By Amrith Ramkumar

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 17, 2020).

Google parent Alphabet Inc. became the fourth U.S. company ever

to achieve a $1 trillion market value Thursday, punctuating a

powerful rally in shares of large internet stocks to start

2020.

The search-engine giant joins peers Apple Inc., Amazon.com Inc.

and Microsoft Corp. as the only firms to reach the threshold during

intraday trading. Apple and Amazon accomplished the feat in the

summer of 2018, while Microsoft hit $1 trillion for the first time

in April of last year. Amazon never closed above $1 trillion and

has fallen well behind Apple and Microsoft, which have rocketed

past that level recently.

The massive gains for technology stocks come with Silicon Valley

companies ascending to the forefront of the world economy and

flexing their muscles in new arenas such as health care and

transportation. Despite concerns about stricter regulatory

scrutiny, the biggest technology companies have continued soaring

in value, highlighting how investors favor firms that steadily

improve sales in a world with tepid economic growth and low

interest rates.

Google faces investor concerns about antitrust probes into its

dominance in advertising and rising costs. Those worries have put

Alphabet shares behind the pace of many of its technology peers in

the past year, but many investors remain confident the company can

continue growing consistently.

"Google is one of those critical, important leaders in multiple

areas," said Michael Lippert, who manages the Baron Capital

Opportunity Fund that counts Alphabet among its largest holdings.

"You almost can't live your life without Googling things."

Alphabet shares have surged since the company said in early

December that Google co-founders Larry Page and Sergey Brin were

stepping down from managing the parent company and ceding control

to Google Chief Executive Sundar Pichai. Analysts have suggested

Mr. Pichai could further buoy the stock either by increasing

buybacks or potentially instituting a dividend payment for the

first time in the company's history because a chunk of his bonus is

tied to share performance.

That anticipation has helped fuel gains ahead of the company's

fourth-quarter earnings report, which is scheduled for early next

month. Citing a potential "shareholder-friendly" approach from Mr.

Pichai, Deutsche Bank analysts recently raised their price target

on Alphabet shares to $1,735, which would mark a roughly 20%

increase from their Thursday level.

Even shares of smaller companies seen as disruptive and having

outsize growth potential have soared in the new year, including

electric-auto maker Tesla Inc. and plant-based meat-alternative

maker Beyond Meat Inc. The broad gains have helped drive major

indexes to records.

Although Alphabet has had to combat rising costs, the resilience

of its core online advertising business has continued to buoy the

stock.

"It's really been a cash cow," said Dan Morgan, a senior

portfolio manager who focuses on tech at Synovus Trust Co., which

owns Alphabet shares. "They've been steadily continuing to post 15%

to 20% growth, which is pretty amazing when you consider how mature

that model is."

Alphabet's Class A shares advanced 0.8% Thursday, combining with

a rally in its Class C shares, which carry no voting rights, to

lift the company's market value above $1 trillion at the end of

Thursday's session. The Class A shares are up 33% in the past year,

exceeding a 27% rally in the S&P 500.

The largest five companies in the S&P 500 -- Apple,

Microsoft, Alphabet, Amazon and Facebook Inc. -- now account for

about 19% of the index in terms of weighting. Five years ago, the

largest five components in the broad equity gauge made up 12%,

illustrating the growing dominance of a handful of the biggest tech

stocks.

"When growth is scarce, investors are willing to pay up for any

company that's able to deliver," said Amanda Agati, chief

investment strategist at PNC Financial Services Group. "It's been a

very long, slow, sluggish economic growth cycle."

Apple is now approaching a $1.4 trillion market cap, while

Microsoft is at $1.27 trillion and Amazon is at $931 billion.

Facebook stands at $633 billion.

The concentrated gains have fueled concerns that a pullback in

the leading tech shares could drag down the entire market. But

major indexes have shaken off brief selloffs in recent years to

rally to records. The S&P 500 just logged its biggest annual

gain since 2013 with trade tensions receding and interest rates

around the world falling.

Following years of steady returns, investors also are debating

whether the largest internet stocks have gotten too pricey.

Alphabet shares trade at 31 times the company's earnings in the

past year, in line with its 10-year average. Microsoft has a

similar valuation, while Apple trades at 26.5 times earnings and

the S&P 500 at 22 times. Other popular internet stocks Amazon

and Netflix Inc. have valuations north of 80.

Alphabet was created in 2015 when Google formed a new parent

company to separate its core business from a host of other segments

focused on everything from robotics to self-driving cars. The firm

has benefited from its acquisitions of YouTube and internet

advertising company DoubleClick Inc. more than a decade ago and

made more deals since to create a dominant digital ad machine.

Google went public in August 2004, making its time as a public

company and rally to a $1 trillion market value much shorter than

that of other technology giants. Apple and Microsoft became public

companies in the 1980s, while Amazon's initial public offering took

place in 1997.

It has taken Alphabet only a few months to boost its market

capitalization -- calculated by multiplying its share count for

each class of shares by the price -- from $900 billion to $1

trillion. That marks the company's fastest such $100 billion

advance, according to Dow Jones Market Data. Alphabet took almost

two years to go from $800 billion to $900 billion in November.

Write to Amrith Ramkumar at amrith.ramkumar@wsj.com

(END) Dow Jones Newswires

January 17, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

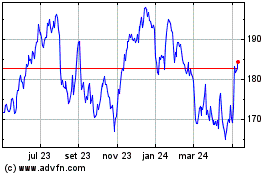

Apple (NASDAQ:AAPL)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

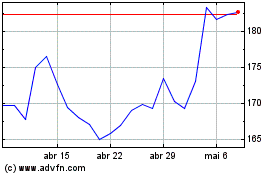

Apple (NASDAQ:AAPL)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025