Lyft to Pay $10 Million For Failure to Disclose Board Member's Role in Pre-IPO Stock Sale

18 Setembro 2023 - 11:05AM

Dow Jones News

By Will Feuer

Lyft has agreed to pay $10 million to settle charges brought by

the Securities and Exchange Commission that allege the ride-hailing

company failed to disclose a board member's role in arranging a

pre-IPO stock sale.

Before Lyft's initial public offering in 2019, a Lyft board

director arranged for a shareholder to sell $424 million worth of

its private shares of Lyft's stock to a special purpose vehicle set

up by an investment adviser affiliated with the same director,

according to the SEC. The director then contacted an investor

interested in purchasing the shares through the vehicle.

Lyft approved the sale and secured a number of terms in the

contract, according to the SEC, making Lyft a participant in the

deal. The director was a related person because of his role on the

board, the SEC said, and because he received millions of dollars in

compensation from the investment adviser for his role in

structuring and negotiating the deal.

The SEC said Lyft should have disclosed the deal in its annual

report for 2019. The director left Lyft's board at the time of the

deal, according to the SEC.

"The federal securities laws required Lyft to disclose that a

director profited from a transaction in which Lyft itself was a

participant," said Sheldon Pollock, associate regional director of

the SEC's New York Office.

Write to Will Feuer at Will.Feuer@wsj.com

(END) Dow Jones Newswires

September 18, 2023 09:50 ET (13:50 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

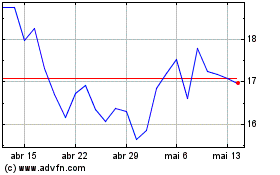

Lyft (NASDAQ:LYFT)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Lyft (NASDAQ:LYFT)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024