Ford Sets Up Joint Venture With Mahindra -- Update

01 Outubro 2019 - 10:32AM

Dow Jones News

By Patrick Thomas and Mike Colias

Ford Motor Co. said it will transfer most of its operations in

India to Mahindra & Mahindra Ltd. as part of a joint venture

with the Indian auto maker.

Mahindra, one of India's largest auto makers, will own 51% of

the venture and Ford 49%. The companies value the venture at about

$275 million.

Ford expects to book an $800 million to $900 million noncash

charge related to the establishment of the joint venture in the

third quarter, the company said in a regulatory filing Tuesday.

Ford said the joint venture will develop and build vehicles for

Ford in India and serve as an export hub. Each company will

continue to sell vehicles under their respective brands in India,

where they have a combined 14% market share, the companies

said.

The move will allow Ford to remain in a market that has growth

potential but where it is difficult to make money because pricing

pressure keeps profit margins thin. Ford said it will add scale by

gaining access to Mahindra's Indian supply base and leveraging its

expertise in low-cost engineering.

Ford Chief Executive Jim Hackett has been overhauling Ford's

overseas operations, part of a broader plan to boost overall

profitability by steering investment toward more-profitable parts

of the auto maker's business, such as its North American truck

portfolio.

In markets where Ford has struggled to turn a profit or build

sizeable market share, it has reduced its presence or exited

entirely. Last spring, Ford ended production and sales in Russia.

The company also is in the midst of selling or closing several

plants in Western Europe, narrowing its focus mostly to larger

vehicles for commercial buyers.

The moves are similar to ones rival General Motors Co. has made

over the past several years under Chief Executive Mary Barra. GM

has left Russia and several Asian markets, and ended sales in

India. It also sold its European business in 2017.

The Detroit car giants and their global rivals spent decades

building out manufacturing footprints and sales forces across the

globe to build economies of scale in a capital-intensive industry.

But many have scaled back in recent years amid pressures to invest

in burgeoning technologies like electric cars and in-vehicle

connectivity.

Ford's said its decision to remain in India through the joint

venture was based on growth expectations for the market and its

strategic importance as an export hub.

"The creation of our joint venture today places India at the

very center of Ford's strategy for international markets," Jim

Farley, Ford's president of new business, technology and strategy,

said at a press conference Tuesday.

Under Mr. Hackett's turnaround plan, Ford has been forging more

partnerships to spread costs and access technology. This year, it

forged an alliance with Volkswagen AG to co-develop commercial and

electric vehicles and to partner on autonomous cars. Ford also is

working on an electric vehicle with Rivian Automotive, a

Detroit-area electric truck startup.

Ford said it will transfer most of its operations in India,

including its personnel and assembly plants in Chennai and Sanand.

The deal is expected to close by mid-2020, the companies said.

Ford said it will retain its engine plant operations in Sanand

as well as the global business services unit, Ford Credit and Ford

Smart Mobility.

The Dearborn, Mich., company said the joint venture is the next

step in its alliance with Mahindra and said the venture is expected

to be operational by mid-2020.

Ford and Mahindra agreed to a three-year partnership in 2017 to

explore potential areas of collaboration on new technologies and

retail sales.

Write to Patrick Thomas at Patrick.Thomas@wsj.com and Mike

Colias at Mike.Colias@wsj.com

(END) Dow Jones Newswires

October 01, 2019 09:17 ET (13:17 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

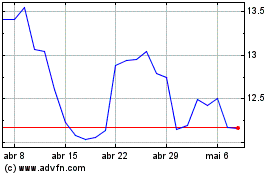

Ford Motor (NYSE:F)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

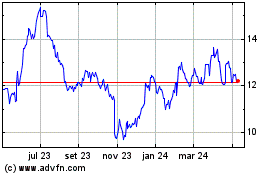

Ford Motor (NYSE:F)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024