| | | | | | | | | | | |

| | | |

| | | |

| Titan International, Inc. | / | 2022 Proxy Statement | iii |

| | | | | | | | | | | |

Notice of Annual Meeting of Stockholders Date: June 9, 2022 Time: 10:00 a.m., CT Place: Virtual web conference Ways to Vote By Mail: If you are a stockholder of record you may vote by returning the enclosed proxy card By Telephone: Call toll-free 1-800-690-6903 By Internet: www.proxyvote.com | | PROXY STATEMENT ANNUAL MEETING OF STOCKHOLDERS TITAN INTERNATIONAL, INC. GENERAL MATTERS This Proxy Statement is being furnished to the stockholders of Titan International, Inc. (Titan or the Company) in connection with the solicitation of proxies by the Board of Directors of the Company (the Board of Directors) for use at the Annual Meeting of Stockholders (the Annual Meeting) to be held on June 9, 2022, at 10:00 a.m. Central Daylight Time via the internet through a virtual web conference at www.virtualshareholdermeeting.com/TWI2022, and at any adjournment or postponement of that meeting. The Company is commencing mailing of the Notice of Internet Availability of Proxy Materials, in lieu of a paper copy of this Proxy Statement, to its stockholders on or about April 19, 2022. In accordance with rules adopted by the Securities and Exchange Commission (the SEC), the Company may furnish proxy materials, including this Proxy Statement and its Annual Report, to its stockholders by providing access to such documents on the internet instead of mailing printed copies. The Company has elected to provide its stockholders access to the Company’s proxy materials over the internet; accordingly, most stockholders will not receive printed copies of these proxy materials unless they request them. Instead, the Notice of Internet Availability of Proxy Materials, which was previously mailed to the Company’s stockholders, will instruct you as to how you may access and review all of the proxy materials on the internet. The Notice of Internet Availability of Proxy Materials also instructs you as to how you may submit your proxy, including by telephone or over the Internet. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice of Internet Availability of Proxy Materials. Although the Company's Annual Report to Stockholders, including its Form 10-K, for the year ended December 31, 2021, has been made available to Titan stockholders in connection with the solicitation of proxies by the Board of Directors, it is not incorporated by reference into this Proxy Statement and shall not be deemed to be proxy soliciting material. In this Proxy Statement, unless the context requires otherwise, references to “we,” “our,” or “us” refer to Titan. VOTING PROCEDURES QUALIFICATIONS TO VOTE Only holders of shares of common stock of the Company (Common Stock) at the close of business on April 12, 2022 (the Record Date) will be entitled to receive notice of, and vote at, the Annual Meeting or any adjournment or postponement thereof. Shares of Common Stock held on the Record Date include shares that are held directly in the name of a holder of |

| | | | | | | | | | | |

| | | |

| | | |

| Titan International, Inc. | / | 2022 Proxy Statement | 1 |

| | | | | | | | | | | | | | | | | |

| | Common Stock (the Common Stockholders) as the registered stockholder of record on the Record Date and those shares of which the Common Stockholder is the beneficial owner on the Record Date and which are held through a broker, bank, or other institution, as nominee, on the Common Stockholder’s behalf (sometimes referred to as being held in “street name”), that is considered the stockholder of record of those shares. SHARES ENTITLED TO VOTE On the Record Date, there were 62,656,877 shares of Common Stock outstanding, and there were no other outstanding classes of stock that will be entitled to vote at the Annual Meeting. VOTES PER SHARE Common Stockholders are entitled to one vote per share of Common Stock they held of record on the Record Date on each matter that may properly come before the Annual Meeting. PROPOSALS REQUIRING VOTE; BOARD RECOMMENDATION Common Stockholders are being asked to consider and vote upon the following matters: |

| Proposal | | Board Recommendation | Page

Reference |

| | | |

| Election of Richard M. Cashin Jr., Gary L. Cowger, Max A. Guinn, Mark H. Rachesky, MD, Paul G. Reitz, Anthony L. Soave, Laura K. Thompson, and Maurice M. Taylor Jr. as directors to serve for one-year terms and until their successors are elected and qualified; | FOR | |

| Ratification of the selection of Grant Thornton LLP by the Board of Directors as the independent registered public accounting firm to audit the Company's financial statements for the year ending December 31, 2022; and | FOR | |

| Approval, in a non-binding advisory vote, of the compensation paid to the Company's named executive officers; | FOR | |

|

| And such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. The Board of Directors unanimously recommends that you vote FOR each of the nominees named in Proposal #1 and FOR each of Proposals #2 and #3. |

| | | | | | | | | | | |

| | | |

| | | |

| Titan International, Inc. | / | 2022 Proxy Statement | 2 |

TIME AND PLACE; DIRECTIONS; ATTENDING THE ANNUAL MEETING

The Annual Meeting of Stockholders of Titan will be held on Thursday, June 9, 2022, at 10:00 a.m. Central Daylight Time, via the internet through a virtual web conference at www.virtualshareholdermeeting.com/TWI2022.

VOTING BY STOCKHOLDERS OF RECORD; SUBMITTING YOUR PROXY

Common Stockholders are asked to vote their shares as promptly as possible. Common Stockholders of record on the Record Date are entitled to cast their votes in person at the Annual Meeting, by telephone or over the internet, as described in the instructions in the Notice of Internet Availability of Proxy Materials and these materials. If you requested to receive printed proxy materials by mail, you may also vote by completing, signing, dating and promptly returning your proxy card in the return envelope according to the instructions on the proxy card. If you submit your vote by telephone or internet, you do not need to mail back a proxy card.

All shares of Common Stock represented at the Annual Meeting by properly executed proxies received prior to or at the Annual Meeting that are not properly revoked will be voted at the Annual Meeting in accordance with the instructions indicated in the proxy. If no instructions are indicated, such proxies will be voted FOR each of the nominees named in Proposal #1 and FOR each of Proposals #2 and #3 and persons designated as proxies will vote with their best judgment on such other business as may properly come before the Annual Meeting. The Board of Directors does not know of any matters that will come before the Annual Meeting other than those described in the Notice of Annual Meeting attached to this Proxy Statement.

VOTING BY BENEFICIAL OWNERS OF COMMON STOCK

If your shares are held in “street name,” your broker or other institution serving as nominee will send you a request for directions for voting those shares. Many brokers, banks, and other institutions serving as nominees (but not all) participate in a program that offers internet voting options and may provide you with a Notice of Internet Availability of Proxy Materials. Follow the instructions on the Notice of Internet Availability of Proxy Materials to access our proxy materials online or to request a paper or email copy of our proxy materials. If you received these proxy materials in paper form, the materials included a voting instruction card so you can instruct your broker or other nominee how to vote your shares.

For a discussion of rules regarding the voting of shares held by beneficial owners when you do not give voting instructions to your broker, please see “Broker Non-Votes” below.

BROKER NON-VOTES

Under the rules of the New York Stock Exchange (NYSE), member brokers that hold shares in “street name” for their customers that are the beneficial owners of those shares only have the authority to vote on certain “routine” items in the event that they have not received instructions from beneficial owners. Under NYSE rules, when a proposal is not a “routine” matter and a member broker has not received voting instructions from the beneficial owner of the shares with respect to that proposal, the brokerage firm may not vote the shares on that proposal because it does not have discretionary authority to vote those shares on that matter. A “broker non-vote” is submitted when a broker returns a proxy card and indicates that, with respect to particular matters, it is not voting a specified number of shares on those matters, as it has not received voting instructions with respect to those shares from the beneficial owner and does not have discretionary authority to vote those shares on such matters. The shares of Common Stock as to which “broker non-votes” are submitted are not entitled to vote at the Annual Meeting with respect to the matters to which the “broker non-votes” apply. However, such shares will be included for purposes of determining whether a quorum is present at the Annual Meeting.

| | | | | | | | | | | |

| | | |

| | | |

| Titan International, Inc. | / | 2022 Proxy Statement | 3 |

QUORUM FOR ANNUAL MEETING

There must be a quorum for the Annual Meeting to be held. The presence, in person or represented by proxy, of Common Stockholders holding a majority of the Common Stock outstanding on the Record Date is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and “broker non-votes” are counted as present in determining whether or not there is a quorum. If a quorum is not present at the time the Annual Meeting is convened, Common Stockholders representing a majority of the shares of Common Stock present, in person or represented by proxy, may adjourn the Annual Meeting.

VOTE REQUIRED TO APPROVE PROPOSALS

Proposal #1: Election of each of Mr. Cashin, Mr. Cowger, Mr. Guinn, Dr. Rachesky, Mr. Reitz, Mr. Soave, Mr. Taylor and Ms. Thompson as directors requires the affirmative vote of Common Stockholders holding a majority of the shares of Common Stock present in person or represented by proxy at the Annual Meeting.

Proposal #2: Ratification of the selection of the independent registered public accounting firm of Grant Thornton LLP requires the affirmative vote of the Common Stockholders holding a majority of the shares of Common Stock present in person or represented by proxy at the Annual Meeting.

Proposal #3: Approval, in a non-binding advisory vote, of named executive officer compensation requires the affirmative vote of the Common Stockholders holding a majority of the shares of Common Stock present in person or represented by proxy at the Annual Meeting. Although the advisory vote on compensation paid to the Company's named executive officers is non-binding, the Board of Directors will review the result of the vote and will take it into account in making a determination concerning executive compensation in the future.

Abstentions are counted in the number of shares present in person or represented by proxy for purposes of determining whether a proposal has been approved and, as a result, are equivalent to votes against Proposal #2 and Proposal #3. There will be no abstentions on Proposal #1. Brokers that do not receive instructions with respect to Proposal #1 and Proposal #3 from their customers will not be entitled to vote on that proposal as each of such proposals is considered a “non-routine” matter; any such broker non-votes will not have any impact on the outcome of Proposal #1 and Proposal #3. However, such shares representing the broker non-votes will be treated as shares present for purposes of determining whether a quorum is present. Because Proposal #2 is considered a “routine” matter, brokers have discretionary authority to vote on Proposal #2 in the absence of timely instructions from their customers. As a result, there will be no broker non-votes with respect to Proposal #2.

REVOKING A PROXY

Any proxy given pursuant to this solicitation may be revoked at any time before it is voted. Common Stockholders may revoke a proxy at any time prior to its exercise by filing with the Secretary of the Company a duly executed revocation (which must be received before the start of the Annual Meeting), submitting a new proxy bearing a later date by following the instructions provided in the Notice of Internet Availability of Proxy Materials or the proxy card (which must be received before the start of the Annual Meeting) or voting in person by written ballot at the Annual Meeting. Attendance at the Annual Meeting will not of itself constitute revocation of a proxy. Any written notice revoking a proxy should be sent to: Michael G. Troyanovich, Secretary and General Counsel of Titan International, Inc., 1525 Kautz Road, Suite 600, West Chicago, Illinois 60185. If you are a beneficial owner, you may revoke your proxy and change your vote at any time before the Annual Meeting by: (i) submitting new voting instructions to your broker or other intermediary; or (ii) if you have obtained a legal proxy from your broker or other intermediary, by attending the Annual Meeting and voting in person by written ballot.

| | | | | | | | | | | |

| | | |

| | | |

| Titan International, Inc. | / | 2022 Proxy Statement | 4 |

COMPANY'S TRANSFER AGENT

Computershare Trust Company, N.A.

| | | | | |

| Mailing address: | Physical address: |

| P.O. Box 505000 | 462 South 4th Street, Suite 1600 |

| Louisville, KY 40233 | Louisville, KY 40202 |

Stockholder Information: (877) 237-6882 Agent website: www.computershare.com/investor

COMMON STOCK DATA

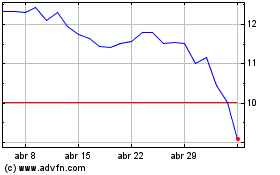

The Common Stock is listed and traded on the New York Stock Exchange under the symbol "TWI."

VOTE TABULATION

Broadridge Investor Communication Services will be responsible for determining whether or not a quorum is present and tabulate votes cast by proxy or in person at the Annual Meeting.

VOTING RESULTS

Titan will announce preliminary voting results at the Annual Meeting and publish final results by filing a Current Report on Form 8-K with the SEC.

PLEASE VOTE

Every stockholder's vote is important. Whether or not you intend to be present at the Annual Meeting, please vote your shares as promptly as possible in accordance with the instructions in the Notice of Internet Availability of Proxy Materials and these materials. Common Stockholders of record on the record date are entitled to cast their votes in person at the Annual Meeting, by telephone or over the Internet, as described in the instructions in the Notice of Internet Availability of Proxy Materials and these materials. If you requested to receive printed proxy materials by mail, you may also vote by completing, signing, dating and promptly returning your proxy card in the return envelope provided to you, which requires no postage if mailed in the United States.

PROXY NOTICE

Important Notice Regarding the Availability of Proxy Materials for Annual Meeting of Stockholders to be held on June 9, 2022.

The Notice of Internet Availability of Proxy Materials, the Proxy Statement and the Company's Annual Report to Stockholders, including its Form 10-K, for the year ended December 31, 2021, are available at the Company's website, www.ir.titan-intl.com/financials/sec-filings, www.ir.titan-intl.com/financials/annual-and-proxy-reports, and www.proxyvote.com.

| | | | | | | | | | | |

| | | |

| | | |

| Titan International, Inc. | / | 2022 Proxy Statement | 5 |

| | | | | | | | | | | |

PROPOSAL ONE ELECTION OF DIRECTORS The Board of Directors recommends that stockholders vote FOR the election of each of Richard M. Cashin Jr., Gary L. Cowger, Max A. Guinn, Mark H. Rachesky, MD, Paul G. Reitz, Anthony L. Soave, Laura K. Thompson, and Maurice M. Taylor Jr. as Directors to serve until the 2023 Annual Meeting of Stockholders. | |

Vote Your Board of Directors recommends that you vote "FOR" the election of each nominee.

8 Directors Currently on the Board of Directors Visit the Investor Relations section of the Company's website at https://ir.titan-intl.com/governance/board-of-directors/default.aspx to view a comprehensive summary of relevant skills possessed by Titan's Board of Directors. |

The Board of Directors currently consists of eight directors with each of the directors elected annually to serve until the next annual meeting of stockholders, and until such director's successor is elected and qualified. The Board of Directors has determined that, with the exception of the Chairman of the Board (Mr. Taylor) and Paul G. Reitz, each of Richard M. Cashin Jr., Gary L. Cowger, Max A. Guinn, Mark H. Rachesky, MD, Anthony L. Soave and Laura K. Thompson meets the independence requirements for directors set forth in the NYSE listing standards.

The Nominating Committee of the Board of Directors (the Nominating Committee) recommended to the Board of Directors the nomination of, and the Board of Directors is nominating, each of Richard M. Cashin Jr., Gary L. Cowger, Max A. Guinn, Mark H. Rachesky, MD, Paul G. Reitz, Anthony L. Soave, Laura K. Thompson, and Maurice M. Taylor Jr. at the Annual Meeting for election as a director to serve until the 2023 Annual Meeting of Stockholders and until a successor is elected and qualified. Each of the nominees is currently a director serving on the Board of Directors and has consented to serve as a director if elected.

In the unexpected event that any nominee for director becomes unable or declines to serve before the Annual Meeting, it is intended that shares represented by proxies that are properly submitted will be voted for such substitute nominee as may be appointed by the Company's existing Board of Directors, as recommended by the Nominating Committee. The following is a brief description of the business experience of each of the nominees for at least the past five years. |

| | | | | | | | | | | |

| | | |

| | | |

| Titan International, Inc. | / | 2022 Proxy Statement | 6 |

NOMINEES

| | | | | | | | |

| | Richard (Dick) Cashin is President of OEP Capital Advisors LP (OEP), which currently manages $5 billion of investments and commitments on behalf of over 100 individual and institutional investors. OEP is an independent investment advisor, the former private equity investment arm of JP Morgan Chase (JPM), having completed a spin-out from JPM in January 2015. OEP and its predecessors have invested nearly $13 billion in over 85 investments. During his fourteen-year tenure with JPM, Mr. Cashin was the Managing Partner of OEP. Prior to that, Mr. Cashin was Managing Partner of Cashin Capital Partners (April 2000-April 2001) and President of Citigroup Venture Capital, Ltd. (1980-2000, became President in 1994). Dick serves on the Board of Tenax Aerospace. He is a Trustee of the American University in Cairo, Boys Club of New York, Brooklyn Museum, Central Park Conservancy, Jazz at Lincoln Center, National Rowing Foundation, and Newport Festivals Foundation. He is active in inner-city educational initiatives, Harvard fundraising and has served as Co-Chairman of his Harvard class for over 40 years. Mr. Cashin possesses particular knowledge and experience in finance, strategic planning, acquisitions and leadership of organizations that enhances the Board of Directors' overall qualifications. Mr. Cashin's experience with large mergers and acquisitions especially contributes to Titan's overall long-range plan. “No one knows more about finance than Mr. Cashin. Just look at all he’s accomplished throughout his career. He always has great ideas and the ability to execute them. He’s a rare gem for our business – trust irreplaceable.” – Maurice M. Taylor Jr. |

Richard M. Cashin Jr. Age: 69 Director since: 1994 | |

| |

| | | | | | | | | | | |

| | | |

| | | |

| Titan International, Inc. | / | 2022 Proxy Statement | 7 |

| | | | | | | | |

| | Mr. Cowger is the chairman and CEO of GLC Ventures, LLC, a management consultancy on business, manufacturing and technology strategy, and global organizational structures and implementation. He serves on the board of directors of College for Creative Studies and Kettering University (formerly known as General Motors Institute), where he was a past Chairman. Mr. Cowger has served as a board member of Delphi Technologies PLC, Tecumseh Products, Saturn Corporation, OnStar, Saab, Adam Opel, AG, GM of Canada, NUMMI, GMAC, and Delphi Automotive. He has also served on the board of the United Negro College Fund, the MIT North America Executive Board, the board of the Detroit Symphony, the governing board for the Leaders for Manufacturing at MIT, and the board of Focus Hope, and was the Co-Chair of the Martin Luther King Memorial Foundation Executive Leadership Cabinet with the Honorable Andrew Young. Mr. Cowger enjoyed a long-term career with General Motors from 1965 until his retirement in December 2009. He held senior positions at General Motors including President and Managing Director of GM de Mexico (1994-1997), Chairman of Adam Opel, AG (1998), Group Vice President of Manufacturing and Labor Relations (1999-2001), and President of GM North America (2001-2005). Mr. Cowger's global manufacturing background provides an informed perspective to the Company's global operations. “His whole career was at General Motors during their bankruptcy they had to make drastic changes to their manufacturing process. Mr. Cowger managed all their factories world-wide during this time and was instrumental in successfully navigating that tough time. Titan is lucky to have him.” – Maurice M. Taylor Jr. |

Gary L. Cowger Age: 75 Director since: 2014 | |

| |

| | | | | | | | |

| | Mr. Guinn served in various roles with Deere & Company for 38 years, from 1980 through his retirement in November 2018. Mr. Guinn served as President of the Worldwide Construction & Forestry Division of Deere & Company from October 2014 through his retirement and as Senior Vice President, Human Resources, Communications, Public Affairs, and Labor Relations from 2012 to 2014. Prior to 2012, he held positions of increasing responsibility in quality services, supply management, and manufacturing in the agricultural, construction and forestry businesses. From 2014 to 2018, Mr. Guinn also served as a Director of John Deere Capital Corporation, which provides and administers financing for retail purchases of new equipment manufactured by John Deere’s agriculture and turf and construction and forestry operations and used equipment taken in trade for this equipment. Mr. Guinn received a BS degree in Mechanical Engineering from the University of Missouri-Rolla (now Missouri University of Science & Technology) and an MBA from the University of Dubuque. Mr. Guinn's global manufacturing background and experience bring unique insights into the Company's global operations. “Mr. Guinn’s entire career at Deere was in the manufacturing of equipment. Titan is manufacturing products that Mr. Guinn knows as well as anyone else. Period. No one understands the manufacturing process like him and Titan greatly benefits from his expertise.” – Maurice M. Taylor Jr. |

Max A. Guinn Age: 63 Director since: 2019 | |

| |

| | | | | | | | | | | |

| | | |

| | | |

| Titan International, Inc. | / | 2022 Proxy Statement | 8 |

| | | | | | | | |

| | Dr. Rachesky is the Founder and Chief Investment Officer of MHR Fund Management LLC, a New York-based investment firm that takes a private equity approach to investing and that was founded in 1996. MHR manages approximately $5 billion of capital and has holdings in public and private companies in a variety of industries. Dr. Rachesky is Chairman of the Board of Directors of Lions Gate Entertainment Corp. and Telesat Corporation. He has also previously served as a director of Loral Space & Communications, Inc., Navistar International Corporation, Emisphere Technologies, Inc. and Leap Wireless International, Inc. Dr. Rachesky holds an MBA from the Stanford University School of Business, an MD from the Stanford University School of Medicine and a BA in Molecular Aspects of Cancer from the University of Pennsylvania. Dr. Rachesky, who is 63 years old, became a director of the Company in June 2014. Dr. Rachesky has demonstrated leadership skills as well as extensive financial expertise and broad-based business knowledge and relationships. In addition, Dr. Rachesky has significant expertise and perspective as a member of the board of directors of private and public companies engaged in a wide range of businesses. “Dr. Rachesky is one real smart guy and knows when to move on financial matters, which are very important when you are growing. There is not a better combination than him and Dick Cashin together. They are both incredibly smart and competitive.” – Maurice M. Taylor Jr. |

Mark H. Rachesky, MD Age: 63 Director since: 2014 | |

| |

| | | | | | | | |

| | Mr. Reitz joined the Company in 2010 as Chief Financial Officer, became President in February 2014, and was named Chief Executive Officer (CEO) effective in January 2017. Prior to joining Titan, he was the Chief Accounting Officer for Carmike Cinemas based in Columbus, Georgia. He has also held leadership positions with McLeodUSA Publishing, Yellow Book USA Inc., and Deloitte and Touche LLP. He has a Master's of Business Administration Degree from the University of Iowa and a Bachelor of Business Administration Degree from Northwood University. He is on the Board of Directors of Culver-Stockton College. He also was previously on the Board of Directors of Wheels India Limited. Mr. Reitz has held leadership roles on both the financial and operational sides of Titan. This experience has provided Mr. Reitz with an extensive knowledge of the opportunities available to and challenges involved in Titan's business. “I hired Mr. Reitz and he stepped in as Titan’s CFO and he did such a great job handling big deals in South America, Russia, and France. He has a unique outlook when it comes to our acquisitions and financial nature. We wouldn’t be where we are today without his work and leadership.” – Maurice M. Taylor Jr. |

Paul G. Reitz Age: 49 Director since: 2017 | |

| |

| | | | | | | | | | | |

| | | |

| | | |

| Titan International, Inc. | / | 2022 Proxy Statement | 9 |

| | | | | | | | |

| | Mr. Soave is President, Chief Executive Officer and founder of Soave Enterprises LLC, a privately held, Detroit-headquartered company comprised of numerous holdings in the real estate development, environmental and industrial services, metals recycling, agriculture, and automotive retailing industries, among others. Mr. Soave has held this position since 1998. From 1974 to 1998, he served as President and Chief Executive Officer of Detroit-based City Management Corporation, which he founded. Mr. Soave possesses particular knowledge and experience in sales, distribution, and leadership in diversified businesses that enhances the Board of Directors' overall qualifications. Mr. Soave's experiences in building businesses from the ground up contribute to the dynamic of Titan's entrepreneurial spirit. Mr. Soave's operational and distribution background further assist with the Company's direction. “Titan International is very fortunate to have had Mr. Soave since the beginning – over 30 years! No one has more of a gut business feel than Mr. Soave. All anyone has to do is look at the businesses he started or bought into in the beginning that made him a billionaire. He is just plain smart.” – Maurice M. Taylor Jr. |

Anthony L. Soave Age: 82 Director since: 1994 | |

| |

| | | | | | | | |

| | Ms. Thompson is a global business executive with deep financial and business expertise established over a 35-year career with The Goodyear Tire & Rubber Company. Ms. Thompson served as Executive Vice President of Goodyear until her retirement in March 2019, and from 2013 to 2018 she served as Executive Vice President and Chief Financial Officer. She also served in various finance and business roles including Vice President Finance North America, Vice President Business Development and Director Investor Relations. Ms. Thompson is also a Director at Parker Hannifin Corporation and WESCO International Inc. She is also active in her community including being Vice President of the Hoover Instrumental Music Association and an Advancement Council member of the Business College at The University of Akron. Ms. Thompson is a trusted business advisor with a proven track record of developing growth strategies and delivering results in dynamic and complex business environments. Ms. Thompson’s knowledge and experience in business transformations and turnarounds, mergers, acquisitions and divestitures, as well as, demonstrated success in developing talent, building teams and championing diversity and inclusion, will further assist Titan in achieving its strategic goals. “Ms. Thompson was the lead person for Goodyear Tire on our acquisition of Goodyear Farm Tire business for North America. In 2005 the entire Titan team was impressed with Ms. Thompson’s knowledge, of not only the financial part of Goodyear, but the pluses and minuses in manufacturing. She is one smart lady.” – Maurice M. Taylor Jr. |

Laura K. Thompson Age: 57 Director since: 2021 | |

| |

| | | | | | | | | | | |

| | | |

| | | |

| Titan International, Inc. | / | 2022 Proxy Statement | 10 |

| | | | | | | | |

| | Mr. Taylor is Chairman of the Company's Board of Directors. Mr. Taylor retired as Chief Executive Officer of the Company in December 2016, a position that he held since 1990. Mr. Taylor has served as a director of Titan International, Inc. since 1990, when Titan was acquired in a leveraged buyout by Mr. Taylor and other investors. Mr. Taylor, who owned 53% of Titan at the time, took the Company public in 1992 on NASDAQ and, in 1993, moved Titan to the NYSE. Mr. Taylor, who is 77 years old, has been in the manufacturing business for more than 50 years and has a bachelor's degree in engineering. He is also a journeyman tool and die maker as well as a certified welder. Mr. Taylor's work experiences provide in-depth knowledge and experience in sales, manufacturing, engineering, and innovation that enhances the Board of Directors' overall qualifications. Mr. Taylor's extensive background with the Company has given him a breadth of insight into Titan's markets and the requirements of end users. With Mr. Taylor's knowledge and a management style that constantly re-evaluates short-term goals, Titan is able to adapt quickly to changing conditions. Mr. Taylor picked up the nickname of "The Grizz" so for many years the mascot of Titan was a version of a friendly Grizz bear. In 1996, Mr. Taylor ran as a Republican candidate for President of the United States, campaigning to bring sound fiscal management and business know-how to Washington. “Mr. Taylor possesses a special skill to see a path when others see only obstacles and no way forward. That skill combined with his ability to create strong connections with people has made him an exceptional visionary leader for decades. His entrepreneurial mindset and passion has driven Titan to become a leader in our industry, and his continuing contributions to Titan are valuable to me and my team.” – Paul G. Reitz |

Maurice M. Taylor Jr. Age: 77 Director since: 1990 | |

| |

| | | | | | | | | | | |

| | | |

| | | |

| Titan International, Inc. | / | 2022 Proxy Statement | 11 |

| | | | | | | | | | | |

PROPOSAL TWO RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF GRANT THORNTON LLP | | |

The Board of Directors recommends that stockholders vote FOR the ratification of the selection of the independent registered public accounting firm, Grant Thornton LLP, to audit the consolidated financial statements of the Company and its subsidiaries for the year ending December 31, 2022. Grant Thornton LLP served the Company as the independent registered public accounting firm during the year ended December 31, 2021, and has been selected by the Audit Committee of the Board of Directors (the Audit Committee) to serve as the independent registered public accounting firm for the present year ending December 31, 2022. Grant Thornton LLP has served the Company in this capacity since 2012. If stockholders fail to ratify the selection of Grant Thornton LLP, the Audit Committee will consider this fact when selecting an independent registered public accounting firm for the audit year ending December 31, 2023. A representative from Grant Thornton LLP is expected to be present at the Annual Meeting and will have an opportunity to make a statement if such representative desires to do so and will be available to respond to appropriate questions of stockholders in attendance. | Grant Thornton LLP Grant Thornton LLP served the Company as the independent registered public accounting firm during the year ended December 31, 2021 |

| | | | | | | | | | | |

| | | |

| | | |

| Titan International, Inc. | / | 2022 Proxy Statement | 12 |

| | | | | | | | | | | |

PROPOSAL THREE APPROVAL, IN A NON-BINDING ADVISORY VOTE, OF THE COMPENSATION PAID TO THE NAMED EXECUTIVE OFFICERS | |

|

As required by Section 14A of the Securities Exchange Act of 1934 (the Exchange Act) the Company is providing stockholders with the opportunity to vote, on a non-binding advisory basis, on a resolution approving the compensation of our named executive officers as disclosed in this Proxy Statement in accordance with the rules of the SEC, including in the “Compensation Discussion and Analysis” section and the compensation tables and narrative discussion contained in the “Compensation of Named Executive Officers” section of this Proxy Statement. As described in the "Compensation Discussion and Analysis" section, the objectives of the Company's compensation program are to attract and retain individuals with the necessary skills that are vital to the long-term success of Titan. The compensation program is designed to be fair and just to both the Company and the individual. The overall goal of the Company's compensation policy is to maximize stockholder value by attracting, retaining and motivating the executive officers that are critical to the long-term success of the Company. Stockholders are encouraged to review the “Compensation Discussion and Analysis” and “Compensation of Named Executive Officers” sections of this Proxy Statement for additional information regarding the Company's executive compensation. The Board of Directors is requesting the support of Titan's stockholders for the named executive officer compensation as disclosed including in the “Compensation Discussion and Analysis” and “Compensation of Named Executive Officers” sections of this Proxy Statement. This proposal gives the Company's stockholders the opportunity to express their views on the named executive officers' compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the overall compensation objectives and philosophy described in this Proxy Statement. The Board of Directors recommends that stockholders vote FOR the approval, in a non-binding advisory vote, of the compensation paid to the named executive officers and the following resolution: “RESOLVED, that the compensation of the Company's Named Executive Officers as described in the Company's definitive Proxy Statement for the Company's 2022 Annual Meeting of Stockholders pursuant to Item 402 of Regulation S-K, including the sections entitled 'Compensation Discussion and Analysis' and 'Compensation of Named Executive Officers,' is hereby APPROVED.” | Executive Compensation This proposal gives the Company's stockholders the opportunity to express their views on the named executive officers' compensation. |

| | | | | | | | | | | |

| | | |

| | | |

| Titan International, Inc. | / | 2022 Proxy Statement | 13 |

The vote on the compensation of our named executive officers, commonly referred to as "say-on-pay," is advisory and not binding on the Company, the Board of Directors, or the Compensation Committee of the Board of Directors (the Compensation Committee). The final decision on the compensation and benefits of our named executive officers and on whether, and, if so, how, to address any stockholder approval or disapproval of named executive officer compensation remains with the Board of Directors and the Compensation Committee. However, the Board of Directors and the Compensation Committee value the opinions of the Company’s stockholders as expressed through their votes and other communications, and expect to consider the outcome of this vote, together with other relevant factors, when making future compensation decisions for the named executive officers.

The Board of Directors previously determined that the Company will hold an advisory vote on executive compensation annually. The next say-on pay vote is expected to be held at the Company's 2023 annual meeting of stockholders.

OTHER BUSINESS

The Board of Directors does not intend to present at the Annual Meeting any business other than the items stated in the “Notice of Annual Meeting of Stockholders” and does not know of any matters to be brought before the Annual Meeting other than those referred to above. If, however, any other matters properly come before the Annual Meeting requiring a stockholder vote, the persons designated as proxies will vote on each such matter in accordance with their best judgment.

| | | | | | | | | | | |

| | | |

| | | |

| Titan International, Inc. | / | 2022 Proxy Statement | 14 |

AUDIT AND OTHER FEES

The Audit Committee of the Board of Directors engaged the independent registered public accounting firm of Grant Thornton LLP as independent accountants to audit the Company's consolidated financial statements for the fiscal year ended December 31, 2021. Fees paid to the independent registered public accounting firm of Grant Thornton LLP included the following:

AUDIT FEES

For the years ended December 31, 2021 and 2020, Grant Thornton LLP billed the Company $2,190,688 and $2,088,285, respectively, for professional services rendered for the audit of the Company's annual consolidated financial statements included in the Company's Form 10-K, including fees related to the audit of internal controls in connection with the Sarbanes-Oxley Act of 2002, reviews of the quarterly financial statements included in the Company's Form 10-Q reports, statutory audits of foreign subsidiaries and related administrative fees and out-of-pocket expenses incurred by Grant Thornton LLP.

AUDIT-RELATED FEES

For the years ended December 31, 2021, Grant Thornton LLP billed the Company $115,000 for professional services rendered related to the Company's offering of senior secured notes in 2021 and registration of common stock under the Titan International, Inc. Equity and Incentive Compensation Plan.

For the year ended December 31, 2020, Grant Thornton LLP did not provide to the Company any audit-related services and did not bill the Company for any related fees.

TAX AND ALL OTHER FEES

For the year ended December 31, 2021, Grant Thornton LLP billed the Company $20,000 for professional services rendered related to statutory report preparation and research and development tax credit services. For the year ended December 31, 2020, Grant Thornton LLP did not provide to the Company any tax or other services and did not bill the Company for any related fees.

| | | | | | | | | | |

| 2021 | 2020 | | |

| Audit Fees | $2,190,688 | $2,088,285 | | |

| Audit-Related Fees | 115,000 | | — | | | |

| Tax Fees | — | | — | | | |

| All Other Fees | 20,000 | | — | | | |

| Total | 2,325,688 | | 2,088,285 | | | |

Audit Committee Pre-Approval

All of the services provided by Grant Thornton LLP for each of 2021 and 2020 were pre-approved by the Audit Committee as required by and described in the Audit Committee's Charter.

| | | | | | | | | | | |

| | | |

| | | |

| Titan International, Inc. | / | 2022 Proxy Statement | 15 |

AUDIT COMMITTEE REPORT

In connection with the filing and preparation of the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, the Audit Committee reviewed and discussed the audited financial statements with the Company’s management and its independent auditors, including meetings where the Company’s management was not present.

The Audit Committee selected Grant Thornton LLP (GT) to serve as the independent registered public accounting firm for the Company for 2021 with stockholders' approval. The Audit Committee has discussed the issue of independence with GT and is satisfied that they have met the independence requirement including receipt of the written disclosures and the letter from GT as required by PCAOB Rule 3526 (Public Company Accounting Oversight Board Rule 3526, Communications with Audit Committees Concerning Independence). The Audit Committee has discussed with GT the applicable requirements of the PCAOB and SEC.

The Audit Committee periodically meets independently with GT to discuss the accounting principles applied by management and to discuss the quality of the Company's internal audit function. GT reported to the Audit Committee that there were no unresolved matters with management to report. The Audit Committee has established procedures for the receipt, retention and treatment of complaints relating to the Company. The members of the Audit Committee are not professionally engaged in the practice of auditing or accounting and are not experts in those fields, but make every effort to test the veracity of facts and accounting principles applied by management.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the Company's audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2021.

Members of the Audit Committee:

•Richard M. Cashin, Jr., Chairman

•Gary L. Cowger

•Max A. Guinn

•Laura K. Thompson

| | | | | | | | | | | |

| | | |

| | | |

| Titan International, Inc. | / | 2022 Proxy Statement | 16 |

COMPENSATION OF DIRECTORS

The Company uses a combination of cash and stock-based incentive compensation to attract and retain qualified directors to serve on the Board of Directors. In setting director compensation, the Company considers the amount of time and skill level required by the directors in fulfilling their duties to the Company. In 2018, the Compensation Committee engaged Pay Governance, as its outside compensation consultant, to analyze its then-current non-employee director compensation practices. Based on Pay Governance’s previous analysis, the Compensation Committee adopted for 2021 the recommendation to allow each non-employee director to elect to receive such director’s annual director fee in restricted stock units instead of cash.

Each non-employee director of the Company receives an annual director fee of $90,000 in cash. Each non-employee director of the Company may elect to receive all or a portion of the annual director fee in restricted stock units, granted pursuant to a restricted stock unit award, under the Company's applicable equity plan, in lieu of cash. To the extent a non-employee director made such an election for 2021, the received restricted stock units are scheduled to vest on June 16, 2022, the one year anniversary of the grant date (June 16, 2021), provided that the non-employee director remains in continuous service through such vesting date or until his or her earlier death, disability, retirement or not standing for re-election. The number of restricted stock units received under each such grant was calculated based on the closing price of Common Stock on June 16, 2021 of $9.16 per share.

In addition to the annual director fee, the Company approved a 2021 grant of restricted stock units under the Titan International Inc. Equity and Incentive Compensation Plan (the Incentive plan) to each non-employee director equivalent to approximately $90,000 in value, calculated based on the closing price of Common Stock on June 16, 2021 of $9.16 per share. These additional restricted stock units are scheduled to vest on June 16, 2022, the one year anniversary of the grant date (June 16, 2021), provided that the non-employee director remains in continuous service through such vesting date or until his or her earlier death, disability, retirement or not standing for re-election.

The Chairman of the Board receives an additional $90,000 fee, payable in cash or, upon the Chairman of the Board’s election, in restricted stock units. The Audit Committee Chairman receives an additional $22,500 annual cash payment while each Chairman of the Compensation Committee, the Corporate Governance Committee of the Board of Directors (the Corporate Governance Committee), and the Nominating Committee receives an additional $15,000 annual cash payment for such person's service in those positions. The “audit committee financial expert” serving on the Audit Committee receives an additional $7,500 annual cash payment for this role. Titan also reimburses directors for out-of-pocket expenses related to their attendance at such meetings.

| | | | | | | | | | | | | | | | | |

Annual Director Fee | Annual Grant of Restricted Stock Units | Chairman of the

Board Fee | Audit Committee Chairman Fee | Other Committee Chairman Fee | Audit Committee Financial Expert Fee |

| $90,000 | $90,000 | $90,000 | $22,500 | $15,000 | $7,500 |

The Company does not have any consulting contracts or arrangements with any of its directors. At December 31, 2021, the directors beneficially owned, in the aggregate, approximately 18.7% of the outstanding shares of Common Stock.

| | | | | | | | | | | |

| | | |

| | | |

| Titan International, Inc. | / | 2022 Proxy Statement | 17 |

| | |

| Compensation of Directors |

DIRECTOR COMPENSATION TABLE FOR 2021

The table below summarizes the compensation earned by each member of the Board of Directors (other than Paul G. Reitz, Titan's President and Chief Executive Officer) for service on the Board of Directors for 2021. For a summary of the compensation earned by Mr. Reitz, see "Compensation of Named Executive Officers" below.

| | | | | | | | | | | | | | | | | | | |

| Name of Director | Fees Earned or Paid in Cash ($) | Stock Awards ($)(a) | | | All Other Compensation ($) | | Total

($) |

| | | | | | | |

| | | | | | | |

| Richard M. Cashin Jr. | 37,500 | | 180,000 | | | | 92,632 | | (c) | 310,132 | |

| Gary L. Cowger | 90,000 | | 90,000 | | | | — | | | 180,000 | |

| Max A. Guinn | 15,000 | | 180,000 | | | | — | | | 195,000 | |

| Mark H. Rachesky, MD | — | | 180,000 | | | | 48,753 | | (c) | 228,753 | |

| Anthony L. Soave | — | | 180,000 | | | | — | | | 180,000 | |

| Maurice M. Taylor Jr. | 90,000 | | 180,000 | | | | — | | | 270,000 | |

| Laura K. Thompson (b) | 116,250 | | 108,750 | | | | — | | | 225,000 | |

(a)The amounts included in the “Stock Awards” column reflect the aggregate grant date fair value of (i) 9,825 restricted stock units granted to each non-employee director in June 2021 for his or her annual restricted stock units award and (ii) an additional 9,825 restricted stock units granted to each of Messrs. Taylor, Cashin, Guinn, Rachesky, Soave and to Ms. Thompson upon his or her respective elections to receive the annual $90,000 board retainer fee in restricted stock units in lieu of cash. In each case, the value is computed in accordance with Financial Accounting Standards Board Accounting Standards Codification (FASB ASC) Topic 718 Compensation - Stock Compensation. The restricted stock units for each non-employee director on the Company's Board of Directors were granted on June 16, 2021 and are scheduled to vest on June 16, 2022, the one year anniversary of the grant date, or, if earlier, upon the non-employee director’s death, disability, retirement or not standing for re-election. As previously disclosed, each such member of the Company's Board of Directors may elect to receive all or a portion of his or her annual $90,000 board retainer fee in restricted stock units in lieu of cash.

(b)Laura K. Thompson was appointed to the Company's board of directors on April 1, 2021. Ms. Thompson received an initial grant of 1,951 shares of restricted stock units based on the April 1, 2021 closing stock price of $9.61 which vests on the one year anniversary of the grant date. In addition, Ms. Thompson received $26,250 as an incremental pro-rata amount of the annual board retainer fee for the period from her April 1, 2021 start date to June 15, 2021 and, as noted in (a) above, an annual board retainer fee of $90,000. Ms. Thompson received equity of $108,750 comprised of 9,825 restricted stock units valued at $90,000 (see (a) for further detail) and her initial equity grant of 1,951 shares of restricted stock units valued at $18,750.

(c)This amount consists of the aggregate incremental cost for personal use of Company aircraft. The method used to calculate this cost is set forth in a footnote to the Summary Compensation Table.

DIRECTORS OUTSTANDING STOCK OPTIONS AND RESTRICTED STOCK UNITS AWARDS

The following table shows the outstanding stock options and restricted stock units as of December 31, 2021 for each member of the Board of Directors (other than Mr. Reitz, Titan's President and Chief Executive Officer):

| | | | | | | | | | |

| Name of Director | Number of Stock Options | Number of Restricted Stock Units | | |

| Richard M. Cashin Jr. | 135,000 | 19,650 | | |

| Gary L. Cowger | — | 9,825 | | |

| Max A. Guinn | — | 19,650 | | |

| Mark H. Rachesky, MD | 99,000 | 19,650 | | |

| Anthony L. Soave | 135,000 | 19,650 | | |

| Maurice M. Taylor Jr. | 49,200 | 19,650 | | |

| Laura K. Thompson | — | 11,776 | | |

| | | | | | | | | | | |

| | | |

| | | |

| Titan International, Inc. | / | 2022 Proxy Statement | 18 |

| | |

| Compensation of Directors |

DIRECTOR STOCK OWNERSHIP GUIDELINES

The Board of Directors believes that each director should develop a meaningful ownership position in the Company. Therefore, the Board of Directors adopted stock ownership guidelines for non-employee directors of the Company. Pursuant to these guidelines, each non-employee director is expected to achieve stock ownership of at least five times their annual cash retainer within five years of the later to occur of the adoption of the guidelines or first becoming a non-employee director. As of December 31, 2021, all of the non-employee directors were in compliance with the stock ownership guidelines.

| | | | | | | | | | | |

| | | |

| | | |

| Titan International, Inc. | / | 2022 Proxy Statement | 19 |

COMMITTEES OF THE

BOARD OF DIRECTORS

MEETINGS

The following table provides (i) the membership of each committee of the Board of Directors as of the date of the filing of this proxy statement and (ii) the number of meetings held by each committee during 2021:

| | | | | | | | | | | | | | | | | |

| Name of Director | Board of

Directors | Audit Committee | Compensation Committee | Nominating Committee | Corporate Governance Committee |

| | | | | |

| | | | | |

| | | | | |

| Richard M. Cashin Jr. | | | | | |

| Gary L. Cowger | | | | | |

| Max A. Guinn | | | | | |

| Mark H. Rachesky, MD | | | | | |

| Paul G. Reitz | | | | | |

| Anthony L. Soave | | | | | |

| Maurice M. Taylor Jr. | | | | | |

Laura K. Thompson(a) | | | | | |

2021 Meetings | 9 | 4 | 1 | 1 | 2 |

| | | | | |

| |

| Member of the Board of Directors or applicable Committee |

| Chairman of the Board of Directors or applicable Committee |

| (a) | Laura K. Thompson was appointed to the Company's Board of Directors, effective as of April 1, 2021, and her appointments to the Board are reflected in the table above as of the date of her appointment. |

BOARD OF DIRECTORS

The Board of Directors approves nominees for election as directors. Each current director who served on the Board of Directors during 2021 attended 75% or more of (i) the aggregate number of meetings of the Board of Directors during the period in which such individual was a director and (ii) the aggregate number of meetings of committees on which such director served during 2021. The Board of Directors and committee meetings are presided over by the applicable Chairman. If the Chairman is unavailable, the directors present appoint a temporary Chairman to preside at the meeting.

AUDIT COMMITTEE

The Audit Committee was composed of four independent non-employee directors during 2021. The Board of Directors has determined that each of the members of the Audit Committee satisfies the requirements of the NYSE with respect to independence,

| | | | | | | | | | | |

| | | |

| | | |

| Titan International, Inc. | / | 2022 Proxy Statement | 20 |

| | |

| Committees of the Board of Directors |

accounting or financial-related expertise, and financial literacy. Mr. Cashin qualifies as an "audit committee financial expert" as defined in the SEC rules under the Sarbanes-Oxley Act of 2002.

The Audit Committee retains the independent registered public accounting firm to perform audit and non-audit services, reviews the scope and results of such services, consults with the internal audit staff, reviews with management and the independent registered public accounting firm any recommendations of the auditors regarding changes and improvements in the Company's accounting procedures and controls and management's response thereto, and reports to the Board of Directors. The Audit Committee meets quarterly with members of management, internal audit, and the independent registered public accounting firm, individually and together, to review and approve the financial press releases and periodic reports on Form 10-Q and Form 10-K prior to their filing and release. The Audit Committee operates under a written charter, which was amended and restated on March 2, 2021, and is available on the Company's website: www.titan-intl.com. In September 2016, Titan entered into an Audit Committee Observer Agreement (the Observer Agreement) with, among others, MHR Institutional Partners III LP, MHR Capital Partners Master Account LP, MHR Capital Partners (100) LP, MHR Institutional Advisors III LLC, MHR Advisors LLC, MHRC LLC, MHR Fund Management LLC, MHR Holdings LLC, and Mark H. Rachesky (collectively, the MHR Entities) that permits the MHR Entities to designate an observer of the Audit Committee. Mr. David Gutterman was designated to serve effective as of March 14, 2018, and as of the date of this Proxy Statement serves as the observer pursuant to the Observer Agreement.

COMPENSATION COMMITTEE

The Compensation Committee provides oversight of all of Titan's executive compensation and benefit programs. The Compensation Committee reviews and approves and makes recommendations accordingly to the Board of Directors regarding, the salaries and all other forms of compensation of the Company's executive officers, including reviewing and approving corporate goals and objectives with respect to executive officer compensation. The Compensation Committee is responsible for the adoption of, the administration of, and making awards under, the Company’s equity compensation plans, to the extent provided for by any such plan. The Compensation Committee is also primarily responsible for reviewing the non-employee director compensation program and recommending any changes to the program to the Board of Directors. Subject to applicable law, the Compensation Committee may establish subcommittees or delegate specific responsibilities to the Compensation Committee Chair or any other committee member(s), or member of management, as applicable.

NOMINATING COMMITTEE

The Nominating Committee recommended to the Board of Directors that each of Richard M. Cashin Jr., Gary L. Cowger, Max A. Guinn, Mark H. Rachesky, MD, Paul G. Reitz, Anthony L. Soave, Laura K. Thompson, and Maurice M. Taylor Jr. stand for re-election as directors based on approved criteria. See Proposal #1 for further information regarding these director nominees.

Pursuant to its charter, the Nominating Committee is responsible for the following: (i) identification of individuals qualified to become Directors of the Company; (ii) seeking to address vacancies on the Board of Directors by actively considering candidates that bring a diversity of background and opinion; (iii) considering director candidates on merit and considering the benefits of all aspects of diversity when recommending such candidates to serve as new directors; (iv) developing a process for annual evaluation of the Board of Directors and its committees; and (v) reviewing the Board of Directors' committee structure and composition to make annual recommendations to the Board of Directors regarding the appointment of directors to serve as members of each committee and as committee chairpersons.

| | | | | | | | | | | |

| | | |

| | | |

| Titan International, Inc. | / | 2022 Proxy Statement | 21 |

| | |

| Committees of the Board of Directors |

CORPORATE GOVERNANCE COMMITTEE

Pursuant to its charter, the Corporate Governance Committee is responsible for the following: (i) development and recommendation of a set of corporate governance guidelines; (ii) oversight of the Company's corporate governance practices and procedures; (iii) evaluation of the Corporate Governance Committee and its success in meeting the requirements of its charter; (iv) development and oversight of a Company orientation program for new directors and continuing education program for current directors; (v) review and discussion with management of disclosure of the Company's corporate governance practices; (vi) monitoring compliance with the Company's Code of Business Conduct; and (vii) reviewing transactions between the Company and any related persons.

BOARD LEADERSHIP STRUCTURE

The Company's Board of Directors is currently comprised of seven non-employee directors and Mr. Reitz, Titan's President and CEO, who was appointed to the Board of Directors in December 2017. Mr. Taylor, the Chairman of the Board, served as Chief Executive Officer until his retirement in 2016. Mr. Taylor has served as Chairman of the Board since 2005, and has been a member of the Board of Directors since 1993, when Titan first became a public company. The Company believes that the composition of the Board of Directors, including the independent, experienced directors, benefits Titan and its stockholders.

While the Board of Directors does not have a formal policy requiring the separation of the positions of Chairman of the Board and Chief Executive Officer, the roles of the Chairman of the Board and the Chief Executive Officer are currently separated. The Company believes that this structure is the best governance model for the Company at this time as the Chairman of the Board, Mr. Taylor, is able to focus on Board matters with the insight and experience gained from years of being the Company's Chief Executive Officer, allowing the current President and Chief Executive Officer, Mr. Reitz, to focus on the Company's operations. The Board of Directors believes Titan is well-served by the current leadership structure.

The Board of Directors conducts an annual evaluation in order to determine whether it and its committees are functioning effectively. As part of this annual self-evaluation, the Board of Directors evaluates whether the current leadership structure continues to be advantageous for Titan and its stockholders.

RISK OVERSIGHT

The Board of Directors is responsible for overseeing Titan's Enterprise Risk Management (ERM) process. The Board of Directors focuses on Titan's ERM strategy and the most significant risks facing Titan from strategic, financial, operational and legal perspectives considering impact, likelihood and velocity. The Board of Directors evaluates whether appropriate risk mitigation strategies are implemented by management and are effective. The Board of Directors is also apprised of particular risk management matters in connection with its general oversight and approval of corporate matters. The Board of Directors works with the Audit Committee in its oversight of Titan's ERM process. The Audit Committee Chairman reviews with management (i) policies with respect to risk assessment and management of risks that may be material to the Company, (ii) Titan's system of disclosure controls and system of internal controls over financial reporting, and (iii) Titan's compliance with legal and regulatory requirements. The Company's other Board committees also consider and address risk as they perform their respective committee responsibilities, including evaluation of risks relating to the Company's compensation programs and corporate governance standards. Each of the committees reports to the full Board of Directors as appropriate, including when a matter rises to the level of a material risk.

Titan's management is responsible for day-to-day risk management. The Company's Internal Audit team reports functionally to the Audit Committee and administratively to the Chief Financial Officer and serves as the primary monitoring and testing function for

| | | | | | | | | | | |

| | | |

| | | |

| Titan International, Inc. | / | 2022 Proxy Statement | 22 |

| | |

| Committees of the Board of Directors |

company-wide policies and procedures. The Chief Financial Officer and the Internal Audit team manage the day-to-day oversight of the ERM strategy for ongoing business described above.

The Board of Directors believes the risk management responsibilities detailed above are an effective approach for addressing the risks facing the Company at this time.

RISKS RELATING TO EMPLOYEE COMPENSATION POLICIES AND PRACTICES

The Board of Directors does not believe that the Company's compensation policies and practices are reasonably likely to have a material adverse effect on the Company at this time or that any portion of its compensation policies and practices encourage excessive risk taking. In examining risks relating to employee compensation policies and practices, the Company considered the following factors:

•The Company is an industrial manufacturer; in the Company's opinion, this business does not lend itself to or incentivize significant risk-taking by Company employees.

•A portion of the compensation for our named executive officers consists of a fixed base salary established by their respective employment agreements, which creates little, if any, risk to the Company.

•Discretionary bonuses are determined by the Compensation Committee based upon a variety of measures, including business objectives and performance metrics. In making determinations with respect to such bonuses, the Compensation Committee considers the Company’s strategic objectives and near-term and long-term interests, as well as those of the Company’s stockholders. In that regard, the Compensation Committee believes that the Company’s compensation program for its executives has an appropriate balance of risk and reward in relation to the Company’s business plan, and does not encourage excessive or unnecessary risk-taking behavior.

•The compensation practices for the Company's non-bargaining employees and management have been established over several decades; in the Company's opinion, based on its experience, these practices have not promoted significant risk-taking.

•The Company does not have a history of material changes in compensation that would have a material adverse effect on the Company related to risk management practices and risk-taking incentives.

| | | | | | | | | | | |

| | | |

| | | |

| Titan International, Inc. | / | 2022 Proxy Statement | 23 |

DIRECTOR NOMINATION PROCESS

The Nominating Committee and other members of the Board of Directors identify candidates for consideration by the Nominating Committee for election to the Board of Directors. An executive search firm may also be utilized to identify qualified director candidates for consideration.

The Nominating Committee evaluates candidates from any reasonable source, including stockholder recommendations and recommendations from current directors and executive officers, based on the qualifications for a director described in its charter. These considerations include, among other things, merit, expected contributions to the Board of Directors, whether the candidate meets the independence standards of the SEC and the NYSE, and a diversity of background and opinion, with diversity being broadly considered by the Board of Directors to mean a variety of opinions, perspectives, personal and professional experiences and backgrounds, including gender, race and ethnicity differences, as well as other differentiating characteristics such as organizational experience, professional experience, education, cultural and other background, viewpoint, skills and other personal qualities. The Nominating Committee then presents qualified candidates to the full Board of Directors for consideration and selection. In connection with the next search by the board for a new director, the Company is committed to incorporating procedures by which women and diverse racial and ethnic backgrounds are identified for consideration.

The Nominating Committee will consider nominees for election to the Board of Directors that are recommended by stockholders, applying the same criteria for candidates as discussed above. Any person who intends to solicit proxies in support of director nominees other than the Company's nominees for the 2023 Annual Meeting of Stockholders must provide notice to the Company no later than April 8, 2023, or if the date of the 2023 Annual Meeting of Stockholders is moved more than 30 calendar days from June 9, 2023, then notice must be provided by the later of 60 calendar days prior to the date of the 2023 Annual Meeting of Stockholders or the tenth calendar day following the Company's announcement of the date of the 2023 Annual Meeting of Stockholders.

INVOLVEMENT IN LEGAL PROCEEDINGS

The Company is not aware of any events with respect to any director or executive officer of the Company requiring disclosure under Item 401(f) of Regulation S-K that are material to an evaluation of the ability or integrity of any director or executive officer.

| | | | | | | | | | | |

| | | |

| | | |

| Titan International, Inc. | / | 2022 Proxy Statement | 24 |

COMPENSATION DISCUSSION

AND ANALYSIS

OVERVIEW

This Compensation Discussion and Analysis describes the compensation policies and determinations that applied to the Company's named executive officers for 2021. The Compensation Committee is empowered to review and approve the annual compensation package for the Company's named executive officers. The named executive officers for 2021 were as follows:

| | | | | |

| Position | Name |

| President and Chief Executive Officer | Paul G. Reitz |

| Senior Vice President and Chief Financial Officer | David A. Martin |

| Secretary and General Counsel | Michael G. Troyanovich |

| Vice President and Chief Accounting Officer | Anthony C. Eheli |

OBJECTIVE

The objectives of the Company's compensation program are to attract and retain individuals with the necessary skills that are vital to the long-term success of the Company. To achieve these objectives, the compensation program is designed to be fair to both the Company and the individual. Consideration is given to the individual's overall responsibilities, qualifications, experience, and job performance.

PHILOSOPHY

The overall goal of the Company's compensation policy is to maximize stockholder value by attracting, retaining, motivating and rewarding the executive officers that are critical to its long-term success. The Compensation Committee believes that executive compensation should be designed to promote the long-term economic goals of the Company. The philosophy of the Compensation Committee as it relates to executive compensation is that the CEO and other executive officers should be compensated at competitive levels sufficient to attract, motivate, and retain talented executives who are capable of leading the Company in achieving its business objectives in an industry facing increasing competition and change. To that end, the Compensation Committee has determined that the compensation package for executive officers shall consist of the following components reflecting a mix of fixed and variable compensation, as well as cash and equity compensation, with the amount and mix of compensation for named executive officers established pursuant to the terms of applicable employment agreements and otherwise determined by the Compensation Committee, as described below:

•Base salaries to reflect responsibility, experience, tenure, and performance of executive officers;

•Discretionary cash bonus awards, when applicable, to reward performance in achieving strategic business objectives and individual objectives;

•Long-term incentive compensation, when applicable, to emphasize business and individual objectives; and

•Other benefits as deemed appropriate to be competitive in the marketplace.

See “Employment Agreements” below for a description of the employment agreements to which the named executive officers are party. In addition to reviewing the compensation of executive officers generally in light of competitive market data that is publicly available, the Compensation Committee also considers recommendations from its independent compensation consultant, if any, as well as recommendations from the Company's CEO regarding the total compensation for the other named executive officers. The Compensation Committee also considered the historical compensation of each named executive officer, from both a base salary and total compensation package perspective, in setting the 2021 compensation for the executives.

COMPENSATION COMMITTEE CHARTER

The Compensation Committee has a charter to assist in carrying out its responsibilities. The Compensation Committee reviews the charter and the guidelines contained therein on an annual basis and makes any modifications as it deems necessary. The Compensation Committee Charter is available on our website at www.titan-intl.com.

EXECUTIVE COMPENSATION DECISION-MAKING

The Compensation Committee analyzes individual and Company performance in relation to considering changes to compensation programs. The Compensation Committee also relies on data and studies previously prepared by Pay Governance in 2018 to assist it in setting compensation and developing pay practices that reflect the Company’s and stockholder goals. The Company's management and members of the Board of Directors also provide the Compensation Committee with historical compensation information relating to the executive officers to assist the Compensation Committee in formulating the named executive officer’s compensation. The Compensation Committee considers competitors, markets, and individual performance, as well as the Company’s performance when making salary adjustments and bonus awards. With the prior assistance of Pay Governance, the Compensation Committee generally evaluates the named executive officer’s compensation and pay mix against the Company’s peer group. The information provided to the Compensation Committee includes items such as base salary, bonuses (both annual and long-term incentives), and equity-based awards. The Compensation Committee takes into account the historical trend of each element of compensation, the analysis previously prepared by Pay Governance, and the total compensation for each year in connection with its decision about proposed compensation amounts. The Compensation Committee sets all compensation with regard to the CEO of the Company. For the other named executive officers of the Company, the Compensation Committee receives recommendations from the CEO which it considers when setting compensation for these individuals. The Compensation Committee members also informally communicate with others in their own marketplaces to compare salaries and compensation packages.

The Compensation Committee has the authority to engage compensation consultants to assist with designing compensation for the named executive officers. The Compensation Committee consulted with Pay Governance in 2018, which analyzed and made recommendations with respect to the Company’s compensation of its named executive officers. The Compensation Committee has assessed the independence of Pay Governance, as required under NYSE listing rules. The Compensation Committee is not aware of any conflict of interest that has been raised by the work previously performed by Pay Governance. As the Company is a manufacturer in the off-highway industry, the Company utilized a selected peer group that includes nineteen public companies in the manufacturing and industrial business. The size of a company is also considered when selecting it for the peer group. For 2021, there were no changes to the selected peer group. The companies chosen for comparison include the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| Alamo Group, Inc. | | | Commercial Vehicle Group, Inc. | | | Graco Inc. | | | Park-Ohio Holdings Corp. | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Applied Industrial Technologies, Inc. | | | DXP Enterprises, Inc. | | | ITT Inc. | | | Stoneridge, Inc. | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Barnes Group Inc. | | | Enerpac Tool Group Corp. | | | Lindsay Corporation | | | Valmont Industries, Inc. | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| EnPro Industries, Inc. | | | Federal Signal Corporation | | | Wabash National Corporation | | | Chart Industries, Inc. | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Materion Corporation | | | Modine Manufacturing Company | | | Watts Water Technologies, Inc. | | | | |

| | | | | | | | | | | |

The Compensation Committee recognizes other companies may use different types of calculations and matrices to decide what a compensation package should contain. However, the Compensation Committee believes any package that uses only such formulas and matrices may not be a complete representation of the Company’s performance. The Compensation Committee's members use their extensive business experience and judgment, including reviewing competitive compensation information obtained from public information to evaluate and determine the Company's executive compensation packages in addition to performance measures. While the Compensation Committee considers the executive compensation information for the group previously obtained through Pay Governance, the Compensation Committee does not focus on aligning the compensation for the Company’s executives to any specified percentage or level of the executive compensation for companies in the group (and therefore does not technically "benchmark" executive compensation). The Compensation Committee's philosophy of evaluating the overall Company performance, not just using numeric measurement criteria, allows the Compensation Committee greater flexibility in carrying out its duties.

The Compensation Committee may grant performance awards as part of an executive officer’s compensation package. Generally, performance awards require satisfaction of pre-established performance goals, consisting of one or more business criteria and one or more targeted performance level with respect to such criteria as a condition of awards being granted, becoming exercisable or settled, or as a condition to accelerating the timing of such events. Performance may be measured over a period of any length specified by the Compensation Committee. Additional detail regarding 2021 performance measures used by the Compensation Committee in connection with establishing named executive officer compensation for 2021 can be found under “Incentive Compensation” below.

In setting compensation packages, including performance-based incentives, the Compensation Committee considers the provisions of its incentive programs. The Compensation Committee takes into account whether or not stock-based compensation is to be given as part of the executives' compensation package. The performance goals under the Company’s incentive programs are designed using recommendations from the Company’s compensation consultant and the Compensation Committee's business experience and judgment to best align executive compensation with the Company's actual performance.

The Company conducts a stockholder outreach program through which the Company interacts with stockholders on a number of matters throughout the year, including executive compensation. The compensation paid to the Company's named executive officers disclosed in the Company's 2021 Proxy Statement was approved by approximately 52% of the shares present in person or represented by proxy at the 2021 annual meeting of stockholders, which reflects, in the view of the Compensation Committee, the benefit of that outreach. The Committee believes that the existing compensation program continues to attract, retain and appropriately incentivize senior management. As a result, the Compensation Committee chose not to make any substantial changes to the existing executive compensation program for 2021 specifically in response to the 2021 say-on-pay voting results.

SALARY LEVEL CONSIDERATIONS