Charles Schwab to Reduce Real-Estate Footprint, Headcount

21 Agosto 2023 - 6:06PM

Dow Jones News

By Denny Jacob

Charles Schwab plans to reduce its real estate footprint and

headcount as it prepares for the integration of TD Ameritrade and

streamlining operations post-integration.

The multinational financial institution, which offers banking,

brokerage, retirement-investing and wealth-management services,

said it plans to close or downsize certain corporate offices,

according to a regulatory filing. It also plans to reduce its

operating costs primarily through lower headcount and professional

services, it disclosed.

Charles Schwab expects to realize at least $500 million of

incremental annual run-rate cost savings as a result of its

actions.

The Westlake, Texas-based company said it expects to incur exit

and related costs between $400 million and $500 million in order to

achieve its cost savings. Charles Schwab said it anticipates most

costs related to eliminated positions would be incurred in the

second half of 2023, while costs related to real estate would be

incurred in 2023 and 2024.

Write to Denny Jacob at denny.jacob@wsj.com

(END) Dow Jones Newswires

August 21, 2023 16:51 ET (20:51 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

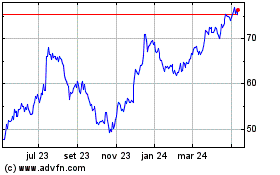

Charles Schwab (NYSE:SCHW)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

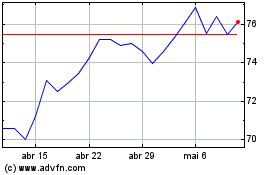

Charles Schwab (NYSE:SCHW)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024