Current Report Filing (8-k)

30 Janeiro 2023 - 6:32PM

Edgar (US Regulatory)

0001138978

false

0001138978

2023-01-25

2023-01-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest reported): January 25, 2023

Novo

Integrated Sciences, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-40089 |

|

59-3691650 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

Number) |

11120

NE 2nd Street, Suite 200, Bellevue, WA 98004

(Address

of principal executive offices)

(206)

617-9797

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2.)

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CF$ 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on which Registered |

| N/A |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

As

previously disclosed in the Current Report on Form 8-K filed with the Securities and Exchange Commission on December 21, 2022 by Novo

Integrated Sciences, Inc. (the “Company”), on December 15, 2022, the Company received a notice on December 15, 2022 (the

“December Nasdaq Notice”) from the Listing Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq”)

advising the Company that it was not in compliance with Nasdaq’s continued listing requirements under Nasdaq Listing Rule 5250(c)(1)

(the “Rule”) as a result of its failure to timely file its Annual Report on Form 10-K for the fiscal year ended August 31,

2022 (the “Form 10-K”). On January 26, 2023, the Company reported that it received a notice (the “January Nasdaq Notice”)

on January 25, 2023 from Nasdaq advising the Company that it was not in compliance with Nasdaq’s continued listing requirements

under the Rule as a result of its failure to timely file the Form 10-K and its Quarterly Report on Form 10-Q for the fiscal quarter ended

November 30, 2022 (the “Form 10-Q”).

Per

the January Nasdaq Notice and in accordance with the December Nasdaq Notice, the Company has 60 calendar days from receipt of the December

Nasdaq Notice or until February 13, 2023, to submit a plan to regain compliance with the Rule with the respect to the Form 10-K and the

Form 10-Q. If Nasdaq accepts the Company’s plan, then Nasdaq may grant an exception of up to 180 calendar days from the due date

of the Form 10-K, or until June 12, 2023, to regain compliance.

The

Company intends to file the Form 10-K and the Form 10-Q as promptly as possible in order to regain compliance with the Rule. However,

if the Company does not submit the Form 10-K and the Form 10-Q by February 13, 2023, the Company will submit a plan by such date to Nasdaq

that outlines, as definitively as possible, the steps the Company will take to promptly file the Form 10-K and/or the Form 10-Q, as applicable,

and regain compliance.

Item

3.02. Unregistered Sales of Equity Securities.

Between

January 26, 2023 and January 30, 2023, the Company issued 39,397,034 shares of common stock to certain note holders upon conversion

of their notes. Following such issuances, as of January 30, 2023, the Company’s issued and outstanding common share count

is 128,258,227.

As

of January 30, 2023, the principal balance owed by the Company pursuant to the senior secured convertible note, dated as of December

14, 2021, as amended, issued by the Company to Hudson Bay Master Fund Ltd. is $300,000.00, and the principal balance owed by the Company

pursuant to the senior secured convertible note, dated as of December 14, 2021, as amended, issued by the Company to CVI Investments,

Inc. is $6,110.75.

Item

7.01. Regulation FD Disclosure.

On

January 30, 2023, the Company issued a press release regarding the January Nasdaq Notice. A copy of the foregoing press release is attached

as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

The

information included in this Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that

section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or

the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. The information set forth under this

Item 7.01 shall not be deemed an admission as to the materiality of any information in this Current Report on Form 8-K that is required

to be disclosed solely to satisfy the requirements of Regulation FD.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Novo

Integrated Sciences, Inc. |

| |

|

|

| Dated:

January 30, 2023 |

By: |

/s/

Robert Mattacchione |

| |

|

Robert

Mattacchione |

| |

|

Chief

Executive Officer |

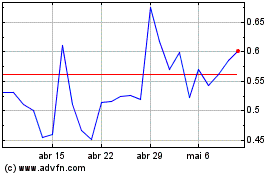

Novo Integrated Sciences (NASDAQ:NVOS)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Novo Integrated Sciences (NASDAQ:NVOS)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025