Axos Financial Shares Rise 12% After Buying Two Loan Portfolios From FDIC

08 Dezembro 2023 - 1:29PM

Dow Jones News

By Chris Wack

Axos Financial shares were up 12% to $49.80 on Friday after the

company's wholly owned Axos Bank subsidiary completed the

acquisition of two performing commercial real estate loan

portfolios from the Federal Deposit Insurance Corporation.

The stock hit its 52-week low of $32.05 on Nov. 13, and is now

up 29% in the past 12 months.

Axos Bank bought the portfolios, including multi-family loans,

for a purchase price equal to 63% of par value, resulting in an

discount to par value for the purchased loans of $463.7

million.

Axos Bank paid cash for the acquired loans.

All 58 loans are current on principal and interest payments. The

transaction value was enhanced by the inclusion of a series of

back-to-back interest rate swaps that allow the borrowers to pay an

average fixed rate of 3.8%, while Axos receives a primarily

variable note rate of 6.9%.

Write to Chris Wack at chris.wack@wsj.com

(END) Dow Jones Newswires

December 08, 2023 11:14 ET (16:14 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

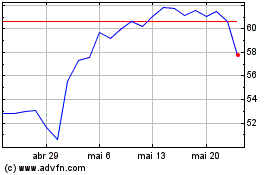

Axos Financial (NYSE:AX)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

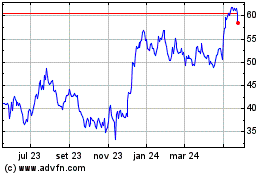

Axos Financial (NYSE:AX)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024