Bausch + Lomb Launches Proposed Financing for Xiidra Acquisition

11 Setembro 2023 - 8:58AM

Dow Jones News

By Robb M. Stewart

Bausch + Lomb is offering $1.4 billion in debt and is looking to

secure an incremental term loan facility to help finance the

planned acquisition of a dry-eye drug from Novartis.

The eye-care company said Monday a wholly owned subsidiary has

launched an offering of new senior secured notes due 2028 to fund

the proposed purchase of Xiidra, Novartis's non-steroid eye drop

approved to treat the signs and symptoms of dry eye disease, for

$1.75 billion in cash, plus possible milestone payments based on

sales and pipeline commercialization.

Bausch + Lomb also is seeking to enter into the term loan

facility that could in the form of an incremental amendment to its

existing credit agreement or a separate credit agreement. The

company said it expects to borrow $500 million of new term B loans

under the facility.

The deal for Xiidra was first big move by Chief Executive Brent

Saunders since he returned to the helm in March. Bausch + Lomb has

said the acquisition, which it expects to close by the end of the

year, will be immediately accretive.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

September 11, 2023 07:43 ET (11:43 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

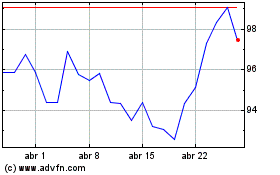

Novartis (NYSE:NVS)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

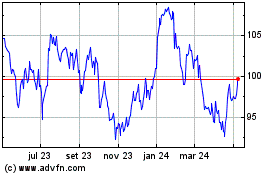

Novartis (NYSE:NVS)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024