Nuvation Bio to receive $150 million in royalty

interest financing and $50 million in debt upon U.S. FDA approval

of taletrectinib, with access to additional $50 million in debt at

the Company’s option

Proceeds from the royalty interest financing

expected to fully fund U.S. commercial launch of taletrectinib

Pro forma cash balance expected to fully fund

development of current clinical-stage pipeline and create a path to

potential profitability without the need for additional

fundraising; improves flexibility for opportunistic capital

deployment

Nuvation Bio Inc. (NYSE: NUVB), a global biopharmaceutical

company tackling some of the greatest unmet needs in oncology,

today announced non-dilutive financings of up to $250 million with

Sagard Healthcare Partners (Sagard). The transaction comprises a

royalty interest financing of $150 million and a senior term loan

of up to $100 million. These financings strengthen Nuvation Bio’s

balance sheet to fully fund commercialization of taletrectinib in

the U.S., if approved, and development of the Company’s current

clinical-stage pipeline. The transaction also provides Nuvation Bio

with a path to potential profitability without the need to raise

additional capital.

“This transaction is a significant milestone for Nuvation Bio as

we prepare to bring taletrectinib to the U.S. market, subject to

FDA approval, in mid-2025,” said David Hung, M.D., Founder,

President, and Chief Executive Officer of Nuvation Bio. “With these

financings, we are well positioned to launch taletrectinib and

drive continued development of our clinical-stage pipeline—all

without the need for additional fundraising. This also improves our

flexibility to pursue strategic opportunities to deploy our

capital. We are thrilled to have support from Sagard and appreciate

their shared confidence in taletrectinib and Nuvation Bio as we

continue toward our goal of improving outcomes for patients with

cancer.”

Subject to the approval of taletrectinib by the U.S. Food and

Drug Administration (FDA) on or prior to September 30, 2025, Sagard

will provide Nuvation Bio with an upfront cash payment of $150

million. In return, Sagard will receive tiered royalties on U.S.

net sales of taletrectinib, including 5.5% of annual U.S. net sales

up to $600 million and 3.0% of annual U.S. net sales between $600

million and $1 billion. Nuvation Bio will retain all annual U.S.

net sales above $1 billion. Payments to Sagard will cease upon the

earliest occurrence of total royalties reaching 1.6 times its

investment by June 30, 2031, 1.75 times its investment by June 30,

2034, or 2.0 times its investment thereafter.

“We are excited to partner with Nuvation Bio, an organization

with deep oncology expertise and a commitment to delivering

transformative therapies,” said Raja Manchanda, Partner at Sagard

Healthcare Partners. “We believe taletrectinib has the potential to

redefine the treatment landscape for patients with ROS1-positive

non-small cell lung cancer, and we are pleased to provide a

structured financing that supports both potential near-term

commercialization and long-term growth.”

In addition to the royalty financing, Sagard has committed to a

5-year, senior secured term loan of up to $100 million, with $50

million to be funded upon U.S. FDA approval of taletrectinib on or

prior to September 30, 2025. The second tranche of $50 million is

available at Nuvation Bio's option until June 30, 2026, as long as

Nuvation Bio has achieved first U.S. commercial sale of

taletrectinib. The term loan will bear interest at SOFR + 6.00%,

subject to a 4.00% SOFR floor. There are no scheduled amortization

payments associated with the term loan, with all outstanding

principal due at maturity.

TD Cowen served as financial advisor and Cooley LLP served as

legal advisor to Nuvation Bio. Sidley Austin LLP served as legal

advisors to Sagard.

About Sagard

Sagard is a multi-strategy alternative asset management firm

with over US$25B under management, 150 portfolio companies, and 400

professionals. Sagard invests in venture capital, private equity,

private credit, and real estate. Sagard delivers flexible capital,

an entrepreneurial culture, and a global network of investors,

commercial partners, advisors, and value creation experts. Sagard’s

dynamic and supportive ecosystem gives its partners the advantage

they need to learn, grow and win at every stage. The firm has

offices in Canada, the United States, Europe and the Middle

East.

About Nuvation Bio

Nuvation Bio is a global biopharmaceutical company tackling some

of the greatest unmet needs in oncology by developing

differentiated and novel product candidates. Nuvation Bio’s

programs include taletrectinib (ROS1), safusidenib (mIDH1),

NUV-1511 (DDC), and NUV-868 (BET). Nuvation Bio was founded in 2018

by biopharma industry veteran David Hung, M.D., who previously

founded Medivation, Inc., which brought to patients one of the

world’s leading prostate cancer medicines. Nuvation Bio has offices

in New York, San Francisco, Boston, and Shanghai. For more

information, please visit www.nuvationbio.com or follow the Company

on LinkedIn and X (@nuvationbioinc).

Forward Looking Statements

Certain statements included in this press release that are not

historical facts are forward-looking statements for purposes of the

safe harbor provisions under the United States Private Securities

Litigation Reform Act of 1995. Forward-looking statements are

sometimes accompanied by words such as “believe,” “may,” “will,”

“estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,”

“would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,”

“outlook” and similar expressions that predict or indicate future

events or trends or that are not statements of historical matters.

These forward-looking statements include, but are not limited to,

our expectations regarding U.S. FDA approval and commercial launch

of taletrectinib, and the timing thereof, receipt and use of

proceeds from the financings to fully fund U.S. commercial launch

of taletrectinib and development of Nuvation Bio’s current

clinical-stage pipeline, the path to potential profitability

without need to raise additional capital, and the potential of

taletrectinib to redefine the treatment landscape for patients with

ROS1-positive non-small cell lung cancer. These statements are

based on various assumptions, whether or not identified in this

press release, and on the current expectations of the management

team of Nuvation Bio and are not predictions of actual performance.

These forward-looking statements are subject to a number of risks

and uncertainties that may cause actual results to differ from

those anticipated by the forward-looking statements, including but

not limited to the challenges associated with conducting drug

discovery and initiating or conducting clinical studies due to,

among other things, difficulties or delays in the regulatory

process, enrolling subjects or manufacturing or acquiring necessary

products; the emergence or worsening of adverse events or other

undesirable side effects; risks associated with preliminary and

interim data, which may not be representative of more mature data;

and competitive developments. Risks and uncertainties facing

Nuvation Bio are described more fully in its Form 10-Q filed with

the SEC on November 6, 2024, under the heading “Risk Factors,” and

other documents that Nuvation Bio has filed or will file with the

SEC. You are cautioned not to place undue reliance on the

forward-looking statements, which speak only as of the date of this

press release. Nuvation Bio disclaims any obligation or undertaking

to update, supplement or revise any forward-looking statements

contained in this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250303777574/en/

Nuvation Bio Investor Contact: ir@nuvationbio.com

Nuvation Bio Media Contact: media@nuvationbio.com

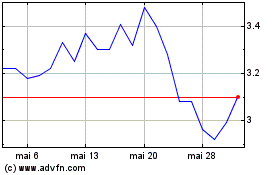

Panacea Acquisition (NYSE:NUVB)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Panacea Acquisition (NYSE:NUVB)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025