CAB Payments Cuts 2023 Revenue Views Amid Uncertainties Over Africa Payment Flows

24 Outubro 2023 - 4:32AM

Dow Jones News

By Michael Susin

CAB Payments Holdings warned that revenue for the full year will

come below expectations amid increasing uncertainties regarding its

key currency corridors in Africa.

The London-listed fintech group on Tuesday said that it

currently expects 2023 revenue to be at least 20% ahead of the

prior year figure of 109.4 million pounds ($134 million). This

represents a 17% fall from its previous guidance, it added.

The company said that the lowered guidance is mainly driven by a

number of changes to the market conditions in some of its key

currency corridors, added to the continuing uncertainties

surrounding the Nigerian Naira and its impact in both volumes and

margins, particularly on the Central African franc and West African

franc.

Currency corridors are the set of payment flows between one

country and another.

"These challenges are recent but continuing, and coincide with

the traditionally strong fourth quarter for both of these

corridors; it is unclear when and to what extent conditions in

these markets may improve," it said.

CAB Payments will be seeking opportunities to lessen the impact

on group profitability in 2023 through cost reduction measures and

efficiencies, the company said.

"Therefore, the company anticipates that the majority of any

revenue impact will flow through to the bottom line," it added.

Write to Michael Susin at michael.susin@wsj.com

(END) Dow Jones Newswires

October 24, 2023 03:17 ET (07:17 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

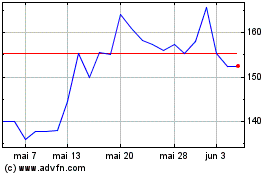

Cab Payments (LSE:CABP)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Cab Payments (LSE:CABP)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024