Adobe, Figma Scrap $20 Billion Acquisition -- Update

18 Dezembro 2023 - 11:39AM

Dow Jones News

By Dean Seal

Adobe has called off its planned $20 billion acquisition of the

collaboration-software company Figma, weeks after international

regulators warned that the deal would likely harm competition.

Adobe and Figma said Monday morning that they have mutually

agreed to terminate the cash-and-stock transaction because they

couldn't see a clear path to receiving regulatory approval from the

European Commission and Britain's Competition and Markets

Authority.

The U.K. agency late last month said that, following a detailed

investigation, it provisionally found the acquisition would

eliminate competition between two main companies in product-design

software, reduce innovation and remove Figma as a threat to Adobe's

flagship Photoshop and Illustrator products.

The European Commission aired similar concerns in November and

gave Adobe a chance to respond to its objections.

Adobe Chief Executive Shantanu Narayen said Monday that the

companies strongly disagree with the recent regulatory findings but

"believe it is in our respective best interests to move forward

independently."

The companies have signed a termination agreement that requires

Adobe to pay Figma a $1 billion termination fee.

Adobe agreed to buy Figma, a maker of so-called collaborative

interface tools, in September 2022. The acquisition would have been

the largest yet for the Silicon Valley software giant known for its

common workplace tools and PDF files.

The deal, which would have cost Adobe the equivalent of about

the last three years of its combined free cash flow, surprised

Adobe's investors. It also drew criticism from some Figma users

over concerns that the acquisition would slow innovation and lead

to price changes.

The U.K. Competition and Markets Authority, whose profile had

been rising after it initially rejected Microsoft's since-completed

$75 billion acquisition of Activision Blizzard a month earlier,

said in May that it would investigate whether the Figma purchase

would result in a "substantial lessening of competition within any

market or markets in the United Kingdom for goods or services."

The U.K. competition regulator stepped up its investigation in

late June before disclosing its provisional findings in late

November.

In August, the European Union's antitrust enforcer opened its

own in-depth investigation into the proposed acquisition. The

European Commission said a preliminary probe indicated the

transaction might reduce competition in the global markets for

interactive product design software and digital asset creation

tools.

The E.U. watchdog formally objected to the deal last month,

saying it could significantly imperil competition for the supply of

interactive product design tools and of vector and raster editing

tools.

Write to Dean Seal at dean.seal@wsj.com

(END) Dow Jones Newswires

December 18, 2023 09:24 ET (14:24 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

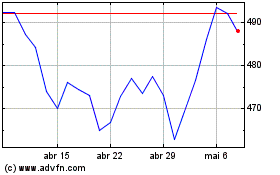

Adobe (NASDAQ:ADBE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Adobe (NASDAQ:ADBE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024