Imperial Oil Plans Substantial Issuer Bid to Buy Up to C$1.5 Billion of Its Shares

27 Outubro 2023 - 9:50AM

Dow Jones News

By Robb M. Stewart

Imperial Oil plans to return cash to investors with the purchase

for cancellation of up to 1.5 billion Canadian dollars ($1.08

billion) of its shares.

Exxon Mobil, the Canadian oil company's majority shareholder,

will make a proportionate tender to maintain its stake in Imperial

Oil at just under 70% following the substantial issuer bid.

Imperial Oil expects the terms and pricing will be determined

and the offer launched during the next two weeks, and will be

completed before the end of the year.

The company completed an accelerated normal course issuer

program this month, which saw it return more than C$2.3 billion in

all to its shareholders.

Imperial Oil's production averaged 423,000 gross oil-equivalent

barrels a day in the third quarter, down from 430,000 barrels a day

in the same period last year. Adjusting for its sale of XTO Energy

Canada, which closed in the third quarter of 2022, the company said

its production increased by about 5,000 gross oil-equivalent

barrels a day.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

October 27, 2023 08:35 ET (12:35 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

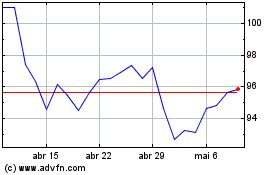

Imperial Oil (TSX:IMO)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

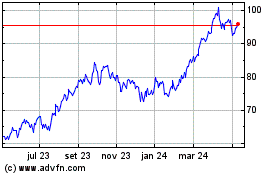

Imperial Oil (TSX:IMO)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024