Median Technologies Gives Update on Drawdowns of the Iris Equity Line

05 Fevereiro 2025 - 1:45PM

Business Wire

Regulatory News:

Median Technologies (FR0011049824, ALMDT, PEA/SME scheme

eligible), a leading developer of eyonis™, a suite of artificial

intelligence (AI) powered Software as a Medical Device (SaMD) for

early cancer diagnostics, and a globally leading provider of

AI-based image analyses and imaging services for oncology drug

developers, announced that, on January 23, 2025, the Company signed

a financing agreement with Iris in the form of bonds redeemable in

shares for a maximum amount of €10 million. On January 24, 2025,

Iris subscribed to an initial tranche of 1,600 redeemable bonds of

a nominal value of €4 million.

The Company will have the right to suspend and reactivate the

drawdowns of the tranches without penalty. The key terms and

conditions of the financing facility are as follows:

- A single tranche of 4,000 warrants, subscribed by Iris Capital,

each warrant entitling its holder to subscribe to a bond redeemable

in shares,

- Iris Capital has committed to subscribing over a 24-month

period to 4,000 bonds upon the exercise of the warrants in six (6)

tranches (the first for €4,000,000, the second for €2,500,000, the

third to fifth for €1,000,000 each, and the sixth and final for

€500,000),

- Median Technologies will have the right to suspend and

reactivate the drawdowns of the tranches without penalty,

- The redemption price of the bonds in new shares is equal to 95%

of the lowest volume-weighted average price over the twenty-five

(25) trading days immediately preceding the bond redemption date.

By way of exception, the parties may agree on a redemption price

for the Bonds in the event of a block sale of the shares resulting

from the redemption of the said Bonds by Iris Capital.

- Furthermore, it is specified that the redemption price of the

bonds can in no case be lower than (i) the minimum price set by the

board of directors of Median Technologies, namely 95% of the

volume-weighted average price of the trading day immediately

preceding the bond redemption date, (ii) the minimum price set by

the combined general meeting of the company's shareholders on June

19, 2024, namely the average closing price of Median Technologies’

ordinary shares observed over the twenty (20) trading sessions

preceding the bond redemption date, reduced by a discount of 20%,

(iii) nor the nominal value of the company’s shares.

Status to-date of bonds subscribed and

exercised

Date

Bonds subscribed

Bonds exercised

Shares subscribed

Exercise price (€)

Jan.24, 2025

1,600

Feb.04, 2025

120

85,886

3.493

Total

1,600

120

85,886

About Median Technologies: Pioneering innovative imaging

solutions and Software as Medical Devices, Median Technologies

harnesses cutting-edge AI to enhance the accuracy of early cancer

diagnoses and treatments. Median's offerings include iCRO, which

provides medical image analysis and management in oncology trials,

and eyonis™, an AI/ML tech-based suite of software as medical

devices (SaMD). Median empowers biopharmaceutical entities and

clinicians to advance patient care and expedite the development of

novel therapies. The French-based company, with a presence in the

U.S. and China, trades on the Euronext Growth market (ISIN:

FR0011049824, ticker: ALMDT). Median is also eligible for the

French SME equity savings plan scheme (PEA-PME). For more

information, visit www.mediantechnologies.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250205511698/en/

MEDIAN TECHNOLOGIES Emmanuelle Leygues VP, Corporate

Marketing & Financial Communications +33 6 10 93 58 88

emmanuelle.leygues@mediantechnologies.com

Investors Ghislaine Gasparetto SEITOSEI ACTIFIN

+33 6 21 10 49 24 ghislaine.gasparetto@seitosei-actifin.com

U.S. media & investors Chris Maggos COHESION

BUREAU +41 79 367 6254 chris.maggos@cohesionbureau.com

Press Caroline Carmagnol ALIZE RP +33 6 64 18 99

59 median@alizerp.com

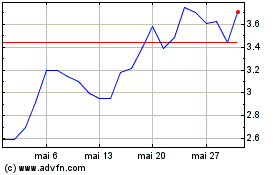

Median Technologies (EU:ALMDT)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Median Technologies (EU:ALMDT)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025