Shell PLC on Thursday reported a 54% rise in net profit for the

fourth quarter compared with the earlier quarter, which it

attributed to higher liquefied natural gas trading and optimization

results, favorable deferred tax movements and partly offset by

lower realized oil and gas prices, and higher operating expenses.

Here's what the energy giant had to say:

On integrated gas:

"Segment earnings, compared with the third quarter 2022,

reflected the net effect of higher contributions from trading and

optimization and realized prices (increase of $2,855 million), and

favorable deferred tax movements (increase of $516 million), partly

offset by lower volumes (decrease of $363 million) mainly

reflecting longer than expected maintenance at Prelude and

operational issues at QGC."

"The trading and optimization contributions were driven by

seasonality combined with capturing optimization opportunities

generated through the scale and scope of our LNG trading

portfolio."

"Fourth quarter 2022 segment earnings also included charges of

$708 million due to the fair value accounting of commodity

derivatives. As part of Shell's normal business, commodity

derivative hedge contracts are entered into for mitigation of

economic exposures on future purchases and sales."

"As these commodity derivatives are measured at fair value, this

creates an accounting mismatch over periods. These charges are part

of identified items and compare with the third quarter 2022 which

included gains of $3,419 million due to the fair value accounting

of commodity derivatives."

On upstream:

"Segment earnings, compared with the third quarter 2022, were

mainly driven by lower oil and gas prices (decrease of $1,849

million) and the comparative adverse impacts of the one-off

non-cash provision release (decrease of $503 million) and storage

transfer effects, included in the share of profit of joint ventures

and associates (decrease of $609 million), in the third

quarter."

"Fourth quarter 2022 segment earnings also included charges of

$1,385 million relating to the EU solidarity contribution and $441

million relating to the UK Energy Profits Levy, partly offset by

gains of $304 million due to the fair value accounting of commodity

derivatives."

"These gains and losses are part of identified items, and

compare with the third quarter 2022 which included a gain of $312

million due to the impact of the discount rate change on provisions

and charges of $361 million relating to the UK Energy Profits Levy

and an impairment charge of $303 million."

On marketing:

"Segment earnings, compared with the third quarter 2022,

reflected lower marketing margins (decrease of $201 million) mainly

driven by seasonal impacts in Mobility, and higher operating

expenses (increase of $177 million)."

"Fourth quarter 2022 segment earnings also included impairment

charges of $85 million. These charges are part of identified

items."

On chemicals and products:

"Segment earnings, compared with the third quarter 2022,

reflected higher operating expenses (increase of $213 million), and

higher depreciation charges (increase of $101 million), with both

operating expenses and depreciation including the start-up of

operations at Shell Polymers Monaca. These increases were partly

offset by favorable deferred tax movements (increase of $230

million). Margins were in line with the third quarter 2022, with

higher Refining margins offset by lower contributions from trading

and optimization."

"Fourth quarter 2022 segment earnings also included losses of

$214 million due to the fair value accounting of commodity

derivatives, legal provisions of $86 million, impairment charges of

$84 million and tax charges relating to the EU solidarity

contribution of $74 million. These charges are part of identified

items, and compare with the third quarter 2022 which included gains

of $226 million due to the fair value accounting of commodity

derivatives."

On renewables and energy solutions:

"Segment earnings, compared with the third quarter 2022,

reflected higher trading and optimization results mainly driven by

the European market, partly offset by the American market as

significant price volatility continued. The fourth quarter 2022

also included higher operating expenses."

"Fourth quarter 2022 segment earnings also included net gains of

$4,748 million due to the fair value accounting of commodity

derivatives, and impairment charges of $361 million mainly in

Europe. As part of Shell's normal business, commodity derivative

hedge contracts are entered into for mitigation of economic

exposures on future purchases, sales and inventory."

"As these commodity derivatives are measured at fair value, this

creates an accounting mismatch over periods. These net gains are

part of identified items and compare with the third quarter 2022

which included net losses of $4,414 million due to the fair value

accounting of commodity derivatives."

On 2023 outlook:

"Integrated gas production is expected to be approximately

910-970 thousand boe/d. LNG liquefaction volumes are expected to be

approximately 6.6-7.2 million tonnes."

"Upstream production is expected to be approximately 1,750-1,950

thousand boe/d."

"Marketing sales volumes are expected to be approximately

2,150-2,650 thousand b/d."

"Refinery utilization is expected to be approximately 87%-95%.

Chemicals manufacturing plant utilization is expected to be

approximately 68%-76%. The utilization ranges presented use the

revised methodology."

"Corporate adjusted earnings are expected to be a net expense of

approximately $400-$600 million in the first quarter 2023 and a net

expense of approximately $1,700- $2,300 million for the full year

2023. This excludes the impact of currency exchange rate

effects."

"Cash capital expenditure is expected to be within the $23-27

billion range for the full year."

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

February 02, 2023 03:10 ET (08:10 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

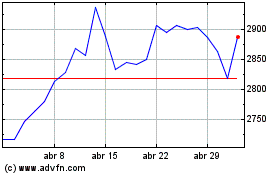

Shell (LSE:SHEL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Shell (LSE:SHEL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024