Stephan Gratziani Appointed CEO; Michael

Johnson Named Executive Chairman

Herbalife Ltd. (NYSE: HLF) today reported financial results for

the fourth quarter and year ended December 31, 2024:

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250219267078/en/

“With three consecutive quarters of new distributor growth, a

new incoming CEO and significantly improved Adjusted EBITDA2

margins, we enter 2025 with strong momentum.” - Michael Johnson,

Chairman and CEO

Highlights

Fourth Quarter 2024

- Net sales of $1.2 billion, down 0.6% vs. Q4 ’23 and at high end

of guidance range

- Includes 330 basis points of FX headwinds

- Up 2.7% year-over-year on constant currency basis1

- Net income of $177.9 million includes non-cash income tax

benefits of $147.3 million; adjusted net income2 $36.8 million

- Adjusted EBITDA2 of $150.0 million exceeds guidance; adjusted

EBITDA2 margin up 340 basis points vs. Q4 ‘23

- Diluted EPS of $1.74; adjusted diluted EPS2 $0.36

Full-Year 2024

- Net sales of $5.0 billion, down 1.4% vs. 2023 and at high end

of guidance range

- Up 1.2% year-over-year on constant currency basis1

- Adjusted EBITDA2 of $634.8 million exceeds guidance; adjusted

EBITDA2 margin up 140 basis points vs. 2023

- Credit Agreement EBITDA2 $728.8 million; total leverage ratio

reduced to 3.2x at December 31

- Net cash provided by operating activities of $285.4 million;

capital expenditures $122.0 million

Outlook

- First quarter and full-year 2025 guidance provided

Management Commentary

Herbalife reported fourth quarter 2024 net sales of $1.2

billion, down 0.6% year-over-year, including 330 basis points of

foreign currency headwinds. On a constant currency basis1, net

sales increased 2.7% year-over-year.

Fourth quarter gross profit margin improved to 77.8% compared to

76.3% in the fourth quarter of 2023. On a year-over-year basis,

gross profit margin primarily benefited from approximately 80 basis

points of pricing, approximately 30 basis points of favorable input

costs, mainly related to manufacturing efficiencies, approximately

30 basis points from lower inventory write-downs and approximately

20 basis points of favorable foreign currency, partially offset by

approximately 20 basis points of unfavorable sales mix.

Fourth quarter net income was $177.9 million, with net income

margin of 14.7% and adjusted net income2 of $36.8 million. Net

income includes $147.3 million of non-cash net deferred income tax

benefits related to changes the Company initiated to its corporate

entity structure during the fourth quarter of 2024, including

intra-entity transfers of intellectual property to one of its

European subsidiaries. These non-cash net deferred income tax

benefits are excluded from the adjusted results. Adjusted EBITDA2

of $150.0 million includes approximately $12 million of foreign

currency headwinds year-over-year, with adjusted EBITDA2 margin of

12.4%, up 340 basis points versus the fourth quarter of 2023.

Diluted EPS was $1.74 and includes $1.44 favorable impact related

to the non-cash deferred income tax benefits recognized in the

quarter. Adjusted diluted EPS2 was $0.36, which includes a $0.07

year-over-year foreign currency headwind.

For full-year 2024, net sales were $5.0 billion, down 1.4%

year-over-year, including 260 basis points of foreign currency

headwinds. On a constant currency basis1, net sales increased 1.2%

year-over-year.

Full-year 2024 net income was $254.3 million, with net income

margin of 5.1% and adjusted net income2 of $198.9 million. Net

income includes $147.3 million of non-cash net deferred income tax

benefits related to changes the Company initiated to its corporate

entity structure during the fourth quarter of 2024, which are

excluded from the adjusted results. Adjusted EBITDA2 of $634.8

million includes approximately $42 million of foreign currency

headwinds year-over-year, with adjusted EBITDA2 margin of 12.7%, up

140 basis points versus 2023. Diluted EPS was $2.50 and includes

$1.45 favorable impact related to the non-cash deferred income tax

benefits recognized in the fourth quarter. Adjusted diluted EPS2

was $1.96, which includes a $0.28 year-over-year foreign currency

headwind.

Net cash provided by operating activities was $69.6 million and

$285.4 million for the three and twelve months ended December 31,

2024, respectively. Capital expenditures were $25.7 million and

$122.0 million for the three and twelve months ended December 31,

2024, respectively, and capitalized SaaS implementation costs were

approximately $3 million and $16 million, respectively. The Company

expects to incur total capitalized SaaS implementation costs of

approximately $25 million to $30 million for the full year of 2025,

which are not included in capital expenditures.

During the first quarter of 2024, the Company initiated a

Restructuring Program designed to bring leadership closer to its

markets, streamline the employee structure and accelerate

productivity. Substantially all actions related to the program were

completed as of June 30. The Restructuring Program is expected to

deliver annual savings of at least $80 million beginning in 2025,

with at least $20 million and at least $50 million of savings

realized during the three and twelve months ended December 31,

2024, respectively. The Company expects to incur total program

pre-tax expenses of approximately $74 million (up from

approximately $70 million) related to the program, which are

primarily related to severance costs. For the three and twelve

months ended December 31, 2024, approximately $1 million and $69

million, respectively, of pre-tax expenses were recognized in

SG&A related to the restructuring and are excluded from the

adjusted results.

On February 11, 2025, and consistent with its capital allocation

priorities, the Company redeemed $65.0 million aggregate principal

amount of the 7.875% Senior Notes due 2025 (“2025 Notes”) for an

aggregate purchase price of $67.3 million, which included $2.3

million of accrued and unpaid interest. Following the redemption,

the outstanding principal balance of the 2025 Notes is $197.3

million and remains due in September 2025.

"2024 was a transformative year for Herbalife," said John

DeSimone, Chief Financial Officer. "Our strong margin improvement

and progress in paying down debt have positioned us to deliver

long-term shareholder value.”

Distributor trends remain strong and reflect greater engagement

globally. For the fourth quarter, the number of new distributors

joining Herbalife worldwide increased 22% year-over-year – marking

the Company’s third consecutive quarter of year-over-year growth.

Overall event attendance at the Company’s Extravaganza training

events across the globe was greater in 2024 than in 2023, further

reflecting the demand and value these in-person events provide for

development and networking. In 2025, the Company expects to host

multi-city and multi-day events in select regions to accommodate

the increased demand. The Company believes these events and other

initiatives have supported an increase in sales leader retention.

For the twelve-month requalification period ending January 2025,

approximately 70.3% of the distributor sales leaders, excluding

China, requalified to retain their status, up from 68.3% for the

same period a year ago.

These positive trends continued into the new year as the Company

began its global rollout of the Diamond Development Mastermind

Program, an ongoing training and accountability program led by

President Stephan Gratziani and supported by network marketing

industry leader and coach, Eric Worre. In January, a kickoff event

was held for the Asia Pacific region, with approximately 400

distributors attending the in-person session in Korea and nearly

2,600 distributors attending virtually or via the live streamed

event from 13 other locations across the region. This weekend, the

program will be expanded to the Mexico market, with approximately

2,000 attendees expected, with additional markets to follow

throughout the year.

In February, the Company celebrated its 45th anniversary of

changing people’s lives through science-backed nutrition products

and a business opportunity. In March, the Company will host

Herbalife Honors in Los Angeles, California, with approximately

3,000 distributor leaders from around the world expected to attend

the annual leadership training and recognition event.

CEO Transition

As announced in a separate press release today, the Board of

Directors have appointed Stephan Gratziani as Chief Executive

Officer. Mr. Gratziani succeeds Michael Johnson who will transition

to the role of Executive Chairman. In addition, Rob Levy has been

appointed to President, Worldwide Markets. All appointments are

effective as of May 1, 2025.

“For both the fourth quarter and full year, we delivered net

sales growth on a constant currency basis1," said Michael Johnson.

"Our 2024 results reflect the resilience of Herbalife, our

distributors and our communities. I am excited and confident in the

future of Herbalife under the experienced and visionary leadership

of Stephan Gratziani.”

Fourth Quarter and Full-Year 2024 Key Metrics

Regional Net Sales and Foreign Exchange

(“FX”) Impact

Reported Net Sales

YoY Growth (Decline)

$ million

Q4 ‘24

Q4 ‘23

including FX

excluding

FX1

North America

$

245.0

$

252.8

(3.1

)%

(3.0

)%

Latin America

199.5

196.4

1.6

%

15.5

%

EMEA

257.2

250.1

2.8

%

5.6

%

Asia Pacific

439.8

433.5

1.5

%

3.0

%

China

65.9

82.2

(19.8

)%

(20.3

)%

Worldwide

$

1,207.4

$

1,215.0

(0.6

)%

2.7

%

Reported Net Sales

YoY Growth (Decline)

$ million

FY ‘24

FY ‘23

including FX

excluding

FX1

North America

$

1,054.4

$

1,131.4

(6.8

)%

(6.8

)%

Latin America

832.5

820.9

1.4

%

7.8

%

EMEA

1,084.8

1,068.8

1.5

%

4.4

%

Asia Pacific

1,723.8

1,713.9

0.6

%

3.0

%

China

297.6

327.4

(9.1

)%

(7.5

)%

Worldwide

$

4,993.1

$

5,062.4

(1.4

)%

1.2

%

Regional Volume Point Metrics

Volume Points

in millions

Q4 ‘24

Q4 ‘23

YoY % Chg.

FY ‘24

FY ‘23

YoY % Chg.

North America(a)

239.5

250.6

(4.4

)%

1,029.5

1,160.9

(11.3

)%

Latin America(b)

264.8

239.4

10.6

%

1,035.8

1,028.0

0.8

%

EMEA

269.2

279.5

(3.7

)%

1,136.2

1,222.9

(7.1

)%

Asia Pacific

548.9

552.3

(0.6

)%

2,145.3

2,151.5

(0.3

)%

China

49.4

60.1

(17.8

)%

222.1

237.6

(6.5

)%

Worldwide(c)

1,371.8

1,381.9

(0.7

)%

5,568.9

5,800.9

(4.0

)%

Note: During Q2 ‘24, most markets

within the Latin America region, excluding Mexico, implemented a 5%

price reduction and Volume Point adjustments for most products to

enhance the competitiveness of product pricing and aiming to

stimulate incremental volume growth.

During Q4 ‘24, the U.S. and

Puerto Rico markets within the North America region implemented

Volume Point adjustments for most products for strategic

reasons.

Refer to the Company's Annual

Report on Form 10-K for the year ended December 31, 2024, for

additional details.

(a)

Excluding North America related

Volume Point adjustments noted above, the year-over-year percentage

change for Q4 ‘24 and FY ‘24 would have been a decrease of 6.1% and

11.7%, respectively.

(b)

Excluding Latin America related

Volume Point adjustments noted above, the year-over-year percentage

change for Q4 ‘24 and FY ‘24 would have been an increase of 8.6%

and decrease of 0.6%, respectively.

(c)

Excluding the Volume Point

adjustments noted above, the year-over-year percentage change for

Q4 ‘24 and FY ‘24 would have been a decrease of 1.4% and 4.3%,

respectively.

Outlook

First Quarter 2025 Guidance

$ million

Q1 ‘25 Guidance

Q1 ‘24 Results

Net sales

(5.5)% to (1.5)% YoY

1,264.3

Net sales at constant currency(a)

0% to +4% YoY

Adjusted EBITDA2

140 – 150

138.3

Adjusted EBITDA2 at constant

currency(a)

158 – 168

Capital expenditures

30 – 40

32.9

Full-Year 2025 Guidance

$ million

FY ‘25 Guidance

FY ‘24 Results

Net sales

(3)% to +3% YoY

4,993.1

Net sales at constant currency(a)

+1% to +7% YoY

Adjusted EBITDA2

600 – 640

634.8

Adjusted EBITDA2 at constant

currency(a)

670 – 710

Capital expenditures

100 – 130

122.0

(a)

Non-GAAP Measure. Net sales and

adjusted EBITDA2 at constant currency represent projections using

U.S. Dollars at Q1 ‘24 and FY ‘24 average FX rates, respectively,

and adjusting for other FX related impacts. Refer to Schedule A –

“Reconciliation of Non-GAAP Financial Measures” for a discussion of

non-GAAP guidance and why the Company believes adjusting for the

effects of foreign exchange is useful.

Guidance Assumptions

- Net sales and adjusted EBITDA2 use the average daily exchange

rates for the first three weeks of January 2025 to translate local

currency projections for all of 2025

- Outlook does not include any potential impact of incremental

tariffs

Earnings Webcast and Conference Call

Herbalife’s senior management team will host a live audio

webcast and conference call to discuss its fourth quarter and

full-year 2024 financial results on Wednesday, February 19, 2025,

at 5:30 p.m. ET (2:30 p.m. PT).

The live audio webcast will be available at the following link:

https://edge.media-server.com/mmc/p/mssckczw.

Participants joining via the conference call may obtain the

dial-in information and personal PIN to access the call by

registering at the following link:

https://register.vevent.com/register/BI34b011f4acb546d392c732dd054eb4c4.

Senior management also plans to reference slides during the

webcast and call, which will be available under the Investor

Relations section of Herbalife’s website at

https://ir.herbalife.com, where financial and other information is

posted from time to time. The live webcast will also be available

at the same website, along with a replay of the webcast following

the completion of the event and for 12 months thereafter.

____________________

1

Growth/decline in net sales

excluding the effects of foreign exchange is based on “net sales in

local currency,” a non-GAAP financial measure. Refer to Schedule A

– “Reconciliation of Non-GAAP Financial Measures” for a discussion

of why the Company believes adjusting for the effects of foreign

exchange is useful.

2

Non-GAAP measure. Refer to

Schedule A – “Reconciliation of Non-GAAP Financial Measures” for a

detailed reconciliation of these measures to the most directly

comparable U.S. GAAP measure for historical periods, as applicable,

and a discussion of why the Company believes these non-GAAP

measures are useful and certain information regarding non-GAAP

guidance.

About Herbalife Ltd.

Herbalife (NYSE: HLF) is a premier health and wellness company,

community and platform that has been changing people's lives with

great nutrition products and a business opportunity for its

independent distributors since 1980. The Company offers

science-backed products to consumers in more than 90 markets

through entrepreneurial distributors who provide one-on-one

coaching and a supportive community that inspires their customers

to embrace a healthier, more active lifestyle to live their best

life.

For more information, visit https://ir.herbalife.com.

Forward-Looking Statements

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

All statements other than statements of historical fact are

“forward-looking statements” for purposes of federal and state

securities laws, including any projections of earnings, revenue or

other financial items; any statements of the plans, strategies and

objectives of management, including for future operations, capital

expenditures, or share repurchases; any statements concerning

proposed new products, services, or developments; any statements

regarding future economic conditions or performance; any statements

of belief or expectation; and any statements of assumptions

underlying any of the foregoing or other future events.

Forward-looking statements may include, among others, the words

“may,” “will,” “estimate,” “intend,” “continue,” “believe,”

“expect,” “anticipate” or any other similar words.

Although we believe that the expectations reflected in any of

our forward-looking statements are reasonable, actual results or

outcomes could differ materially from those projected or assumed in

any of our forward-looking statements. Our future financial

condition and results of operations, as well as any forward-looking

statements, are subject to change and to inherent risks and

uncertainties, many of which are beyond our control. Important

factors that could cause our actual results, performance and

achievements, or industry results to differ materially from

estimates or projections contained in or implied by our

forward-looking statements include the following:

- the potential impacts of current global economic conditions,

including inflation, unfavorable foreign exchange rate

fluctuations, and tariffs or retaliatory tariffs, on us; our

Members, customers, and supply chain; and the world economy;

- our ability to attract and retain Members;

- our relationship with, and our ability to influence the actions

of, our Members;

- our noncompliance with, or improper action by our employees or

Members in violation of, applicable U.S. and foreign laws, rules,

and regulations;

- adverse publicity associated with our Company or the

direct-selling industry, including our ability to comfort the

marketplace and regulators regarding our compliance with applicable

laws;

- changing consumer preferences and demands and evolving industry

standards, including with respect to climate change,

sustainability, and other environmental, social, and governance

matters;

- the competitive nature of our business and industry;

- legal and regulatory matters, including regulatory actions

concerning, or legal challenges to, our products or network

marketing program and product liability claims;

- the Consent Order entered into with the Federal Trade

Commission, or FTC, the effects thereof and any failure to comply

therewith;

- risks associated with operating internationally and in

China;

- our ability to execute our growth and other strategic

initiatives, including implementation of our restructuring

initiatives, and increased penetration of our existing

markets;

- any material disruption to our business caused by natural

disasters, other catastrophic events, acts of war or terrorism,

including the war in Ukraine, cybersecurity incidents, pandemics,

and/or other acts by third parties;

- our ability to adequately source ingredients, packaging

materials, and other raw materials and manufacture and distribute

our products;

- our reliance on our information technology infrastructure;

- noncompliance by us or our Members with any privacy laws,

rules, or regulations or any security breach involving the

misappropriation, loss, or other unauthorized use or disclosure of

confidential information;

- contractual limitations on our ability to expand or change our

direct-selling business model;

- the sufficiency of our trademarks and other intellectual

property;

- product concentration;

- our reliance upon, or the loss or departure of any member of,

our senior management team;

- restrictions imposed by covenants in the agreements governing

our indebtedness;

- risks related to our convertible notes;

- changes in, and uncertainties relating to, the application of

transfer pricing, income tax, customs duties, value added taxes,

and other tax laws, treaties, and regulations, or their

interpretation;

- our incorporation under the laws of the Cayman Islands;

and

- share price volatility related to, among other things,

speculative trading and certain traders shorting our common

shares.

Additional factors and uncertainties that could cause actual

results or outcomes to differ materially from our forward-looking

statements are set forth in the Company's Annual Report on Form

10-K for the fiscal year ended December 31, 2024, filed with the

Securities and Exchange Commission on February 19, 2025, including

under the headings “Risk Factors” and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations” and in

our Consolidated Financial Statements and the related Notes

included therein. In addition, historical, current, and

forward-looking sustainability-related statements may be based on

standards for measuring progress that are still developing,

internal controls and processes that continue to evolve, and

assumptions that are subject to change in the future.

Forward-looking statements made in this release speak only as of

the date hereof. We do not undertake any obligation to update or

release any revisions to any forward-looking statement or to report

any events or circumstances after the date hereof or to reflect the

occurrence of unanticipated events, except as required by law.

Results of Operations

Herbalife Ltd. and

Subsidiaries

Condensed Consolidated

Statements of Income

(in millions, except per share

amounts)

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

(unaudited)

Net sales

$

1,207.4

$

1,215.0

$

4,993.1

$

5,062.4

Cost of sales

267.5

287.6

1,104.3

1,191.0

Gross profit

939.9

927.4

3,888.8

3,871.4

Royalty overrides

397.0

397.4

1,633.0

1,659.2

Selling, general, and administrative expenses

436.9

474.3

1,875.4

1,866.0

Other operating income (1)

(0.5

)

(0.1

)

(5.5

)

(10.2

)

Operating income

106.5

55.8

385.9

356.4

Interest expense, net

53.9

38.1

206.0

154.4

Other expense (income), net (2)

-

-

10.5

(1.0

)

Income before income taxes

52.6

17.7

169.4

203.0

Income taxes

(125.3

)

7.5

(84.9

)

60.8

Net income

$

177.9

$

10.2

$

254.3

$

142.2

Earnings per share: Basic

$

1.76

$

0.10

$

2.53

$

1.44

Diluted

$

1.74

$

0.10

$

2.50

$

1.42

Weighted-average shares outstanding: Basic

101.1

99.3

100.6

99.0

Diluted

102.0

100.7

101.6

100.2

(1) Other operating income for the three and twelve months

ended December 31, 2024 and 2023 relates to certain China

government grant income. (2) Other expense, net for the year ended

December 31, 2024 relates to loss on extinguishment of 2018 Credit

Facility, as well as partial redemption and private repurchase of

2025 Notes. Other income, net for the year ended December 31, 2023

relates to gain on extinguishment of a portion of 2024 Convertible

Notes.

Herbalife Ltd. and

Subsidiaries

Condensed Consolidated Balance

Sheets

(in millions)

December 31,

December 31,

2024

2023

ASSETS Current Assets: Cash and cash equivalents

$

415.3

$

575.2

Receivables, net

68.9

81.2

Inventories

475.4

505.2

Prepaid expenses and other current assets

184.1

237.7

Total Current Assets

1,143.7

1,399.3

Property, plant and equipment, net

460.2

506.5

Operating lease right-of-use assets

185.7

185.8

Marketing-related intangibles and other intangible assets, net

312.3

314.0

Goodwill

87.7

95.4

Deferred income tax assets

398.6

179.3

Other assets

139.9

129.1

Total Assets

$

2,728.1

$

2,809.4

LIABILITIES AND SHAREHOLDERS' DEFICIT Current Liabilities:

Accounts payable

$

70.0

$

84.0

Royalty overrides

334.1

343.4

Current portion of long-term debt

283.5

309.5

Other current liabilities

542.8

540.7

Total Current Liabilities

1,230.4

1,277.6

Non-current liabilities: Long-term debt, net of current

portion

1,976.6

2,252.9

Non-current operating lease liabilities

169.5

167.6

Other non-current liabilities

152.7

171.6

Total Liabilities

3,529.2

3,869.7

Commitments and Contingencies Shareholders' deficit:

Common shares

0.1

0.1

Paid-in capital in excess of par value

278.2

233.9

Accumulated other comprehensive loss

(271.4

)

(232.0

)

Accumulated deficit

(808.0

)

(1,062.3

)

Total Shareholders' Deficit

(801.1

)

(1,060.3

)

Total Liabilities and Shareholders' Deficit

$

2,728.1

$

2,809.4

Herbalife Ltd. and

Subsidiaries

Condensed Consolidated

Statements of Cash Flows

(in millions)

Year Ended December

31,

2024

2023

Cash flows from operating activities: Net income

$

254.3

$

142.2

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization

121.4

113.3

Share-based compensation expenses

50.0

48.0

Non-cash interest expense

13.4

7.4

Deferred income taxes

(229.6

)

(41.1

)

Inventory write-downs

18.9

28.5

Foreign exchange transaction loss

7.6

6.0

Loss (gain) on extinguishment of debt

10.5

(1.0

)

Other

6.4

6.5

Changes in operating assets and liabilities: Receivables

5.9

(12.6

)

Inventories

(30.4

)

57.5

Prepaid expenses and other current assets

43.1

(13.8

)

Accounts payable

(14.6

)

(7.4

)

Royalty overrides

11.1

(6.5

)

Other current liabilities

40.4

23.8

Other

(23.0

)

6.7

Net cash provided by operating activities

285.4

357.5

Cash flows from investing activities: Purchases of property,

plant and equipment

(122.0

)

(135.0

)

Proceeds from sale and leaseback transaction, net of related

expenses

37.9

-

Other

(0.5

)

0.2

Net cash used in investing activities

(84.6

)

(134.8

)

Cash flows from financing activities: Borrowings from senior

secured credit facility and other debt, net of discount

1,394.4

215.2

Principal payments on senior secured credit facility and other debt

(1,937.0

)

(289.6

)

Repayment of convertible senior notes

(197.0

)

(64.3

)

Proceeds from senior secured notes, net of discount

778.4

-

Repayment of senior notes

(344.3

)

-

Debt issuance costs

(24.0

)

(1.8

)

Share repurchases

(8.3

)

(11.0

)

Other

2.5

3.2

Net cash used in financing activities

(335.3

)

(148.3

)

Effect of exchange rate changes on cash, cash equivalents, and

restricted cash

(22.9

)

4.8

Net change in cash, cash equivalents, and restricted cash

(157.4

)

79.2

Cash, cash equivalents, and restricted cash, beginning of period

595.5

516.3

Cash, cash equivalents, and restricted cash, end of period

$

438.1

$

595.5

Cash paid during the year: Interest paid

$

194.4

$

159.1

Income taxes paid

$

146.5

$

133.1

Supplemental Information

SCHEDULE A: RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(unaudited)

Adjusted Net Income, Adjusted Diluted EPS, Adjusted EBITDA and

Credit Agreement EBITDA

In addition to its reported results calculated in accordance

with U.S. GAAP, the Company has included in this release adjusted

net income, adjusted diluted EPS, adjusted EBITDA and credit

agreement EBITDA, performance measures that the Securities and

Exchange Commission defines as “non-GAAP financial measures.”

Adjusted net income, adjusted diluted EPS, adjusted EBITDA and

credit agreement EBITDA exclude the impact of certain unusual or

non-recurring items such as expenses related to restructuring

initiatives, expenses related to the digital technology program,

gains or losses from sale of property, gains or losses from

extinguishment of debt and certain tax expenses and benefits, as

further detailed in the reconciliations below. Adjusted EBITDA

margin represents adjusted EBITDA divided by net sales. Credit

agreement EBITDA represents EBITDA adjusted for items permitted

under our senior secured credit facilities.

Management believes that such non-GAAP performance measures,

when read in conjunction with the Company’s reported results,

calculated in accordance with U.S. GAAP, can provide useful

supplemental information for investors because they facilitate a

period to period comparative assessment of the Company’s operating

performance relative to its performance based on reported results

under U.S. GAAP, while isolating the effects of some items that

vary from period to period without any correlation to core

operating performance and eliminate certain charges that management

believes do not reflect the Company’s operations and underlying

operational performance.

The Company’s definitions and calculations as set forth in the

tables below of adjusted net income, adjusted diluted EPS, adjusted

EBITDA and credit agreement EBITDA may not be comparable to

similarly titled measures used by other companies because other

companies may not calculate them in the same manner as the Company

does and should not be viewed in isolation from, nor as

alternatives to, net income or diluted EPS calculated in accordance

with U.S. GAAP.

The Company does not provide a reconciliation of forward-looking

adjusted EBITDA or constant currency adjusted EBITDA guidance to

net income, the comparable U.S. GAAP measure, because, due to the

unpredictable or unknown nature of certain significant items, such

as income tax expenses or benefits, loss contingencies, and any

gains or losses in connection with refinancing transactions, we

cannot reconcile these non-GAAP projections without unreasonable

efforts. We expect the variability of these items, which are

necessary for a presentation of the reconciliation, could have a

significant impact on our reported U.S. GAAP financial results.

Currency Fluctuation

Our international operations have provided and will continue to

provide a significant portion of our total net sales. As a result,

total net sales will continue to be affected by fluctuations in the

U.S. dollar against foreign currencies. In order to provide a

framework for assessing how our underlying businesses performed

excluding the effect of foreign currency fluctuations, in addition

to comparing the percent change in net sales from one period to

another in U.S. dollars, we also compare the percent change in net

sales from one period to another period using “net sales in local

currency.” Net sales in local currency is not a measure presented

in accordance with U.S. GAAP. Net sales in local currency removes

from net sales in U.S. dollars the impact of changes in exchange

rates between the U.S. dollar and the local currencies of our

foreign subsidiaries, by translating the current period net sales

into U.S. dollars using the same foreign currency exchange rates

that were used to translate the net sales for the previous

comparable period. We believe presenting net sales in local

currency is useful to investors because it allows a meaningful

comparison of net sales of our foreign operations from period to

period. However, net sales in local currency should not be

considered in isolation or as an alternative to net sales in U.S.

dollar measures that reflect current period exchange rates, or to

other financial measures calculated and presented in accordance

with U.S. GAAP.

The following is a reconciliation of net income to adjusted net

income:

Three Months Ended December

31,

Year Ended December

31,

$ million

2024

2023

2024

2023

Net income

$

177.9

$

10.2

$

254.3

$

142.2

Expenses related to Restructuring Program (1) (2)

0.9

-

69.1

-

Expenses related to Transformation Program (1) (2)

4.0

12.2

13.4

54.2

Digital technology program costs (1) (2)

4.6

9.5

26.7

32.1

Gain on sale of property (1) (2)

-

-

(4.0

)

-

Korea tax settlement (1) (2)

-

-

-

8.6

Loss (gain) on extinguishment of debt (1) (2)

-

-

10.5

(1.0

)

Income tax adjustments for above items (1) (2)

(3.3

)

(3.3

)

(23.8

)

(14.3

)

Deferred income tax benefits, net, from corporate entity

reorganization

(147.3

)

-

(147.3

)

-

Adjusted net income

$

36.8

$

28.6

$

198.9

$

221.8

The following is a reconciliation of diluted earnings per share

to adjusted diluted earnings per share:

Three Months Ended December

31,

Year Ended December

31,

$ per share

2024

2023

2024

2023

Diluted earnings per share

$

1.74

$

0.10

$

2.50

$

1.42

Expenses related to Restructuring Program (1) (2)

0.01

-

0.68

-

Expenses related to Transformation Program (1) (2)

0.04

0.12

0.13

0.54

Digital technology program costs (1) (2)

0.05

0.09

0.26

0.32

Gain on sale of property (1) (2)

-

-

(0.04

)

-

Korea tax settlement (1) (2)

-

-

-

0.09

Loss (gain) on extinguishment of debt (1) (2)

-

-

0.10

(0.01

)

Income tax adjustments for above items (1) (2)

(0.03

)

(0.03

)

(0.23

)

(0.14

)

Deferred income tax benefits, net, from corporate entity

reorganization

(1.44

)

-

(1.45

)

-

Adjusted diluted earnings per share (5)

$

0.36

$

0.28

$

1.96

$

2.21

The following is a reconciliation of net income to EBITDA,

adjusted EBITDA and Credit Agreement EBITDA and Credit Agreement

total leverage ratio:

Three Months Ended

Year Ended December

31,

$ million

Dec 31 '23

Mar 31 '24

Jun 30 '24

Sep 30 '24

Dec 31 '24

2024

2023

Net sales

$

1,215.0

$

1,264.3

$

1,281.1

$

1,240.3

$

1,207.4

$

4,993.1

$

5,062.4

Net income

$

10.2

$

24.3

$

4.7

$

47.4

$

177.9

$

254.3

$

142.2

Interest expense, net

38.1

37.9

57.7

56.5

53.9

206.0

154.4

Income taxes

7.5

9.7

7.5

23.2

(125.3

)

(84.9

)

60.8

Depreciation and amortization

28.2

29.2

32.6

30.6

29.0

121.4

113.3

EBITDA

84.0

101.1

102.5

157.7

135.5

496.8

470.7

Amortization of SaaS implementation costs

3.1

3.6

8.7

5.0

5.0

22.3

6.0

Expenses related to Restructuring Program

-

16.7

48.8

2.7

0.9

69.1

-

Expenses related to Transformation Program

12.2

5.9

3.5

-

4.0

13.4

54.2

Digital technology program costs

9.5

11.0

6.0

5.1

4.6

26.7

32.1

Gain on sale of property

-

-

-

(4.0

)

-

(4.0

)

-

Korea tax settlement

-

-

-

-

-

-

8.6

Loss (gain) on extinguishment of debt

-

-

10.5

-

-

10.5

(1.0

)

Adjusted EBITDA

108.8

138.3

180.0

166.5

150.0

634.8

570.6

Interest income

3.2

3.7

2.8

2.8

3.0

12.3

11.5

Inventory write-downs

6.6

4.7

6.7

5.6

1.9

18.9

28.5

Share-based compensation expenses

12.3

11.9

11.8

13.0

13.3

50.0

48.0

Other expenses (3)

11.8

0.9

6.7

9.3

(4.1

)

12.8

11.5

Credit Agreement EBITDA

$

142.7

$

159.5

$

208.0

$

197.2

$

164.1

$

728.8

$

670.1

Credit Agreement Total Debt (4)

$

2,332.7

$

2,581.1

Credit Agreement Total Leverage Ratio

3.2x

3.9x

Net income margin

0.8

%

1.9

%

0.4

%

3.8

%

14.7

%

5.1

%

2.8

%

Adjusted EBITDA margin

9.0

%

10.9

%

14.1

%

13.4

%

12.4

%

12.7

%

11.3

%

(1) Based on interim income tax reporting rules, these

(income)/expense items are not considered discrete items. The tax

effect of the adjustments between our U.S. GAAP and non-GAAP

results takes into account the tax treatment and related tax

rate(s) that apply to each adjustment in the applicable tax

jurisdiction(s). (2) Excludes tax (benefit)/expense as

follows:

Three Months Ended December

31,

Year Ended December

31,

$ million

2024

2023

2024

2023

Expenses related to Restructuring Program

$

(2.6

)

$

-

$

(17.5

)

$

-

Expenses related to Transformation Program

(1.2

)

(2.3

)

(3.1

)

(10.6

)

Digital technology program costs

0.7

(1.2

)

(1.8

)

(2.6

)

Gain on sale of property

-

-

0.9

-

Korea tax settlement

-

0.3

-

(1.1

)

Loss (gain) on extinguishment of debt

(0.2

)

(0.1

)

(2.3

)

-

Total income tax adjustments

$

(3.3

)

$

(3.3

)

$

(23.8

)

$

(14.3

)

Three Months Ended December

31,

Year Ended December

31,

$ per share

2024

2023

2024

2023

Expenses related to Restructuring Program

$

(0.03

)

$

-

$

(0.17

)

$

-

Expenses related to Transformation Program

(0.01

)

(0.02

)

(0.03

)

(0.11

)

Digital technology program costs

0.01

(0.01

)

(0.02

)

(0.03

)

Gain on sale of property

-

-

0.01

-

Korea tax settlement

-

-

-

(0.01

)

Loss (gain) on extinguishment of debt

-

-

(0.02

)

-

Total income tax adjustments (5)

$

(0.03

)

$

(0.03

)

$

(0.23

)

$

(0.14

)

(3) Other expenses include certain non-cash items such as

bad debt expense, unrealized foreign currency gains and losses, and

other gains and losses (4) Represents the outstanding

principal amount of total debt as of the respective period end

(5) Amounts may not total due to rounding

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250219267078/en/

Media Contact: Thien Ho Vice President, Global Corporate

Communications thienh@herbalife.com Investor Contact: Erin

Banyas Vice President, Head of Investor Relations

erinba@herbalife.com

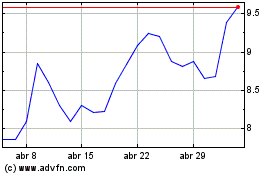

Herbalife (NYSE:HLF)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Herbalife (NYSE:HLF)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025