Full-Year Revenue of $4.08 Billion, Record

Diluted Earnings Per Share of $17.19, and Strong Operating Cash

Flows of $573 Million

Valmont® Industries, Inc. (NYSE: VMI), a global leader that

provides products and solutions to support vital infrastructure and

advance agricultural productivity, today reported financial results

for the fourth quarter and fiscal year ended December 28, 2024.

President and Chief Executive Officer Avner M. Applbaum

commented, “The fourth quarter capped off an outstanding year for

Valmont as we continued executing our strategy. Both our

Infrastructure and Agriculture segments achieved sales growth, and

we expanded consolidated operating profit margins year-over-year

through strategic pricing, improved operational efficiencies, and

disciplined cost management. I want to thank the entire Valmont

team for their dedication and hard work in delivering these strong

results.”

“Looking ahead to 2025, demand for our Infrastructure products

and solutions will drive continued sales growth. In Agriculture,

international sales, particularly large-scale projects, will help

offset expected market softness in North America. Across both

segments, we remain focused on commercial and operational

excellence, leveraging our streamlined organization to deliver

exceptional value to our customers and shareholders.”

Fourth Quarter 2024 Highlights (all metrics compared to

Fourth Quarter 2023 unless otherwise noted)

- Net sales increased 2.1% to $1.04 billion, compared to $1.02

billion

- Operating income increased to $120.0 million or 11.6% of net

sales, compared to $63.5 million or 6.3% of net sales ($100.2

million or 9.9% adjusted1 in 2023)

- Diluted earnings per share (“EPS”) increased to $3.84, compared

to $1.38 ($3.18 adjusted1 in 2023)

- Operating cash flows increased 66.9% to $193.4 million,

compared to $115.9 million

- Cash and cash equivalents at the end of the fourth quarter were

$164.3 million

- Invested $25.6 million in capital expenditures and returned

$27.0 million to shareholders through share repurchases and

dividends

- Moody's Ratings upgraded the Company's credit rating to

Baa2

Full Year 2024 Highlights (all metrics compared to Full

Year 2023 unless otherwise noted)

- Net sales decreased 2.4% to $4.08 billion, compared to $4.17

billion

- Infrastructure sales of $3.0 billion were similar to prior

year, while Agriculture sales declined 8.3%

- Operating income increased to $524.6 million or 12.9% of net

sales, compared to $291.6 million or 7.0% of net sales ($473.2

million or 11.3% adjusted1 in 2023)

- Diluted EPS increased to $17.19, compared to $6.78 ($14.98

adjusted1 in 2023)

- Operating cash flows meaningfully increased 86.7% to $572.7

million, compared to $306.8 million, driven by strong net earnings

and effective working capital management

- Free cash flow1 increased 134.9% to $493.2 million, compared to

$210.0 million

- Invested $79.5 million in capital expenditures and returned

$118.4 million to shareholders through share repurchases and

dividends

- Deployed $393.0 million to fully repay the revolving credit

facility balance, achieving a net leverage ratio1 of 1.0

- Achieved return on invested capital1 of 16.4%

Key Financial Metrics

Fourth Quarter 2024

GAAP

Adjusted1

(In thousands, except per-share

amounts)

12/28/2024

12/30/2023

12/28/2024

12/30/2023

Q4 2024

Q4 2023

vs. Q4 2023

Q4 2024

Q4 2023

vs. Q4 2023

Net Sales

$

1,037,294

$

1,015,526

2.1%

$

1,037,294

$

1,015,526

2.1%

Gross Profit

313,021

282,941

10.6%

313,021

282,941

10.6%

Gross Profit as a % of Net Sales

30.2%

27.9%

30.2%

27.9%

Operating Income

119,988

63,548

88.8%

119,988

100,204

19.7%

Operating Income as a % of Net Sales

11.6%

6.3%

11.6%

9.9%

Net Earnings Attributable to VMI2

77,653

28,587

171.6%

77,653

66,034

17.6%

Diluted Earnings per Share

3.84

1.38

178.3%

3.84

3.18

20.8%

Weighted Average Shares Outstanding

20,197

20,764

20,197

20,764

Full Year 2024

GAAP

Adjusted1

(In thousands, except per-share

amounts)

12/28/2024

12/30/2023

12/28/2024

12/30/2023

FY 2024

FY 2023

vs. FY 2023

FY 2024

FY 2023

vs. FY 2023

Net Sales

$

4,075,034

$

4,174,598

(2.4)%

$

4,075,034

$

4,174,598

(2.4)%

Gross Profit

1,241,212

1,236,034

0.4%

1,241,212

1,236,034

0.4%

Gross Profit as a % of Net Sales

30.5%

29.6%

30.5%

29.6%

Operating Income

524,584

291,557

79.9%

524,584

473,237

10.9%

Operating Income as a % of Net Sales

12.9%

7.0%

12.9%

11.3%

Net Earnings Attributable to VMI2,3

348,259

143,475

142.7%

348,259

316,926

9.9%

Diluted Earnings per Share3

17.19

6.78

153.5%

17.19

14.98

14.8%

Weighted Average Shares Outstanding

20,261

21,159

20,261

21,159

Fourth Quarter 2024 Segment Review (all metrics compared

to Fourth Quarter 2023 unless otherwise noted)

Infrastructure (73.3% of Net

Sales)

Products and solutions to serve the infrastructure markets of

utility, solar, lighting and transportation, and

telecommunications, along with coatings services to protect metal

products

Sales increased 2.1% to $763.6 million, compared to $748.3

million.

Utility sales grew 5.9%, driven by pricing excellence and a

favorable product mix, with higher volumes of distribution and

substation products, which more than offset steel index deflation.

Telecommunications sales increased significantly, benefiting from a

higher level of carrier spending in a stabilizing North American

market. Solar sales declined significantly, primarily in North

America, following the Company’s strategic decision earlier in 2024

to exit certain low-margin projects.

Operating income increased to $122.0 million or 16.0% of net

sales, compared to $82.6 million or 11.1% of net sales ($98.7

million or 13.2% adjusted1 in 2023). This growth was driven by

pricing excellence, a reduction in the cost of goods sold and

higher volumes.

Agriculture (26.7% of Net

Sales)

Center pivot and linear irrigation equipment components for

agricultural markets, including aftermarket parts and tubular

products, and advanced technology solutions for precision

agriculture

Sales increased 2.3% to $278.0 million, compared to $271.6

million, despite a 2.3% unfavorable impact from foreign currency

translation.

In North America, irrigation equipment volumes were slightly

lower. Increased replacement sales, driven by severe weather events

earlier in 2024, were offset by continued agriculture market

softness due to lower grain prices. Internationally, sales were

higher year-over-year, led by strong growth in the Europe, Middle

East, and Africa (“EMEA”) region, and slightly higher sales in

Brazil amid a stabilizing market environment.

Operating income increased to $28.5 million or 10.3% of net

sales, compared to $13.9 million or 5.2% of net sales ($27.8

million or 10.3% adjusted1 in 2023), reflecting reduced SG&A

expenses.

Providing 2025 Full-Year Financial

Outlook and Key Assumptions

The Company is introducing its full-year 2025 financial outlook,

including projected net sales and diluted earnings per share, and

key assumptions for the year.

Metric

2025 Outlook

Net Sales

$4.0 to $4.2 billion

~(2%) to ~+3%

~(0.5%) to ~+4.5% Constant

Currency1

Infrastructure Net

Sales

$3.02 to $3.16 billion

Growth of ~+1% to ~+5.5%

~+2% to ~+6.5% Constant

Currency1

Agriculture Net Sales

$0.98 to $1.04 billion

Decline of ~(9.5%) to ~(3.5%)

~(7%) to ~(1%) Constant

Currency1

Diluted Earnings per

Share

$17.20 to $18.80

Capital Expenditures

$140 to $160 million

Effective Tax Rate

~26.0%

Key Assumptions

- Steel cost assumptions are aligned with futures markets as of

February 14, 2025.

- Based on the Company’s understanding of the recently announced

China tariffs, and the steel and aluminum import tariffs introduced

on February 10, 2025, these direct impacts have been factored into

the 2025 outlook.

- The potential timing and impact of additional U.S. import

tariffs, including a proposed 25% tariff on all imports from Mexico

and Canada, as well as retaliatory actions by other countries,

remains unclear and are not included in the 2025 outlook.

1Please see Reg G reconciliation to GAAP measures at end of

document 2Net earnings attributable to Valmont Industries, Inc.

including change in redemption value of redeemable noncontrolling

interests 3Q2 2024 included a tax benefit of approximately $3.0

million or $0.15 per share due to the reduction of a valuation

allowance on a tax loss carryforward in a foreign subsidiary

A live audio discussion with Avner M. Applbaum, President and

Chief Executive Officer, and Thomas Liguori, Executive Vice

President and Chief Financial Officer, will take place on Tuesday,

February 18, 2025 at 8:00 a.m. CT. The discussion can be accessed

by telephone at +1 877.407.6184 or +1 201.389.0877 (no Conference

ID needed) or via webcast at the following link: Valmont Industries

4Q and Full Year 2024 Earnings Conference Call. A slide

presentation will be available for download on the Investors page

of valmont.com during the webcast. A replay of the event will be

accessible three hours after the call at the above link or by

telephone at +1 877.660.6853 or +1 201.612.7415 using access code

13750342. The replay will be available until 10:59 p.m. CT on

February 25, 2025.

About Valmont Industries, Inc.

For nearly 80 years, Valmont has been a global leader that

provides products and solutions to support vital infrastructure and

advance agricultural productivity. We are committed to

customer-focused innovation that delivers lasting value. Learn more

about how we’re Conserving Resources. Improving Life.® at

valmont.com.

Concerning Forward-Looking Statements

This release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

These statements are based on assumptions made by management,

considering its experience in the industries where Valmont

operates, perceptions of historical trends, current conditions,

expected future developments, and other relevant factors. It is

important to note that these statements are not guarantees of

future performance or results. They involve risks, uncertainties

(some of which are beyond Valmont’s control), and assumptions.

While management believes these forward-looking statements are

based on reasonable assumptions, numerous factors could cause

actual results to differ materially from those anticipated. These

factors include, among other things, risks described in Valmont’s

reports to the Securities and Exchange Commission (“SEC”), the

Company’s actual cash flows and net income, future economic and

market circumstances, industry conditions, company performance and

financial results, operational efficiencies, availability and price

of raw materials, availability and market acceptance of new

products, product pricing, domestic and international competitive

environments, geopolitical risks, and actions and policy changes by

domestic and foreign governments. The Company cautions that any

forward-looking statements in this release are made as of its

publication date and does not undertake to update these statements,

except as required by law.

Website and Social Media Disclosure

The Company uses its website and social media channels, as

identified on its website, to distribute company information. Posts

on these channels may contain material information. Therefore,

investors should monitor these channels alongside the Company’s

press releases, SEC filings, and public conference calls and

webcasts. The contents of the Company’s website and social media

channels are not considered part of this press release.

VALMONT INDUSTRIES, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF EARNINGS

(Dollars and shares in thousands,

except per-share amounts)

(Unaudited)

Thirteen weeks ended

Fifty-two weeks ended

December 28,

December 30,

December 28,

December 30,

2024

2023

2024

2023

Net sales

$

1,037,294

$

1,015,526

$

4,075,034

$

4,174,598

Cost of sales

724,273

732,585

2,833,822

2,938,564

Gross profit

313,021

282,941

1,241,212

1,236,034

Selling, general, and administrative

expenses

193,033

188,363

716,628

768,423

Impairment of goodwill and other

intangible assets

—

—

—

140,844

Realignment charges

—

31,030

—

35,210

Operating income

119,988

63,548

524,584

291,557

Other income (expenses):

Interest expense

(12,342

)

(15,314

)

(58,722

)

(56,808

)

Interest income

1,825

1,651

7,183

6,230

Gain on deferred compensation

investments

518

1,773

3,634

3,564

Gain (loss) on divestitures

(4,474

)

—

(4,474

)

2,994

Other

138

(6,492

)

(3,524

)

(11,085

)

Total other income (expenses)

(14,335

)

(18,382

)

(55,903

)

(55,105

)

Earnings before income taxes and equity in

loss of nonconsolidated subsidiaries

105,653

45,166

468,681

236,452

Income tax expense

27,199

10,882

117,978

90,121

Equity in loss of nonconsolidated

subsidiaries

(19

)

(200

)

(79

)

(1,419

)

Net earnings

78,435

34,084

350,624

144,912

Loss (earnings) attributable to redeemable

noncontrolling interests

(782

)

1,877

(2,365

)

5,937

Net earnings attributable to Valmont

Industries, Inc.

77,653

35,961

348,259

150,849

Change in redemption value of redeemable

noncontrolling interests

—

(7,374

)

—

(7,374

)

Net earnings attributable to Valmont

Industries, Inc. including change in redemption value of redeemable

noncontrolling interests

$

77,653

$

28,587

$

348,259

$

143,475

Weighted average shares outstanding -

Basic

20,031

20,577

20,122

20,956

Earnings per share - Basic

$

3.88

$

1.39

$

17.31

$

6.85

Weighted average shares outstanding -

Diluted

20,197

20,764

20,261

21,159

Earnings per share - Diluted

$

3.84

$

1.38

$

17.19

$

6.78

Cash dividends per share

$

0.60

$

0.60

$

2.40

$

2.40

VALMONT INDUSTRIES, INC. AND

SUBSIDIARIES

SUMMARY OPERATING

RESULTS

(Dollars in thousands)

(Unaudited)

Thirteen weeks ended

Fifty-two weeks ended

December 28,

December 30,

December 28,

December 30,

2024

2023

2024

2023

Infrastructure

Net sales

$

760,848

$

745,713

$

2,998,381

$

2,999,637

Gross profit

230,383

201,968

903,736

842,081

as a percentage of net sales

30.3

%

27.1

%

30.1

%

28.1

%

Selling, general, and administrative

expenses

108,345

103,227

406,596

424,997

as a percentage of net sales

14.2

%

13.8

%

13.6

%

14.2

%

Impairment of goodwill and other

intangible assets

—

—

—

3,571

Realignment charges

—

16,191

—

17,260

Operating income

122,038

82,550

497,140

396,253

as a percentage of net sales

16.0

%

11.1

%

16.6

%

13.2

%

Agriculture

Net sales

$

276,446

$

269,813

$

1,076,653

$

1,174,961

Gross profit

82,638

80,973

337,476

393,953

as a percentage of net sales

29.9

%

30.0

%

31.3

%

33.5

%

Selling, general, and administrative

expenses

54,139

58,833

199,140

230,729

as a percentage of net sales

19.6

%

21.8

%

18.5

%

19.6

%

Impairment of goodwill and other

intangible assets

—

—

—

137,273

Realignment charges

—

8,194

—

9,101

Operating income

28,499

13,946

138,336

16,850

as a percentage of net sales

10.3

%

5.2

%

12.8

%

1.4

%

Corporate

Selling, general, and administrative

expenses

$

30,549

$

26,303

$

110,892

$

112,697

Realignment charges

—

6,645

—

8,849

Operating loss

(30,549

)

(32,948

)

(110,892

)

(121,546

)

VALMONT INDUSTRIES, INC. AND

SUBSIDIARIES

SUMMARY OPERATING

RESULTS

(Dollars in thousands)

(Unaudited)

In the fourth quarter of fiscal 2024, the

Company renamed its Transmission, Distribution, and Substation

product line to the Utility product line.

In fiscal 2024, the Company realigned

management's reporting structure for certain composite structure

sales and, accordingly, revised its presentation of sales across

product lines to reflect how the product is currently managed. The

reporting for the thirteen and fifty-two weeks ended December 30,

2023 was adjusted to conform to the fiscal 2024 presentation. As a

result, Utility product line sales increased and Lighting and

Transportation product line sales decreased by $14,598 and $47,902

for the thirteen and fifty-two weeks ended December 30, 2023,

respectively.

Thirteen weeks ended December

28, 2024

Infrastructure

Agriculture

Intersegment

Consolidated

Geographical Market:

North America

$

597,830

$

129,319

$

(4,209

)

$

722,940

International

165,811

148,665

(122

)

314,354

Total sales

$

763,641

$

277,984

$

(4,331

)

$

1,037,294

Product Line:

Utility

$

350,710

$

—

$

—

$

350,710

Lighting and Transportation

216,130

—

—

216,130

Coatings

87,029

—

(2,671

)

84,358

Telecommunications

74,121

—

—

74,121

Solar

35,651

—

(122

)

35,529

Irrigation Equipment and Parts

—

255,042

(1,538

)

253,504

Technology Products and Services

—

22,942

—

22,942

Total sales

$

763,641

$

277,984

$

(4,331

)

$

1,037,294

Thirteen weeks ended December

30, 2023

Infrastructure

Agriculture

Intersegment

Consolidated

Geographical Market:

North America

$

575,166

$

136,378

$

(4,240

)

$

707,304

International

173,124

135,266

(168

)

308,222

Total sales

$

748,290

$

271,644

$

(4,408

)

$

1,015,526

Product Line:

Utility

$

331,272

$

—

$

—

$

331,272

Lighting and Transportation

221,612

—

—

221,612

Coatings

84,129

—

(2,409

)

81,720

Telecommunications

56,660

—

—

56,660

Solar

54,617

—

(168

)

54,449

Irrigation Equipment and Parts

—

244,148

(1,831

)

242,317

Technology Products and Services

—

27,496

—

27,496

Total sales

$

748,290

$

271,644

$

(4,408

)

$

1,015,526

VALMONT INDUSTRIES, INC. AND

SUBSIDIARIES

SUMMARY OPERATING

RESULTS

(Dollars in thousands)

(Unaudited)

Fifty-two weeks ended December

28, 2024

Infrastructure

Agriculture

Intersegment

Consolidated

Geographical Market:

North America

$

2,348,250

$

570,517

$

(17,045

)

$

2,901,722

International

660,326

513,191

(205

)

1,173,312

Total sales

$

3,008,576

$

1,083,708

$

(17,250

)

$

4,075,034

Product Line:

Utility

$

1,368,333

$

—

$

—

$

1,368,333

Lighting and Transportation

884,128

—

—

884,128

Coatings

353,739

—

(9,992

)

343,747

Telecommunications

250,770

—

—

250,770

Solar

151,606

—

(203

)

151,403

Irrigation Equipment and Parts

—

985,840

(7,055

)

978,785

Technology Products and Services

—

97,868

—

97,868

Total sales

$

3,008,576

$

1,083,708

$

(17,250

)

$

4,075,034

Fifty-two weeks ended December

30, 2023

Infrastructure

Agriculture

Intersegment

Consolidated

Geographical Market:

North America

$

2,318,801

$

587,056

$

(16,282

)

$

2,889,575

International

691,266

595,167

(1,410

)

1,285,023

Total sales

$

3,010,067

$

1,182,223

$

(17,692

)

$

4,174,598

Product Line:

Utility

$

1,291,670

$

—

$

—

$

1,291,670

Lighting and Transportation

916,170

—

—

916,170

Coatings

354,330

—

(9,020

)

345,310

Telecommunications

252,165

—

—

252,165

Solar

195,732

—

(1,410

)

194,322

Irrigation Equipment and Parts

—

1,069,425

(7,262

)

1,062,163

Technology Products and Services

—

112,798

—

112,798

Total sales

$

3,010,067

$

1,182,223

$

(17,692

)

$

4,174,598

VALMONT INDUSTRIES, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Dollars in thousands)

(Unaudited)

December 28,

December 30,

2024

2023

ASSETS

Current assets:

Cash and cash equivalents

$

164,315

$

203,041

Receivables, net

654,360

657,960

Inventories

590,263

658,428

Contract assets

187,257

175,721

Prepaid expenses and other current

assets

87,197

92,479

Total current assets

1,683,392

1,787,629

Property, plant, and equipment, net

588,972

617,394

Goodwill and other non-current assets

1,057,608

1,072,425

Total assets

$

3,329,972

$

3,477,448

LIABILITIES, REDEEMABLE NONCONTROLLING

INTERESTS, AND SHAREHOLDERS' EQUITY

Current liabilities:

Current installments of long-term debt

$

692

$

719

Notes payable to banks

1,669

3,205

Accounts payable

372,197

358,311

Accrued expenses

275,407

277,764

Contract liabilities

126,932

70,978

Income taxes payable

22,509

—

Dividends payable

12,019

12,125

Total current liabilities

811,425

723,102

Long-term debt, excluding current

installments

729,941

1,107,885

Operating lease liabilities

134,534

162,743

Other non-current liabilities

60,459

66,646

Total liabilities

1,736,359

2,060,376

Redeemable noncontrolling interests

51,519

62,792

Shareholders' equity

1,542,094

1,354,280

Total liabilities, redeemable

noncontrolling interests, and shareholders' equity

$

3,329,972

$

3,477,448

VALMONT INDUSTRIES, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Dollars in thousands)

(Unaudited)

Fifty-two weeks ended

December 28,

December 30,

2024

2023

Cash flows from operating activities:

Net earnings

$

350,624

$

144,912

Depreciation and amortization

95,395

98,708

Contribution to defined benefit pension

plan

(19,599

)

(17,345

)

Impairment of goodwill and other

intangible assets

—

140,844

Loss (gain) on divestitures

4,474

(2,994

)

Change in working capital

120,453

(66,342

)

Other

21,331

8,992

Net cash flows from operating

activities

572,678

306,775

Cash flows from investing activities:

Purchases of property, plant, and

equipment

(79,451

)

(96,771

)

Proceeds from divestiture, net of cash

divested

3,830

6,369

Proceeds from property damage insurance

claims

—

7,468

Acquisitions, net of cash acquired

—

(32,676

)

Other

(3,257

)

329

Net cash flows from investing

activities

(78,878

)

(115,281

)

Cash flows from financing activities:

Net repayments on short-term

borrowings

(1,485

)

(3,298

)

Proceeds from long-term borrowings

30,009

370,012

Principal repayments on long-term

borrowings

(408,080

)

(134,748

)

Dividends paid

(48,358

)

(49,515

)

Purchases of redeemable noncontrolling

interests

(17,745

)

—

Repurchases of common stock

(70,069

)

(345,279

)

Other

(6,832

)

(13,577

)

Net cash flows from financing

activities

(522,560

)

(176,405

)

Effect of exchange rates on cash and cash

equivalents

(9,966

)

2,546

Net change in cash and cash

equivalents

(38,726

)

17,635

Cash and cash equivalents—beginning of

period

203,041

185,406

Cash and cash equivalents—end of

period

$

164,315

$

203,041

VALMONT INDUSTRIES, INC. AND

SUBSIDIARIES

FISCAL 2025 FULL-YEAR

FINANCIAL OUTLOOK BRIDGE

(Dollars in millions, except

per-share amounts)

(Unaudited)

The tables below outline the bridge from

fiscal 2024 net sales and diluted earnings per share to the

forecasted figures for fiscal 2025.

Net sales - fiscal 2024

$

4,075

Infrastructure volume

200

Net pricing (steel deflation)

(40

)

Agriculture storm volume

(50

)

Strategic deselection

(25

)

FX translation

(60

)

Net sales outlook midpoint - fiscal

2025

$

4,100

Diluted earnings per share - fiscal

2024

$

17.19

Operating profit

0.50

Interest expense

0.35

Share count

0.16

Tariff

(0.20)

Diluted earnings per share outlook

midpoint - fiscal 2025

$

18.00

VALMONT INDUSTRIES, INC. AND

SUBSIDIARIES

USE OF NON-GAAP FINANCIAL MEASURES

Management utilizes non-GAAP financial measures to assess the

Company’s historical and prospective financial performance,

evaluate operational profitability on a consistent basis, factor

into executive compensation decisions, and enhance transparency for

the investment community. These non-GAAP measures are intended to

supplement, not replace, the Company’s reported financial results

prepared in accordance with GAAP. It is important to note that

other companies may calculate these measures differently, which can

limit their usefulness for comparison across organizations.

The following non-GAAP measures may be included in financial

releases and other financial communications:

- Adjusted Operating Income, Adjusted Operating Margin,

Adjusted Net Earnings, and Adjusted Diluted EPS: These metrics

provide meaningful supplemental insights into the Company’s

operating performance by excluding items that are not considered

part of core operating results. This approach enhances

comparability across reporting periods. Adjustments may include

costs or benefits associated with acquisitions, expenses related to

realignment or restructuring programs, goodwill or intangible asset

impairment, significant expenses or benefits from changes in tax

laws or rates, cumulative effects of changes in accounting

standards, refinancing-related expenses, loss or gain from a

partial or full settlement of the U.K. defined benefit pension plan

obligation, losses from natural disasters, and other non-recurring

items.

- Adjusted EBITDA: This metric is a key component of a

financial ratio included in the covenants of our major debt

agreements. It is calculated as net earnings before interest,

taxes, depreciation, amortization, stock-based compensation, and

other adjustments as outlined in the applicable debt agreements.

This metric offers investors and analysts valuable insights into

the Company’s core operating performance. Adjusted EBITDA margin is

also used to evaluate profitability.

- Leverage Ratio: This ratio is calculated by taking the

sum of interest-bearing debt, minus unrestricted cash in excess of

$50.0 million (but not exceeding $500.0 million), and dividing it

by Adjusted EBITDA. This is a key financial ratio included in the

covenants of our major debt agreements and is calculated on a

rolling four-fiscal-quarter basis.

- Free Cash Flow: Calculated as net cash provided by

operating activities minus capital expenditures, free cash flow

serves as an indicator of the Company’s financial strength.

However, this measure does not fully reflect the Company’s ability

to deploy cash freely, as it obligations such as debt repayments

and other fixed commitments.

- Backlog: This operating measure is used to evaluate

future potential sales revenue. An order is included in the backlog

upon receipt of a customer purchase order or the execution of a

sales order contract. Backlog is particularly relevant to the

Infrastructure segment due to the longer-term nature of its

projects. However, backlog is not a term defined under U.S. GAAP

and does not measure contract profitability. It should not be

viewed as the sole indicator of future revenue, as many projects

with short lead times book-and-bill within the same reporting

period and are not included in the backlog.

- Constant Currency: Defined as financial results adjusted

for foreign currency translation impacts by translating current

period and prior period activity using the same currency conversion

rate. This approach is used for countries whose functional currency

is not the U.S. dollar.

- ROIC: Return on invested capital (“ROIC”) and adjusted

ROIC are key operating ratios that enable investors to assess our

operating performance relative to the investment needed to generate

operating profit. ROIC is calculated as after-tax operating income

divided by the average of beginning and ending invested capital.

Adjusted ROIC is calculated as after-tax adjusted operating income

divided by the average of beginning and ending invested capital.

Invested capital represents total assets minus total liabilities

(excluding interest-bearing debt and redeemable noncontrolling

interests).

VALMONT INDUSTRIES, INC. AND

SUBSIDIARIES

SUMMARY OF EFFECT OF

SIGNIFICANT NON-RECURRING ITEMS ON 2023 REPORTED RESULTS

REGULATION G

RECONCILIATION

(Dollars and shares in thousands,

except per-share amounts)

(Unaudited)

The non-GAAP table below discloses the

impacts on net earnings for fiscal 2023 from several items,

including the impairment of goodwill and other intangible assets,

realignment charges, and non-recurring charges associated with

major scope changes for two strategic projects initiated by

departed senior leadership. It also includes the effects of the

loss from Argentine peso hyperinflation and non-recurring tax

benefit items. Amounts may be impacted by rounding. The Company

believes that presenting non-GAAP adjusted net earnings, alongside

the corresponding reported GAAP measures, provides useful insights

for both management and investors when evaluating performance.

Thirteen

Fifty-two

weeks ended

Diluted

weeks ended

Diluted

December 30,

earnings per

December 30,

earnings per

2023

share1

2023

share1

Net earnings attributable to Valmont

Industries, Inc. including change in redemption value of redeemable

noncontrolling interests - as reported

$

28,587

$

1.38

$

143,475

$

6.78

Less: Change in redemption value of

redeemable noncontrolling interests

7,374

0.36

7,374

0.35

Net earnings attributable to Valmont

Industries, Inc.

35,961

1.73

150,849

7.13

Impairment of goodwill and other

intangible assets

—

—

140,844

6.66

Realignment charges

31,030

1.49

35,210

1.66

Other non-recurring charges

5,626

0.27

5,626

0.27

Total adjustments, pre-tax

36,656

1.77

181,680

8.59

Tax effect of adjustments2

(9,118

)

(0.44

)

(14,550

)

(0.69

)

Loss from Argentine peso hyperinflation,

net of tax, attributable to Valmont Industries, Inc.

2,535

0.12

2,535

0.12

Non-recurring tax benefit items

—

—

(3,588

)

(0.17

)

Net earnings attributable to Valmont

Industries, Inc. - adjusted

$

66,034

$

3.18

$

316,926

$

14.98

Average shares outstanding - diluted

20,764

21,159

The Company previously adjusted non-GAAP

financial measures to exclude Prospera intangible asset

amortization and stock-based compensation for Prospera employees,

providing investors with a clearer view of the Agriculture

segment’s performance related to traditional products. Following

the annual impairment testing of intangible asset values as of

September 2, 2023, the Company significantly reduced the value of

Prospera intangible assets. Additionally, realignment activities

approved by the Board of Directors in the third quarter of fiscal

2023 impacted future stock compensation for Prospera employees. As

a result, the Company no longer considers these historical

adjustments related to Prospera to be relevant for understanding

the Agriculture segment’s performance in the fourth quarter of

fiscal 2023, the second half of fiscal 2023, or in future periods.

Since these adjustments were included in net earnings for the first

half of fiscal 2023, the Company has removed their impact when

presenting the “further adjusted” net earnings for fiscal 2023

below.

Thirteen

Fifty-two

weeks ended

Diluted

weeks ended

Diluted

December 30,

earnings per

December 30,

earnings per

2023

share1

2023

share1

Net earnings attributable to Valmont

Industries, Inc. - adjusted

$

66,034

$

3.18

$

316,926

$

14.98

Prospera intangible asset amortization

—

—

3,290

0.16

Prospera stock-based compensation

—

—

4,278

0.20

Tax effect of adjustments2

—

—

(1,092

)

(0.05

)

Net earnings attributable to Valmont

Industries, Inc. - further adjusted

$

66,034

$

3.18

$

323,402

$

15.28

Average shares outstanding - diluted

20,764

21,159

1Diluted earnings per share includes

rounding.

2The tax effect of adjustments is

calculated based on the income tax rate in each applicable

jurisdiction.

VALMONT INDUSTRIES, INC. AND

SUBSIDIARIES

SUMMARY OF EFFECT OF

SIGNIFICANT NON-RECURRING ITEMS ON 2023 REPORTED RESULTS

REGULATION G

RECONCILIATION

(Dollars in thousands)

(Unaudited)

The non-GAAP tables below disclose the

impacts on operating income (loss) for fiscal 2023 from several

items, including the impairment of goodwill and other intangible

assets, realignment charges, and other non-recurring charges

associated with major scope changes for two strategic projects

initiated by departed senior leadership. Amounts may be impacted by

rounding. The Company believes that presenting non-GAAP adjusted

operating income (loss), alongside the corresponding reported GAAP

measures, provides useful insights for both management and

investors when evaluating performance.

Thirteen weeks ended December

30, 2023

Operating Income (Loss)

Reconciliation

Infrastructure

Agriculture

Corporate

Consolidated

Operating income (loss) - as reported

$

82,550

$

13,946

$

(32,948

)

$

63,548

Realignment charges

16,191

8,194

6,645

31,030

Other non-recurring charges

—

5,626

—

5,626

Adjusted operating income (loss)

$

98,741

$

27,766

$

(26,303

)

$

100,204

Net sales - as reported

745,713

269,813

—

1,015,526

Operating income (loss) as a % of net

sales

11.1

%

5.2

%

NM

6.3

%

Adj. operating inc. (loss) as a % of net

sales

13.2

%

10.3

%

NM

9.9

%

Fifty-two weeks ended December

30, 2023

Operating Income (Loss)

Reconciliation

Infrastructure

Agriculture

Corporate

Consolidated

Operating income (loss) - as reported

$

396,253

$

16,850

$

(121,546

)

$

291,557

Impairment of goodwill and other

intangible assets

3,571

137,273

—

140,844

Realignment charges

17,260

9,101

8,849

35,210

Other non-recurring charges

—

5,626

—

5,626

Adjusted operating income (loss)

$

417,084

$

168,850

$

(112,697

)

$

473,237

Net sales - as reported

2,999,637

1,174,961

—

4,174,598

Operating income (loss) as a % of net

sales

13.2

%

1.4

%

NM

7.0

%

Adj. operating inc. (loss) as a % of net

sales

13.9

%

14.4

%

NM

11.3

%

The Company previously adjusted non-GAAP

financial measures to exclude Prospera intangible asset

amortization and stock-based compensation for Prospera employees,

providing investors with a clearer view of the Agriculture

segment’s performance related to traditional products. Following

the annual impairment testing of intangible asset values as of

September 2, 2023, the Company significantly reduced the value of

Prospera intangible assets. Additionally, realignment activities

approved by the Board of Directors in the third quarter of fiscal

2023 impacted future stock compensation for Prospera employees. As

a result, the Company no longer considers these historical

adjustments related to Prospera to be relevant for understanding

the Agriculture segment’s performance in the fourth quarter of

fiscal 2023, the second half of fiscal 2023, or in future periods.

Since these adjustments were included in operating income (loss)

for the first half of fiscal 2023, the Company has removed their

impact when presenting “further adjusted” operating income (loss)

for fiscal 2023 below.

Fifty-two weeks ended December

30, 2023

Operating Income (Loss)

Reconciliation

Infrastructure

Agriculture

Corporate

Consolidated

Adjusted operating income (loss)

$

417,084

$

168,850

$

(112,697

)

$

473,237

Prospera intangible asset amortization

—

3,290

—

3,290

Prospera stock-based compensation

—

4,278

—

4,278

Further adjusted operating income

(loss)

$

417,084

$

176,418

$

(112,697

)

$

480,805

Net sales - as reported

2,999,637

1,174,961

—

4,174,598

Adj. operating inc. (loss) as a % of net

sales

13.9

%

14.4

%

NM

11.3

%

Further adj. oper. inc. (loss) as a % of

net sales

13.9

%

15.0

%

NM

11.5

%

NM = not meaningful

VALMONT INDUSTRIES, INC. AND

SUBSIDIARIES

REGULATION G RECONCILIATION OF

ADJUSTED EBITDA

(Dollars in thousands)

(Unaudited)

Thirteen weeks

ended

Fifty-two weeks

ended

December 28,

December 28,

2024

2024

Net cash flows from operating

activities

$

193,414

$

572,678

Interest expense

12,342

58,722

Income tax expense

27,199

117,978

Deferred income taxes

8,696

24,655

Redeemable noncontrolling interests

(782

)

(2,365

)

Net periodic pension cost

(158

)

(640

)

Contribution to defined benefit pension

plan

60

19,599

Changes in assets and liabilities

(78,881

)

(128,232

)

Other

(11,638

)

(12,172

)

Proforma divestitures adjustment

59

(2,346

)

Adjusted EBITDA

$

150,311

$

647,877

Net earnings attributable to Valmont

Industries, Inc.

$

77,653

$

348,259

Interest expense

12,342

58,722

Income tax expense

27,199

117,978

Depreciation and amortization

24,854

95,395

Stock-based compensation

8,204

29,869

Proforma divestitures adjustment

59

(2,346

)

Adjusted EBITDA

$

150,311

$

647,877

Net sales

$

1,037,294

$

4,075,034

Adjusted EBITDA

$

150,311

$

647,877

Adjusted EBITDA margin

14.5

%

15.9

%

VALMONT INDUSTRIES, INC. AND

SUBSIDIARIES

REGULATION G RECONCILIATION OF

LEVERAGE RATIO

(Dollars in thousands)

(Unaudited)

December 28,

2024

Interest-bearing debt, excluding

origination fees and discounts of $25,613

$

757,915

Less: Cash and cash equivalents in excess

of $50,000

114,315

Net indebtedness

$

643,600

Adjusted EBITDA

647,877

Leverage ratio

0.99

VALMONT INDUSTRIES, INC. AND

SUBSIDIARIES

REGULATION G RECONCILIATION OF

FREE CASH FLOW

(Dollars in thousands)

(Unaudited)

Fifty-two weeks ended

December 28,

December 30,

2024

2023

Net cash flows from operating

activities

$

572,678

$

306,775

Net cash flows from investing

activities

(78,878

)

(115,281

)

Net cash flows from financing

activities

(522,560

)

(176,405

)

Net cash flows from operating

activities

$

572,678

$

306,775

Purchases of property, plant, and

equipment

(79,451

)

(96,771

)

Free cash flow

$

493,227

$

210,004

VALMONT INDUSTRIES, INC. AND

SUBSIDIARIES

BACKLOG

(Dollars in millions)

(Unaudited)

December 28,

December 30,

2024

2023

Infrastructure

$

1,273.3

$

1,299.6

Agriculture

163.4

165.9

Total backlog

$

1,436.7

$

1,465.5

VALMONT INDUSTRIES, INC. AND

SUBSIDIARIES

REGULATION G RECONCILIATION OF

CONSTANT CURRENCY

(Dollars in thousands)

(Unaudited)

Fiscal 2025 Net Sales

Outlook

Low End

High End

Infrastructure

Agriculture

Consolidated

Infrastructure

Agriculture

Consolidated

Net sales

$

3,025,000

$

975,000

$

4,000,000

$

3,160,000

$

1,040,000

$

4,200,000

Impact of foreign exchange

35,000

25,000

60,000

35,000

25,000

60,000

Net sales - constant currency

$

3,060,000

$

1,000,000

$

4,060,000

$

3,195,000

$

1,065,000

$

4,260,000

Net sales - year-over-year change

0.9

%

(9.4

)%

(1.8

)%

5.4

%

(3.4

)%

3.1

%

Impact of foreign exchange

1.2

%

2.3

%

1.5

%

1.2

%

2.3

%

1.5

%

Net sales - constant currency

2.1

%

(7.1

)%

(0.4

)%

6.6

%

(1.1

)%

4.5

%

The foreign exchange impact assumes the

following currency exchange rates for the most significant

translation effects: BRL/USD: 5.90, AUD/USD: 1.58, and EUR/USD:

0.96

VALMONT INDUSTRIES, INC. AND

SUBSIDIARIES

REGULATION G RECONCILIATION OF

RETURN ON INVESTED CAPITAL

(Dollars in thousands)

(Unaudited)

Fifty-two

weeks ended

December 28,

2024

Operating income

$

524,584

Effective tax rate

25.2

%

Tax effect on operating income

(132,050

)

After-tax operating income

$

392,534

Average invested capital

$

2,396,436

Return on invested capital

16.4

%

Total assets

$

3,329,972

Less: Defined benefit pension asset

(46,520

)

Less: Accounts payable

(372,197

)

Less: Accrued expenses

(275,407

)

Less: Contract liabilities

(126,932

)

Less: Income taxes payable

(22,509

)

Less: Dividends payable

(12,019

)

Less: Deferred income taxes

(6,344

)

Less: Operating lease liabilities

(134,534

)

Less: Deferred compensation

(33,302

)

Less: Other non-current liabilities

(20,813

)

Total invested capital

$

2,279,395

Beginning invested capital

2,513,477

Average invested capital

$

2,396,436

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218576019/en/

Renee Campbell renee.campbell@valmont.com

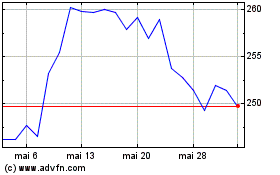

Valmont Industries (NYSE:VMI)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Valmont Industries (NYSE:VMI)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025