Altria Group, Inc. (Altria) (NYSE: MO) is participating in the

Consumer Analyst Group of New York Conference in Orlando, Florida

today. Billy Gifford, Altria’s Chief Executive Officer, and Sal

Mancuso, Altria’s Executive Vice President and Chief Financial

Officer, will highlight our exciting progress toward our Vision,

discuss how our traditional tobacco businesses continue to support

our strategies and provide more detail on our long-term growth

aspirations.

“We believe our actions over time have positioned Altria to win

in U.S. nicotine over the long term,” said Billy Gifford. “We have

a demonstrated commitment to responsibility, an extensive

understanding of U.S. nicotine consumers and a compelling portfolio

with products in each of today’s smoke-free categories. We also

have significant cash flows and a flexible balance sheet that

support our investments and cash returns to shareholders.”

Remarks and Presentation

The presentation will be webcast live on www.altria.com in a

listen-only mode, beginning at approximately 10:00 a.m. Eastern

Time. A copy of the business presentation, prepared remarks and a

replay of the webcast will be available at www.altria.com.

2025 Full-Year Guidance

We reaffirm our guidance to deliver 2025 full-year adjusted

diluted earnings per share (EPS) in a range of $5.22 to $5.37,

representing a growth rate of 2% to 5% from a base of $5.12 in

2024. Our guidance includes the impact of one fewer shipping day in

2025, which occurs in the first quarter, assumes limited impact on

combustible and e-vapor product volumes from enforcement efforts in

the illicit e-vapor market and includes the reinvestment of

anticipated cost savings related to our previously announced

Optimize & Accelerate initiative (Initiative). The guidance

range also includes lower expected net periodic benefit income.

While our 2025 full-year adjusted diluted EPS guidance accounts

for a range of scenarios, the external environment remains dynamic.

We will continue to monitor conditions related to (i) the economy,

including the cumulative impact of inflation, (ii) adult tobacco

consumer (ATC) dynamics, including purchasing patterns and adoption

of smoke-free products, (iii) illicit product enforcement and (iv)

regulatory, litigation and legislative developments.

Our 2025 full-year adjusted diluted EPS guidance range includes

planned investments in support of our Vision, such as (i)

marketplace activities in support of our smoke-free products and

(ii) continued smoke-free product research, development and

regulatory preparation expenses. This guidance range excludes the

per share impacts that we expect to record in 2025 related to

charges associated with our Initiative.

Our full-year adjusted diluted EPS guidance range excludes the

impact of certain income and expense items that our management

believes are not part of underlying operations. These items may

include, for example, loss on early extinguishment of debt,

restructuring charges, asset impairment charges, acquisition,

disposition and integration-related items, equity

investment-related special items, certain income tax items, charges

associated with tobacco and health and certain other litigation

items, and resolutions of certain non-participating manufacturer

(NPM) adjustment disputes under the Master Settlement Agreement

(NPM Adjustment Items). See Schedule 1 below for the income and

expense items for the full-year 2024.

Our management cannot estimate on a forward-looking basis the

impact of certain income and expense items, including those items

noted in the preceding paragraph, on our reported diluted EPS

because these items, which could be significant, may be unusual or

infrequent, are difficult to predict and may be highly variable. As

a result, we do not provide a corresponding U.S. generally accepted

accounting principles (GAAP) measure for, or reconciliation to, our

adjusted diluted EPS guidance.

Altria’s Profile

We have a leading portfolio of tobacco products for U.S. tobacco

consumers age 21+. Our Vision is to responsibly lead the transition

of adult smokers to a smoke-free future (Vision). We are Moving

Beyond Smoking™, leading the way in moving adult smokers away from

cigarettes by taking action to transition millions to potentially

less harmful choices - believing it is a substantial opportunity

for adult tobacco consumers, our businesses and society.

Our wholly owned subsidiaries include leading manufacturers of

both combustible and smoke-free products. In combustibles, we own

Philip Morris USA Inc. (PM USA), the most profitable U.S. cigarette

manufacturer, and John Middleton Co. (Middleton), a leading U.S.

cigar manufacturer. Our smoke-free portfolio includes ownership of

U.S. Smokeless Tobacco Company LLC (USSTC), the leading global

moist smokeless tobacco (MST) manufacturer, Helix Innovations LLC

(Helix), a leading manufacturer of oral nicotine pouches, and NJOY,

LLC (NJOY), an e-vapor manufacturer with a commercialized product

portfolio fully covered by marketing granted orders from the U.S.

Food and Drug Administration (FDA).

Additionally, we have a majority-owned joint venture, Horizon

Innovations LLC (Horizon), for the U.S. marketing and

commercialization of heated tobacco stick products.

Our equity investments include Anheuser-Busch InBev SA/NV (ABI),

the world’s largest brewer, and Cronos Group Inc. (Cronos), a

leading Canadian cannabinoid company.

The brand portfolios of our operating companies include

Marlboro®, Black & Mild®, Copenhagen®, Skoal®, on!® and NJOY®.

Trademarks related to Altria referenced in this release are the

property of Altria or our subsidiaries or are used with

permission.

Learn more about Altria at www.altria.com and follow us on X (formerly known

as Twitter), Facebook and LinkedIn.

Forward-Looking and Cautionary Statements

This release contains projections of future results and other

forward-looking statements that are subject to a number of risks

and uncertainties and are made pursuant to the Safe Harbor

Provisions of the Private Securities Litigation Reform Act of

1995.

Important factors that may cause actual results to differ

materially from those contained in the forward-looking statements

included in this release are described in our publicly filed

reports, including our Annual Report on Form 10-K for the year

ended December 31, 2023. These factors include the following:

- our inability to anticipate and respond to changes in ATC

preferences and purchase behavior;

- our inability to compete effectively;

- the growth of the e-vapor category, including illicit

disposable e-vapor products, which contributes to reductions in

domestic cigarette consumption levels and shipment volume;

- the risks associated with illicit trade in tobacco products

(including counterfeit products, illegally imported products,

illicit disposable e-vapor products and oral nicotine pouch

products) and the sale of products designed to avoid the regulatory

framework for tobacco products, such as products using nicotine

analogues, each of which contributes to reductions in the

consumption levels and shipment volumes of our businesses’

products;

- our failure to develop and commercialize innovative products,

including tobacco products that may reduce health risks relative to

other tobacco products and appeal to ATCs;

- changes, including in macroeconomic and geopolitical conditions

(including inflation), that result in shifts in ATC disposable

income and purchasing behavior, including choosing lower-priced and

discount brands or products, and reductions in shipment

volumes;

- unfavorable outcomes with respect to litigation proceedings or

any governmental investigations, including significant monetary and

non-monetary remedies and importation bans;

- the risks associated with significant federal, state and local

government actions, including FDA regulatory actions and inaction,

and various private sector actions;

- increases in tobacco product-related taxes;

- our failure to complete or manage successfully strategic

transactions, including our acquisition of NJOY and other

acquisitions, dispositions, joint ventures and investments in third

parties, or realize the anticipated benefits of such

transactions;

- significant changes in price, availability or quality of

tobacco, other raw materials or component parts, including as a

result of changes in macroeconomic, climate and geopolitical

conditions;

- our reliance on a few significant facilities and a small number

of key suppliers, distributors and distribution chain service

providers and the risks associated with an extended disruption at a

facility or in service by a supplier, distributor or distribution

chain service provider;

- the risk that we may be required to write down intangible

assets, including trademarks and goodwill, due to impairment;

- the risk that we could decide, or be required, to recall

products;

- the various risks related to health epidemics and pandemics and

the measures that international, federal, state and local

governments, agencies, law enforcement and health authorities

implement to address them;

- our inability to attract and retain a highly skilled and

diverse workforce due to the decreasing social acceptance of

tobacco usage, tobacco control actions and other factors;

- the risks associated with the various U.S. and foreign laws and

regulations to which we are subject due to our international

business operations;

- the risks concerning a challenge to our tax positions, an

increase in the income tax rate or other changes to federal or

state tax laws;

- the risks associated with legal and regulatory requirements

related to climate change and other environmental sustainability

matters;

- disruption and uncertainty in the credit and capital markets,

including risk of losing access to these markets;

- a downgrade or potential downgrade of our credit ratings;

- our inability to attract investors due to increasing investor

expectations of our performance relating to corporate

responsibility factors, including environmental, social and

governance matters;

- the failure of our, or our key service providers’ or key

suppliers’, information systems to function as intended, or

cyber-attacks or security breaches affecting us or our key service

providers or key suppliers;

- our failure, or the failure of our key service providers or key

suppliers, to comply with laws related to personal data protection,

privacy, artificial intelligence and information security;

- our ability to recognize the expected cost savings in

connection with the Initiative or successfully reinvest those

savings in our businesses in support of our Vision and 2028

Enterprise Goals, in each case, in the expected manner or timeframe

or at all;

- the risk that the expected benefits of our investment in ABI

may not materialize in the expected manner or timeframe or at all,

including due to macroeconomic and geopolitical conditions; foreign

currency exchange rates; ABI’s business results; ABI’s share price;

impairment losses on the value of our investment; our incurrence of

additional tax liabilities related to our investment in ABI; and

potential reductions in the number of directors that we can have

appointed to the ABI board of directors; and

- the risks associated with our investment in Cronos, including

legal, regulatory and reputational risks and the risk that the

expected benefits of the transaction may not materialize in the

expected manner or timeframe or at all.

You should understand that it is not possible to predict or

identify all factors and risks. Consequently, you should not

consider the foregoing list to be complete. We do not undertake to

update any forward-looking statement that we may make from time to

time except as required by applicable law. All subsequent written

and oral forward-looking statements attributable to Altria or any

person acting on our behalf are expressly qualified in their

entirety by the cautionary statements referenced above.

Schedule 1

ALTRIA GROUP, INC.

and Subsidiaries

Reconciliation of GAAP and

non-GAAP Measures

(dollars in millions, except per

share data)

(Unaudited)

Earnings before Income

Taxes

Provision for Income

Taxes

Net Earnings

Diluted EPS

2024 Reported

$

13,658

$

2,394

$

11,264

$

6.54

NPM Adjustment Items

(27

)

(7

)

(20

)

(0.01

)

Acquisition, disposition and

integration-related items

(2,527

)

(665

)

(1,862

)

(1.08

)

Asset impairment, exit and implementation

costs

422

107

315

0.18

Tobacco and health and certain other

litigation items

101

25

76

0.04

ABI-related special items

2

—

2

—

Cronos-related special items

18

3

15

0.01

Income tax items

—

969

(969

)

(0.56

)

2024 Adjusted for Special Items

$

11,647

$

2,826

$

8,821

5.12

While we report our financial results in accordance with GAAP,

our management reviews certain financial results, including diluted

EPS, on an adjusted basis, which excludes certain income and

expense items, including those items noted under “2025 Full-Year

Guidance” in the release. Our management does not view any of these

special items to be part of our underlying results as they may be

highly variable, may be unusual or infrequent, are difficult to

predict and can distort underlying business trends and results. Our

management believes that adjusted financial measures provide useful

additional insight into underlying business trends and results and

provide a more meaningful comparison of year-over-year results. Our

management uses adjusted financial measures for planning,

forecasting and evaluating business and financial performance,

including allocating capital and other resources and evaluating

results relative to employee compensation targets. These adjusted

financial measures are not required by, or calculated in accordance

with GAAP, and may not be calculated the same as similarly titled

measures used by other companies. These adjusted financial measures

should thus be considered as supplemental in nature and not

considered in isolation or as a substitute for the related

financial information prepared in accordance with GAAP.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218457455/en/

Altria Client Services Investor Relations 804-484-8222

Altria Client Services Media Relations 804-484-8897

www.altria.com/contact-us/media

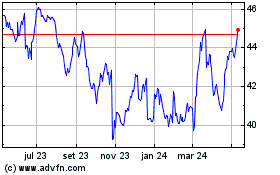

Altria (NYSE:MO)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

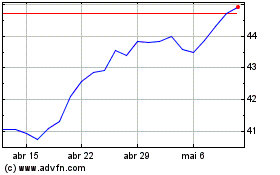

Altria (NYSE:MO)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025