ProPetro Holding Corp. ("ProPetro" or "the Company") (NYSE:

PUMP) today announced financial and operational results for the

fourth quarter and full year of 2024.

Full Year 2024 Results and Highlights

- Revenue was $1.4 billion, an 11% decrease from 2023.

- Net loss was $138 million ($1.31 loss per diluted share) as

compared to net income of $86 million ($0.76 income per diluted

share) in 2023.

- Adjusted Net Income(1) was $29 million which excludes noncash

impairment expenses.

- Adjusted EBITDA(1) was $283 million, a 30% decrease from

2023.

- Announced the formation of PROPWR℠, our new power

generation business, with total ordered capacity of 140 megawatts

of power generation equipment.

- Completed the acquisition of Aqua Prop, LLC

("AquaProp℠").

- Repurchased and retired 7.2 million shares during 2024 with

total repurchases of 13.0 million shares representing approximately

11% of our outstanding common stock since plan inception in May

2023.

- Reduced incurred capital expenditures to $133 million, a

decrease of 57% from 2023.

- Net cash provided by operating activities, Free Cash Flow(2)

and Free Cash Flow adjusted for Acquisition Consideration(2) were

$252 million, $97 million, and $118 million, respectively.

- Four FORCE® electric-powered hydraulic fracturing fleets

are now operating under contract with leading customers with a

fifth expected to be deployed in 2025.

- Our FORCE® electric and Tier IV DGB Dual-fuel fleets now

represent approximately 75% of our hydraulic fracturing

capacity.

- Published our second ProPetro | ProEnergy | ProPeople

Sustainability Report in October of 2024.

Fourth Quarter 2024 Results and Highlights

- Revenue was $321 million compared to $361 million for the prior

quarter.

- Net loss of $17 million, or $0.17 per diluted share, compared

to net loss of $137 million, or $1.32 per diluted share, for the

prior quarter.

- Adjusted net loss(1) was $596 thousand which excludes noncash

impairment expenses.

- Adjusted EBITDA(1) was $53 million compared to $71 million in

the prior quarter.

- Capital expenditures incurred of $25 million.

- Repurchased and retired 0.4 million shares.

- Placed orders for 140 megawatts of power generation equipment

for our PROPWR business.

- Divested Vernal, Utah, cementing operations on November 1,

2024.

(1)

Adjusted Net Income (Loss) and

Adjusted EBITDA are non-GAAP financial measures and are described

and reconciled to net income (loss) in the table under “Non-GAAP

Financial Measures.”

(2)

Free Cash Flow and Free Cash Flow

adjusted for Acquisition Consideration are non-GAAP financial

measures and are described and reconciled to net cash from

operating activities in the table under “Non-GAAP Financial

Measures."

Sam Sledge, Chief Executive Officer, commented, “Thanks to the

hard work and dedication of the ProPetro team, our fourth-quarter

and fiscal year results reflect the merits of our strategy and the

resilience of our business model. 2024 was a pivotal year for

ProPetro, and our results further validate our ability to drive

value despite broader industry-wide challenges. We maintained

stable pricing, delivered strong free cash flow, and continued to

optimize our fleet with next-generation equipment. We also

successfully expanded our service offerings with the launch of

PROPWR, our power generation business, opening a new avenue

for growth and allowing us to meet the increasing demand for

reliable, low-cost power solutions in the Permian Basin. We expect

the opportunities to deliver value to our existing and new

customers seeking power generation solutions to be significant. We

are confident we are taking the right steps to drive long-term

value creation and resilient free cash flow for shareholders.”

David Schorlemer, Chief Financial Officer, said, “Despite the

expected seasonal slowdown in the fourth quarter, the Company

continued to demonstrate strong financial performance, maintaining

free cash flow generation and a healthy balance sheet. Most

noteworthy, the Company reduced its capital expenditures by nearly

60% compared to 2023. This significant achievement highlights the

effectiveness of our team's optimization efforts in extending

equipment life and our strategic deployment of lower

capital-intensity assets, namely our FORCE® electric frac

fleets. Additionally, we returned $111 million of capital through

our share repurchase program since its inception in May 2023 while

also improving our working capital position year-over-year. Our

ability to prudently manage capital while funding strategic growth

initiatives reflects our Company’s unique attributes, paired with

our focus on financial and operational discipline. Thanks to the

investments made over the past several years, today ProPetro is a

stronger and more resilient company, poised for sustainable

long-term value creation.”

Fourth Quarter 2024 Financial Summary

Revenue was $321 million, compared to $361 million for the third

quarter of 2024. The decrease in revenue is primarily attributable

to our decreased hydraulic fracturing utilization caused by

seasonality and holiday impacts.

Cost of services, excluding depreciation and amortization of

approximately $48 million, decreased to $243 million from $268

million during the third quarter of 2024.

General and administrative expense of $29 million increased from

$27 million in the third quarter of 2024. General and

administrative expense excluding non-recurring and non-cash

stock-based compensation of $4 million, non-cash business

acquisition contingent consideration adjustments of -$1 million and

other non-recurring expenses of $1 million was $25 million, or 8%

of revenue, compared to 6% for the third quarter of 2024.

Net loss totaled $17 million, or $0.17 per diluted share,

compared to net loss of $137 million, or $1.32 per diluted share,

for the third quarter of 2024. The net loss for the fourth quarter

included a noncash impairment expense of $24 million related to

full impairment of the goodwill in our wireline reporting unit. The

net loss for the prior quarter included a noncash impairment

expense of $189 million related to the Company's Tier II

diesel-only pumping units and related conventional equipment in our

hydraulic fracturing operating segment which currently represent a

diminishing part of our active fleets.

Adjusted EBITDA decreased to $53 million from $71 million for

the third quarter of 2024. The decrease in Adjusted EBITDA was

primarily attributable to our decreased hydraulic fracturing and

wireline utilization caused by seasonality and holiday impacts.

Moreover, we elected to keep all fleets staffed despite the

decreased utilization, in our anticipation of our customers

resuming operations in early January 2025.

Liquidity and Capital Spending

As of December 31, 2024, we had cash and cash equivalents of $50

million and borrowings under our ABL Credit Facility were $45

million. Total liquidity at the end of the fourth quarter of 2024

was $161 million, which included cash and cash equivalents and $111

million of available borrowing capacity under our ABL Credit

Facility.

Capital expenditures incurred during the fourth quarter of 2024

were $25 million, the majority of which related to maintenance

expenditures and support equipment for our FORCE® electric

frac fleet offering. Net cash used in investing activities as shown

on the statement of cash flows during the fourth quarter of 2024

was $24 million.

Share Repurchases

The Company repurchased and retired 7.2 million shares during

2024. During the fourth quarter of 2024, the Company repurchased

and retired 0.4 million shares, bringing the total repurchases to

13.0 million shares, representing approximately 11% of our

outstanding common stock since plan inception in May 2023.

PROPWR Update

In December, we announced an initial order for over 110

megawatts of natural gas-fueled power generation equipment, valued

at $122 million. Approximately $104 million of this amount, beyond

the initial down payment, will be financed. Subsequently, we

entered into a separate agreement with another equipment

manufacturer to purchase an additional 30 megawatts of power

generation equipment, valued at $25 million, which will be funded

through our cash flow.

We plan to place further orders for additional power generation

capacity in the coming weeks and months as we finalize customer

contracts and assess future demand from our customers. The majority

of these deliveries are anticipated in the second half of 2025 and

early 2026, bringing our total capacity to between approximately

150 and 200 megawatts in early 2026. We aim to continue expanding

this business line over the next several years, given favorable

market conditions and demand trends.

We have made progress in obtaining customer commitments and are

actively negotiating long-term contracts for our incoming

equipment.

Guidance

The Company anticipates full-year 2025 capital expenditures to

be between $300 million and $400 million. Of this, the completions

business is expected to account for $150 million to $200 million,

while an additional $150 million to $200 million will be allocated

for growth capital expenditures in our PROPWR business. The

Company expects to finance a significant portion of the

PROPWR capital expenditures.

During the fourth quarter of 2024, 14 hydraulic fracturing

fleets were active but experienced white space due to holiday and

seasonality impacts. The Company expects to run between 14 and 15

frac fleets in the first quarter of 2025.

Outlook

Mr. Sledge concluded, “Looking ahead, we are excited about the

opportunities in front of us and enter 2025 with great momentum, a

strong foundation, and a clear vision for the future. Our fleet

modernization efforts will continue to drive efficiencies for our

customers while enhancing our competitive positioning. At the same

time, the introduction of PROPWR represents an exciting

avenue for growth, positioning ProPetro to capitalize on the supply

demand imbalance for natural gas power generation solutions across

a number of verticals in the energy industry and beyond. With a

strong balance sheet, disciplined capital allocation program, and

unwavering focus on operational excellence, we believe 2025 will be

another positive year for ProPetro.”

Conference Call Information

The Company will host a conference call at 8:00 AM Central Time

on February 19, 2025, to discuss financial and operating results

for the fourth quarter of 2024. The call will also be webcast on

ProPetro’s website at www.propetroservices.com. To access the conference

call, U.S. callers may dial toll free 1-844-340-9046 and

international callers may dial 1-412-858-5205. Please call ten

minutes ahead of the scheduled start time to ensure a proper

connection. A replay of the conference call will be available for

one week following the call and can be accessed toll free by

dialing 1-877-344-7529 for U.S. callers, 1-855-669-9658 for

Canadian callers, as well as 1-412-317-0088 for international

callers. The access code for the replay is 4912422. The Company has

also posted the scripted remarks on its website.

About ProPetro

ProPetro Holding Corp. is a Midland, Texas-based provider of

premium completion services to leading upstream oil and gas

companies engaged in the exploration and production of North

American unconventional oil and natural gas resources. We help

bring reliable energy to the world. For more information visit

www.propetroservices.com.

Forward-Looking Statements

Except for historical information contained herein, the

statements and information in this news release and discussion in

the scripted remarks described above are forward-looking statements

that are made pursuant to the Safe Harbor Provisions of the Private

Securities Litigation Reform Act of 1995. Statements that are

predictive in nature, that depend upon or refer to future events or

conditions or that include the words “may,” “could,” “plan,”

“project,” “budget,” “predict,” “pursue,” “target,” “seek,”

“objective,” “believe,” “expect,” “anticipate,” “intend,”

“estimate,” "will," "should" and other expressions that are

predictions of, or indicate, future events and trends or that do

not relate to historical matters generally identify forward‑looking

statements. Our forward‑looking statements include, among other

matters, statements about the supply of and demand for

hydrocarbons, our business strategy, industry, projected financial

results and future financial performance, expected fleet

utilization, sustainability efforts, the future performance of

newly improved technology, expected capital expenditures, the

impact of such expenditures on our performance and capital

programs, our fleet conversion strategy, our share repurchase

program, and the anticipated commercial prospects of PROPWR,

including our ability to successfully commence operations, the

demand for its services and anticipated benefits of the new

business line. A forward‑looking statement may include a statement

of the assumptions or bases underlying the forward‑looking

statement. We believe that we have chosen these assumptions or

bases in good faith and that they are reasonable.

Although forward‑looking statements reflect our good faith

beliefs at the time they are made, forward-looking statements are

subject to a number of risks and uncertainties that may cause

actual events and results to differ materially from the

forward-looking statements. Such risks and uncertainties include

the volatility of oil prices, changes in the supply of and demand

for power generation, the risks associated with the establishment

of a new service line, including delays, lack of customer

acceptance and cost overruns, the global macroeconomic uncertainty

related to the conflict in the Middle East region and the

Russia-Ukraine war, general economic conditions, including the

impact of continued inflation, central bank policy actions, the

risk of a global recession, changes in U.S. trade policy, including

proposed tariffs, and other factors described in the Company's

Annual Report on Form 10-K and Quarterly Reports on Form 10-Q,

particularly the “Risk Factors” sections of such filings, and other

filings with the Securities and Exchange Commission (the “SEC”). In

addition, the Company may be subject to currently unforeseen risks

that may have a materially adverse impact on it. Accordingly, no

assurances can be given that the actual events and results will not

be materially different than the anticipated results described in

the forward-looking statements. Readers are cautioned not to place

undue reliance on such forward-looking statements and are urged to

carefully review and consider the various disclosures made in the

Company’s Annual Report on Form 10-K, Quarterly Reports on Form

10-Q and other filings made with the SEC from time to time that

disclose risks and uncertainties that may affect the Company’s

business. The forward-looking statements in this news release are

made as of the date of this news release. ProPetro does not

undertake, and expressly disclaims, any duty to publicly update

these statements, whether as a result of new information, new

developments or otherwise, except to the extent that disclosure is

required by law.

PROPETRO HOLDING CORP.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except per

share data)

(Unaudited)

Three Months Ended

Years Ended

December 31, 2024

September 30, 2024

December 31, 2023

December 31, 2024

December 31, 2023

REVENUE - Service revenue

$

320,554

$

360,868

$

347,776

$

1,444,286

$

1,630,399

COSTS AND EXPENSES:

Cost of services (exclusive of

depreciation and amortization)

243,473

267,555

261,034

1,065,514

1,131,801

General and administrative expenses

(inclusive of stock‑based compensation)

28,631

26,556

27,990

114,323

114,354

Depreciation and amortization

47,706

54,299

62,152

211,733

180,886

Property and equipment impairment

expense

—

188,601

—

188,601

—

Goodwill impairment expense

23,624

—

—

23,624

—

(Gain) loss on disposal of assets and

business

(4,433

)

2,149

4,883

7,451

73,015

Total costs and expenses

339,001

539,160

356,059

1,611,246

1,500,056

OPERATING (LOSS) INCOME

(18,447

)

(178,292

)

(8,283

)

(166,960

)

130,343

OTHER (EXPENSE) INCOME:

Interest expense

(1,882

)

(1,939

)

(2,292

)

(7,815

)

(5,308

)

Other (expense) income, net

(76

)

1,799

(7,784

)

5,531

(9,533

)

Total other income (expense)

(1,958

)

(140

)

(10,076

)

(2,284

)

(14,841

)

INCOME (LOSS) BEFORE INCOME TAXES

(20,405

)

(178,432

)

(18,359

)

(169,244

)

115,502

INCOME TAX BENEFIT (EXPENSE)

3,343

41,365

1,250

31,385

(29,868

)

NET (LOSS) INCOME

$

(17,062

)

$

(137,067

)

$

(17,109

)

$

(137,859

)

$

85,634

NET (LOSS) INCOME PER COMMON SHARE:

Basic

$

(0.17

)

$

(1.32

)

$

(0.16

)

$

(1.31

)

$

0.76

Diluted

$

(0.17

)

$

(1.32

)

$

(0.16

)

$

(1.31

)

$

0.76

WEIGHTED AVERAGE COMMON SHARES

OUTSTANDING:

Basic

102,953

104,121

110,164

105,469

113,004

Diluted

102,953

104,121

110,164

105,469

113,416

NOTE: Business acquisition contingent

consideration adjustment of $1.8 million has been reclassified from

other income (expense) to general and administrative expenses for

the three months ended September 30, 2024, to conform to the

presentation for the three months and year ended December 31, 2024.

There is no impact to net loss due to this reclassification.

PROPETRO HOLDING CORP.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except share

data)

(Unaudited)

December 31, 2024

December 31, 2023

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$

50,443

$

33,354

Accounts receivable - net of allowance for

credit losses of $0 and $236, respectively

195,994

237,012

Inventories

16,162

17,705

Prepaid expenses

17,719

14,640

Short-term investment, net

7,849

7,745

Other current assets

4,054

353

Total current assets

292,221

310,809

PROPERTY AND EQUIPMENT - net of

accumulated depreciation

688,225

967,116

OPERATING LEASE RIGHT-OF-USE ASSETS

132,294

78,583

FINANCE LEASE RIGHT-OF-USE ASSETS

30,713

47,449

OTHER NONCURRENT ASSETS:

Goodwill

920

23,624

Intangible assets - net of

amortization

64,905

50,615

Other noncurrent assets

14,367

2,116

Total other noncurrent assets

80,192

76,355

TOTAL ASSETS

$

1,223,645

$

1,480,312

LIABILITIES AND SHAREHOLDERS’

EQUITY

CURRENT LIABILITIES:

Accounts payable

$

92,963

$

161,441

Accrued and other current liabilities

70,923

75,616

Operating lease liabilities

39,063

17,029

Finance lease liabilities

19,317

17,063

Total current liabilities

222,266

271,149

DEFERRED INCOME TAXES

59,770

93,105

LONG-TERM DEBT

45,000

45,000

NONCURRENT OPERATING LEASE LIABILITIES

58,849

38,600

NONCURRENT FINANCE LEASE LIABILITIES

13,187

30,886

OTHER LONG-TERM LIABILITIES

8,300

3,180

Total liabilities

407,372

481,920

COMMITMENTS AND CONTINGENCIES

SHAREHOLDERS’ EQUITY:

Preferred stock, $0.001 par value,

30,000,000 shares authorized, none issued, respectively

—

—

Common stock, $0.001 par value,

200,000,000 shares authorized, 102,994,958 and 109,483,281 shares

issued and outstanding, respectively

103

109

Additional paid-in capital

884,995

929,249

Retained earnings (accumulated

deficit)

(68,825

)

69,034

Total shareholders’ equity

816,273

998,392

TOTAL LIABILITIES AND SHAREHOLDERS’

EQUITY

$

1,223,645

$

1,480,312

PROPETRO HOLDING CORP.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Years Ended December

31,

2024

2023

CASH FLOWS FROM OPERATING ACTIVITIES:

Net (loss) income

$

(137,859

)

$

85,634

Adjustments to reconcile net (loss) income

to net cash provided by operating activities:

Depreciation and amortization

211,733

180,886

Property and equipment impairment

expense

188,601

—

Goodwill impairment expense

23,624

—

Deferred income tax (benefit) expense

(33,336

)

27,840

Amortization of deferred revenue

rebate

438

359

Stock‑based compensation

17,288

14,450

Provision for credit losses

—

34

Loss on disposal of assets and businesses,

net

7,451

73,015

Unrealized (gain) loss on short-term

investment

(105

)

2,538

Business acquisition contingent

consideration adjustments

(2,600

)

—

Changes in operating assets and

liabilities:

Accounts receivable

51,498

(12,408

)

Other current assets

(2,301

)

(831

)

Inventories

1,543

(6,017

)

Prepaid expenses

1,327

(6,143

)

Accounts payable

(64,501

)

(11,429

)

Accrued and other current liabilities

(10,506

)

26,814

Net cash provided by operating

activities

252,295

374,742

CASH FLOWS FROM INVESTING ACTIVITIES:

Capital expenditures

(140,297

)

(370,869

)

Business acquisitions, net of cash

acquired

(21,038

)

(22,215

)

Proceeds from sale of assets

6,236

8,957

Net cash used in investing activities

(155,099

)

(384,127

)

CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds from borrowings

—

30,000

Repayments of borrowings

—

(15,000

)

Payments of finance lease obligation

(17,676

)

(4,663

)

Repayments of insurance financing

(970

)

—

Payment of debt issuance costs

—

(1,179

)

Tax withholdings paid for net settlement

of equity awards

(1,909

)

(3,543

)

Share repurchases

(59,108

)

(51,738

)

Payment of excise taxes on share

repurchases

(444

)

—

Net cash used in financing activities

(80,107

)

(46,123

)

NET INCREASE (DECREASE) IN CASH AND CASH

EQUIVALENTS

17,089

(55,508

)

CASH AND CASH EQUIVALENTS — Beginning of

year

33,354

88,862

CASH AND CASH EQUIVALENTS — End of

year

$

50,443

$

33,354

Reportable Segment Information

Three Months Ended

December 31, 2024

(in thousands)

Hydraulic Fracturing

Wireline

Cementing

All Other

Reconciling Items

Total

Service revenue

$

236,934

$

45,217

$

38,476

$

—

$

(73

)

$

320,554

Adjusted EBITDA for reportable

segments

$

54,597

$

7,084

$

6,106

$

(370

)

$

(14,761

)

$

52,656

Depreciation and amortization

$

40,359

$

5,329

$

1,998

$

—

$

20

$

47,706

Goodwill impairment expense (2)

$

—

$

23,624

$

—

$

—

$

—

$

23,624

Operating lease expense on FORCE® fleets

(3)

$

14,500

$

—

$

—

$

—

$

—

$

14,500

Capital expenditures

$

21,173

$

1,627

$

1,959

$

—

$

4

$

24,763

Three Months Ended

September 30, 2024

(in thousands)

Hydraulic Fracturing

Wireline

Cementing

All Other

Reconciling Items

Total

Service revenue

$

274,138

$

47,958

$

38,920

$

—

$

(148

)

$

360,868

Adjusted EBITDA for reportable

segments

$

66,166

$

9,194

$

8,989

$

—

$

(13,219

)

$

71,130

Depreciation and amortization

$

46,752

$

5,260

$

2,264

$

—

$

23

$

54,299

Property and equipment impairment expense

(1)

$

188,601

$

—

$

—

$

—

$

—

$

188,601

Operating lease expense on FORCE® fleets

(3)

$

12,516

$

—

$

—

$

—

$

—

$

12,516

Capital expenditures

$

33,465

$

1,757

$

1,575

$

—

$

38

$

36,83

Year Ended

December 31, 2024

(in thousands)

Hydraulic Fracturing

Wireline

Cementing

All Other

Reconciling Items

Total

Service revenue

$

1,092,000

$

203,182

$

149,411

$

—

$

(307

)

$

1,444,286

Adjusted EBITDA for reportable

segments

$

270,505

$

43,857

$

26,539

$

(370

)

$

(57,288

)

$

283,243

Depreciation and amortization

$

182,188

$

20,633

$

8,812

$

—

$

100

$

211,733

Property and equipment impairment expense

(1)

$

188,601

$

—

$

—

$

—

$

—

$

188,601

Goodwill impairment expense (2)

$

—

$

23,624

$

—

$

—

$

—

$

23,624

Operating lease expense on FORCE® fleets

(3)

$

47,141

$

—

$

—

$

—

$

—

$

47,141

Capital expenditures

$

116,257

$

7,713

$

9,376

$

—

$

42

$

133,388

Goodwill

$

920

$

—

$

—

$

—

$

—

$

920

Total assets

$

961,485

$

156,349

$

73,935

$

—

$

31,876

$

1,223,645

Year Ended

December 31, 2023

(in thousands)

Hydraulic Fracturing

Wireline

Cementing

All Other

Reconciling Items

Total

Service revenue

$

1,280,523

$

229,599

$

120,277

$

—

$

—

$

1,630,399

Adjusted EBITDA for reportable

segments

$

366,809

$

61,930

$

24,665

$

—

$

(49,444

)

$

403,960

Depreciation and amortization

$

156,057

$

18,762

$

5,845

$

—

$

222

$

180,886

Operating lease expense on FORCE® fleets

(3)

$

5,087

$

—

$

—

$

—

$

—

$

5,087

Capital expenditures

$

294,377

$

12,203

$

3,440

$

—

$

—

$

310,020

Goodwill

$

—

$

23,624

$

—

$

—

$

—

$

23,624

Total assets

$

1,189,526

$

198,957

$

78,475

$

—

$

13,354

$

1,480,312

(1)

Represents noncash property and

equipment impairment expense on our Tier II Units for the year

ended December 31, 2024. There was no impairment expense for the

year ended December 31, 2023.

(2)

Represents noncash impairment of

goodwill in our wireline operating segment.

(3)

Represents lease costs related to

operating leases on our FORCE® electric-powered hydraulic

fracturing fleets. This cost is recorded within cost of services in

our condensed consolidated statements of operations.

Non-GAAP Financial Measures

Adjusted Net Income (Loss), Adjusted EBITDA, Free Cash Flow and

Free Cash Flow adjusted for Acquisition Consideration are not

financial measures presented in accordance with GAAP. We define

Adjusted Net Income (Loss) as net income (loss) plus impairment

expenses, less income tax benefit. We define EBITDA as net income

(loss) plus (i) interest expense, (ii) income tax expense (benefit)

and (iii) depreciation and amortization. We define Adjusted EBITDA

as EBITDA plus (i) loss (gain) on disposal of assets and business,

(ii) stock-based compensation, (iii) business acquisition

contingent consideration adjustments, (iv) other expense (income),

(v) other unusual or nonrecurring (income) expenses such as

impairment expenses, costs related to asset acquisitions, insurance

recoveries, one-time professional fees and legal settlements and

(vi) retention bonus and severance expense. We define Free Cash

Flow as net cash provided by operating activities less net cash

used in investing activities. We define Free Cash Flow adjusted for

Acquisition Consideration as Free Cash Flow excluding net cash paid

as consideration for business acquisitions.

We believe that the presentation of these non-GAAP financial

measures provide useful information to investors in assessing our

financial condition and results of operations. Net income (loss) is

the GAAP measure most directly comparable to Adjusted Net Income

(Loss), Adjusted EBITDA, and net cash from operating activities is

the GAAP measure most directly comparable to Free Cash Flow and

Free Cash Flow adjusted for Acquisition Consideration. Non-GAAP

financial measures should not be considered as alternatives to the

most directly comparable GAAP financial measures. Non-GAAP

financial measures have important limitations as analytical tools

because they exclude some, but not all, items that affect the most

directly comparable GAAP financial measures. You should not

consider Adjusted Net Income (Loss), Adjusted EBITDA, Free Cash

Flow or Free Cash Flow adjusted for Acquisition Consideration in

isolation or as a substitute for an analysis of our results as

reported under GAAP. Because Adjusted Net Income (Loss), Adjusted

EBITDA, Free Cash Flow and Free Cash Flow adjusted for Acquisition

Consideration may be defined differently by other companies in our

industry, our definitions of these non-GAAP financial measures may

not be comparable to similarly titled measures of other companies,

thereby diminishing their utility.

Reconciliation of Net Income (Loss) to Adjusted Net Income

(Loss)

Three Months Ended

Year Ended

(in thousands)

December 31, 2024

September 30, 2024

December 31, 2024

December 31, 2023

Net (loss) income

$

(17,062

)

$

(137,067

)

$

(137,859

)

$

85,634

Property and equipment impairment expense

(1)

—

188,601

188,601

—

Goodwill impairment expense (2)

23,624

—

23,624

—

Income tax benefit

(7,158

)

(38,230

)

(45,388

)

—

Adjusted net (loss) income

$

(596

)

$

13,304

$

28,978

$

85,634

(1)

Represents noncash impairment of

our conventional Tier II diesel-only hydraulic fracturing pumps and

associated conventional assets.

(2)

Represents noncash impairment of

goodwill in our wireline operating segment.

Reconciliation of Net Income (Loss) to Adjusted

EBITDA

Three Months Ended

Year Ended

(in thousands)

December 31, 2024

September 30, 2024

December 31, 2024

December 31, 2023

Net (loss) income

$

(17,062

)

$

(137,067

)

$

(137,859

)

$

85,634

Depreciation and amortization

47,706

54,299

211,733

180,886

Property and equipment impairment expense

(1)

—

188,601

188,601

—

Goodwill impairment expense (2)

23,624

—

23,624

—

Interest expense

1,882

1,939

7,815

5,308

Income tax (benefit) expense

(3,343

)

(41,365

)

(31,385

)

29,868

(Gain) loss on disposal of assets and

business

(4,433

)

2,149

7,451

73,015

Stock‑based compensation

4,313

4,615

17,288

14,450

Business acquisition contingent

consideration adjustments (5)

(800

)

(1,800

)

(2,600

)

—

Other expense (income), net (3)

76

(1,799

)

(5,531

)

9,533

Other general and administrative expense,

net (4)

264

346

1,782

2,969

Retention bonus and severance expense

429

1,212

2,324

2,297

Adjusted EBITDA

$

52,656

$

71,130

$

283,243

$

403,960

(1)

Represents the noncash impairment

expense of our conventional Tier II diesel-only hydraulic

fracturing pumps and associated conventional assets.

(2)

Represents the noncash impairment

expense of goodwill in our wireline operating segment.

(3)

Other income for the three months

ended September 30, 2024, is primarily comprised of tax refunds

(net of advisory fees) of $1.8 million. Other income for the year

ended December 31, 2024, is primarily comprised of tax refunds (net

of advisory fees) totaling $5.0 million and insurance

reimbursements of $2.0 million, partially offset by a $2.0 million

loss to a customer related to an accidental cementing job failure.

Other expense for the year ended December 31, 2023, includes

settlement expenses resulting from routine audits and true-up

health insurance costs of totaling approximately $7.4 million and a

$2.5 million unrealized loss on short-term investment.

(4)

Other general and administrative

expense for the year ended December 31, 2024, primarily relates to

nonrecurring professional fees paid to external consultants in

connection with our business acquisitions. Other general and

administrative expense for the year ended December 31, 2023,

primarily relates to nonrecurring professional fees paid to

external consultants in connection with our business acquisitions

and legal settlements, net of reimbursement from insurance

carriers.

(5)

Represents reclassification of

AquaProp Earnout Liability reclassified from Other expense (income)

net, to Income/loss from revaluation of contingent consideration,

$0.8 million related to Q4 2024 and $1.8 million to Q3 2024.

Reconciliation of Cash from Operating Activities to Free Cash

Flow and Free Cash Flow adjusted for Acquisition

Consideration

Three Months Ended

(in thousands)

December 31, 2024

September 30, 2024

Cash from Operating Activities

$

37,863

$

34,669

Cash used in Investing Activities

(24,496

)

(39,680

)

Free Cash Flow

13,367

(5,011

)

Acquisition Consideration

—

—

Free Cash Flow adjusted for Acquisition

Consideration

$

13,367

$

(5,011

)

Year Ended

(in thousands)

December 31, 2024

December 31, 2023

Cash from Operating Activities

$

252,295

$

374,742

Cash used in Investing Activities

(155,099

)

(384,127

)

Free Cash Flow

97,196

(9,385

)

Acquisition Consideration

21,038

22,215

Free Cash Flow adjusted for Acquisition

Consideration

$

118,234

$

12,830

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250219232763/en/

Investor Contacts: David Schorlemer Chief Financial

Officer david.schorlemer@propetroservices.com 432-227-0864 Matt

Augustine Director, Corporate Development and Investor Relations

matt.augustine@propetroservices.com 432-219-7620

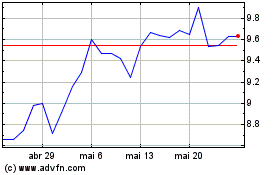

ProPetro (NYSE:PUMP)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

ProPetro (NYSE:PUMP)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025