Siemens Energy Seeks State Guarantees for Long-Term Projects -- At a Glance

30 Outubro 2023 - 10:07AM

Dow Jones News

By Giulia Petroni

THE NEWS: Siemens Energy is in the news ahead of a potential

deal with the German government to secure guarantees for its

long-term projects. Shares tumbled last week on worries about the

company's financial position after it warned of a

worse-than-expected loss at its wind division and confirmed it was

in preliminary talks with different stakeholders, including the

German government and banking partners, to secure guarantees.

According to people familiar with the matter, the company is

seeking state guarantees of up to 15 billion euro ($$15.85

billion). Supervisory Board Chairman Joe Kaeser said in an

interview with newspaper Welt am Sonntag over the weekend that

talks with the German government concern state guarantees, not a

direct cash injection. German business newspaper Handelsblatt

reported that a decision could be made in the coming days.

MARKET REACTION: Share trade 5% higher at EUR7.86. The stock

recovered Friday after plunging 32% a day earlier, when the energy

company made the discussions public and warned that losses at its

troubled wind unit, Siemens Gamesa, are expected to be higher than

market forecasts.

STATE GUARANTEES: Such guarantees are financial backstop

commonly issued to ensure viability of sizeable or long-term

projects. Siemens Energy said it needs the guarantees due to strong

growth in order intake. The company's order backlog stood at EUR109

billion as of the end of June.

ANALYSTS' COMMENTS: Most investors agree that Siemens Energy

isn't facing a liquidity issue and that political support is clear,

according to Citi analysts. However, "what conditions may come

alongside political support are an unknown, as are the potential

operational impacts to the business from its woes," they said in a

note. The analysts see Siemens Energy's liquidity position as still

strong, with total equity standing at EUR9.4 billion euros as of

the last reporting date. In regards to Siemens's involvement,

Berenberg analysts said that the German conglomerate's guarantees

for Siemens Energy have reduced to around EUR7 billion as of end of

March from around EUR28 billion at the time of the spinoff. "Given

Siemens' desire to ultimately exit its position in Siemens Energy

in full, we consider it unlikely that it would rally behind Siemens

Energy at this moment," the analysts said.

FINANCIAL SITUATION: Siemens Energy's results for fiscal 2023

are expected to be fully in line with guidance, the company said.

In August, the German company said it expects its net loss to widen

to around EUR4.5 billion, from expectations that it would exceed

the prior year's loss of EUR712 million by up to a low triple-digit

million amount. The profit margin before special items is seen at

between minus 10% and minus 8%, while comparable revenue growth is

expected between 9% and 11%. Free cash flow (pretax) is seen up to

a negative low triple-digit million amount. The company is

scheduled to release results for the fourth quarter of its fiscal

year on Nov. 15 and host its capital market day on Nov. 21. No

decisions have been made yet in regards to the annual budget for

2024, it said.

WIND DIVISION TROUBLES: Siemens Gamesa's net losses and cash

outflow are expected to be worse than market expectations in fiscal

2024, while order intake and revenue should be lower, Siemens

Energy said. Challenges are mainly due to quality issues of the 4.X

and 5.X onshore platforms, with expenses amounting to EUR1.6

billion. The main part of the expected repair costs for the

platforms is expected in fiscal 2024 and 2025. The unit also

expects to see increased product costs and ramp-up challenges in

the offshore business, leading to additional charges of EUR600

million. The cash outflow resulting from these burdens will be

spread over several years and amount to a low two-to-three-digit

million sum in the current year, according to Siemens Energy.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

October 30, 2023 08:52 ET (12:52 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

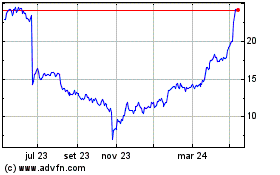

Siemens Energy (TG:ENR)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

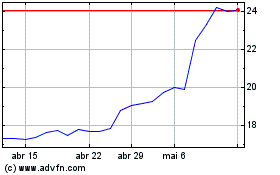

Siemens Energy (TG:ENR)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024