- JAAA is the largest CLO ETF and is ranked first in YTD net

flows for all active ETFs

- Fund assets grew by over 200% in 2024, making Janus

Henderson the third largest active fixed income ETF

provider

Janus Henderson Investors (NYSE: JHG) today announced that its

pioneering AAA Collateralized Loan Obligation ETF, Janus

Henderson AAA CLO ETF (JAAA), has surpassed $20

billion in assets under management (AUM). JAAA is the largest CLO

ETF, as measured by AUM1 and ranked first in year-to-date net flows

for all active ETFs.2 Janus Henderson’s suite of CLO products also

includes JBBB, and a European CLO ETF.

In 2024, JAAA attracted the most inflows among all actively

managed fixed income ETFs, highlighting its appeal and the growing

investor appetite for innovative fixed-income solutions. The Fund's

AUM experienced significant growth, starting 2024 at $5.3 billion

and soaring to $16.6 billion by year end, representing a growth

rate of over 200%. Janus Henderson is now the third largest active

fixed income ETF provider and the eighth largest active ETF

provider.3

JAAA was launched in October 2020 as one of the first CLO ETFs

in the market. Since then, the Fund has continued to significantly

expand U.S. investor access to the high-quality floating rate

AAA-rated CLO market, an asset class that historically was largely

only available to institutional investors, and is now available in

a liquid, transparent, tax-efficient ETF structure.

Managed by Portfolio Managers John Kerschner, CFA,

Nick Childs, CFA, and Jessica Shill, JAAA is an

actively managed ETF that invests in high-quality CLOs and seeks

high yield without sacrificing quality or extending duration.

John Kerschner, Head of U.S. Securitized Products and

Portfolio Manager at Janus Henderson, said, “We are pleased to

reach this $20 billion milestone in less than five years and are

encouraged by the continued interest in our CLO ETFs across retail,

intermediary, and institutional clients. JAAA has demonstrated its

benefits including diversification, attractive floating-rate yield,

high credit quality, and liquidity through various market events,

which have helped contribute to the growth of the asset class.”

Nick Cherney, Head of Innovation at Janus Henderson,

commented, “The continued growth of JAAA demonstrates clearly that

innovative solutions that address client needs will always be the

core of any successful product offering. JAAA has enabled the

addition of this important asset class to a whole range of

portfolios which historically were unable to benefit from the

compelling attributes of CLO allocations in a robust fixed income

portfolio.”

Michael Schweitzer, Head of North America Client Group,

added, “We are grateful to our clients and their clients who have

placed their confidence and trust in us to manage their capital. We

believe investors should maintain diversification within their

fixed income portfolios throughout the interest rate cycle.

Therefore, in our view, an allocation to short duration fixed

income remains highly relevant in the current environment,

particularly considering how attractive short-term yields are.”

Janus Henderson has been at the forefront of active ETF

innovation and offers a number of pioneering ETFs. In Fixed Income,

these include JAAA, the largest CLO ETF1, JBBB, which

provides exposure to floating-rate CLOs generally rated BBB,

JSI, which invests in opportunities across the U.S.

securitized markets, JMBS, an actively managed

mortgage-backed securities ETF, VNLA, an active global short

duration income ETF, JLQD, a corporate bond ETF, and

JEMB, an emerging markets debt hard currency ETF. The firm

won Global Capital’s inaugural CLO ETF Provider of the Year award

in 2024.4 In Equities, Janus Henderson’s active ETFs include the

recently launched JXX, the first fundamental active equity

ETF from the firm’s Denver-based Equities team, JMID a Mid

Cap Growth Alpha ETF, and JRE, a U.S. real estate ETF, among

others.

Notes to editors

Janus Henderson Group is a leading global active asset manager

dedicated to helping clients define and achieve superior financial

outcomes through differentiated insights, disciplined investments,

and world-class service. As of December 31, 2024, Janus Henderson

had approximately US$379 billion in assets under management, more

than 2,000 employees, and offices in 25 cities worldwide. The firm

helps millions of people globally invest in a brighter future

together. Headquartered in London, Janus Henderson is listed on the

New York Stock Exchange.

Investing involves risk, including the possible loss of

principal and fluctuation of value. Past performance is no

guarantee of future results. There is no assurance the stated

objective(s) will be met.

Please consider the charges, risks, expenses, and investment

objectives carefully before investing. For a prospectus or, if

available, a summary prospectus containing this and other

information, please call Janus Henderson at 800.668.0434 or

download the file from janushenderson.com/info. Read it

carefully before you invest or send money.

OBJECTIVE: Janus Henderson AAA CLO ETF (JAAA) seeks capital

preservation and current income by seeking to deliver floating-rate

exposure to high quality AAA-rated collateralized loan obligations

(“CLOs”).

Collateralized Loan Obligations (CLOs) are debt

securities issued in different tranches, with varying degrees of

risk, and backed by an underlying portfolio consisting primarily of

below investment grade corporate loans. The return of principal is

not guaranteed, and prices may decline if payments are not made

timely or credit strength weakens. CLOs are subject to liquidity

risk, interest rate risk, credit risk, call risk and the risk of

default of the underlying assets.

Concentrated investments in a single sector, industry or

region will be more susceptible to factors affecting that group and

may be more volatile than less concentrated investments or the

market as a whole. Derivatives can be highly volatile and more

sensitive to changes in economic or market conditions than other

investments. This could result in losses that exceed the original

investment and may be magnified by leverage. Actively managed

portfolios may fail to produce the intended results. No investment

strategy can ensure a profit or eliminate the risk of loss.

Derivatives can be more volatile and sensitive to

economic or market changes than other investments, which could

result in losses exceeding the original investment and magnified by

leverage.

Actively managed portfolios may fail to produce the

intended results. No investment strategy can ensure a profit or

eliminate the risk of loss.

Credit quality ratings are measured on a scale that generally

ranges from AAA (highest) to D (lowest). Ratings may differ by

rating agency.

Janus Henderson Investors US LLC is the investment adviser and

ALPS Distributors, Inc. is the distributor. ALPS is not affiliated

with Janus Henderson or any of its subsidiaries.

Janus Henderson is a trademark of Janus Henderson Group plc or

one of its subsidiaries. © Janus Henderson Group plc.

This press release is solely for the use of members of the media

and should not be relied upon by personal investors, financial

advisers, or institutional investors. We may record telephone calls

for our mutual protection, to improve customer service and for

regulatory record keeping purposes. All opinions and estimates in

this information are subject to change without notice.

1 Source: Bloomberg Professional Service and Janus Henderson, as

of February 3, 2025. 2 Source: Bloomberg Professional Service, as

of January 31, 2025. 3 Source: Morningstar, as of December 31,

2024. 4 The CLO ETF Provider of the Year is chosen at Global

Capital’s discretion and is based on a process that includes both

self-submitted applications, independent research conducted by the

awarding body, and market poll. Global Capital evaluates

organizations based on their involvement in innovative or complex

transactions, execution quality and structuring, business growth

and advancement, and the extent of their securitization

capabilities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250206364853/en/

Press Inquiries Janus Henderson Investors Media

Contact: Candice Sun Global Head of Media Relations +1 303-336-5452

candice.sun@janushenderson.com Investor Relations Contact: Jim

Kurtz Head of Investor Relations +1 303-336-4529

jim.kurtz@janushenderson.com

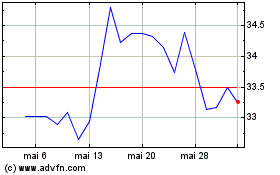

Janus Henderson (NYSE:JHG)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Janus Henderson (NYSE:JHG)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025