Rihanna and LVMH Hit Pause on Fenty Fashion Line

10 Fevereiro 2021 - 5:07PM

Dow Jones News

By Matthew Dalton

PARIS -- Rihanna is finding that luxury fashion is a hard market

to crack, even with her gigawatt name recognition and the backing

of luxury-goods company LVMH Moët Hennessy Louis Vuitton SE.

The pop star and the Paris-based conglomerate are putting their

fashion joint venture, launched in 2019, on hold after sales got

off to a slow start and then faltered during the pandemic.

LVMH on Wednesday said that, pending better conditions, it had

made the decision to pause the venture jointly with the pop

icon.

The fashion label, Fenty, failed to replicate the early success

of the cosmetics line that Rihanna and LVMH launched together in

2017. The singer, born Robyn Rihanna Fenty, promoted her eponymous

cosmetics brand to her vast social-media audience -- 91 million

followers on Instagram and 102 million on Twitter. That generated

huge exposure for products that stood out in the market for being

tailored to a range of different skin tones.

Fenty Beauty recently launched a new skin care line, which LVMH

said last month was selling well.

But the luxury fashion market is dominated by big, incumbent

labels such as LVMH's own Louis Vuitton, Chanel, Hermès and Gucci.

The industry's bread-and-butter products -- handbags and

accessories -- are much more expensive than cosmetics. Upstart

brands lack decades of heritage that give older fashion houses the

cachet to convince shoppers to spend hundreds of dollars and up on

a purchase.

"I would say it's still work in progress when it comes to really

defining what the offer would be," Jean Jacques Guiony, LVMH's

chief financial officer, said of Fenty fashion in October.

Fenty Beauty also gained significant exposure through Sephora,

the cosmetics retail company owned by LVMH with more than 2,600

stores around the world. Fenty fashion had a smaller retail

audience: e-commerce and pop-up stores.

A spokeswoman for Rihanna didn't respond to a request for

comment.

LVMH and Bernard Arnault, its billionaire chief executive and

controlling shareholder, say they are still eager to work with

Rihanna. Apart from the cosmetics line, Mr. Arnault has taken a

stake in Savage X Fenty, Rihanna's lingerie brand, LVMH said

Wednesday. The investment comes through L Catterton, the

private-equity fund partly controlled by Mr. Arnault.

"We in the LVMH family believe a lot in Rihanna," a person close

to Mr. Arnault said. "But we're focusing during the pandemic on

what's truly working well: beauty, skin care and Savage."

Breaking into the market has become even tougher during the

pandemic, when luxury shoppers have gravitated toward the biggest,

most established brands.

That trend has helped drive surging revenue at LVMH's two

biggest fashion brands, Louis Vuitton and Dior; revenue at LVMH's

fashion leather and goods division fell just 5% in 2020, despite

being forced to shut boutiques across the world in the spring

during pandemic lockdowns.

LVMH's shares have surged over the past year and are trading

near record highs. With a market cap of EUR267 billion, LVMH is now

the second-most valuable company in Europe, behind only Nestle

SA.

Write to Matthew Dalton at Matthew.Dalton@wsj.com

(END) Dow Jones Newswires

February 10, 2021 14:52 ET (19:52 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

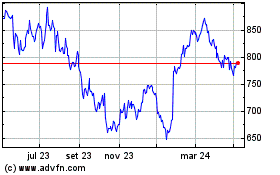

Lvmh Moet Hennessy Louis... (EU:MC)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

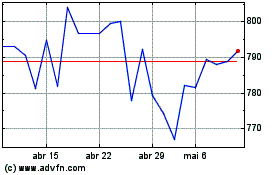

Lvmh Moet Hennessy Louis... (EU:MC)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024