Mueller Industries, Inc. (NYSE: MLI) today reported 2024 fourth

quarter and full year results.

For the Fourth Quarter 2024 versus Fourth Quarter 2023:

• Net sales:

$923.5 million vs. $732.4 million, up

26.1%.

• Operating income:

$170.3 million vs. $135.2 million, up

26.0%.

• Net income:

$137.7 million vs. $119.2 million, up

15.4%.

• Diluted EPS:

$1.21 vs. $1.05, up 15.2%.

For the Full Year 2024 versus the Full Year 2023:

• Net sales:

$3.8 billion vs. $3.4 billion, up

10.2%.

• Operating income:

$770.4 million vs. $756.1 million, up

1.9%.

• Net income:

$604.9 million vs. $602.9 million, up

0.3%.

• Diluted EPS:

$5.31 vs. $5.30, up 0.2%.

Financial and Operating Commentary:

- The quarter over quarter increase in net sales of $191.2

million was primarily attributable to sales recorded by businesses

acquired during the second half of 2024 and improved unit volume in

our U.S. construction related products. Higher net selling prices

also contributed to the increase in net sales, as COMEX copper

averaged $4.22 per pound during the quarter, 13% higher than the

prior year period.

- The fourth quarter results include $10.7 million of non-cash

expense related to purchase accounting adjustments for the

acquisitions.

- The Company generated $140.1 million of cash from operations in

the fourth quarter, and $645.9 million for the year.

- Year-end cash and short-term investments totaled $1.06 billion,

and our current ratio is 5.1 to 1.

Regarding the results, Greg Christopher, Mueller’s CEO said, “We

ended 2024 on a very positive note, and in terms of quarter over

quarter operating income performance, the fourth quarter was our

strongest of the year. Despite subdued conditions, 2024 was a very

solid year, as evidenced by our strong operational cash generation.

Moreover, by year end, we successfully completed the integration of

our Nehring Electrical Works and Elkhart Products acquisitions.

Although they did not contribute to our fourth quarter operating

income, we are excited about their progress and market position,

and expect they will be important contributors in 2025.”

He added, “We enter 2025 with a number of promising initiatives

underway, and are committed to reinvesting to strengthen and

improve our core operations. In addition, we continue to search for

acquisitions that will expand our infrastructure products platforms

and provide opportunities to increase our capabilities,

particularly in nonferrous metals manufacturing.

We believe that while the impact of the new administration’s

trade and regulatory policies will take time, they will ultimately

prove beneficial to our business. Our concentration in the U.S. and

status as a leading manufacturer position us well, as the U.S.

remains one of the most secure end markets. All in all, we maintain

a positive outlook for our Company in 2025 and beyond.”

Mueller Industries, Inc. (NYSE: MLI) is an industrial

corporation whose holdings manufacture vital goods for important

markets such as air, water, oil and gas distribution; climate

comfort; food preservation; energy transmission; medical; aerospace

and automotive. It includes a network of companies and brands

throughout North America, Europe, Asia, and the Middle East.

*********************

Statements in this release that are not strictly historical may

be “forward-looking” statements, which involve risks and

uncertainties. These include economic and currency conditions,

continued availability of raw materials and energy, market demand,

pricing, competitive and technological factors, and the

availability of financing, among others, as set forth in the

Company’s SEC filings. The words “outlook,” “estimate,” “project,”

“intend,” “expect,” “believe,” “target,” “encourage,” “anticipate,”

“appear,” and similar expressions are intended to identify

forward-looking statements. The reader should not place undue

reliance on forward-looking statements, which speak only as of the

date of this report. The Company has no obligation to publicly

update or revise any forward-looking statements to reflect events

after the date of this report.

MUELLER INDUSTRIES,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(Unaudited)

For the Quarter Ended

For the Year Ended

(In thousands, except per share data)

December 28, 2024

December 30, 2023

December 28, 2024

December 30, 2023

Net sales

$

923,536

$

732,377

$

3,768,766

$

3,420,345

Cost of goods sold

668,166

536,383

2,724,328

2,433,511

Depreciation and amortization

22,236

9,250

53,133

39,954

Selling, general, and administrative

expense

64,703

51,184

226,696

208,172

Gain on sale of businesses

—

—

—

(4,137

)

Gain on sale of assets, net

(1,827

)

—

(5,780

)

—

Impairment charges

—

324

—

6,258

Gain on insurance settlement

—

—

—

(19,466

)

Operating income

170,258

135,236

770,389

756,053

Interest expense

(75

)

(713

)

(410

)

(1,221

)

Interest income

10,695

13,642

53,468

38,208

Realized and unrealized gains on

short-term investments

385

21,503

914

41,865

Gain on extinguishment of NMTC

liability

1,265

7,534

1,265

7,534

Environmental (expense) income

(542

)

202

(2,218

)

(825

)

Other (expense) income, net

(3,774

)

471

(2,946

)

3,618

Income before income taxes

178,212

177,875

820,462

845,232

Income tax expense

(45,670

)

(46,440

)

(205,076

)

(220,762

)

Income (loss) from unconsolidated

affiliates, net of foreign tax

8,061

(12,139

)

2,156

(14,821

)

Consolidated net income

140,603

119,296

617,542

609,649

Net income attributable to noncontrolling

interests

(2,951

)

(58

)

(12,663

)

(6,752

)

Net income attributable to Mueller

Industries, Inc.

$

137,652

$

119,238

$

604,879

$

602,897

Weighted average shares for basic earnings

per share

111,545

111,556

111,385

111,420

Effect of dilutive stock-based awards

2,415

2,425

2,580

2,242

Adjusted weighted average shares for

diluted earnings per share

113,960

113,981

113,965

113,662

Basic earnings per share

$

1.23

$

1.07

$

5.43

$

5.41

Diluted earnings per share

$

1.21

$

1.05

$

5.31

$

5.30

Dividends per share

$

0.20

$

0.15

$

0.80

$

0.60

MUELLER INDUSTRIES,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME, CONTINUED

(Unaudited)

For the Quarter Ended

For the Year Ended

(In thousands)

December 28, 2024

December 30, 2023

December 28, 2024

December 30, 2023

Summary Segment Data:

Net sales:

Piping Systems Segment

$

592,834

$

513,938

$

2,514,096

$

2,382,573

Industrial Metals Segment

229,017

125,363

818,439

577,875

Climate Segment

112,622

103,933

488,446

500,790

Elimination of intersegment sales

(10,937

)

(10,857

)

(52,215

)

(40,893

)

Net sales

$

923,536

$

732,377

$

3,768,766

$

3,420,345

Operating income:

Piping Systems Segment

$

148,912

$

113,634

$

617,451

$

569,239

Industrial Metals Segment

14,399

14,972

92,560

76,379

Climate Segment

33,718

25,963

146,054

171,864

Unallocated expenses

(26,771

)

(19,333

)

(85,676

)

(61,429

)

Operating income

$

170,258

$

135,236

$

770,389

$

756,053

MUELLER INDUSTRIES,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(In thousands)

December 28, 2024

December 30, 2023

ASSETS

Cash and cash equivalents

$

1,037,229

$

1,170,893

Short-term investments

21,874

98,146

Accounts receivable, net

450,113

351,561

Inventories

462,279

380,248

Other current assets

40,734

39,173

Total current assets

2,012,229

2,040,021

Property, plant, and equipment, net

515,131

385,165

Operating lease right-of-use assets

32,702

35,170

Other assets

730,844

298,945

$

3,290,906

$

2,759,301

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current portion of debt

$

1,094

$

796

Accounts payable

173,743

120,485

Current portion of operating lease

liabilities

8,117

7,893

Other current liabilities

215,033

187,964

Total current liabilities

397,987

317,138

Long-term debt

—

185

Pension and postretirement liabilities

11,199

12,062

Environmental reserves

15,423

15,030

Deferred income taxes

25,742

19,134

Noncurrent operating lease liabilities

24,547

26,683

Other noncurrent liabilities

11,600

10,353

Total liabilities

486,498

400,585

Total Mueller Industries, Inc.

stockholders’ equity

2,773,165

2,337,445

Noncontrolling interests

31,243

21,271

Total equity

2,804,408

2,358,716

$

3,290,906

$

2,759,301

MUELLER INDUSTRIES,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

For the Year Ended

(In thousands)

December 28, 2024

December 30, 2023

Cash flows from operating

activities

Consolidated net income

$

617,542

$

609,649

Reconciliation of consolidated net income

to net cash provided by operating activities:

Depreciation and amortization

53,376

40,824

Stock-based compensation expense

26,787

23,131

Provision for doubtful accounts

receivable

1,147

(84

)

(Income) loss from unconsolidated

affiliates

(2,156

)

14,821

Dividends from unconsolidated

affiliates

4,769

—

Gain on sale of businesses

—

(4,137

)

Unrealized gain on short-term

investments

(549

)

(24,765

)

Gain on disposals of assets

(5,780

)

(1

)

Insurance proceeds - noncapital

related

18,900

9,854

Gain on sale of securities

(365

)

(17,100

)

Gain on insurance settlement

—

(19,466

)

Impairment charges

—

6,258

Gain on extinguishment of NMTC

liability

(1,265

)

(7,534

)

Deferred income tax (benefit) expense

(867

)

4,790

Changes in assets and liabilities, net of

effects of businesses acquired:

Receivables

(56,565

)

30,915

Inventories

(32,768

)

67,903

Other assets

(1,046

)

(20,700

)

Current liabilities

24,360

(40,606

)

Other liabilities

(1,145

)

(3,497

)

Other, net

1,533

2,511

Net cash provided by operating

activities

645,908

672,766

Cash flows from investing

activities

Proceeds from sale of assets, net of cash

transferred

12,005

279

Purchase of short-term investments

(21,325

)

(106,231

)

Purchase of long-term investments

(6,785

)

—

Proceeds from the sale of securities

98,465

55,454

Proceeds from the maturity of short-term

investments

—

217,863

Acquisition of businesses, net of cash

acquired

(602,692

)

—

Capital expenditures

(80,203

)

(54,025

)

Insurance proceeds - capital related

6,100

24,646

Dividends from unconsolidated

affiliates

—

1,093

Issuance of notes receivable

(3,800

)

—

Investments in unconsolidated

affiliates

(8,700

)

(3,999

)

Net cash (used in) provided by investing

activities

(606,935

)

135,080

MUELLER INDUSTRIES,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS, CONTINUED

(Unaudited)

For the Year Ended

(In thousands)

December 28, 2024

December 30, 2023

Cash flows from financing

activities

Dividends paid to stockholders of Mueller

Industries, Inc.

(89,107

)

(66,868

)

Dividends paid to noncontrolling

interests

—

(9,312

)

Repayments of long-term debt

(222

)

(241

)

Issuance (repayment) of debt by

consolidated joint ventures, net

397

(30

)

Repurchase of common stock

(48,681

)

(19,303

)

Net cash used to settle stock-based

awards

(22,865

)

(8,755

)

Net cash used in financing activities

(160,478

)

(104,509

)

Effect of exchange rate changes on

cash

(13,823

)

5,590

(Decrease) increase in cash, cash

equivalents, and restricted cash

(135,328

)

708,927

Cash, cash equivalents, and restricted

cash at the beginning of the year

1,174,223

465,296

Cash, cash equivalents, and restricted

cash at the end of the year

$

1,038,895

$

1,174,223

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250203510446/en/

Jeffrey A. Martin (901) 753-3226

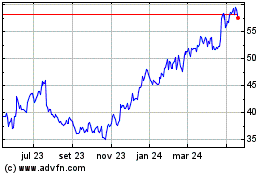

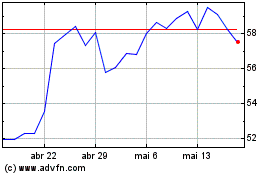

Mueller Industries (NYSE:MLI)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Mueller Industries (NYSE:MLI)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025