Provides Preliminary Select Financial Results

for Q4 and Full Year 2024

Provides Preliminary Outlook for Full Year

2025

Board Authorizes Additional $70 Million to

Existing Share Repurchase Program

Paysafe Limited (“Paysafe” or the “Company”) (NYSE: PSFE), a

leading payments platform, announced a definitive agreement to sell

its direct marketing payment processing business line (“the

disposed business”). Paysafe also announced preliminary select

results for the fourth quarter and full year 2024, along with

supplemental financial information for comparability purposes,

giving effect to the disposed business.

Bruce Lowthers, CEO of Paysafe commented: “The divestiture of

our direct marketing payment processing business reflects our

commitment to portfolio and resource optimization to focus on our

largest growth opportunities as a company. This accelerates our

transformation by exiting a non-strategic business line, bringing a

close to the repositioning of our Merchant Solutions segment. This

represents a significant milestone that enhances long-term

shareholder value by positioning Paysafe to deliver resilient

growth and sharpen our focus on Paysafe's ideal customers and

verticals in the experience economy.”

Agreement to sell direct marketing payment processing

business

Paysafe has entered into a definitive agreement to sell

substantially all assets related to its direct marketing payment

processing business line (Paysafe Direct LLC) to KORT Payments, a

specialized omnichannel payments provider, led by Joel Leonoff,

founder and former CEO of Paysafe. The business primarily consists

of direct marketing and other card-not-present volume in both

complex and traditional industry verticals.

The transaction includes reseller and merchant contracts, as

well as dedicated technology and employees related to the business.

The consideration for this transaction largely consists of annual

earnout payments over the next five years. The transaction is

expected to close in 30 days subject to finalizing certain

transition services-related items.

Additional background

During the Company’s prior two earnings calls, management

discussed that strategically it was in the best interest of

Paysafe’s shareholders to reduce the Company’s exposure to direct

marketing, a business line within the SMB portfolio of its Merchant

Solutions segment. In the fourth quarter, the Company continued

reviewing alternatives for the business line and exiting higher

risk merchants and determined that an accelerated exit would best

support long-term shareholder value and minimize disruption to the

impacted employees and remaining customers.

John Crawford, CFO of Paysafe commented: “This is a meaningful

step forward to improve our financial performance by eliminating a

declining, non-core revenue stream while significantly reducing

Paysafe’s exposure to higher risk verticals. It’s important to

highlight that the core businesses performed in line with our

expectations for 2024, including 10% revenue growth from our

Merchant Solutions segment, excluding the disposed business, and 4%

revenue growth from our Digital Wallets segment. We look forward to

providing more detail on our 2024 performance and 2025 outlook

during our earnings call next month.”

Preliminary select financial results

To supplement the preliminary financial results, which were

impacted by the accelerated merchant exits and associated credit

losses during the fourth quarter, the Company has provided

additional historical information for comparability purposes giving

effect to the disposed business.

Full year 2024

Subject to the finalization of financial reporting processes,

including the finalization of our review of income taxes, net

income for 2024 is expected to be between $19 million and $25

million, compared to a net loss of $20 million in 2023.

Full year revenue for 2024 is estimated to be $1,705 million, an

increase of 6% compared to 2023, or 7% when excluding the disposed

business.

Adjusted EBITDA for the full year 2024 is estimated to be $452

million, a decrease of 2%, compared to 2023, or an increase of 2%,

when excluding the disposed business. This includes total credit

losses of $47 million in 2024, an increase of $26 million compared

to 2023. As previously discussed on the Company’s earnings calls,

Paysafe made significant investments in 2024 totaling approximately

$29 million to expand its sales capabilities and optimize the

portfolio.

The combined year-over-year headwinds from movements in foreign

exchange rates and interest on consumer deposits to full year

revenue and adjusted EBITDA were approximately $6 million and $7

million, respectively.

Fourth quarter 2024

Subject to the finalization of financial reporting processes,

including the finalization of income taxes, net income for the

fourth quarter of 2024 is expected to be between $31 million and

$37 million, compared to a net loss of $12 million in the fourth

quarter of 2023.

Revenue for the fourth quarter of 2024 is estimated to be $420

million, an increase of 1% compared to the fourth quarter of 2023,

or 4% when excluding the disposed business.

Adjusted EBITDA for the fourth quarter of 2024 is estimated to

be $103 million, a decrease of 16%, or an increase of 1% when

excluding the disposed business. This includes total credit losses

of $23 million in the fourth quarter of 2024, an increase of $16

million compared to the fourth quarter of 2023.

The combined year-over-year headwinds from movements in foreign

exchange rates and interest on consumer deposits to fourth quarter

revenue and adjusted EBITDA were approximately $5 million and $4

million, respectively.

Summary of estimated segment results

Three Months Ended December

31, (1)

Paysafe

YoY

Results of disposed business

(2)

($ in millions) (unaudited)

2024

2023

change

2024

2023

Revenue:

Merchant Solutions

$

230

$

227

1%

$

13

$

24

Digital Wallets

$

194

$

191

2%

$

0

$

0

Intersegment

$

(4

)

$

(4

)

0%

$

0

$

0

Total Revenue

$

420

$

415

1%

$

13

$

24

Adjusted EBITDA:

Merchant Solutions

$

33

$

57

-42%

$

(6

)

$

13

Digital Wallets

$

89

$

82

9%

$

0

$

0

Corporate

$

(18

)

$

(17

)

-6%

$

0

$

0

Total Adjusted EBITDA

$

103

$

122

-16%

$

(6

)

$

13

Twelve Months Ended December

31, (1)

Paysafe

YoY

Results of disposed business

(2)

($ in millions) (unaudited)

2024

2023

change

2024

2023

Revenue:

Merchant Solutions

$

958

$

878

9%

$

104

$

102

Digital Wallets

$

766

$

735

4%

$

0

$

0

Intersegment

$

(18

)

$

(12

)

50%

$

0

$

0

Total Revenue

$

1,705

$

1,601

6%

$

104

$

102

Adjusted EBITDA:

Merchant Solutions

$

191

$

222

-14%

$

43

$

58

Digital Wallets

$

339

$

319

6%

$

0

$

0

Corporate

$

(78

)

$

(82

)

5%

$

0

$

0

Total Adjusted EBITDA

$

452

$

459

-2%

$

43

$

58

(1)

Amounts may not sum due to rounding.

(2)

The adjusted EBITDA amounts for the

disposed business exclude certain indirect costs that were

historically allocated to the disposed business. Such allocations

included labor and non-labor expenses related to the business

line’s shared functions (e.g., finance, technology and legal, among

others). Indirect costs associated with the disposed business were

$4 million and $2 million for three months ended December 31, 2024

and 2023, respectively, and $14 million and $5 million for the

twelve months ended December 31, 2024 and 2023, respectively.

Outlook

For full year 2025, Paysafe expects year-over-year revenue

growth to be between 6.5% and 8.0% and adjusted EBITDA margin to be

between 27.1% and 27.6%, with adjusted EBITDA growth in the

mid-teens. This preliminary outlook excludes the results of the

disposed business for 2024 and 2025.

Paysafe continues to expect to generate strong free cash flow

and to reduce leverage, including its goal to achieve 3.5x net

leverage by the end of 2026.

Share repurchase program

The Company is also announcing that its Board of Directors has

authorized a $70 million increase to its existing share repurchase

program. Including the $70 million increase announced today,

approximately $77 million in aggregate remains available under the

share repurchase program.

Under the share repurchase program, management is authorized to

purchase shares of our common stock from time to time through open

market purchases or privately negotiated transactions at prevailing

prices as permitted by securities laws and other legal

requirements, and subject to market conditions and other factors.

This program does not obligate the Company to acquire any

particular amount of common stock and the program may be extended,

modified, suspended or discontinued at any time at the Company’s

discretion.

Basis of preliminary financial information

Paysafe intends to provide its full financial results and a more

detailed update with our scheduled fourth quarter earnings call on

March 4, 2025, alongside formal guidance for 2025. Until that time,

the preliminary results described in this press release reflect

management’s estimates based upon information available to

management as of the date of this release, are unaudited, and are

subject to the finalization of our financial reporting processes.

These preliminary estimates should not be viewed as a substitute

for full annual financial statements prepared in accordance with

GAAP. There is a possibility that these preliminary results could

differ materially from the actual results when they are finalized

and publicly disclosed.

About Paysafe

Paysafe is a leading payments platform with an extensive track

record of serving merchants and consumers in the global

entertainment sectors. Its core purpose is to enable businesses and

consumers to connect and transact seamlessly through

industry-leading capabilities in payment processing, digital

wallet, and online cash solutions. With over 25 years of online

payment experience, an annualized transactional volume of $152

billion in 2024, and approximately 3,300 employees located in 12+

countries, Paysafe connects businesses and consumers across 260

payment types in over 48 currencies around the world. Delivered

through an integrated platform, Paysafe solutions are geared toward

mobile-initiated transactions, real-time analytics and the

convergence between brick-and-mortar and online payments. Further

information is available at www.paysafe.com.

Forward-looking Statements

This press release includes “forward-looking statements” within

the meaning of U.S. federal securities laws. These forward-looking

statements are provided for illustrative purposes only and are not

intended to serve as, and must not be relied on by any investor as,

a guarantee, an assurance, a prediction or a definitive statement

of fact or probability. Paysafe Limited’s (“Paysafe,” “PSFE,” the

“Company,” “we,” “us,” or “our”) actual results may differ from

their expectations, estimates, and projections and, consequently,

you should not rely on these forward-looking statements as

predictions of future events. Words such as “anticipate,” “appear,”

“approximate,” “believe,” “budget,” “continue,” “could,”

“estimate,” “expect,” “forecast,” “foresee,” “guidance,” “intends,”

“likely,” “may,” “might,” “plan,” “possible,” “potential,”

“predict,” “project,” “seek,” “should,” "will," “would” and

variations of such words and similar expressions (or the negative

version of such words or expressions) may identify forward-looking

statements, but the absence of these words does not mean that a

statement is not forward-looking. These forward-looking statements

include, without limitation, Paysafe’s expectations with respect to

future performance.

These forward-looking statements involve significant risks,

uncertainties, and events that may cause the actual results to

differ materially, and potentially adversely, from those expressed

or implied in the forward-looking statements. While the Company

believes its assumptions concerning future events are reasonable, a

number of factors could cause actual results to differ materially

from those projected, including, but not limited to: cyberattacks

and security vulnerabilities; complying with and changes in money

laundering regulations, financial services regulations,

cryptocurrency regulations, consumer and business privacy and data

use regulations or other regulations in Bermuda, the UK, Ireland,

Switzerland, the United States, Canada and elsewhere; risks related

to our focus on specialized and high-risk verticals; geopolitical

events and the economic and other impacts of such geopolitical

events and the responses of governments around the world; acts of

war and terrorism; the effects of global economic uncertainties,

including inflationary pressure and rising interest rates, on

consumer and business spending; risks associated with foreign

currency exchange rate fluctuations; changes in our relationships

with banks, payment card networks, issuers and financial

institutions; risk related to processing online payments for

merchants and customers engaged in the online gambling and foreign

exchange trading sectors; risks related to becoming an unwitting

party to fraud or being deemed to be handling proceeds resulting

from the criminal activity by customers; the effects of

chargebacks, merchant insolvency and consumer deposit settlement

risk; changes to our continued financial institution sponsorships;

failure to hold, safeguard or account accurately for merchant or

customer funds; risks related to the availability, integrity and

security of internal and external IT transaction processing systems

and services; our ability to manage regulatory and litigation

risks, and the outcome of legal and regulatory proceedings; failure

of fourth parties to comply with contractual obligations; changes

and compliance with payment card network operating rules;

substantial and increasingly intense competition worldwide in the

global payments industry; risks related to developing and

maintaining effective internal controls over financial reporting;

managing our growth effectively, including growing our revenue

pipeline; any difficulties maintaining a strong and trusted brand;

keeping pace with rapid technological developments; risks

associated with the significant influence of our principal

shareholders; the effect of regional epidemics or a global pandemic

on our business; and other factors included in the “Risk Factors”

in our Form 20-F and in other filings we make with the SEC, which

are available at https://www.sec.gov. Readers are cautioned not to

place undue reliance upon any forward-looking statements, which

speak only as of the date made.

The Company expressly disclaims any obligations or undertaking

to release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in their

expectations with respect thereto or any change in events.

Disposed Business and Non-GAAP financial measures

This release includes the presentation and discussion of

financial information that reflects the disposal of the Company's

direct marketing payment processing business line. Additionally, to

supplement the Company’s condensed consolidated financial

statements presented in accordance with generally accepted

accounting principles, or GAAP, the Company presents in this

release non-GAAP measures of certain components of financial

performance. This includes Adjusted EBITDA and net leverage which

are supplemental measures that not required by, or presented in

accordance with, accounting principles generally accepted in the

United States (“U.S. GAAP”).

Adjusted EBITDA is defined as net income/(loss) before the

impact of income tax (benefit)/expense, interest expense, net,

depreciation and amortization, share-based compensation, impairment

expense on goodwill and intangible assets, restructuring and other

costs, loss/(gain) on disposal of a subsidiaries and other assets,

net, and other income/(expense), net. These adjustments also

include certain costs and transaction items that are not reflective

of the underlying operating performance of the Company. Management

believes Adjusted EBITDA to be a useful profitability measure to

assess the performance of our businesses and improves the

comparability of operating results across reporting periods.

Net leverage is defined as net debt (gross debt less cash and

cash equivalents) divided by the last twelve months Adjusted

EBITDA. Management believes net leverage is a useful measure of the

Company's credit position and progress towards leverage

targets.

Management believes the presentation of these disposed business

and non-GAAP financial measures, including Adjusted EBITDA and net

leverage, when considered together with the Company’s results

presented in accordance with GAAP, provide users with useful

supplemental information in comparing the operating results across

reporting periods by excluding items that are not considered

indicative of Paysafe’s core operating performance. In addition,

management believes the presentation of these disposed business and

non-GAAP financial measures provides useful supplemental

information in assessing the Company’s results on a basis that

fosters comparability across periods by excluding the impact on the

Company’s reported GAAP results of acquisitions and dispositions

that have occurred in such periods. However, these non-GAAP

measures exclude items that are significant in understanding and

assessing Paysafe’s financial results or position. Therefore, these

measures should not be considered in isolation or as alternatives

to revenue, net income, cash flows from operations or other

measures of profitability, liquidity or performance under GAAP.

You should be aware that Paysafe’s presentation of these

measures may not be comparable to similarly titled measures used by

other companies.

GAAP to Non-GAAP reconciliation (1)

Three Months Ended

Year Ended

December 31,

December 31,

($ in millions)(unaudited)

2024

2023

2024

2023

Net income / (loss) (2)

$

34

$

(12

)

$

22

$

(20)

Income tax (benefit) / expense

(18

)

13

(8

)

41

Interest expense, net

33

39

141

151

Depreciation and amortization

66

66

273

263

Share-based compensation expense

4

6

39

29

Impairment expense on goodwill and

intangibles assets

—

1

1

1

Restructuring and other costs

4

2

5

6

Loss on disposal of subsidiaries and other

assets, net

—

—

1

—

Other (income) / expense, net

(19

)

7

(21

)

(13)

Paysafe total Adjusted EBITDA

$

103

$

122

$

452

$

459

(1)

Amounts may not sum due to rounding.

(2)

Due to ongoing reviews of financial

statement line items within the reconciliation of Adjusted EBITDA

to Net income for both the three months ended and the year ended

December 31, 2024, including but not limited to income taxes, we

are reporting a range of preliminary net income, from $31 million

to $37 million for the three months ended December 31, 2024 and a

range from $19 million to $25 million for the year ended December

31, 2024. Each of the numbers included in the reconciliation are

also considered to be the mid-point of a similar range.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250210507533/en/

Media Crystal Wright Paysafe +1 (904) 328-7740

crystal.wright@paysafe.com

Investors Kirsten Nielsen Paysafe +1 (646) 901-3140

kirsten.nielsen@paysafe.com

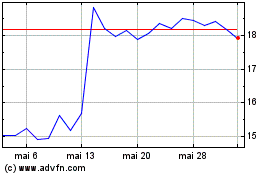

Paysafe (NYSE:PSFE)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Paysafe (NYSE:PSFE)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025