Italy's Enel Plans to Boost Investments, Cut Costs as Part of 2024-26 Strategy -- Update

22 Novembro 2023 - 5:22AM

Dow Jones News

By Giulia Petroni

Enel plans to boost investments in grids and refocus its

renewables strategy while boosting cash generation and cutting

costs as part of its plan for the 2024-26 period.

The Rome-based energy company said it aims to focus on its

regulated businesses, improving grids' resiliency and

digitalization, and on higher-margin renewables investments,

specifically in onshore wind, solar and battery storage.

The company targets around 35.8 billion euros ($39.07 billion)

in total gross capital expenditure, with approximately EUR18.6

billion allocated toward grids and EUR12.1 billion toward

renewables. Italy will get around 49% of the overall gross

capex.

"The group plans to allocate its investments efficiently," Enel

said on Wednesday at its capital markets day. "Regulated businesses

will be at the center of group strategy to improve quality and

resiliency. Likewise, renewable investment decisions will be more

selective."

Net capex is expected to amount to around EUR26.2 billion.

Enel also plans to boost its cash generation, with around

EUR43.8 billion of funds from operations expected to fully cover

net investments and dividends.

It aims to achieve a total cost reduction of around EUR1.2

billion in 2026, and implement a disposal plan with an estimated

positive impact of around EUR11.5 billion on net debt between 2023

and 2024. Deals in an advanced negotiation stage are expected to

have an impact of around EUR3.3 billion on net debt.

"In the next three years, we will adopt a more selective

approach towards investments in order to maximize profitability

while minimizing risks," said Chief Executive Flavio Cattaneo, who

succeeded long-serving CEO Francesco Starace in May. "Financial

discipline will be the cornerstone of our strategy, boosting cash

generation and efficiencies, with sustainability continuing to

guide our business decisions."

The company sees its ordinary earnings before interest, taxes,

depreciation and amortization at between EUR23.6 billion and

EUR24.3 billion in 2026, while net ordinary income is expected

between EUR7.1 billion and EUR7.3 billion.

Enel confirmed a EUR0.43 fixed minimum dividend per share for

the 2024-26 period, and said it would increase it up to a 70%

payout on net ordinary income if cash flow neutrality is

achieved.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

November 22, 2023 03:07 ET (08:07 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

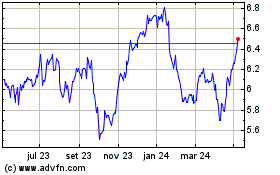

Enel (BIT:ENEL)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

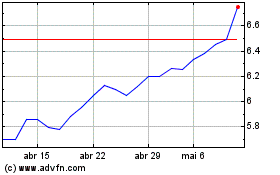

Enel (BIT:ENEL)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024