Standard Chartered's First-Quarter Profit Rose; Credit Impairment Charges Jumped

28 Abril 2022 - 2:23AM

Dow Jones News

By Yifan Wang

Standard Chartered PLC's first-quarter profit edged up by 4%,

thanks to recovering interest income and better cost efficiency,

even though the bank sharply raised credit impairment charges to

reflect China's property sector risk and the impact of the

Russia-Ukraine war.

Standard Chartered's move to dial up credit impairments was in

line with its peer HSBC Holdings PLC, which earlier this week also

made large provisions in the first quarter for souring loans in

Russia and China.

The Asia-focused bank Thursday posted underlying pretax profit

of $1.50 billion, compared with $1.45 billion in the same period in

2021.

First-quarter operating income rose 9% to $4.29 billion,

extending an upturn since the bank in late 2021 resumed top-line

growth for the first time since 2019.

The growth was driven by a rebound in net-interest income, as

global central banks began to raise interest rates earlier this

year. Net-interest income rose 8% to $1.79 billion. Stanchart's

net-interest margin increased by 0.07 percentage point to

1.29%.

Credit impairments during the quarter were $200 million, up from

$20 million in the same period a year earlier. The lender raised

charges on its exposure to China's commercial real estate

sector.

The bank remains "alert to the challenging external environment

including the continued impact of Covid-19 in key markets,

idiosyncratic pressures in the China commercial real estate sector,

commodity price volatility and the impact of the Russia-Ukraine

military conflict," it said.

The bank maintained its previous guidance that income will grow

in the 5%-7% range in 2022. "We are on track to deliver 10% return

on tangible equity by 2024, if not earlier," it said.

Write to Yifan Wang at yifan.wang@wsj.com

(END) Dow Jones Newswires

April 28, 2022 01:08 ET (05:08 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

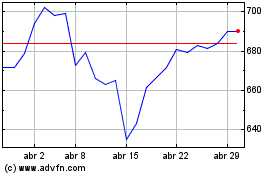

Standard Chartered (LSE:STAN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Standard Chartered (LSE:STAN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024