Arcus Biosciences Shares Rally as Gilead Exercises Options

18 Novembro 2021 - 3:07PM

Dow Jones News

By Colin Kellaher

Shares of Arcus Biosciences Inc. rose more than 15% oThursday

after collaboration partner Gilead Sciences Inc. exercised its

options to three programs in Arcus's clinical-stage portfolio.

Arcus will receive $725 million in option payments for the

programs, which the anti-TIGIT molecules domvanalimab and AB308,

along with etrumadenant and quemliclustat.

Gilead, which formed its cancer collaboration with Arcus last

year, said it has been encouraged by early clinical data from each

of the programs, and that companies can now accelerate the clinical

development and advancement of the clinical-stage molecules and

explore treatment combinations across their portfolios.

Analysts at SVB Leerink, who have long had an "outperform"

rating on Arcus shares, said Gilead's move comes sooner than they

had expected and validates the company's adenosine pathway.

SVB Leerink raised its price target on Arcus to $100 from $68,

saying it expects Gilead will continue with trials that are already

under way, and that the companies by early next year will announce

a broader suite of studies for the medicines in new indications and

treatment settings.

Arcus shares were recently up 13.8% at $42.02 after hitting a

52-week high of $43.56 earlier in the session. Shares of Gilead

edged up less than 1% to $67.98.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

November 18, 2021 12:52 ET (17:52 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

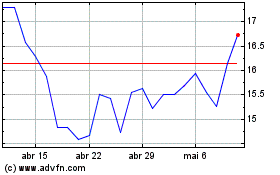

Arcus Biosciences (NYSE:RCUS)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

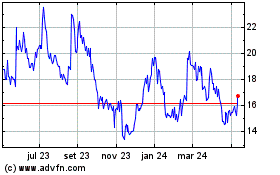

Arcus Biosciences (NYSE:RCUS)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024