Airlines Have the Cash. Now They Need Passengers -- Update

15 Abril 2020 - 6:30PM

Dow Jones News

By Alison Sider

U.S. airlines succeeded in getting billions of dollars of

federal aid, but it will only buy them a few months: Their survival

depends on how quickly passengers return when coronavirus-driven

restrictions ease.

The Treasury said late Tuesday that it had struck an agreement

in principle with 10 major airlines to distribute $25 billion in

payroll assistance that Congress approved in the $2.2 trillion

federal stimulus package last month.

The money will keep workers employed -- airlines that accept the

money are barred from laying off or furloughing staff until

October. It will also give the Treasury a stake in their future,

including up to 12% in American Airlines Group Inc. if the world's

biggest carrier proceeds with its plan to seek a separate

government loan.

However, the carriers may find themselves back in the same dire

position in the fall if demand doesn't improve. With people staying

home to comply with state shelter orders, demand is down as much as

95% and planes are flying nearly empty. Delta Air Lines Inc. and

United Airlines Holdings Inc. are among the airlines that have

warned that they will have to shrink to adjust to a slow

recovery.

American Airlines Chief Executive Doug Parker said Wednesday

there are early signs people are thinking about traveling again,

including some new bookings beyond 90 days out and customer

inquiries about convention travel in the fourth quarter. But it

could be months or years before people are traveling the way they

did before the pandemic hit, according to airlines and

analysts.

"It certainly feels like we're at the bottom...the real question

is how long you stay at the bottom," Mr. Parker told CNBC, adding

that the government funds would be sufficient based on the

airline's projections of low demand through the second quarter and

a "very gradual" recovery later in the year.

The International Air Transport Association on Tuesday forecast

that airlines around the world would lose $314 billion in revenue

this year, a 55% drop from 2019, as it incorporated more

pessimistic assumptions about the impact on the global economy and

the relaxation of travel restrictions.

Airline shares were mixed Wednesday, with United and American up

around 3%, and Delta and Southwest Airlines Co. falling.

Airlines and labor unions campaigned aggressively for government

aid, warning that the carriers would need an immediate cash

infusion to avoid furloughs. Still, paychecks are likely to be

smaller for many workers, including pilots and flight attendants

who won't be paid above the minimum levels set out by their

contracts. Airlines have been encouraging employees to take unpaid

leave or early retirement to help cut costs and stretch the

government funds. Tens of thousands have volunteered.

The outlook for airlines has only gotten worse since they began

asking for government aid, with passenger counts dropping by the

day. While formal talks haven't started, some industry officials

are starting to think about whether the government would step in

with more assistance.

The assistance funding is more limited than what airlines had

been banking on in some respects. Airlines have said they would

have to repay about 30% of the funds, which they hadn't originally

anticipated, at a time when airlines are already taking on billions

of dollars of additional debt and drawing down credit lines. Some

airlines and analysts pointed out that the funds cover only about

three-quarters of carriers' labor costs.

"The approved grant amount was lower than we anticipated on an

airline by airline basis," Cowen & Co. analyst Helane Becker

wrote. Still, some had feared the government would demand even more

in return for the money.

American is the first carrier to confirm it will go ahead with

an application for another $4.75 billion government loan from a

separate $25 billion program in the stimulus. American said in a

filing Wednesday that it would issue warrants to purchase an

additional 38 million shares to the Treasury for that loan, in

addition to collateral that hasn't yet been determined.

The loan amounts will be determined by airline capacity,

including international flying, with aircraft, spare parts, routes

and loyalty programs as potential forms of collateral, an industry

official said.

The government will wind up with small stakes in the largest

airlines -- about 0.5% of Southwest and 1% of Delta, if it chooses

to exercise warrants the airlines are offering as part of the

agreement. The warrants give the government the right to purchase a

certain amount of shares at last week's prices.

While the government funds are a lifeline, they also present new

burdens, including a requirement for airlines to continue flying to

the cities in their networks.

Airlines have been asking the Transportation Department to make

certain exceptions for cities where state and local governments are

preventing travel. These include cities where multiple airlines

offer service, cities that are relatively close to other airports,

and other places where demand has dried up.

"Flying empty, or nearly empty airplanes, to points that do not

offer enough business to make them rational, much less commercially

viable, is a waste of precious resources," United said in a filing

last week.

--Doug Cameron contributed to this article.

Write to Alison Sider at alison.sider@wsj.com

(END) Dow Jones Newswires

April 15, 2020 17:15 ET (21:15 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

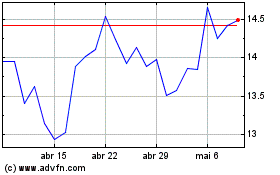

American Airlines (NASDAQ:AAL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

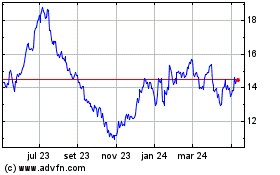

American Airlines (NASDAQ:AAL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024