Point Biopharma Holders Resisting Eli Lilly Tender Offer

17 Novembro 2023 - 10:48AM

Dow Jones News

By Colin Kellaher

Eli Lilly's planned $1.4 billion acquisition of Point Biopharma

Global has hit a speed bump, as the radiopharmaceutical company's

shareholders appear to not be going along with the tender

offer.

Eli Lilly on Friday said it has extended its $12.50-a-share cash

tender offer for Point until Dec. 1 to give the companies more time

to meet the minimum tender condition.

Eli Lilly, which had already extended the tender offer to

Thursday, said that less than 26.5% of Point shares had been

tendered.

Several Point investors have filed suit over the deal, alleging

the company omitted and/or misrepresented material information

regarding the takeover.

In a filing earlier this month with the U.S. Securities and

Exchange Commission, biotechnology investment firm BVF Partners

disclosed a 16.5% stake in Point and said it wouldn't participate

in the tender offer.

BVF said a takeover of Point by Eli Lilly before the release of

results from a critical Phase 3 study of PNT2002 in metastatic

castration resistant prostate cancer isn't in the best interest of

Point's shareholders, adding that it sees the potential for

significant upside for Point's shareholders to await the results of

the study, expected by the end of the year.

Eli Lilly said it has received all regulatory approvals needed

to complete the deal, which represented an 87% premium to Point's

closing price of $6.68 before it was announced.

However, Point shares closed Thursday at $13.33, about 6.6%

above the takeover price, indicating that investors are balking at

the deal.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

November 17, 2023 08:33 ET (13:33 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

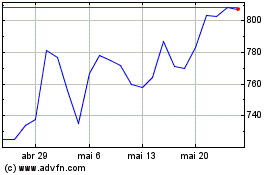

Eli Lilly (NYSE:LLY)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Eli Lilly (NYSE:LLY)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024