes produced and sold in other periods as

follows (in millions):

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

Tax credit attributable to volumes

produced and sold during the period

$

5

$

6

$

26

$

24

Less:

Total recognized in 2024

79

—

79

—

Adjustment to reflect tax credit in the

proper period

$

(74

)

$

6

$

(53

)

$

24

- Adjusted earnings per common share – assuming dilution

is defined as adjusted net income attributable to Valero Energy

Corporation stockholders divided by the number of weighted-average

shares outstanding in the applicable period, assuming

dilution.

- Refining margin is defined as Refining segment operating

income (loss) excluding operating expenses (excluding depreciation

and amortization expense), depreciation and amortization expense,

and other operating expenses. We believe Refining margin is an

important measure of our Refining segment’s operating and financial

performance as it is the most comparable measure to the industry’s

market reference product margins, which are used by industry

analysts, investors, and others to evaluate our performance.

- Renewable Diesel margin is defined as Renewable Diesel

segment operating income excluding operating expenses (excluding

depreciation and amortization expense) and depreciation and

amortization expense. We believe Renewable Diesel margin is an

important measure of our Renewable Diesel segment’s operating and

financial performance as it is the most comparable measure to the

industry’s market reference product margins, which are used by

industry analysts, investors, and others to evaluate our

performance.

- Ethanol margin is defined as Ethanol segment operating

income excluding operating expenses (excluding depreciation and

amortization expense), depreciation and amortization expense, and

other operating expenses. We believe Ethanol margin is an important

measure of our Ethanol segment’s operating and financial

performance as it is the most comparable measure to the industry’s

market reference product margins, which are used by industry

analysts, investors, and others to evaluate our performance.

- Adjusted Refining operating income (loss) is defined as

Refining segment operating income (loss) excluding other operating

expenses. We believe adjusted Refining operating income (loss) is

an important measure of our Refining segment’s operating and

financial performance because it excludes items that are not

indicative of that segment’s core operating performance.

- Adjusted Ethanol operating income is defined as Ethanol

segment operating income excluding other operating expenses. We

believe adjusted Ethanol operating income is an important measure

of our Ethanol segment’s operating and financial performance

because it excludes items that are not indicative of that segment’s

core operating performance.

- Adjusted net cash provided by operating activities is

defined as net cash provided by operating activities excluding the

items noted below. We believe adjusted net cash provided by

operating activities is an important measure of our ongoing

financial performance to better assess our ability to generate cash

to fund our investing and financing activities. The basis for our

belief with respect to each excluded item is provided below.

– Changes in current assets and

current liabilities – Current assets net of current liabilities

represents our operating liquidity. We believe that the change in

our operating liquidity from period to period does not represent

cash generated by our operations that is available to fund our

investing and financing activities.

– DGD’s adjusted net cash

provided by operating activities attributable to the other joint

venture member’s ownership interest in DGD – We are a 50 percent

joint venture member in DGD and we consolidate DGD’s financial

statements. Our Renewable Diesel segment includes the operations of

DGD and the associated activities to market its products. Because

we consolidate DGD’s financial statements, all of DGD’s net cash

provided by operating activities (or operating cash flow) is

included in our consolidated net cash provided by operating

activities.

DGD’s members use DGD’s

operating cash flow (excluding changes in its current assets and

current liabilities) to fund its capital investments rather than

distribute all of that cash to themselves. Nevertheless, DGD’s

operating cash flow is effectively attributable to each member and

only 50 percent of DGD’s operating cash flow should be attributed

to our net cash provided by operating activities. Therefore, we

have adjusted our net cash provided by operating activities for the

portion of DGD’s operating cash flow attributable to the other

joint venture member’s ownership interest because we believe that

it more accurately reflects the operating cash flow available to us

to fund our investing and financing activities. The adjustment is

calculated as follows (in millions):

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

DGD operating cash flow data

Net cash provided by operating

activities

$

352

$

50

$

889

$

537

Exclude: Changes in current assets and

current liabilities

116

(80

)

148

(488

)

Adjusted net cash provided by operating

activities

236

130

741

1,025

Other joint venture member’s ownership

interest

50

%

50

%

50

%

50

%

DGD’s adjusted net cash provided by

operating activities attributable to the other joint venture

member’s ownership interest in DGD

$

119

$

65

$

371

$

512

- Capital investments attributable to Valero is defined as

all capital expenditures and deferred turnaround and catalyst cost

expenditures presented in our consolidated statements of cash

flows, excluding the portion of DGD’s capital investments

attributable to the other joint venture member and all of the

capital expenditures of VIEs other than DGD.

DGD’s members use DGD’s

operating cash flow (excluding changes in its current assets and

current liabilities) to fund its capital investments rather than

distribute all of that cash to themselves. Because DGD’s operating

cash flow is effectively attributable to each member, only 50

percent of DGD’s capital investments should be attributed to our

net share of total capital investments. We also exclude the capital

expenditures of other VIEs that we consolidate because we do not

operate those VIEs. We believe capital investments attributable to

Valero is an important measure because it more accurately reflects

our capital investments.

(e)

The Refining segment regions reflected

herein contain the following refineries: U.S. Gulf Coast-

Corpus Christi East, Corpus Christi West, Houston, Meraux, Port

Arthur, St. Charles, Texas City, and Three Rivers Refineries;

U.S. Mid Continent- Ardmore, McKee, and Memphis Refineries;

North Atlantic- Pembroke and Quebec City Refineries; and

U.S. West Coast- Benicia and Wilmington Refineries.

(f)

Primarily includes petrochemicals, gas

oils, No. 6 fuel oil, petroleum coke, sulfur, and asphalt.

(g)

Valero uses certain operating statistics

(as noted below) in the earnings release tables and the

accompanying earnings release to evaluate performance between

comparable periods. Different companies may calculate them in

different ways.

All per barrel of throughput, per gallon

of sales, and per gallon of production amounts are calculated by

dividing the associated dollar amount by the throughput volumes,

sales volumes, and production volumes for the period, as

applicable.

Throughput volumes, sales volumes, and

production volumes are calculated by multiplying throughput volumes

per day, sales volumes per day, and production volumes per day (as

provided in the accompanying tables), respectively, by the number

of days in the applicable period. We use throughput volumes, sales

volumes, and production volumes for the Refining segment, Renewable

Diesel segment, and Ethanol segment, respectively, due to their

general use by others who operate facilities similar to those

included in our segments. We believe the use of such volumes

results in per unit amounts that are most representative of the

product margins generated and the operating costs incurred as a

result of our operation of those facilities.

(h)

The RVO cost represents the average market

cost on a per barrel basis to comply with the Renewable Fuel

Standard program. The RVO cost is calculated by multiplying (i) the

average market price during the applicable period for the RINs

associated with each class of renewable fuel (i.e., biomass-based

diesel, cellulosic biofuel, advanced biofuel, and total renewable

fuel) by (ii) the quotas for the volume of each class of renewable

fuel that must be blended into petroleum-based transportation fuels

consumed in the U.S., as set or proposed by the U.S. Environmental

Protection Agency, on a percentage basis for each class of

renewable fuel and adding together the results of each

calculation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250129852767/en/

Valero Contacts Investors: Homer Bhullar, Vice President

– Investor Relations and Finance, 210-345-1982 Eric Herbort,

Director – Investor Relations and Finance, 210-345-3331 Gautam

Srivastava, Director – Investor Relations, 210-345-3992

Media: Lillian Riojas, Executive Director – Media Relations and

Communications, 210-345-5002

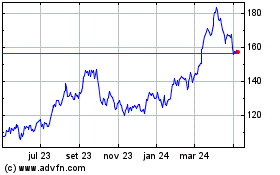

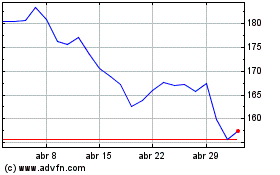

Valero Energy (NYSE:VLO)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Valero Energy (NYSE:VLO)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025