Exxon Cuts Capital Spending by 30% in Response to Coronarivus

07 Abril 2020 - 9:10AM

Dow Jones News

By Christopher M. Matthews

Exxon Mobil Corp. said Tuesday that it would cut its 2020

capital spending by 30% as global demand for oil is sapped by the

coronavirus.

The largest portion of the $10 billion in cuts will be in the

Permian Basin, the largest U.S. oil field, in Texas and New Mexico.

Exxon said it would evaluate how the cuts would affect

production.

"We haven't seen anything like we are facing today," Chief

Executive Darren Woods said on a call with reporters Tuesday

morning.

With the announcement, Exxon became the latest major oil firm to

significantly reduce its budget in response to a crash in oil

prices caused in large part by the response to the virus. Rival

Chevron Corp. said last month it would cut its spending by $4

billion, or 20%. Large, international oil companies and U.S. shale

producers have collectively slashed budgets by tens of billions of

dollars.

Exxon's move comes ahead of a virtual meeting set for Thursday

by the Organization of the Petroleum Exporting Countries with other

oil-producing nations including Canada and Russia to discuss an

agreement to cut oil production. But Russian and Saudi Arabian

officials have said any truce in their fight for market share,

which has also helped crater oil prices over the past month, must

be accompanied by a production cut in the U.S.

Exxon, Chevron and other large U.S. oil companies are adamantly

opposed to mandated production cuts, believing that a free market

should sort things out. Many U.S. shale wells aren't economic at

current prices, and producers will ultimately be forced to shut-in

some wells.

But even globally coordinated production cuts would likely be

insufficient to stem the rapidly building oil glut as the new

coronavirus batters oil demand. Rystad Energy estimates global

demand may shrink by 25 million barrels a day, meaning that even

the 10 to 15 million barrels in cuts proposed by some Saudi and

Russian officials wouldn't be enough.

Even with the cuts, Exxon will have trouble covering its

dividend and capital expenses in 2020 without taking on debt or

selling off assets. It sold $8.5 billion in bonds in March, using a

window of opportunity to convert short-term debt into long-term

debt at low rates. S&P Global Ratings downgraded the company's

credit rating and unsecured debt in March.

(END) Dow Jones Newswires

April 07, 2020 07:55 ET (11:55 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

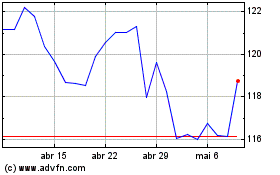

Exxon Mobil (NYSE:XOM)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

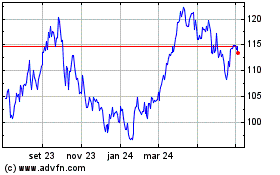

Exxon Mobil (NYSE:XOM)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024