Potential threat by Beijing to capitalist hub looms over bid for

London marketplace

By Steven Russolillo and Stella Yifan Xie

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 13, 2019).

Charles Li, the head of Hong Kong's stock exchange, has built

his career and company's success on China. Now that could prove to

be his biggest challenge.

The prospect of tighter control from Beijing is threatening the

rule of law that underpins Hong Kong's role as a financial hub. And

political and security concerns could help scuttle an unsolicited

$36.6 billion offer for the London Stock Exchange Group Ltd., in

what would be by far his biggest deal.

The timing of the approach to LSE was also notable. The surprise

move was aimed at disrupting another deal that would effectively

put the LSE out of bounds. But given shifting political winds, the

exchange could also find in the future that it encounters a

frostier reception in the West.

The 58-year-old Mr. Li is a voluble former lawyer, banker,

journalist and oil worker. For much of his decadelong tenure as

chief executive of Hong Kong Exchanges & Clearing Ltd., he has

focused on building closer ties between the exchange and its

mainland Chinese counterparts, staking its growth on China's

increasing wealth and global influence.

On Wednesday, Mr. Li sought to sell the media on the benefits of

uniting the Hong Kong and London exchanges into a group with an

18-hour trading day, in a deal that would help deepen the

connections between China and global markets.

Speaking from a London office a few minutes' walk from the LSE's

headquarters, he admitted to admiring LSE for months and described

the saga as a corporate "Romeo and Juliet" story -- a typically

colorful turn of phrase.

"He's a very successful salesman," said Christopher Cheung

Wah-fung, a lawmaker in Hong Kong who represents the

financial-services sector and is also chief executive of brokerage

Christfund Securities. "He always has a bunch of plausible theories

to defend his arguments."

HKEX didn't make Mr. Li available for comment.

The LSE proposal, the latest in a long line of mooted deals

involving the U.K. exchange, has run immediately into skepticism.

"It's a bold move and one that appears to have a low chance of

success," said Neil Wilson, an analyst at Safecap Investment Ltd.'s

Markets.com.

Mr. Li has spent a decade talking about the opportunities from

the two-way internationalization of China's capital markets, and

joining forces with LSE could be the biggest step in realizing that

vision, according to a person close to him.

One hurdle will be persuading the target's board and

shareholders to scrap LSE's existing $14.5 billion deal to buy

financial-information provider Refinitiv Holdings Ltd.

Exchange deals are often also fraught with political risk. The

U.K. government could veto this deal because LSE forms a critical

part of the country's financial infrastructure, according to people

familiar with the matter.

Meanwhile, worries are intensifying in Hong Kong financial

circles over Beijing's increasing encroachment on the territory,

which has helped fuel months of increasingly violent protests. Half

of the Hong Kong exchange's board, excluding the CEO, is appointed

by the Hong Kong government, which could potentially add to the

sensitivity.

HKEX shares fell 3.5% on Thursday as its own investors digested

the deal.

Mr. Li got his start as an offshore oil worker in mainland China

before entering college. He spent a few years as a journalist

working for China Daily, a state mouthpiece, and later earned a

master's in journalism at the University of Alabama.

He pivoted again and earned a law degree from Columbia

University. He worked at law firms in New York before joining

Merrill Lynch China in 1994, becoming its president in 1999. He

joined J.P. Morgan China as its chairman in 2003.

Unlike many Western exchanges, HKEX faces little competition in

its home market for share trading, futures or clearing, and is thus

highly profitable. That means it has felt less pressure than

European or U.S. rivals to diversify into areas like compiling

indexes, or to gain scale through acquisitions.

The only notable overseas acquisition came in 2012, when it

bought the London Metal Exchange for $2.12 billion.

That restraint has paid off so far. Since Mr. Li took the helm

in January 2010, the gain in the company's shares has more than

doubled that of the benchmark Hang Seng Index. The group has a

market value of roughly $38 billion, according to FactSet.

Instead, Mr. Li has focused partly on linking mainland China

with global markets. The exchange introduced Stock Connect in 2014,

a trading link giving foreign investors access to shares in

Shanghai and Shenzhen, and letting mainland investors trade in Hong

Kong.

By enabling easier buying and selling of onshore shares, the

program helped persuade influential index providers to add Chinese

shares to their benchmarks. He has also presided over a similar

program called Bond Connect.

The exchange has also moved to stay competitive. It was the

world's biggest market for initial public offerings last year. With

Mr. Li's support, the city revamped its listing rules in 2018 to

allow companies with unequal voting rights and unprofitable

biotechnology companies to go public.

However, Mr. Cheung, the lawmaker, said some of Mr. Li's

initiatives had yet to pay off. "I can't see any actual benefit for

Hong Kong through the LME deal or the efforts to bring back

U.S.-listed Chinese tech companies," he said.

Write to Steven Russolillo at steven.russolillo@wsj.com and

Stella Yifan Xie at stella.xie@wsj.com

(END) Dow Jones Newswires

September 13, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

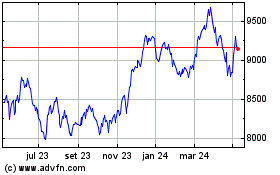

London Stock Exchange (LSE:LSEG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

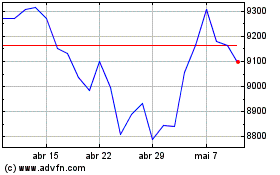

London Stock Exchange (LSE:LSEG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024