SolarEdge Technologies, Inc. (Nasdaq: SEDG), a global leader in

smart energy technology, today announced its financial results for

the fourth quarter ended December 31, 2024 and full year ended

December 31, 2024.

“There are exciting opportunities ahead for SolarEdge,” said

Shuki Nir, CEO of SolarEdge. “We are just getting started on our

turnaround story. The return to positive free cash flow generation

in Q4 is a solid first step, and we expect to be free cash flow

positive in Q1 2025 and for the full year 2025.”

Fourth Quarter 2024 Summary

The Company reported revenues of $196.2 million, down 17% from

$235.4 million in the prior quarter.

Revenues from the solar segment were $189.0 million, down 15%

from $222.1 million in the prior quarter.

The Company shipped 895 MW (AC) of inverters and 130 MWh of

batteries for PV applications.

During the fourth quarter, the Company undertook an asset

valuation analysis which resulted in a write down and impairment of

various assets that impacted both GAAP and Non-GAAP financials. In

total, the write down and impairment amount was $138 million.

GAAP gross margin was negative 57.2%1, compared to negative

309.1%1 in the prior quarter.

Non-GAAP gross margin2 was negative 39.5%1, compared to negative

305.0%1 in the prior quarter.

Gross margin from the solar segment was negative 38.8%1,

compared to negative 285.4%1 in the prior quarter.

GAAP operating expenses were $151.4 million1, compared to

$382.91 million in the prior quarter.

Non-GAAP operating expenses2 were $106.8 million, compared to

$116.3 million in the prior quarter.

GAAP operating loss was $263.7 million1, compared to $1.111

billion in the prior quarter.

Non-GAAP operating loss2 was $184.1 million1, compared to

$833.61 million in the prior quarter.

GAAP net loss was $287.4 million1, compared to $1.231 billion in

the prior quarter.

Non-GAAP net loss2 was $202.5 million1, compared to $899.81

million in the prior quarter.

GAAP net loss per share was $5.001, compared to a GAAP net loss

per share of $21.581 in the prior quarter.

Non-GAAP net loss per share2 was $3.521, compared to a Non-GAAP

net loss per share of $15.781 in the prior quarter.

Cash provided by operating activities was $37.8 million,

compared with $89.4 million used in the prior quarter.

Free cash flow2 generated was $25.5 million, compared with a

free cash flow deficit of $136.7 in the prior year.

As of December 31, 2024, cash, cash equivalents, restricted

cash, bank deposits, restricted bank deposits and marketable

securities totaled $81.8 million, net of debt, compared to $51.3

million as of September 30, 2024.

Full Year 2024 Summary

The Company reported total revenues of $901.5 million, compared

to $2.98 billion in the prior year.

Revenues from the solar segment of $842.4 million, compared to

from $2.82 billion in the prior year.

The Company shipped 3,563 MW (AC) of inverters and 576 MWh of

batteries for PV applications.

During 2024, the company reported write downs and impairments of

various assets that impacted both GAAP and Non-GAAP financials. In

total, the write down and impairment amount was $1.17 billion.

GAAP gross margin was negative 97.3%1, compared to 23.6% in the

prior year.

Non-GAAP gross margin2 was negative 89.7%1, compared to 26.7% in

the prior year.

Gross margin from the solar segment was negative 84.4%1,

compared to 29.2% in the prior year.

GAAP operating expenses were $831.1 million1, compared to

$663.61 million in the prior year.

Non-GAAP operating expenses2 were $447.1 million, compared to

$503.1 million in the prior year.

GAAP operating loss was $1.71 billion1, compared to a GAAP

operating income of $40.21 million in the prior year.

Non-GAAP operating loss2 was $1.25 billion1, compared to

Non-GAAP operating income of $290.0 million in the prior year.

GAAP net loss was $1.81 billion1, compared to GAAP net income of

$34.31 million in the prior year.

Non-GAAP net loss2 was $1.31 billion1, compared to Non-GAAP net

income of $248.4 million in the prior year.

GAAP net loss per share was $31.641, compared to GAAP earnings

per share of $0.611 in the prior year.

Non-GAAP net loss per share2 was $22.991, compared to Non-GAAP

earnings per share of $4.39 in the prior year.

Cash used in operating activities was $313.3 million, compared

to $180.1 million used in the prior year.

Free cash flow2 deficit was $421.5 million, compared with a free

cash flow deficit of $350.6 in the prior year.

Immaterial prior quarter adjustment

During the preparation of the audited financial statements and

subsequent to filing the Form 10-Q for the third quarter of 2024,

the Company considered an amended agreement with a customer which

was signed on December 21, 2024. In connection with such amendment,

the Company determined it was appropriate to revise previously

reported revenues and loans receivables with this customer for the

three and nine months ended, September 30, 2024.

The financial information presented in this earnings release has

been revised accordingly for the period ended September 30, 2024.

The Company will also adjust previously reported financial

information for such immaterial revision in future filings, as

applicable.

For the nine months ended September 30, 2024, the revised

revenues and net loss are $705.2 million and $1,519 million,

respectively, which is $25.5 million lower revenues and $25.5

million higher loss than as previously reported. The revised net

loss per share is $26.67. For the three months ended September 30,

2024, the revised revenues and net loss are $235.4 million and

$1,231 million, respectively, which is $25.5 million lower revenues

and $25.5 million higher loss than as previously reported. The

revised net loss per share is $21.58. The impact on the Company’s

consolidated financial information as of September 30, 2024 was a

reduction of loans receivables of $25.5 million and of total

stockholder equity by $25.5 million.

Outlook for the First Quarter 2025

The Company also provides guidance for the first quarter ending

March 31, 2025 as follows:

- Revenues to be within the range of $195 million to $215

million;

- Non-GAAP gross margin* expected to be within the range of 6% to

10%;

- Non-GAAP operating expenses* to be within the range of $98

million to $103 million.

Due to the closure of our Energy Storage business in Korea,

going forward we will not report segments in our financial

reporting.

*Non-GAAP gross margin and Non-GAAP operating expenses

are non-GAAP financial measures, and these forward-looking measures

have not been reconciled to the most comparable GAAP outlook

because it is not possible to do so without unreasonable efforts

due to the uncertainty and potential variability of reconciling

items, which are dependent on future events and often outside of

management’s control and which could be significant. Because such

items cannot be reasonably predicted with the level of precision

required, we are unable to provide outlook for the comparable GAAP

measures. Forward-looking estimates of Non-GAAP gross margin and

Non-GAAP operating expenses are made in a manner consistent with

the relevant definitions and assumptions noted herein and in our

filings with the SEC.

Conference Call

The Company will host a conference call to discuss its results

for the fourth quarter and year ended December 31, 2024 at 8:00

a.m. ET on Wednesday, February 19, 2025. The call will be

available, live, to interested parties by dialing +1 800-445-7795.

For international callers, please dial +1 785-424-1699. The

Conference ID is SEDG. To avoid a delay in connecting to the

call, please dial in 10 minutes prior to the start time. A live

webcast will also be available in the Investors Relations section

of the Company’s website at: http://investors.solaredge.com.

A replay of the webcast will be available in the Investor

Relations section of the Company’s web site approximately two hours

after the conclusion of the call and will remain available for

approximately 30 calendar days.

______________________________________________________________________

1 Includes impairments and write offs. See financials and

reconciliation for details. 2 Non-GAAP financial measure. See

“Non-GAAP Financial Measures” for additional information on

non-GAAP financial measures and a reconciliation to the most

comparable GAAP measures.

About SolarEdge

SolarEdge is a global leader in smart energy technology. By

leveraging world-class engineering capabilities and with a

relentless focus on innovation, SolarEdge creates smart energy

solutions that power our lives and drive future progress. SolarEdge

developed an intelligent inverter solution that changed the way

power is harvested and managed in photovoltaic (PV) systems. The

SolarEdge DC optimized inverter seeks to maximize power generation

while lowering the cost of energy produced by the PV system.

Continuing to advance smart energy, SolarEdge addresses a broad

range of energy market segments through its PV, storage, EV

charging, batteries, and grid services solutions. SolarEdge is

online at www.solaredge.com.

Use of Non-GAAP Financial Measures

To provide investors and others with additional information

regarding SolarEdge’s results, SolarEdge has disclosed in this

earnings release the following non-GAAP financial measures:

non-GAAP operating income (loss), non-GAAP operating expenses,

non-GAAP gross margin, non-GAAP net income (loss), non-GAAP net

earnings (loss) per share, and non-GAAP net free cash flow.

SolarEdge has provided a reconciliation of each non-GAAP financial

measure used in this earnings release to the most directly

comparable GAAP financial measure below. These non-GAAP financial

measures differ from GAAP in that they exclude stock-based

compensation, amortization and impairment of acquired intangible

assets, restructuring and impairment charges, acquisition,

disposition and other items, certain litigation and other

contingencies, amortization of debt issuance cost, non-cash

interest expense and non-cash revenue recognized from significant

financing component, certain foreign currency exchange rates, gains

and losses on investments, income and losses from equity method

investments and discrete items that impacted our GAAP tax rate. Our

non-GAAP financial measures also reflect the application of our

non-GAAP tax rate.

SolarEdge’s management uses these non-GAAP financial measures to

understand and compare operating results across accounting periods,

for internal budgeting and forecasting purposes, for short- and

long-term operating plans, to calculate bonus payments and to

evaluate SolarEdge’s financial performance, the performance of its

individual functional groups and the ability of operations to

generate cash. Management believes these non-GAAP financial

measures reflect SolarEdge’s ongoing business in a manner that

allows for meaningful period-to-period comparisons and analysis of

trends in SolarEdge’s business, as they exclude charges and gains

that are not reflective of ongoing operating results. Management

also believes that these non-GAAP financial measures provide useful

information to investors and others in understanding and evaluating

SolarEdge’s operating results and future prospects from the same

perspective as management and in comparing financial results across

accounting periods.

The use of non-GAAP financial measures has certain limitations

because they do not reflect all items of income and expense that

affect SolarEdge’s operations. These non-GAAP financial measures

should be considered in addition to, not as a substitute for or in

isolation from, measures prepared in accordance with GAAP and

should not be considered measures of SolarEdge’s liquidity.

Further, these non-GAAP measures may differ from the non-GAAP

information used by other companies, including peer companies, and

therefore comparability may be limited. Management encourages

investors and others to review SolarEdge’s financial information in

its entirety and not rely on a single financial measure.

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995

Statements contained in this press release contains may contain

forward-looking statements that are based on our management’s

expectations, estimates, projections, beliefs and assumptions in

accordance with information currently available to our management.

This press release contains certain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements include information, among

other things, concerning our possible or assumed future results of

operations, return to positive free cash flow generation, future

demands for solar energy solutions, business strategies, technology

developments, new products and services, financing and investment

plans; dividend policy; competitive position, industry and

regulatory environment, general economic conditions; potential

growth opportunities; cancellations and pushouts of existing

backlog; installation rates; goodwill impairment; and the effects

of competition. Forward-looking statements include statements that

are not historical facts and can be identified by terms such as

“anticipate,” “believe,” “could,” “seek,” “estimate,” “expect,”

“intend,” “may,” “plan,” “potential,” “predict,” “project,”

“should,” “will,” “would” or similar expressions and the negatives

of those terms.

Forward-looking statements inherently involve known and unknown

risks, uncertainties and other factors that may cause our actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed or

implied by the forward-looking statements. Given these

uncertainties, you should not place undue reliance on

forward-looking statements. Also, forward-looking statements

represent our management’s beliefs and assumptions only as of the

date of this release. Important factors that could cause actual

results to differ materially from our expectations include, but are

not limited to: future demand for renewable energy including solar

energy solutions; our ability to maintain a return to free cash

flow positive generation; our ability to forecast demand for our

products accurately and to match production to such demand as well

as our customers’ ability to forecast demand based on inventory

levels; macroeconomic conditions in our domestic and international

markets, as well as inflation concerns, rising interest rates, and

recessionary concerns; changes, elimination or expiration of

government subsidies and economic incentives for on-grid solar

energy applications; changes in the U.S. trade environment;

federal, state, and local regulations governing the electric

utility industry with respect to solar energy; changes in tax laws,

tax treaties, and regulations or the interpretation of them,

including the Inflation Reduction Act; the retail price of

electricity derived from the utility grid or alternative energy

sources; interest rates and supply of capital in the global

financial markets in general and in the solar market specifically;

competition, including introductions of power optimizer, inverter

and solar photovoltaic system monitoring products by our

competitors; developments in alternative technologies or

improvements in distributed solar energy generation; historic

cyclicality of the solar industry and periodic downturns; product

quality or performance problems in our products; shortages, delays,

price changes, or cessation of operations or production affecting

our suppliers of key components; our dependence upon a small number

of outside contract manufacturers and limited or single source

suppliers; capacity constraints, delivery schedules, manufacturing

yields, and costs of our contract manufacturers and availability of

components; delays, disruptions, and quality control problems in

manufacturing; existing and future responses to and effects of

pandemics, epidemics, or other health crises; disruption in our

global supply chain and rising prices of oil and raw materials as a

result of the conflict between Russia and Ukraine; our customers’

financial stability and our ability to retain customers; our

ability to retain key personnel and attract additional qualified

personnel; performance of distributors and large installers in

selling our products; consolidation in the solar industry among our

customers and distributors; our ability to manage effectively the

growth of our organization and expansion into new markets and

integration of acquired businesses; our ability to recognize

expected benefits from restructuring plans; any unauthorized access

to, disclosure, or theft of personal information or unauthorized

access to our network or other similar cyber incidents; disruption

to our business operations due to the evolving state of war in

Israel and political conditions related to the Israeli government's

plans to significantly reduce the Israeli Supreme Court's judicial

oversight; our dependence on ocean transportation to timely deliver

our products in a cost-effective manner; fluctuations in global

currency exchange rates; the impact of evolving legal and

regulatory requirements, including emerging environmental, social

and governance requirements; changes to net metering policies or

the reduction, elimination or expiration of government subsidies

and economic incentives for on-grid solar energy applications;

federal, state, and local regulations governing the electric

utility industry with respect to solar energy; changes in tax laws,

tax treaties, and regulations or the interpretation of them,

including the Inflation Reduction Act; changes in the U.S. trade

environment, including the imposition of import tariffs; business

practices and regulatory compliance of our raw material suppliers;

our ability to maintain our brand and to protect and defend our

intellectual property; the impairment of our goodwill or other

intangible assets; volatility of our stock price; our customers’

financial stability, creditworthiness, and debt leverage ratio; our

ability to retain key personnel and attract additional qualified

personnel; our ability to effectively design, launch, market, and

sell new generations of our products and services; our ability to

retain, and events affecting, our major customers; our ability to

service our debt; future goodwill impairments; and the other

factors set forth under “Item 1A. Risk Factors” in our Annual

Report on Form 10-K for the year ended December 31, 2023, filed on

February 26, 2024, in subsequent Quarterly Reports on Form 10Q and

in other documents we file from time to time with the SEC that

disclose risks and uncertainties that may affect our business. The

preceding list is not intended to be an exhaustive list of all of

our forward‐looking statements. You should not rely upon

forward‐looking statements as predictions of future events.

Although we believe that the expectations reflected in the

forward‐looking statements are reasonable, we cannot guarantee that

future results, levels of activity, performance and events and

circumstances reflected in the forward‐looking statements will be

achieved or will occur. Statements in this press release speak only

as of the date they were made. The Company undertakes no duty or

obligation to update any forward-looking statements contained in

this release, whether as a result of new information, future events

or changes in its expectations or otherwise, except as may be

required by applicable law, regulation or other competent legal

authority.

SOLAREDGE TECHNOLOGIES

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME (LOSS)

(in thousands, except per share

data)

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

Unaudited

Revenues

$

196,217

$

316,044

$

901,456

$

2,976,528

Cost of revenues

308,471

372,469

1,778,660

2,272,705

Gross profit (loss)

(112,254

)

(56,425

)

(877,204

)

703,823

Operating expenses:

Research and development

62,238

75,001

277,237

321,482

Sales and marketing

30,549

38,779

146,865

164,318

General and administrative

36,370

34,628

147,455

146,504

Other operating expenses, net

22,256

32,748

259,527

31,314

Total

operating expenses

151,413

181,156

831,084

663,618

Operating income (loss)

(263,667

)

(237,581

)

(1,708,288

)

40,205

Financial income (expense), net

(12,199

)

22,055

(14,570

)

41,212

Other income (loss), net

(76

)

291

14,547

(318

)

Income (loss) before income taxes

(275,942

)

(215,235

)

(1,708,311

)

81,099

Tax benefits (Income taxes)

(11,041

)

53,202

(96,150

)

(46,420

)

Net loss from equity method

investments

(456

)

(350

)

(1,896

)

(350

)

Net income (loss)

$

(287,439

)

$

(162,383

)

$

(1,806,357

)

$

34,329

SOLAREDGE TECHNOLOGIES

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except per

share data)

December 31,

2024

2023

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$

274,611

$

338,468

Restricted cash

135,328

—

Marketable securities

311,279

521,570

Trade receivables, net of allowances of

$43,038 and $16,400, respectively

160,423

622,425

Inventories, net

645,897

1,443,449

Prepaid expenses and other current

assets

506,769

378,394

Total current

assets

2,034,307

3,304,306

LONG-TERM ASSETS:

Marketable securities

42,597

407,825

Deferred tax assets, net

—

80,912

Property, plant and equipment, net

343,438

614,579

Operating lease right-of-use assets,

net

41,393

64,167

Goodwill and intangible assets, net

58,046

78,341

Loan receivables, net

45,678

2,438

Other long-term assets

64,736

35,163

Total

long-term assets

595,888

1,283,425

Total

assets

2,630,195

4,587,731

LIABILITIES AND STOCKHOLDERS’ EQUITY

CURRENT LIABILITIES:

Trade payables, net

93,491

386,471

Employees and payroll accruals

76,292

76,966

Warranty obligations

140,249

183,047

Deferred revenues and customers

advances

140,870

40,836

Accrued expenses and other current

liabilities

243,872

205,911

Convertible senior notes, net

346,305

—

Total current

liabilities

1,041,079

893,231

LONG-TERM LIABILITIES:

Convertible senior notes, net

330,006

627,381

Warranty obligations

292,116

335,197

Deferred revenues

231,049

214,607

Finance lease liabilities

39,159

41,892

Operating lease liabilities

30,018

45,070

Other long-term liabilities

8,426

18,444

Total

long-term liabilities

930,774

1,282,591

COMMITMENTS AND CONTINGENT LIABILITIES

STOCKHOLDERS’ EQUITY:

Common stock of $0.0001 par value -

Authorized: 125,000,000 shares; issued: 58,780,490 shares at

December 31, 2024 and 57,123,437 shares at December 31, 2023;

outstanding: 58,027,126 shares at December 31, 2024 and 57,123,437

shares at December 31, 2023.

6

6

Additional paid-in capital

1,813,198

1,680,622

Treasury stock, at cost; 753,364 shares

held

(50,194

)

—

Accumulated other comprehensive loss

(76,477

)

(46,885

)

Retained earnings (Accumulated

deficit)

(1,028,191

)

778,166

Total

stockholders’ equity

658,342

2,411,909

Total

liabilities and stockholders’ equity

$

2,630,195

$

4,587,731

SOLAREDGE TECHNOLOGIES

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands, except per share

data)

Year ended December

31,

2024

2023

Cash flows from

operating activities:

Net income (loss)

$

(1,806,357

)

$

34,329

Adjustments to reconcile net income (loss)

to net cash provided by (used in) operating activities:

Depreciation and amortization

59,865

57,196

Provision to write down inventories to net

realizable value

738,757

46,369

Loss on impairment and disposal of

property, plant and equipment

224,772

25,168

Stock-based compensation expenses

137,251

149,945

Impairment of goodwill and intangible

assets

24,674

5,622

Deferred income taxes, net

79,209

(43,071

)

Gain from repurchasing of convertible

notes

(15,456

)

—

Loss (gain) from exchange rate

fluctuations

11,918

(26,878

)

Other items

8,030

8,164

Changes in assets and liabilities:

Trade receivables, net

451,707

296,429

Inventories, net

67,799

(737,223

)

Prepaid expenses and other assets

(122,484

)

(92,067

)

Operating lease right-of-use assets,

net

15,805

16,525

Trade payables, net

(285,505

)

(67,795

)

Warranty obligations

(85,541

)

133,090

Deferred revenues and customers

advances

119,519

39,632

Operating lease liabilities

(15,829

)

(15,981

)

Accrued expenses and other liabilities,

net

78,547

(9,567

)

Net cash used in operating activities

(313,319

)

(180,113

)

Cash flows from

investing activities:

Investment in available-for-sale

marketable securities

(253,431

)

(296,396

)

Proceeds from maturities of

available-for-sale marketable securities

719,454

277,382

Proceeds from sales of available-for-sale

marketable securities

114,564

2,807

Purchase of property, plant and

equipment

(108,163

)

(170,523

)

Business combinations, net of cash

acquired

(10,417

)

(16,653

)

Purchase of intangible assets

(10,000

)

(10,600

)

Disbursements for loans receivables

(37,500

)

(58,000

)

Investment in privately-held companies

(25,664

)

(8,000

)

Proceeds from loans receivables

32,150

—

Proceeds from governmental grant

—

6,794

Other investing activities

(4,707

)

4,295

Net cash provided by (used in) investing

activities

416,286

(268,894

)

Cash flows from

financing activities:

Repurchase of common stock

(50,194

)

—

Partial repurchase of Notes 2025

(267,900

)

—

Proceeds from issuance of Notes 2029, net

of issuance costs

329,214

—

Capped call transactions related to Notes

2029

(28,342

)

—

Tax withholding in connection with

stock-based awards, net

(281

)

(9,259

)

Other financing activities

(2,626

)

(2,697

)

Net cash used in financing activities

(20,129

)

(11,956

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

(11,367

)

16,319

Increase (decrease) in cash, cash

equivalents and restricted cash

71,471

(444,644

)

Cash and cash equivalents at the beginning

of the period

338,468

783,112

Cash, cash equivalents and restricted

cash, end of period

$

409,939

$

338,468

SOLAREDGE TECHNOLOGIES

INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES (Unaudited)

(in thousands, except per share

data and percentages)

Three months ended

Year ended

December 31, 2024

September 30, 2024

June 30, 2024

March 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

December 31, 2022

Gross profit (loss) (GAAP)

$

(112,254

)

$

(727,794

)

$

(10,969

)

$

(26,187

)

$

(56,425

)

$

(877,204

)

$

703,823

$

844,648

Revenues from finance component

(254

)

(250

)

(246

)

(234

)

(230

)

(984

)

(834

)

(614

)

Discontinued operation

26,118

(6

)

(757

)

(434

)

36,648

24,921

36,648

4,314

Stock-based compensation

3,727

6,039

6,218

5,968

5,468

21,952

23,200

21,818

Amortization of stock-based compensation

capitalized in inventories

1,095

1,484

362

197

343

3,138

1,100

—

Amortization and depreciation of acquired

asset

484

2,034

1,343

1,551

1,555

5,412

6,038

7,429

Restructuring charges

3,770

1,216

4,519

5,822

23,154

15,327

23,154

—

Gross profit (loss) (Non-GAAP)

$

(77,314

)

$

(717,277

)

$

470

$

(13,317

)

$

10,513

$

(807,438

)

$

793,129

$

877,595

Gross margin (loss) (GAAP)

(57.2

)%

(309.1

)%

(4.1

)%

(12.8

)%

(17.9

)%

(97.3

)%

23.6

%

27.2

%

Revenues from finance component

(0.1

)

(0.1

)

0.0

(0.1

)

(0.1

)

(0.1

)

0.0

0.0

Discontinued operation

13.3

0.0

(0.3

)

(0.2

)

11.6

2.8

1.2

0.1

Stock-based compensation

1.9

2.6

2.3

2.9

1.8

2.4

0.9

0.7

Amortization of stock-based compensation

capitalized in inventories

0.6

0.6

0.1

0.1

0.1

0.3

0.0

----

Amortization and depreciation of acquired

asset

0.2

1.0

0.5

0.8

0.5

0.6

0.2

0.2

Restructuring charges

1.9

1.0

1.7

2.8

7.3

1.7

0.8

----

Gross margin (loss) (Non-GAAP)

(39.4

)%

(304.0

)%

0.2

%

(6.5

)%

3.3

%

(89.6

)%

26.7

%

28.2

%

Operating expenses (GAAP)

$

151,413

$

382,940

$

149,213

$

147,518

$

181,156

$

831,084

$

663,618

$

678,528

Stock-based compensation - R&D

(10,653

)

(17,115

)

(17,639

)

(17,139

)

(15,982

)

(62,546

)

(66,944

)

(63,211

)

Stock-based compensation - S&M

(4,452

)

(6,816

)

(8,149

)

(7,911

)

(7,347

)

(27,328

)

(30,987

)

(31,017

)

Stock-based compensation - G&A

(5,600

)

(6,672

)

(6,565

)

(6,588

)

(6,133

)

(25,425

)

(28,814

)

(29,493

)

Amortization and depreciation of acquired

assets - R&D

(189

)

(270

)

(271

)

(270

)

(58

)

(1,000

)

(989

)

(1,206

)

Amortization and depreciation of acquired

assets - S&M

(442

)

(566

)

(467

)

(124

)

(190

)

(1,599

)

(927

)

(822

)

Amortization and depreciation of acquired

assets - G&A

—

(2

)

(2

)

(2

)

(2

)

(6

)

(15

)

(21

)

Discontinued operation

(3,350

)

11

—

47

(388

)

(3,293

)

(388

)

—

Restructuring charges

—

(1,299

)

(366

)

(3,943

)

—

(5,607

)

—

—

Assets impairment and disposal by

abandonment

(17,989

)

(232,102

)

----

(1,732

)

(30,790

)

(251,823

)

(30,790

)

(119,141

)

Gain (loss) from assets sales

(1,910

)

(1,827

)

(951

)

(1,058

)

(172

)

(5,746

)

1,262

2,603

Certain litigation and other

contingencies

—

—

—

399

(1,786

)

399

(1,786

)

—

Acquisition costs

—

—

—

(9

)

—

(9

)

(135

)

(350

)

Operating expenses (Non-GAAP)

$

106,828

$

116,282

$

114,803

$

109,188

$

118,308

$

447,101

$

503,105

$

435,870

SOLAREDGE TECHNOLOGIES

INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES (Unaudited)

(in thousands, except per share

data and percentages)

Three months ended

Year ended

December 31, 2024

September 30, 2024

June 30, 2024

March 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

December 31, 2022

Operating income (loss) (GAAP)

$

(263,667

)

$

(1,110,734

)

$

(160,182

)

$

(173,705

)

$

(237,581

)

$

(1,708,288

)

$

40,205

$

166,120

Revenues from finance component

(254

)

(250

)

(246

)

(234

)

(230

)

(984

)

(834

)

(614

)

Discontinued operation

29,468

(17

)

(757

)

(481

)

37,036

28,214

37,036

4,314

Stock-based compensation

24,432

36,642

38,571

37,606

34,930

137,251

149,945

145,539

Amortization of stock-based compensation

capitalized in inventories

1,095

1,484

362

197

343

3,138

1,100

—

Amortization and depreciation of acquired

assets

1,115

2,872

2,083

1,947

1,805

8,017

7,969

9,478

Restructuring charges

3,770

2,515

4,885

9,765

23,154

20,934

23,154

—

Assets impairment and disposal by

abandonment

17,989

232,102

—

1,732

30,790

251,823

30,790

119,141

Loss (gain) from assets sales

1,910

1,827

951

1,058

172

5,746

(1,262

)

(2,603

)

Certain litigation and other

contingencies

—

—

—

(399

)

1,786

(399

)

1,786

—

Acquisition costs

—

—

—

9

—

9

135

350

Operating income (loss)

(Non-GAAP)

$

(184,142

)

$

(833,559

)

$

(114,333

)

$

(122,505

)

$

(107,795

)

$

(1,254,539

)

$

290,024

$

441,725

Financial income (expense), net

(GAAP)

$

(12,199

)

$

5,558

$

(865

)

$

(7,064

)

$

22,055

$

(14,570

)

$

41,212

$

3,750

Non cash interest expense

3,920

3,785

3,636

3,536

3,422

14,877

12,703

9,954

Unrealized losses (gains)

—

—

—

—

—

—

—

119

Currency fluctuation related to lease

standard

1,089

966

(1,523

)

(1,276

)

4,359

(744

)

(3,055

)

(11,187

)

Financial income (expense), net

(Non-GAAP)

$

(7,190

)

$

10,309

$

1,248

$

(4,804

)

$

29,836

$

(437

)

$

50,860

$

2,636

Other income (loss) (GAAP)

$

(76

)

$

(3,928

)

$

18,551

$

—

$

291

$

14,547

$

(318

)

$

7,285

Loss (gain) from sale of equity and debt

investments

76

(1,072

)

(1,970

)

—

(291

)

(2,966

)

193

(8,008

)

Loss (gain) from business combination

—

—

(1,125

)

—

—

(1,125

)

—

—

Gain from the repurchase of convertible

notes

—

—

(15,456

)

—

—

(15,456

)

—

—

Loss (gain) from impairment of private

held companies

—

5,000

—

—

—

5,000

—

—

Other income (loss) (Non-GAAP)

$

—

$

—

$

—

$

—

$

—

$

—

$

(125

)

$

(723

)

Income tax benefit (expense)

(GAAP)

$

(11,041

)

$

(121,108

)

$

12,245

$

23,754

$

53,202

$

(96,150

)

$

(46,420

)

$

(83,376

)

Income tax adjustment

(176

)

44,602

(357

)

(5,062

)

(27,699

)

39,007

(45,896

)

(9,067

)

Income tax benefit (expense)

(Non-GAAP)

$

(11,217

)

$

(76,506

)

$

11,888

$

18,692

$

25,503

$

(57,143

)

$

(92,316

)

$

(92,443

)

Equity method investments income (loss)

(GAAP)

$

(456

)

$

(577

)

$

(567

)

$

(296

)

$

(350

)

$

(1,896

)

$

(350

)

$

—

Loss from equity method investments

456

577

567

296

350

1,896

350

—

Equity method investments income (loss)

(Non-GAAP)

$

—

$

—

$

—

$

—

$

—

$

—

$

—

$

—

SOLAREDGE TECHNOLOGIES

INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES (Unaudited)

(in thousands, except per share

data and percentages)

Three months ended

Year ended

December 31, 2024

September 30, 2024

June 30, 2024

March 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

December 31, 2022

Net income (loss) (GAAP)

$

(287,439

)

$

(1,230,789

)

$

(130,818

)

$

(157,311

)

$

(162,383

)

$

(1,806,357

)

$

34,329

$

93,779

Revenues from finance component

(254

)

(250

)

(246

)

(234

)

(230

)

(984

)

(834

)

(614

)

Discontinued operation

29,468

(17

)

(757

)

(481

)

37,036

28,214

37,036

4,314

Stock-based compensation

24,432

36,642

38,571

37,606

34,930

137,251

149,945

145,539

Amortization of stock-based compensation

capitalized in inventories

1,095

1,484

362

197

343

3,138

1,100

—

Amortization and depreciation of acquired

assets

1,115

2,872

2,083

1,947

1,805

8,017

7,969

9,478

Restructuring charges

3,770

2,515

4,885

9,765

23,154

20,934

23,154

—

Assets impairment and disposal by

abandonment

17,989

232,102

—

1,732

30,790

251,823

30,790

119,141

Loss (gain) from assets sales

1,910

1,827

951

1,058

172

5,746

(1,262

)

(2,603

)

Certain litigation and other

contingencies

—

—

—

(399

)

1,786

(399

)

1,786

—

Acquisition costs

—

—

—

9

—

9

135

350

Non cash interest expense

3,920

3,785

3,636

3,536

3,422

14,877

12,703

9,954

Unrealized losses (gains)

—

—

—

—

—

—

—

119

Currency fluctuation related to lease

standard

1,089

966

(1,523

)

(1,276

)

4,359

(744

)

(3,055

)

(11,187

)

Loss (gain) from sale of equity and debt

investments

76

(1,072

)

(1,970

)

—

(291

)

(2,966

)

193

(8,008

)

Loss (gain) from business combination

—

—

(1,125

)

—

—

(1,125

)

—

—

Gain from the repurchase of convertible

notes

—

—

(15,456

)

—

—

(15,456

)

—

—

Loss (gain) from impairment of private

held companies

—

5,000

—

—

—

5,000

—

—

Income tax adjustment

(176

)

44,602

(357

)

(5,062

)

(27,699

)

39,007

(45,896

)

(9,067

)

equity method adjustments

456

577

567

296

350

1,896

350

—

Net income (loss) (Non-GAAP)

$

(202,549

)

$

(899,756

)

$

(101,197

)

$

(108,617

)

$

(52,456

)

$

(1,312,119

)

$

248,443

$

351,195

SOLAREDGE TECHNOLOGIES

INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES (Unaudited)

(in thousands, except per share

data and percentages)

Three months ended

Year ended

December 31, 2024

September 30, 2024

June 30, 2024

March 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

December 31, 2022

Net basic earnings (loss) per share

(GAAP)

$

(5.00

)

$

(21.58

)

$

(2.31

)

$

(2.75

)

$

(2.85

)

$

(31.64

)

$

0.61

$

1.70

Revenues from finance component

(0.01

)

(0.01

)

0.00

(0.01

)

(0.01

)

(0.02

)

(0.02

)

(0.01

)

Discontinued operation

0.52

0.00

(0.02

)

(0.01

)

0.65

0.49

0.66

0.08

Stock-based compensation

0.42

0.65

0.69

0.66

0.62

2.41

2.65

2.64

Amortization of stock-based compensation

capitalized in

0.02

0.02

0.00

0.01

0.00

0.05

0.02

—

Amortization and depreciation of acquired

assets

0.02

0.05

0.04

0.03

0.04

0.14

0.14

0.17

Restructuring charges

0.07

0.05

0.08

0.17

0.40

0.37

0.41

—

Assets impairment and disposal by

abandonment

0.31

4.07

—

0.03

0.54

4.41

0.54

2.17

Loss (gain) from assets sales

0.03

0.03

0.02

0.02

0.01

0.10

(0.02

)

(0.05

)

Certain litigation and other

contingencies

—

—

—

(0.01

)

0.03

(0.01

)

0.03

—

Acquisition costs

—

—

—

0.00

—

0.00

0.00

0.01

Non cash interest expense

0.07

0.07

0.07

0.06

0.06

0.26

0.23

0.18

Unrealized losses (gains)

—

—

—

—

—

—

—

0.00

Currency fluctuation related to lease

standard

0.02

0.01

(0.04

)

(0.02

)

0.07

(0.01

)

(0.06

)

(0.21

)

Loss (gain) from sale of equity and debt

investments

0.00

(0.02

)

(0.03

)

0.00

0.00

(0.05

)

0.01

(0.14

)

Loss (gain) from business combination

—

—

(0.02

)

—

—

(0.02

)

—

—

Gain from the repurchase of convertible

notes

—

—

(0.27

)

—

—

(0.27

)

—

—

Loss (gain) from impairment of private

held companies

—

0.09

—

—

—

0.09

—

—

Income tax adjustment

0.00

0.78

(0.01

)

(0.09

)

(0.49

)

0.68

(0.81

)

(0.16

)

equity method adjustments

0.01

0.01

0.01

0.01

0.01

0.03

0.00

—

Net basic earnings (loss) per share

(Non-GAAP)

$

(3.52

)

$

(15.78

)

$

(1.79

)

$

(1.90

)

$

(0.92

)

$

(22.99

)

$

4.39

$

6.38

SOLAREDGE TECHNOLOGIES

INC.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES (Unaudited)

(in thousands, except per share

data and percentages)

Three months ended

Year ended

December 31, 2024

September 30, 2024

June 30, 2024

March 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

December 31, 2022

Net diluted earnings (loss) per share

(GAAP)

$

(5.00

)

$

(21.58

)

$

(2.31

)

$

(2.75

)

$

(2.85

)

$

(31.64

)

$

0.60

$

1.65

Revenues from finance component

(0.01

)

(0.01

)

0.00

(0.01

)

(0.01

)

(0.02

)

(0.01

)

(0.01

)

Discontinued operation

0.52

0.00

(0.02

)

(0.01

)

0.65

0.49

0.64

0.08

Stock-based compensation

0.42

0.65

0.69

0.66

0.62

2.41

2.57

2.43

Amortization of stock-based compensation

capitalized in inventories

0.02

0.02

0.00

0.01

0.00

0.05

0.02

—

Amortization and depreciation of acquired

assets

0.02

0.05

0.04

0.03

0.04

0.14

0.14

0.16

Restructuring charges

0.07

0.05

0.08

0.17

0.40

0.37

0.40

—

Assets impairment and disposal by

abandonment

0.31

4.07

—

0.03

0.54

4.41

0.53

2.02

Loss (gain) from assets sales

0.03

0.03

0.02

0.02

0.01

0.10

(0.02

)

(0.04

)

Certain litigation and other

contingencies

—

—

—

(0.01

)

0.03

(0.01

)

0.03

—

Acquisition costs

—

—

—

0.00

—

0.00

0.00

0.00

Non cash interest expense

0.07

0.07

0.07

0.06

0.06

0.26

0.03

0.13

Unrealized losses (gains)

—

—

—

—

—

—

—

0.00

Currency fluctuation related to lease

standard

0.02

0.01

(0.04

)

(0.02

)

0.07

(0.01

)

(0.05

)

(0.19

)

Loss (gain) from sale of equity and debt

investments

0.00

(0.02

)

(0.03

)

—

0.00

(0.05

)

0.00

(0.13

)

Loss (gain) from business combination

—

—

(0.02

)

—

—

(0.02

)

—

—

Gain from the repurchase of convertible

notes

—

—

(0.27

)

—

—

(0.27

)

—

—

Loss (gain) from impairment of private

held companies

—

0.09

—

—

—

0.09

—

—

Income tax adjustment

0.00

0.78

(0.01

)

(0.09

)

(0.49

)

0.68

(0.76

)

(0.15

)

equity method adjustments

0.01

0.01

0.01

0.01

0.01

0.03

0.00

—

Net diluted earnings (loss) per share

(Non-GAAP)

$

(3.52

)

$

(15.78

)

$

(1.79

)

$

(1.90

)

$

(0.92

)

$

(22.99

)

$

4.12

$

5.95

Number of shares used in computing net

diluted earnings (loss) per share (GAAP)

57,467,946

57,029,983

56,687,006

57,140,126

56,916,831

57,082,182

57,237,518

58,100,649

Stock-based compensation

—

—

—

—

—

—

725,859

963,373

Notes due 2025

—

—

—

—

—

—

2,276,818

—

Number of shares used in computing net

diluted earnings (loss) per share (Non-GAAP)

57,467,946

57,029,983

56,687,006

57,140,126

56,916,831

57,082,182

60,240,195

59,064,022

Three months ended

Year ended

December 31, 2024

September 30, 2024

June 30, 2024

March 31, 2024

December 31, 2023

December 31, 2024

December 31, 2023

December 31, 2022

Net cash provided by (used in)

operating activities (GAAP)

$

37,804

$

(89,332

)

$

(44,772

)

$

(217,019

)

$

(139,910

)

$

(313,319

)

$

(180,113

)

$

31,284

Purchases of property and equipment

(12,258

)

(47,370

)

(22,188

)

(26,347

)

(40,501

)

(108,163

)

(170,523

)

(169,341

)

Free cash flow (deficit)

(Non-GAAP)

$

25,546

$

(136,702

)

$

(66,960

)

$

(243,366

)

$

(180,411

)

$

(421,482

)

$

(350,636

)

$

(138,057

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250219900153/en/

Investor Contacts SolarEdge Technologies, Inc. JB Lowe,

Head of Investor Relations investors@solaredge.com

Sapphire Investor Relations, LLC Erica Mannion or Michael Funari

investors@solaredge.com

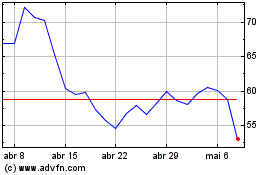

SolarEdge Technologies (NASDAQ:SEDG)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

SolarEdge Technologies (NASDAQ:SEDG)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025