Adbri Gets Takeover Offer From CRH, Barro Group

17 Dezembro 2023 - 7:49PM

Dow Jones News

By David Winning

SYDNEY--Building materials supplier Adbri said it has received a

takeover offer from U.S.-listed CRH and the Barro Group that values

its equity at around $1.41 billion.

Adbri said it is evaluating the cash offer of 3.20 Australian

dollars (US$2.14) a share and has allowed the bid group until

February 28 to scrutinize its books on an exclusive basis.

The Barro Group owns 42.7% of Adbri's stock, while CRH has a

4.6% interest in the Australian company through a cash-settled

derivative.

The takeover offer is pitched at a 41% premium to Adbri's

closing price of A$2.27/share on Friday. Adbri's shares are down

around 19% since hitting a high in mid-August ahead of its earnings

report for the first half of its financial year.

Australia has one of the world's hottest real-estate markets

despite an unprecedented rise in interest rates, adding a new

pillar of support for construction materials that were in high

demand during the pandemic when households flush with stimulus

money sought to renovate their homes.

Record migration has supported housing costs after pandemic

border restrictions were rolled back, prompting Australia's

government to take steps to help out homebuyers and renters. The

government recently rolled out a new housing fund worth the

equivalent of $6.6 billion aims to finance the construction of tens

of thousands of new homes in coming years.

Write to David Winning at david.winning@wsj.com

(END) Dow Jones Newswires

December 17, 2023 17:34 ET (22:34 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

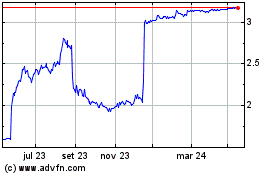

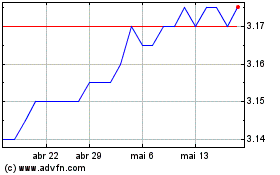

Adbri (ASX:ABC)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Adbri (ASX:ABC)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024