Adidas Upgrades Full-Year Guidance Despite Revenue, Operating Profit Fall

17 Outubro 2023 - 2:31PM

Dow Jones News

By Andrea Figueras

Adidas upgraded its full-year guidance on the back of Yeezy

inventory reductions and a better-than-expected underlying

business, despite a decline in revenue and operating profit in the

third quarter.

The German athletic apparel and footwear company said on Tuesday

that, according to preliminary results, it now expects

currency-neutral revenues to decline at a low-single-digit rate,

while it previously forecast a decline in a mid-single-digit

rate.

The underlying operating profit--excluding any one-offs related

to Yeezy and the underway strategic review--is now estimated around

100 million euros ($105.6 million), up from a prior guidance around

break-even level, the company said.

Adidas also said that it now expects to report an operating loss

of around EUR100 million this year instead of loss of EUR450

million as it had previously forecast, including the potential

write-off of the remaining Yeezy inventory of now around EUR300

million, down from EUR400 million previously.

The company posted a 6% decline in revenue to EUR6 billion,

compared with EUR6.41 billion in the year earlier period.

Currency-neutral revenues increased 1% compared with the prior year

level, it said.

Operating profit fell to EUR409 million during the quarter from

EUR564 million in the year-earlier period, while the operating

margin was 6.8%, down from 8.8% in 2022. Gross margin improved 0.2%

to 49.3%.

Write to Andrea Figueras at andrea.figueras@wsj.com

(END) Dow Jones Newswires

October 17, 2023 13:16 ET (17:16 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

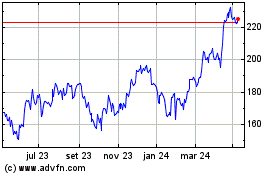

Adidas (TG:ADS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

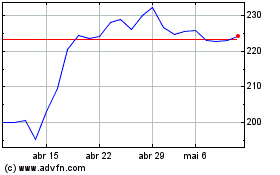

Adidas (TG:ADS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024