Current Report Filing (8-k)

06 Janeiro 2023 - 6:06PM

Edgar (US Regulatory)

0001138978

false

0001138978

2022-12-30

2022-12-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest reported): December 30, 2022

Novo

Integrated Sciences, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-40089 |

|

59-3691650 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

Number) |

11120

NE 2nd Street, Suite 200, Bellevue, WA 98004

(Address

of principal executive offices)

(206)

617-9797

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2.)

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CF$ 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on which Registered |

| N/A |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

As

previously disclosed in a Current Report on Form 8-K filed on December 30, 2022 by Novo Integrated Sciences, Inc. (the “Company”),

on December 23, 2022, the Company, SwagCheck Inc. (“SWAG”), and all SWAG shareholders (collectively, the “SWAG Shareholders”)

entered into that certain Share Purchase Agreement (the “SWAG Agreement”). Pursuant to the terms of the SWAG Agreement, the

Company agreed to purchase, and the SWAG Shareholders agreed to sell to the Company, 100% of the outstanding shares of SWAG in exchange

for $1.00 (the “SWAG Purchase”). SWAG holds a specific right of purchase of a precious gem collection (the “Gems”)

as provided for in an agreement between SWAG and a Court-appointed Successor Receiver for the United States District Court for the Central

District of California (the “Receiver”).

In

addition to certain customary closing conditions in the SWAG Agreement, the obligations of SWAG and the SWAG Shareholders to consummate

the closing of the SWAG Purchase were subject to the satisfaction (or waiver by any of SWAG or the SWAG Shareholders), at or before the

closing date, of certain conditions, including that (i) the Company will have provided SWAG with a binding letter of intent (a “LOI”)

by a competent financing party for financing in the amount of at least $90 million by December 27, 2022 with a closing date no later

than December 30, 2022, (ii) $60 million will be distributed directly to the Receiver for the purchase of the Gems by SWAG, and (iii)

$30 million is a mark-up to be distributed for the benefit of the outgoing SWAG Shareholders.

On

December 30, 2022, the Company, SWAG and the SWAG Shareholders entered into Amendment No. 1 to the SWAG Agreement (the “SWAG Amendment”).

Pursuant to the terms of the SWAG Amendment, the parties agreed as follows:

| ● | The

closing of the SWAG Purchase will occur no later than January 10, 2023, with all contemplated

extensions being subject to the Receiver’s stipulations, conditions, and limitations. |

| ● | The

condition for the Company to provide SWAG with a binding LOI has been deleted. |

| ● | A

total of $92 million will be distributed as follows: (i) $60 million will be distributed

to the Receiver for the purchase of the Gems by SWAG, and (ii) a $32 million mark-up will

be distributed directly for the benefit of the outgoing SWAG Shareholders. |

Following

the closing of SWAG Purchase, SWAG will be a wholly owned subsidiary of the Company and will own title to the Gems, which the Company

intends to either collateralize or sell to raise capital.

The

foregoing description of the SWAG Amendment does not purport to be complete and is qualified in its entirety by the actual SWAG Amendment,

a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Novo

Integrated Sciences, Inc. |

| |

|

|

| Dated:

January 6, 2023 |

By: |

/s/

Robert Mattacchione |

| |

|

Robert

Mattacchione |

| |

|

Chief

Executive Officer |

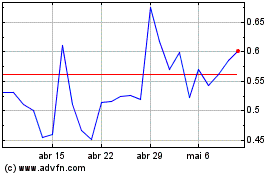

Novo Integrated Sciences (NASDAQ:NVOS)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Novo Integrated Sciences (NASDAQ:NVOS)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025