Current Report Filing (8-k)

06 Março 2023 - 11:45AM

Edgar (US Regulatory)

0001040971

false

¨

0001040971

2023-03-02

2023-03-02

0001040971

slg:SLGreenOperatingPartnershipLPMember

2023-03-02

2023-03-02

0001040971

us-gaap:CommonStockMember

2023-03-02

2023-03-02

0001040971

slg:SeriesIPreferredStockMember

2023-03-02

2023-03-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

Common Stock

| |

|

| CIK |

0001492869 |

| Addess Line 1 |

One Vanderbilt Avenue |

| City |

New York |

| State |

New York |

| Postal Code |

10017 |

| Document Period Date |

March 2, 2023 |

| Form Type |

8-K |

| City Area Code |

212 |

| Local Phone Number |

594-2700 |

| Writing Communication |

¨ |

| Soliciting Material |

¨ |

| Pre commencement Tender Offer |

¨ |

| Pre commencement Issuer Tender Offer |

¨ |

| Emerging Growth Company |

¨ |

| Amendment Flag |

¨ |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

March 2, 2023

SL GREEN REALTY CORP.

SL GREEN OPERATING PARTNERSHIP, L.P.

(Exact Name of Registrant as Specified in Charter)

| Maryland |

1-13199 |

13-3956775 |

(State or Other

Jurisdiction of Incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

| Delaware |

333-167793-02 |

13-3960398 |

(State or Other

Jurisdiction of Incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

| |

One Vanderbilt Avenue

New York, New York 10017

(Address of principal executive offices, including zip code) |

|

(212) 594-2700

(Registrant’s

telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2.):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Registrant |

|

Trading Symbol |

|

Title of Each Class |

|

Name of Each Exchange on

Which Registered |

| SL

Green Realty Corp. |

|

SLG |

|

Common Stock, $0.01 par value |

|

New York Stock Exchange |

| SL

Green Realty Corp. |

|

SLG.PRI |

|

6.500%

Series I Cumulative Redeemable Preferred Stock, $0.01 par value |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ¨

Item 5.02. Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Extension of Matthew DiLiberto as Chief Financial Officer

On

March 2, 2023 Matthew DiLiberto and SL Green Realty Corp. (the “Company”) agreed to extend Mr. DiLiberto’s

term as Chief Financial Officer, effective as of January 1, 2023, for an additional three years through January 1, 2026.

The following summarizes the material terms of the new agreement entered

into by the Company and Mr. DiLiberto in connection with this extension:

| Term: |

|

Three years (1/1/23 — 1/1/26). In the event that a Change-in-Control occurs within 18 months prior to the scheduled expiration of the term, Mr. DiLiberto may extend the term until the date that is 18 months after the Change-in-Control. |

| |

|

|

| Base Salary: |

|

$600,000 per year. |

| |

|

|

| Annual Bonus: |

|

Opportunity to earn 50-250% of base salary, based (i) 60% on a formulaic component based upon the achievement of specific goals established in advance by the Compensation Committee of the Board of Directors of the Company (the “Compensation Committee”) and (ii) 40% on a discretionary component at the Compensation Committee’s discretion. The amount earned may be paid in cash or equity at the discretion of the Compensation Committee. |

| |

|

|

| Annual Time-Based Awards: |

|

Beginning in 2023, Mr. DiLiberto will be eligible to receive an annual award of time-based LTIP units, with an equal amount of each award vesting on each January 1st following such award during the remainder of the term of the employment agreement (i.e., awards made in 2023, 2024 and 2025 will vest over approximately three years, two years and one year, respectively). The value of the award each year will be determined by the Compensation Committee based on its evaluation of Mr. DiLiberto’s performance during the prior year, provided that the amount for target performance will not be less than $1,400,000. The award made in 2023 will be granted upon execution of the agreement, and grants in subsequent years will be made in January of each year. Each award will provide for full acceleration upon a termination of Mr. DiLiberto’s employment without Cause or for Good Reason, whether during or after the term of the employment agreement, or upon Mr. DiLiberto’s resignation following expiration of the term. |

| |

|

|

| Severance Benefits: |

|

If Mr. DiLiberto’s employment is terminated by the Company without Cause or by Mr. DiLiberto for Good Reason during the term, Mr. DiLiberto will be entitled to the following payments or benefits: |

| |

|

|

|

|

| |

|

Termination Without Change-in-Control |

|

Termination in Connection with Change-in-Control |

| |

|

|

|

| |

· The

sum of base salary and average annual bonus for prior three years

· The

target value of the annual time-based equity awards to be granted in January 2024 and 2025, to the extent not yet granted

· Pro-rata

bonus for partial year

· Acceleration

of all unvested equity awards (other than performance-based awards)

· 12

months of benefit continuation payments |

|

· 2x

the sum of base salary and average annual bonus for prior three years

· The

target value of the annual time-based equity awards to be granted in January 2024 and 2025, to the extent not yet granted

· Pro-rata

bonus for partial year

· Acceleration

of all unvested equity awards (other than performance-based awards

· 24

months of benefit continuation payments |

| Termination After Term: |

|

In connection with a qualifying termination following the term of employment, Mr. DiLiberto will be entitled to receive one-half the sum of his then-current base salary and his average annual bonus for the prior three years, payable upon completion of a six-month non-compete. |

| Restrictive Covenants: |

|

Mr. DiLiberto will not compete with the Company while employed (including after the end of the term of employment if employment continues) and until 6 months after any termination of employment, including if such termination is upon or after the expiration of the term of employment. Mr. DiLiberto has also agreed to non-solicitation, non-disparagement and non-interference covenants. |

In the event of a Change-in-Control, the employment agreement also

provides for Mr. DiLiberto to receive a prorated cash bonus based on Mr. DiLiberto’s average annual bonus for the prior

three years, which will offset any prorated bonus that Mr. DiLiberto would be entitled to receive upon termination in connection

with the Change-in-Control, and, to the extent Mr. DiLiberto remains employed following the Change-in-Control and unless otherwise

agreed, for cash compensation for future periods equal to Mr. DiLiberto’s average annual bonus for the three fiscal years prior

to the Change-in-Control and target amounts for all other cash and equity compensation in lieu of the compensation otherwise provided.

The employment agreement also provides for certain payments and benefits if Mr. DiLiberto’s employment is terminated due to

death or disability.

The terms Cause, Good Reason and Change-in-Control, as used above,

are specifically defined in Mr. DiLiberto’s new employment agreement. The discussion above is qualified in its entirety by

reference to the copy of the employment agreement by and between the Company and Mr. DiLiberto, which is being filed with this Current

Report on Form 8-K as Exhibit 10.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SL GREEN REALTY CORP. |

| |

|

| |

By: |

/s/ Andrew S. Levine |

| |

Name: |

Andrew S. Levine |

| |

Title: |

Executive Vice President, Chief Legal Officer and General Counsel |

| |

SL GREEN OPERATING PARTNERSHIP, L.P. |

| |

|

| |

By: SL GREEN REALTY CORP., its general partner |

| |

|

| |

By: |

/s/ Andrew S. Levine |

| |

Name: |

Andrew S. Levine |

| |

Title: |

Executive Vice President, Chief Legal Officer and General Counsel |

Date: March 6, 2023

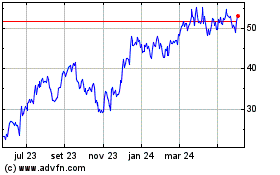

SL Green Realty (NYSE:SLG)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

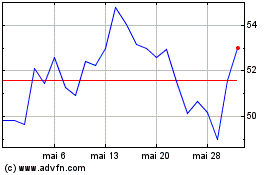

SL Green Realty (NYSE:SLG)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025