Tradeweb Markets Inc. (Nasdaq: TW), a leading, global operator

of electronic marketplaces for rates, credit, equities and money

markets, today announced that the U.S. Securities and Exchange

Commission (SEC) has approved the registration of its swap

execution facility, TW SEF LLC, as a security-based swap execution

facility (SBSEF) under Regulation SE.

This milestone follows the SEC’s new Regulation SE requirements

mandating that any trading system or platform facilitating the

trading or execution of security-based swaps (SBS) among

participants, as delineated in the requirements, register with the

SEC as either an SBSEF or a national securities exchange. With this

approval, TW SEF is now eligible to operate as an SBSEF, thereby

enabling institutional clients to trade single-name credit default

swaps (CDS) via TW SEF in compliance with this new regulatory

framework.

Elisabeth Kirby, Managing Director, Head of Market Structure at

Tradeweb said: “This regulatory approval represents a significant

step forward in fostering more transparency for institutional

single-name CDS markets. As a pioneer in electronic derivatives

trading and a leading electronic trading platform for credit

markets, Tradeweb is uniquely positioned to work with regulators on

initiatives that enhance transparency, efficiency and liquidity in

these markets while ensuring compliance with evolving regulatory

standards.”

Since 2005, Tradeweb has been a leader in bringing greater

transparency and innovation to the EUR, GBP and USD interest rate

swaps markets, advancing the derivatives industry forward with

numerous firsts such as the first electronic swap compression

trade, electronic swaptions trading, electronic cleared inflation

swap, multi-asset package trades and first fully electronic SOFR

swap spread trade. In 2007, Tradeweb launched its multilateral

trading facility (MTF), bringing further transparency to clients

trading swaps in the EU and UK. In 2013, following the

implementation of the Dodd-Frank Wall Street Reform and Consumer

Protection Act, Tradeweb launched TW SEF to align with new

regulatory standards requiring that certain swaps be centrally

cleared and traded on a regulated platform. TW SEF has since

evolved into a leading marketplace, offering institutional clients

enhanced efficiency and liquidity in derivatives trading.

Today, TW SEF is the largest swap execution facility for vanilla

swaps, with over $150 trillion (tn) traded in 2024, or 52% of

industry-wide SEF volume, based on data from Clarus FT. In 2024, TW

SEF facilitated over $590 billion (bn) in average daily volume,

serving more than 57 liquidity providers and over 1,000

institutional clients trading interest rate swaps, single-name

default swaps and credit default swap indices. In 2024, Tradeweb

reported strong volumes in global derivatives trading with an

average of $783.3bn in rates derivatives traded daily.

About Tradeweb Markets Tradeweb Markets Inc. (Nasdaq: TW)

is a leading, global operator of electronic marketplaces for rates,

credit, equities and money markets. Founded in 1996, Tradeweb

provides access to markets, data and analytics, electronic trading,

straight-through-processing and reporting for more than 50 products

to clients in the institutional, wholesale, retail and corporates

markets. Advanced technologies developed by Tradeweb enhance price

discovery, order execution and trade workflows while allowing for

greater scale and helping to reduce risks in client trading

operations. Tradeweb serves more than 2,800 clients in more than 70

countries. On average, Tradeweb facilitated more than $2.2 trillion

in notional value traded per day over the past four fiscal

quarters. For more information, please go to www.tradeweb.com.

Forward-Looking Statements This release contains

forward-looking statements within the meaning of the federal

securities laws. Statements related to, among other things, our

outlook and future performance, the industry and markets in which

we operate, our expectations, beliefs, plans, strategies,

objectives, prospects and assumptions and future events are

forward-looking statements.

We have based these forward-looking statements on our current

expectations, assumptions, estimates and projections. While we

believe these expectations, assumptions, estimates and projections

are reasonable, such forward-looking statements are only

predictions and involve known and unknown risks and uncertainties,

many of which are beyond our control. These and other important

factors, including those discussed under the heading “Risk Factors”

in the documents of Tradeweb Markets Inc. on file with or furnished

to the SEC, may cause our actual results, performance or

achievements to differ materially from those expressed or implied

by these forward-looking statements. In particular, preliminary

average variable fees per million dollars of volume traded are

subject to the completion of management’s final review and our

other financial closing procedures and therefore are subject to

change. Given these risks and uncertainties, you are cautioned not

to place undue reliance on such forward-looking statements. The

forward-looking statements contained in this release are not

guarantees of future events or performance and future events, our

actual results of operations, financial condition or liquidity, and

the development of the industry and markets in which we operate,

may differ materially from the forward-looking statements contained

in this release. In addition, even if future events, our results of

operations, financial condition or liquidity, and events in the

industry and markets in which we operate, are consistent with the

forward-looking statements contained in this release, they may not

be predictive of events, results or developments in future

periods.

Any forward-looking statement that we make in this release

speaks only as of the date of such statement. Except as required by

law, we do not undertake any obligation to update or revise, or to

publicly announce any update or revision to, any of the

forward-looking statements, whether as a result of new information,

future events or otherwise, after the date of this release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250129673643/en/

Media contacts: Daniel Noonan, Tradeweb +1 646 767 4677

Daniel.Noonan@Tradeweb.com

Savannah Steele, Tradeweb +1 646 767 4941

Savannah.Steele@Tradeweb.com

Investor contacts: Ashley Serrao, Tradeweb +1 646 430

6027 Ashley.Serrao@Tradeweb.com

Sameer Murukutla, Tradeweb +1 646 767 4864

Sameer.Murukutla@Tradeweb.com

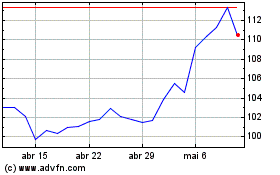

Tradeweb Markets (NASDAQ:TW)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Tradeweb Markets (NASDAQ:TW)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025