Merck KGaA Cuts 2023 Outlook on Inventory, Semiconductor Woes

03 Agosto 2023 - 2:55AM

Dow Jones News

By Cecilia Butini

Merck KGaA on Thursday cut its outlook for the full year due to

high inventory levels of customers in its Life Science business and

delayed recovery in the semiconductor materials market, although it

confirmed its mid-term objectives.

The Germany-based health-care and technology company also posted

declining earnings and sales for the second quarter, though these

came in slightly above expectations.

Merck said it now expects 2023 sales to be between 20.5 billion

euros ($22.42 billion) and EUR21.9 billion, down from its previous

guidance of EUR21.2 billion to EUR22.7 billion. Ebitda pre, an

important earnings metric for the company, is expected to decline

up to 9% and be in a range of EUR5.8 billion to EUR6.4 billion,

having previously been seen between EUR6.1 billion and EUR6.7

billion.

In the second quarter, profit after tax declined to EUR706

million from EUR870 million on sales which fell to EUR5.30 billion

from EUR5.57 billion, the company said. Ebitda pre declined to

EUR1.55 billion from EUR1.78 billion. Analysts polled by FactSet

had expected slightly lower figures.

The company cited foreign-exchange headwinds as contributing to

the decline in sales in the quarter, and also as one further reason

for the guidance cut.

Write to Cecilia Butini at cecilia.butini@wsj.com

(END) Dow Jones Newswires

August 03, 2023 01:40 ET (05:40 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

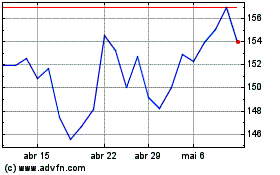

Merck KGAA (TG:MRK)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Merck KGAA (TG:MRK)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024