Trio-Tech International (NYSE MKT: TRT), a comprehensive

provider of semiconductor back-end solutions and a global

value-added supplier of electronic equipment, today announced its

financial results for the second quarter that ended on December 31,

2024. The company also announced shipments of dynamic tester

systems for Silicon Carbide (SiC) and Gallium Nitride (GaN) power

modules during the quarter.

Trio-Tech International Chairman and CEO S.W. Yong’s

Comments

“While our second quarter results were affected by softness in

the semiconductor market and slower electronic equipment sales, we

made progress with shipments of our dynamic tester systems for the

growing SiC and GaN power module markets.

“SiC and GaN are revolutionizing power electronics, particularly

in high-performance applications where efficiency and thermal

management are crucial. Unlike traditional silicon (Si) technology,

SiC and GaN facilitate faster switching with reduced energy loss

and greater power capacity. As industries prioritize performance,

durability, and cost-effectiveness, we believe they will recognize

the advantages of these materials, which ultimately need to be

tested by systems like our dynamic tester that complies with

relevant automotive qualification guidelines (AQG).

“SiC and GaN provide significant benefits in efficiency, power

density, and thermal tolerance, making them well-suited for

demanding applications like industrial power systems, electric

vehicles, and advanced computing like AI. Their capability to

manage higher voltages and temperatures while reducing energy loss

ensures their importance in next-generation power electronics.

“While Silicon remains dominant in many markets today, SiC and

GaN are positioned to gain traction due to their superior

power-handling capabilities and efficiency advantages. Our target

customers include suppliers of power modules and inverters to

automotive manufacturers, power semiconductor manufacturers, and

third-party testing laboratories that provide certification and

compliance services for mission-critical applications.

“Given the strong global demand for SiC and GaN and the

encouraging initial response to our dynamic tester, we are actively

engaging with several potential new customers who are developing

applications for high-efficiency power solutions. We look forward

to providing updates on our progress throughout the remainder of

our fiscal year.”

Fiscal 2025 Second Quarter Financial Results

- Total revenue was $8.6 million, compared to $12.2 million a

year ago.

- Gross margin was $2.2 million, or 26% of revenue, compared to

$2.9 million, or 23% of revenue a year ago.

- Total operating expense was $2.2 million, compared to $2.2

million a year ago.

- Loss from operations was $3,000, compared to income from

operations of $677,000 a year ago.

- Other income was $678,000 mainly due to favorable foreign

currency movement, compared to other expense of $100,000 a year

ago.

- Net income attributable to common shareholders was $507,000,

compared to $507,000 a year ago.

- Net income per diluted share was $0.12, compared to $0.12 a

year ago.

- Cash and cash equivalents were $10.3 million on December 31,

2024, compared to $10.0 million on June 30, 2024.

Fiscal 2025 First Six Months Financial Results

- Total revenue was $18.4 million, compared to $22.2 million a

year ago.

- Gross margin was $4.5 million, or 25% of revenue, compared to

$5.4 million, or 24% of revenue a year ago.

- Total operating expense was $4.4 million, compared to $4.7

million a year ago.

- Income from operations was $130,000, compared to income from

operations of $676,000 a year ago.

- Other income was $366,000, compared to $145,000 a year

ago.

- Net income attributable to common shareholders was $271,000,

compared to $737,000 a year ago.

- Net income per diluted share was $0.06, compared to $0.17 a

year ago.

About Trio-Tech International

Trio-Tech International (NYSE MKT: TRT) is a California-based

company operating in the United States, Singapore, Malaysia,

Thailand, and China. Founded in 1958, Trio-Tech is a leading

provider of semiconductor testing services, manufacturing

solutions, and value-added distribution services. The company’s

diversified business segments include semiconductor back-end

solutions and industrial electronics.

For more information, visit www.triotech.com and

www.universalfareast.com.

Forward Looking Statements

This press release contains statements that are forward looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 and may contain forward looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, and assumptions regarding future activities and results of

operations of the Company. In light of the "safe harbor" provisions

of the Private Securities Litigation Reform Act of 1995, the

following factors, among others, could cause actual results to

differ materially from those reflected in any forward looking

statements made by or on behalf of the Company: market acceptance

of Company products and services; the divestiture of one or more

business segments in response to, among other factors, changing

business conditions or technologies and volatility in the

semiconductor industry, which could affect demand for the Company's

products and services; the impact of competition; problems with

technology; product development schedules; delivery schedules;

changes in military or commercial testing specifications which

could affect the market for the Company's products and services;

difficulties in profitably integrating acquired businesses, if any,

into the Company; risks associated with conducting business

internationally and especially in Asia, including currency

fluctuations and devaluation, currency restrictions, local laws and

restrictions and possible social, political and economic

instability; changes in U.S. and global financial and equity

markets, including market disruptions and significant interest rate

fluctuations; trade tension between U.S. and China and other

economic, financial and regulatory factors beyond the Company's

control. Other than statements of historical fact, all statements

made in this release are forward looking, including, but not

limited to, statements regarding industry prospects, future results

of operations or financial position, and statements of our intent,

belief and current expectations about our strategic direction,

prospective and future financial results and condition. In some

cases, you can identify forward looking statements by the use of

terminology such as "may," "will," "expects," "plans,"

"anticipates," "estimates," "potential," "believes," "can impact,"

"continue," or the negative thereof or other comparable

terminology. Forward looking statements involve risks and

uncertainties that are inherently difficult to predict, which could

cause actual outcomes and results to differ materially from our

expectations, forecasts and assumptions. Many of these risks and

uncertainties are beyond the Company's control. Reference is made

to the discussion of risk factors detailed in the Company's filings

with the Securities and Exchange Commission including its reports

on Form 10-K and 10-Q. Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the dates on which they are made.

TRIO-TECH INTERNATIONAL AND SUBSIDIARIES CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME /

(LOSS) UNAUDITED (IN THOUSANDS, EXCEPT EARNINGS PER

SHARE)

Three Months Ended

Six Months Ended

December 31,

December 31,

December 31,

December 31,

2024

2023

2024

2023

Revenue Semiconductor Back-end Solutions

$

5,809

$

7,896

$

12,688

$

15,072

Industrial Electronics

2,801

4,300

5,715

7,083

Others

9

6

15

13

8,619

12,202

18,418

22,168

Cost of Sales

6,401

9,348

13,878

16,794

Gross Margin

2,218

2,854

4,540

5,374

Operating Expense: General and administrative

1,965

1,817

3,929

3,975

Selling

176

248

326

435

Research and development

114

131

202

216

(Gain) / Loss on disposal of property, plant and equipment

(34

)

(19

)

(47

)

72

Total operating expense

2,221

2,177

4,410

4,698

(Loss) / Income from Operations

(3

)

677

130

676

Other Income / (Expense) Interest expense

(13

)

(22

)

(26

)

(46

)

Other income / (expense), net

686

(82

)

321

114

Government grant

5

4

71

77

Total other income / (expense)

678

(100

)

366

145

Income from Continuing Operations before Income Taxes

675

577

496

821

Income Tax Expense

(139

)

(95

)

(190

)

(132

)

Income from Continuing Operations before Non-controlling

Interest, Net of Taxes

536

482

306

689

Discontinued Operations (Loss) / Income from

discontinued operations, net of tax

(7

)

4

-

4

Net Income

529

486

306

693

Less: Net income / (loss) attributable to non-controlling

interest

22

(21

)

35

(44

)

Net Income Attributable to Common Shareholders

$

507

$

507

$

271

$

737

Amounts Attributable to Common Shareholders: Income

from continuing operations, net of tax

511

503

271

730

(Loss) / Income from discontinued operations, net of tax

(4

)

4

-

7

Net Income Attributable to Common Shareholders

$

507

$

507

$

271

$

737

Basic Earnings per Share: Basic earnings per share

from continuing operations

$

0.12

$

0.12

$

0.06

$

0.18

Basic earnings per share from discontinued operations

-

-

-

-

Basic Earnings per Share from Net Income

$

0.12

$

0.12

$

0.06

$

0.18

Diluted Earnings per Share: Diluted earnings per

share from continuing operations

$

0.12

$

0.12

$

0.06

$

0.17

Diluted earnings per share from discontinued operations

-

-

-

-

Diluted Earnings per Share from Net Income

$

0.12

$

0.12

$

0.06

$

0.17

Weighted Average Number of Common Shares Outstanding

Basic

4,250

4,120

4,250

4,109

Dilutive effect of stock options

153

139

119

161

Number of Shares Used to Compute Earnings Per Share Diluted

4,403

4,259

4,369

4,270

Three Months Ended Six Months Ended Dec. 31, Dec. 31,

Dec. 31, Dec. 31,

2024

2023

2024

2023

Comprehensive (Loss) / Income Attributable to Common

Shareholders: Net income

$

529

$

486

$

306

$

693

Foreign currency translation, net of tax

(1,794

)

1,158

220

975

Comprehensive (Loss) / Income

(1,265

)

1,644

526

1,668

Less: comprehensive income / (loss) attributable to non-

controlling interest

(2

)

(72

)

137

(74

)

Comprehensive (Loss) / Income Attributable to Common

Shareholders

$

(1,263

)

$

1,716

$

389

$

1,742

TRIO-TECH INTERNATIONAL AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (IN THOUSANDS,

EXCEPT NUMBER OF SHARES)

December 31,

June 30,

2024

2024

(Unaudited)

ASSETS CURRENT ASSETS: Cash and cash equivalents

$

10,323

$

10,035

Short-term deposits

6,222

6,497

Trade accounts receivable, less allowance for expected credit

losses of $80 and $209, respectively

9,881

10,661

Other receivables

961

541

Inventories, less provision for obsolete inventories of $771 and

$679, respectively

1,957

3,162

Prepaid expense and other current assets

548

536

Restricted term deposits

756

750

Total current assets

30,648

32,182

NON-CURRENT ASSETS: Deferred tax assets

68

124

Investment properties, net

372

407

Property, plant and equipment, net

5,594

5,937

Operating lease right-of-use assets

1,197

1,887

Other assets

129

232

Restricted term deposits

1,792

1,771

Total non-current assets

9,152

10,358

TOTAL ASSETS

$

39,800

$

42,540

LIABILITIES CURRENT LIABILITIES: Accounts payable

$

1,804

$

3,175

Accrued expense

2,695

3,634

Contract liabilities

721

754

Income taxes payable

288

379

Current portion of bank loans payable

258

261

Current portion of finance leases

42

57

Current portion of operating leases

943

1,162

Total current liabilities

6,751

9,422

NON-CURRENT LIABILITIES: Bank loans payable, net of current portion

524

613

Finance leases, net of current portion

12

34

Operating leases, net of current portion

254

725

Income taxes payable, net of current portion

-

141

Other non-current liabilities

30

27

Total non-current liabilities

820

1,540

TOTAL LIABILITIES

$

7,571

$

10,962

EQUITY SHAREHOLDERS’ EQUITY: Common stock, no par

value, 15,000,000 shares authorized; 4,250,305 shares issued

outstanding as at December 31, 2024 and June 30, 2024, respectively

$

13,325

$

13,325

Paid-in capital

5,656

5,531

Accumulated retained earnings

12,084

11,813

Accumulated other comprehensive income-translation adjustments

778

660

Total shareholders’ equity

31,843

31,329

Non-controlling interest

386

249

TOTAL EQUITY

$

32,229

$

31,578

TOTAL LIABILITIES AND EQUITY

$

39,800

$

42,540

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250213039047/en/

For inquiries, please contact:

PondelWilkinson Inc. Todd Kehrli or Jim Byers

tkehrli@pondel.com jbyers@pondel.com

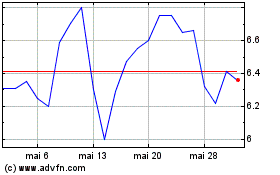

Trio Tech (AMEX:TRT)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Trio Tech (AMEX:TRT)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025