KKR Enters Into Strategic Partnership With Energy Service Provider EGC

18 Fevereiro 2025 - 10:45AM

Business Wire

KKR, a leading global investment firm, announced that KKR has

signed agreements to enter into a strategic partnership with EGC,

an energy service provider based in Düsseldorf, Germany. The

engineering service provider ITG is also part of the group. The

founding family and current shareholders will retain a stake in the

company and will remain active members of the management team.

Former CEO Germany of GETEC Group, Michael Lowak, will join the

group as Chairman, contributing his extensive industry expertise to

support the management team in this strategic partnership .

With KKR as a strategic partner, EGC aims to become the leading

decarbonization partner for the real estate industry and to

accelerate its growth. To this end, the company plans to invest

more in both organic and inorganic growth.

EGC is a second-generation, family-owned and independent energy

services provider in Germany. The company covers the entire value

chain: from planning and developing concepts for energy and

building technology systems, to financing, owning and operating

central heating units and electricity supply networks, to energy

supply. EGC manages a real estate portfolio of approximately 2

million square meters for over 100 clients and operates around 800

central heating units. With ITG, a team of experienced engineering

employees for the planning of energy and building technology

systems and facilities is also part of the group. This engineering

expertise combined with a broad energy services portfolio in

particular is the foundation for the group's strong position.

Buildings account for around a third of global CO2 emissions,

mainly through space and water heating. The decarbonization of

heating systems in buildings is crucial to achieving the EU's

climate targets. EGC supports landlords in developing solutions to

meet their decarbonization goals.

Following the successful completion of the transaction, KKR will

support the company in introducing a broad-based employee ownership

and engagement model. The program will ensure that all employees

are involved in shaping EGC’s future and can participate in the

company's future success. KKR developed this model in 2011 and has

since successfully implemented it globally in 60 portfolio

companies with more than 150,000 non-management employees.

Corinna Pitz and Dirk Pitz, members of EGC's management, said:

“The collaboration with KKR opens up completely new possibilities

for us to further expand our strong market position and to develop

our group of companies. In KKR, we have found a partner that shares

both our strategic goals and our entrepreneurial approach. KKR is

not only an established infrastructure investor, but also has a

long history of working with family-run companies. We are very much

looking forward to this next phase of growth with KKR, which will

open up many new opportunities for our group and employees.”

Michael Lowak, future Chairman of EGC, said: “EGC enables

landlords to efficiently plan, implement and finance the

decarbonization of their properties. The company is thus making a

significant contribution to both the real estate industry and the

energy transition in Germany. I look forward to bringing my

experience and industry knowledge to EGC and working with KKR to

further drive the company's growth.”

Ryan Miller, Managing Director in KKR’s European Infrastructure

team, commented: “To advance the energy transition in Germany at

the necessary pace, we need creative solutions and long-term

capital. We are seeing growing interest in contracting solutions

and significant potential in what is still a very fragmented

market. Together with the management team, we want to develop EGC

into the leading decarbonization partner for the real estate

industry and drive forward the energy transition in Germany.”

KKR has extensive expertise in global infrastructure

investments, particularly in the energy sector, and is committed to

continuing to investing in the future of renewable energy. With

approximately USD 77 billion in infrastructure assets under

management, including more than USD 21 billion invested in the

energy transition, KKR brings a global investment perspective,

extensive experience in large-scale infrastructure projects and a

proven track record in high-profile transactions in Europe such as

Encavis, Vantage Towers, Zenobe, or Greenvolt. In Germany, KKR has

invested more than EUR 18 billion of long-term equity in more than

35 companies in various alternative asset classes since the late

1990s, primarily in partnership with founders, family businesses

and corporations. The strategic partnership with EGC builds on

KKR's long track record of working with family businesses in

Germany.

KKR is funding the investment as part of its Global Climate

Strategy, through which KKR is investing at scale in solutions that

support the transition to a low-carbon economy.

About KKR

KKR is a leading global investment firm that offers alternative

asset management as well as capital markets and insurance

solutions. KKR aims to generate attractive investment returns by

following a patient and disciplined investment approach, employing

world-class people, and supporting growth in its portfolio

companies and communities. KKR sponsors investment funds that

invest in private equity, credit and real assets and has strategic

partners that manage hedge funds. KKR’s insurance subsidiaries

offer retirement, life and reinsurance products under the

management of Global Atlantic Financial Group. References to KKR’s

investments may include the activities of its sponsored funds and

insurance subsidiaries. For additional information about KKR &

Co. Inc. (NYSE: KKR), please visit KKR’s website at www.kkr.com.

For additional information about Global Atlantic Financial Group,

please visit Global Atlantic Financial Group’s website at

www.globalatlantic.com.

About EGC

EGC is a second-generation, family-owned and independent energy

services provider in Germany. The company covers the entire value

chain: from planning and developing concepts for energy and

building technology systems, to financing, owning and operating

central heating units and electricity supply networks, to energy

supply. The company manages a real estate portfolio of over 2

million square meters for over 100 clients and operates around 800

central heating units. Customers of EGC include private and public

housing companies, institutional real estate investors such as

insurance companies, banks, and investment companies. The group

provides services for new constructions and existing buildings, for

single properties as well as entire real estate portfolios. With

ITG, a team of experienced engineering employees for the planning

of energy and building technology systems and facilities is also

part of the group.

Learn more about us: www.egc-fm.de

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218216253/en/

KKR

Thea Homscheid Mobile: +49 (0) 172 13 99 761 E-Mail:

kkr_germany@fgsglobal.com

Emily Lagemann Mobile: +49 (0) 160 99 27 13 35 E-Mail:

kkr_germany@fgsglobal.com

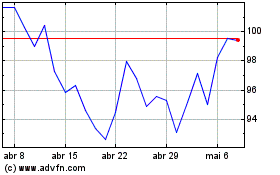

KKR (NYSE:KKR)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

KKR (NYSE:KKR)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025