Higher Interest Rates Take Toll on European Real-Estate Valuations -- At a Glance

24 Agosto 2023 - 8:44AM

Dow Jones News

By Adria Calatayud

Real-estate companies across Europe have reported sizable

earnings hits as higher interest rates left a mark on the

valuations of their properties. Swiss Prime Site on Thursday became

the latest company to book a loss from a devaluation of its

property portfolio following an assessment by external experts.

Here is a list of European real-estate companies that reported

property devaluations in their second-quarter and first-half

results released in recent weeks:

-- Swiss Prime Site reported a fall in net profit for the first

half to 215.5 million Swiss francs ($245.5 million) from CHF267.4

million in the same period last year, hit by a devaluation of its

property portfolio that outweighed a gain from the sale of its

Wincasa real-estate services business. Notably higher interest

rates led to a loss of CHF98.8 million from a property-portfolio

revaluation by an external appraiser, the Swiss company said.

-- Germany's Vonovia slid to a net loss of 1.96 billion euros

($2.13 billion) for the second quarter compared with a profit of

EUR1.69 billion in the same period last year, after it booked a

charge of EUR2.77 billion from fair-value adjustments of investment

properties. "While it is too early to make a call on the second

half, we are seeing some encouraging first signs in part of the

market that could bring some stabilization in the second half of

the year," Chief Executive Rolf Buch said during an earnings

call.

-- Unibail-Rodamco-Westfield reported a swing to a net loss of

EUR537.8 million for the first half from a profit of EUR601.0

million. The Paris-based company said a revaluation of its

portfolio resulted in a fall in the gross market value of its

assets as of June 30 to EUR51.03 billion from EUR52.2 billion at

Dec. 31. The valuation of Unibail-Rodamco-Westfield's assets in the

second half will be key to its credit metrics and financial

performance, which in turn will determine whether URW reinstates

dividend payments next year as intended, Chief Financial Officer

Fabrice Mouchel said during an earnings call.

-- LEG Immobilien said it lost a net EUR1.13 billion in the

second quarter compared with a profit of EUR904.7 million after it

revalued its residential portfolio in light of what it called a

significantly more challenging interest-rate environment. The

revaluation resulted in a 7.4% decline in the German company's

asset value as of June 30, it said. Uncertainty on the prospects

for interest rates and limited transaction evidence mean the

company company can't provide an outlook for the property valuation

in the second half, CFO Kathrin Koehling said during an earnings

call.

-- Smaller peers like Grand City Properties and TAG Immobilien

swung to net losses for the second quarter due to devaluations of

their respective portfolios. Meanwhile, PSP Swiss Property reported

a sharply reduced second-quarter net profit mainly due to

property-revaluation losses. The Swiss company said the valuation

of properties must now cope with market uncertainties arising from

an interest-rate environment that hasn't been seen in the last ten

years.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

August 24, 2023 07:29 ET (11:29 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

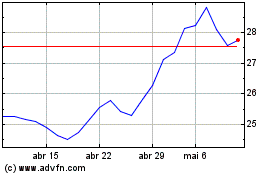

Vonovia (TG:VNA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

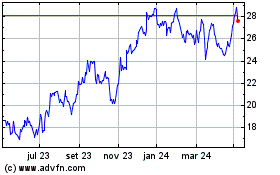

Vonovia (TG:VNA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024