UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

(Amendment No.)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Under Rule 14a-12

| | | | | | | | | | | | | | |

| BIGLARI HOLDINGS INC. |

| (Name of Registrant as Specified in Its Charter) |

| | | | | | | | | | | | | | |

| N/A |

| (Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)Title of each class of securities to which transactions applies:

(2)Aggregate number of securities to which transaction applies:

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it is determined):

(4)Proposed maximum aggregate value of transaction:

(5)Total fee paid:

☐ Fee paid previously with preliminary materials:

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1)Amount previously paid:

(2)Form, Schedule or Registration Statement No.:

(3)Filing Party:

(4)Date Filed:

BIGLARI HOLDINGS INC.

19100 RIDGEWOOD PARKWAY, SUITE 1200

SAN ANTONIO, TEXAS 78259

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

April 20, 2023

To the Shareholders:

You are cordially invited to attend the annual meeting (the “Annual Meeting”) of the shareholders of Biglari Holdings Inc. (the “Corporation” or “Biglari Holdings”), to be held at the Majestic Theatre, 224 East Houston Street, San Antonio, Texas 78205, on April 20, 2023, at 1:00 p.m. Central Daylight Time, for the following purposes:

1.To elect directors.

2.To ratify the selection by the Audit Committee of the Board of Directors (the “Board”) of Deloitte & Touche LLP as the Corporation’s independent registered public accounting firm for 2023.

3.To transact such other business as may properly be brought before the Annual Meeting or any adjournment or postponement thereof.

The Board has fixed the close of business on March 7, 2023, as the record date for determining which shareholders have the right to vote at the Annual Meeting or at any adjournment thereof.

You may vote either by telephone or by internet by following the instructions on the enclosed proxy card, or sign, date, and return the enclosed proxy card in the postage-paid envelope provided. If you are a beneficial owner or you hold your shares in “street name,” please follow the voting instructions provided by your bank, broker, or other nominee.

We look forward to seeing you at the Annual Meeting.

By order of the Board of Directors

SARDAR BIGLARI, Chairman

San Antonio, Texas

March 27, 2023

| | | | | | | | | | | | | | | | | | | | |

| If you are a shareholder and plan to attend the meeting, you must present an admission ticket, which can be obtained by registering in advance of the meeting at proxyvote.com/register. Shareholders may bring up to two guests; however, each guest must also be registered by the shareholder at proxyvote.com/register. Shareholders and their guests must present their admission ticket for admittance to the meeting at the Majestic Theatre. Seating will begin at 11:45 a.m. Cameras, recording devices, and other electronic devices will not be permitted at the meeting. | |

BIGLARI HOLDINGS INC.

19100 RIDGEWOOD PARKWAY, SUITE 1200

SAN ANTONIO, TEXAS 78259

PROXY STATEMENT FOR

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 20, 2023

This proxy statement is furnished in connection with the solicitation by the Board of Directors (the “Board”) of Biglari Holdings Inc. (hereinafter “we,” “our,” “Biglari Holdings,” “Corporation,” or “Company”) of proxies in the accompanying form for the Annual Meeting of Shareholders, to be held at the Majestic Theatre, 224 East Houston Street, San Antonio, Texas 78205, on April 20, 2023, at 1:00 p.m. Central Daylight Time, or at any adjournment or postponement thereof (the “Annual Meeting”).

GENERAL INFORMATION

This proxy statement and the enclosed form of proxy are first being sent to shareholders on or about March 28, 2023. If the form of proxy enclosed herewith is executed and returned as requested, it may nevertheless be revoked at any time prior to exercise by filing an instrument revoking it with our Corporate Secretary or submitting a duly executed proxy bearing a later date. Solicitation of proxies is made by the Corporation and will be made solely by mail at the Corporation’s expense. The Corporation will reimburse brokerage firms, banks, trustees, and others for their actual out-of-pocket expenses in forwarding proxy material to the beneficial owners of its common stock.

As of the close of business on March 7, 2023, the record date for the Annual Meeting, the Corporation had outstanding and entitled to vote 206,864.1 shares of Class A common stock. Only shareholders of record of Class A common stock at the close of business on March 7, 2023, are entitled to vote at the Annual Meeting or at any adjournment thereof. Each share of Class A common stock is entitled to one vote per share on all matters submitted to a vote of shareholders of the Corporation.

The presence at the meeting, in person or by proxy, of shareholders of Class A common stock holding, in the aggregate, a majority of the voting power of the Corporation’s Class A common stock and entitled to vote, shall constitute a quorum for the transaction of business.

A plurality of the votes properly cast for the election of directors by the holders of Class A common stock attending the meeting, in person or by proxy, will elect directors to office. The affirmative vote of a majority of the holders of Class A common stock present, in person or by proxy, is required to approve Proposal 2, ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2023.

Shareholders may vote “FOR” or “WITHHOLD” a vote for the election of directors; and “FOR,” “AGAINST,” or “ABSTAIN” with respect to each other proposal submitted to shareholders at the Annual Meeting. Abstentions will count for purposes of establishing a quorum, but will not count as votes cast on a proposal. Accordingly, abstentions will have no effect on the election of directors and are the equivalent of an “against” vote on Proposal 2. Broker non-votes will also count for purposes of establishing a quorum, but will not count as votes cast for the election of directors and accordingly will have no effect. Since the proposal to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2023 is a “routine” matter under applicable rules, your broker may vote your

shares for you on this proposal absent any other instructions from you. Shareholders who send in proxies but attend the meeting in person may vote directly, if they prefer, and withdraw their proxies, or may allow their proxies to be voted with proxies sent in by other shareholders.

If you are a shareholder and plan to attend the meeting, you must present an admission ticket, which can be obtained by registering in advance of the meeting at proxyvote.com/register. Shareholders may bring up to two guests; however, each guest must also be registered by the shareholder at proxyvote.com/register. Shareholders and their guests must each present an admission ticket for admittance to the meeting. If you do not have an admission ticket, you will not be admitted to the meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING, TO BE HELD ON APRIL 20, 2023.

The Proxy Statement for the Annual Meeting of Shareholders, to be held on April 20, 2023, and the Corporation’s 2022 Annual Report to Shareholders are available at biglariholdings.com and proxyvote.com.

PROPOSAL ONE:

ELECTION OF DIRECTORS

Director Nominees

At the Annual Meeting, a Board consisting of six members will be elected until the next annual meeting. The members of the Board have nominated for election as directors of the Corporation the following six individuals, three of whom are “independent” within the meaning of the listing standards of the New York Stock Exchange. Certain information with respect to nominees for election as directors follows:

SARDAR BIGLARI, age 45, has been Chairman and Chief Executive Officer of Biglari Holdings since 2008. In addition, Mr. Biglari has served as Chairman and Chief Executive Officer of Biglari Capital Corp. (“Biglari Capital”) since 2000. Biglari Capital is the general partner of The Lion Fund, L.P., and The Lion Fund II, L.P., private investment partnerships. Mr. Biglari is an entrepreneur with managerial and investing experience in a broad range of businesses.

PHILIP L. COOLEY, age 79, has been a director of the Corporation since 2008 and Vice Chairman of the Board of Directors since 2009. Between 1985 and 2012, he was the Prassel Distinguished Professor of Business at Trinity University, San Antonio, Texas. He has also served as an advisory director of Biglari Capital since 2000. Mr. Cooley has broad business and investment experience.

RUTH J. PERSON, age 77, has been a director of the predecessor corporation since 2002. Between 2008 and 2014, she was Chancellor, University of Michigan-Flint, and Professor of Management from 2008 to the present. Ms. Person has years of experience in leadership and board positions at various institutions.

KENNETH R. COOPER, age 78, has been a director of the Corporation since October 2010. He has been an attorney in the private law practice of the Kenneth R. Cooper Law Office since 1974. Mr. Cooper has experience in real estate and business matters.

JOHN G. CARDWELL, age 77, has been a director of the Corporation since October 2019. Between 1986 and 2008, he held various positions with Johnson Controls Inc. Mr. Cardwell has over 40 years of experience in corporate management.

EDMUND B. CAMPBELL, III, age 62, has been a director of the Corporation since May 2021. He is the founder of First Guard Insurance Company, a wholly owned Biglari Holdings subsidiary, since 2014. He is the Executive Chairman of First Guard Insurance Company and was its Chief Executive Officer between 1997 and March 2021. Mr. Campbell has over 35 years of experience in the insurance business.

The Board has concluded that the following directors are independent in accordance with the director independence standards of the New York Stock Exchange, and has determined that none of them has a material relationship with the Corporation which would impair his or her independence from management or otherwise compromise his or her ability to act as an independent director: Kenneth R. Cooper, Ruth J. Person, and John G. Cardwell.

When the accompanying proxy card is properly executed and returned, the shares it represents will be voted in accordance with the directions indicated thereon or, if no direction is indicated, the shares will be voted FOR the election of the six nominees identified above. Each of our nominees has consented to being named in this proxy statement and has agreed to serve, if elected. The Corporation expects each nominee to be able to serve if elected, but if any nominee notifies the Corporation before the Annual Meeting that he or she is unable to do so, then the proxies will be voted for the remainder of those nominated and, as designated by the directors, may be voted (i) for a substitute nominee or nominees or (ii) to elect such lesser number to constitute the whole Board as equals the number of nominees who are able to serve.

Our Board unanimously recommends that shareholders vote FOR each of the Company’s six nominees for Director.

Board Meetings, Committees, and Nominations

The Board held four meetings during 2022. Each director attended at least 75% of all meetings of the Board and attended each meeting of the committees of the Board on which he or she served. Directors are encouraged but not required to attend annual meetings of the Corporation’s shareholders. The Board of Directors has not named a lead independent director. A meeting of non-management directors was held in 2022. Kenneth R. Cooper presided as ad hoc chair of the meeting.

The Board has established an Audit Committee in accordance with Section 3(a)(58)A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The 2022 Audit Committee consisted of Kenneth R. Cooper, John G. Cardwell, and Ruth J. Person. The Board determined that each of John G. Cardwell and Ruth J. Person meets the definition of “audit committee financial expert” as that term is used in Item 407(d)(5) of Regulation S-K promulgated under the Securities Act of 1933, as amended (the “Securities Act”). All current members of the Audit Committee meet the criteria for independence set forth in Rule 10A-3 under the Exchange Act and in Section 303A of the New York Stock Exchange Listed Company Manual. The Audit Committee assists the Board with oversight of (a) the integrity of the Corporation’s financial statements; (b) the Corporation’s compliance with legal and regulatory requirements; and (c) the qualifications and independence of the Corporation’s independent public accountants and the Corporation’s internal audit function. The Audit Committee meets periodically with the Corporation’s independent public accountants, internal auditors, and members of management and reviews the Corporation’s accounting policies and internal controls. The Audit Committee also selects the firm of independent public accountants to be retained by the Corporation to perform the audit.

The Audit Committee held five meetings during 2022. The Audit Committee Charter is available on the Corporation’s website at biglariholdings.com. The Audit Committee Charter may also be obtained at no charge by written request to the attention of the Secretary of the Corporation at 19100 Ridgewood Parkway, Suite 1200, San Antonio, Texas 78259.

We are a “controlled company” within the meaning of the New York Stock Exchange rules and thus can rely on exemptions from certain corporate governance requirements. As a result, we are not required to comply with certain director independence and board committee requirements. The Company does not have a governance and nominating committee.

The Board has established a Compensation Committee and adopted a charter to define and outline the responsibilities of its members. The Compensation Committee assists the Board by setting the compensation of the Chief Executive Officer and performing other compensation oversight, as well as reviewing related person transactions. A copy of the Compensation Committee Charter is available on the Corporation’s website at biglariholdings.com and may also be obtained at no charge by written request to the attention of the Secretary of the Corporation at 19100 Ridgewood Parkway, Suite 1200, San Antonio, Texas 78259. The 2022 Compensation Committee consisted of Kenneth R. Cooper, John G. Cardwell, and Ruth J. Person, all of whom are independent directors in accordance with the New York Stock Exchange director independence standards. The Compensation Committee held one meeting during 2022.

The Company does not have a formal policy regarding the consideration of diversity, however defined, in identifying nominees for director. Instead, in identifying director nominees, the Board looks for individuals who possess integrity, ownership mentality, business expertise, and enterprise qualities that support an entrepreneurial culture.

The Company has a policy under which it will consider recommendations presented by shareholders. A shareholder wishing to submit such a recommendation should send a letter to the Secretary of the Corporation at 19100 Ridgewood Parkway, Suite 1200, San Antonio, Texas 78259. The mailing envelope must contain a clear notation that the enclosed letter is a “Director Nominee Recommendation.” The Director Nominee Recommendation must be delivered to us not later than the 90th day nor earlier than the 120th day prior to the first anniversary of the preceding year’s annual meeting. The letter must identify the author as a shareholder and provide a brief summary of the candidate’s qualifications. At a minimum, candidates recommended for nomination to the Board must meet the director independence standards of the New York Stock Exchange. The Company’s policy provides that candidates recommended by shareholders will be evaluated using the same criteria as are applied to all other candidates.

Board Leadership Structure and Role in Risk Oversight

Sardar Biglari is the Corporation’s Chairman of the Board and Chief Executive Officer as well as its controlling shareholder. The Corporation is a holding company owning subsidiaries engaged in a number of diverse business activities, including property and casualty insurance, licensing and media, restaurants, and oil and gas. All major investment and capital allocation decisions are made for the Company and its subsidiaries by Mr. Biglari. Because of Biglari Holdings’ corporate structure and the centralization of its capital allocation decisions, it is most effective for the Corporation to designate Mr. Biglari as both its Chairman and its Chief Executive. Mr. Biglari beneficially owns shares of the Corporation representing approximately 66.3% of the economic interest and 70.4% of the voting interest.

The full Board has responsibility for general oversight of relevant risks. Mr. Biglari bears responsibility for managing various risks faced by the Company. Furthermore, Mr. Biglari reviews with the Board relevant possible risks. In addition, as part of its Charter, the Audit Committee reviews and discusses the Corporation’s policies concerning risk assessment and risk management.

Director Compensation

Directors of Biglari Holdings do not receive grants of Company stock. We do not issue stock options or restricted stock. Our view is that if directors wish to own Company stock, they, like all other shareholders, can purchase shares in the open market. Biglari Holdings does not provide directors and officers liability insurance to its directors.

Directors of the Corporation who are employees do not receive fees for attendance at directors’ meetings. In 2023, a director who is not an employee will receive an annual cash retainer of $90,000, and the Chair of the Audit and Compensation Committees will receive an additional annual cash retainer of $10,000. For his role as Vice Chairman of the Board and other duties, Dr. Cooley will receive an annual cash retainer of $270,000.

The following table provides compensation information for 2022 for each non-management member of the Board who served on the Board during the year.

| | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash | | All Other Compensation | | Total |

| Philip L. Cooley | | $ | 245,000 | | | $ | — | | | $ | 245,000 | |

| Kenneth R. Cooper | | $ | 86,667 | | | $ | — | | | $ | 86,667 | |

| John G. Cardwell | | $ | 76,667 | | | $ | — | | | $ | 76,667 | |

| Ruth J. Person | | $ | 76,667 | | | $ | — | | | $ | 76,667 | |

| Edmund B. Campbell, III | | $ | — | | | $ | — | | | $ | — | |

Meetings of Independent Directors

The Audit and Compensation Committees are composed of independent directors of the Company. The Audit Committee held five meetings and the Compensation Committee held one meeting during 2022. In addition, a meeting of non-management directors was held during 2022. A shareholder or other interested party wishing to contact the independent directors, as applicable, should send a letter to the Secretary of the Corporation at 19100 Ridgewood Parkway, Suite 1200, San Antonio, Texas 78259. The mailing envelope should contain a clear notation that the enclosed letter is to be forwarded to the Corporation’s independent directors.

Shareholder Communications with the Board

Shareholders who wish to communicate with the Board or a particular director may send a letter to the Secretary of the Corporation at 19100 Ridgewood Parkway, Suite 1200, San Antonio, Texas 78259. The mailing envelope should contain a clear notation that the enclosed letter is a “Shareholder-Board Communication” or “Shareholder-Director Communication.” All such letters should identify the author as a shareholder and clearly state whether the intended recipients are all members of the Board or just certain specified individual directors. The Secretary will make copies of all such letters and circulate them to the appropriate director or directors.

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines to promote effective governance of the Corporation. The Corporate Governance Guidelines are available on the Corporation’s website at biglariholdings.com. A copy of the Corporate Governance Guidelines may also be obtained at no charge by written request to the attention of the Secretary of the Corporation at 19100 Ridgewood Parkway, Suite 1200, San Antonio, Texas 78259.

Code of Business Conduct and Ethics

The Corporation has adopted a Code of Conduct for all directors, officers, and employees as well as directors, officers, and employees of each of its subsidiaries. The Code of Conduct is available on the Corporation’s website at biglariholdings.com. A copy of the Code of Conduct may also be obtained at no charge by written request to the attention of the Secretary of the Corporation at 19100 Ridgewood Parkway, Suite 1200, San Antonio, Texas 78259. The Corporation intends to satisfy the disclosure requirement under Item 5.05 of Form 8-K or applicable New York Stock Exchange rules regarding any amendment to, or waiver from, a provision of the Code of Conduct, if any, either by posting such information on the Corporation’s website at biglariholdings.com or by filing a Current Report on Form 8-K with the Securities and Exchange Commission.

Executive Officers

Our executive officers are appointed annually by the Board, or at such interim times as circumstances may require. Other than Mr. Biglari, the only executive officer of the Corporation during 2022 was Bruce Lewis.

Mr. Lewis, age 58, joined the Company as its Controller in January 2012.

PROPOSAL TWO:

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The Audit Committee has selected Deloitte & Touche LLP as our independent registered public accounting firm for 2023. Deloitte & Touche LLP has served in that capacity since fiscal 2003. A representative of Deloitte & Touche LLP will be present at the Annual Meeting, will have an opportunity to make a statement if he or she desires to do so, and will be available to respond to questions.

If the shareholders do not ratify the selection of Deloitte & Touche LLP, the Audit Committee will reconsider its choice, taking into consideration the views of the shareholders, and may (but will not be required to) appoint a different firm to serve in that capacity for 2023.

Required Vote

If a quorum is present, approval of the ratification of Deloitte & Touche LLP as the Corporation’s independent registered public accounting firm for 2023 will require the affirmative vote of the holders of a majority of the Class A common stock present in person or represented by proxy and entitled to vote at the Annual Meeting.

Our Board unanimously recommends that shareholders vote FOR the ratification of the selection by the Audit Committee of Deloitte & Touche LLP as the Corporation’s independent registered public accounting firm for 2023.

Properly dated and signed proxies will be so voted unless shareholders specify otherwise.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The Compensation Discussion and Analysis is designed to provide shareholders with a better understanding of our compensation philosophy. It explains the compensation-related actions taken regarding the executive officers identified in the Summary Compensation Table (the “Named Executive Officers”).

Biglari Holdings is not a conventional company. As a result, our compensation system is unconventional and idiosyncratic to Biglari Holdings. The Company is composed of two distinct components: operating businesses and investments. Our compensation system is, therefore, broken into two segments, one for operations and the other for investments.

The Company conducts its operations through its subsidiaries: Steak n Shake Inc., Western Sizzlin Corporation, First Guard Insurance Company, Southern Oil Company, Southern Pioneer Property & Casualty Insurance Company, Maxim Inc., and Abraxas Petroleum Corporation. As CEO of Biglari Holdings, Mr. Biglari oversees the Company’s operating businesses; his incentive compensation is tied to the performance of these operating businesses. Mr. Biglari’s compensation is reviewed annually by the Compensation Committee of the Corporation’s Board of Directors (the “Committee”). Because Mr. Biglari wishes that his salary remain unchanged, his annual salary has been $900,000 since 2009, and Mr. Biglari has advised the Committee that he would not expect or desire such salary to increase in the future.

In most conventional companies of comparable size, the Committee believes that the CEO would have asked for - and received - far higher total compensation. In addition, Mr. Biglari does not have a severance agreement, a change-in-control arrangement, or an employment agreement with the Company, and has been granted neither stock options nor restricted stock awards by the Company. The Board believes its unconventional compensation system is a rational one, creating less, not more, enterprise risk.

In designing the Company’s incentive agreement (the “Incentive Agreement”), the Committee believes it is most appropriate to determine Mr. Biglari’s compensation for our operating businesses with respect to a return-on-equity methodology.

Summary Compensation Information

The following table discloses the compensation received for the three years ended December 31, 2022, by the Corporation’s Chief Executive Officer and its Controller. Mr. Biglari’s compensation excludes incentive fees (if any) earned through The Lion Fund, L.P., and The Lion Fund II, L.P.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and

Principal

Position | | Year | | Salary | | Bonus | | Non-Equity Incentive | | All Other

Compensation | | Total |

| Sardar Biglari | | 2022 | | $ | 900,000 | | | $ | — | | | $ | — | | | $ | — | | | $ | 900,000 | |

Chairman / Chief | | 2021 | | 900,000 | | | — | | | — | | | — | | | 900,000 | |

Executive Officer | | 2020 | | 900,000 | | | — | | | — | | | — | | | 900,000 | |

| | | | | | | | | | | | |

Bruce Lewis | | 2022 | | $ | 510,000 | | | $ | 530,000 | | | $ | — | | | $ | — | | | $ | 1,040,000 | |

Controller | | 2021 | | 495,000 | | | 510,000 | | | — | | | — | | | 1,005,000 | |

| | 2020 | | 480,000 | | | 500,000 | | | — | | | — | | | 980,000 | |

Narrative Disclosure to Summary Compensation Table

As referenced in the Compensation Discussion and Analysis section, Mr. Biglari, as CEO of Biglari Holdings, oversees the Company’s operating businesses. Fees paid to entities owned by Mr. Biglari in 2022 are fully described under “Related Person Transactions.”

As indicated in the table, for each of the last three years, Mr. Biglari earned a total compensation of $900,000.

Moreover, Mr. Biglari has never sold any stock of Biglari Holdings, with most of his net worth tied to the results of the Company. Many companies issue stock options to CEOs with a limited time horizon, and therefore set a policy on compensation clawback and stock ownership guidelines to mitigate compensation-related risk. The Committee believes that many policies that would be adopted at other companies do not apply to Biglari Holdings because of the ownership structure of our founder-led company. As the controlling shareholder of the Corporation, Mr. Biglari has demonstrated a long-term commitment to the Company, and he would invariably experience a “clawback” as most of his net worth is tied to the destiny of the Corporation’s net worth. The manner in which the high-water mark is calculated in effect creates both deferrals and carryforwards that will prevent performance volatility that could result in undeserved incentive payments. There has not been an incentive payment for the last five years because the Company’s net worth did not exceed the stated high-water mark and hurdle rate.

The Incentive Agreement establishes a performance-based annual incentive payment for Mr. Biglari that is contingent upon the growth in adjusted equity attributable to our operating businesses. Adjustments are made to changes in shareholders’ equity, so the Committee measures only the Company’s economic performance and thus remains unaffected by material non-economic factors. The payout of the incentive agreement is tied to the Corporation’s gain in net worth. The program has proved that our compensation will be far less than the typical arrangement for a company of our size when performance is not exceeding a hurdle in net worth gain. In the long run, the Committee expects that the profits of the Corporation will be reflected in the shareholder return. Thus, the Board finds the compensation arrangement’s alignment of the interests of the Corporation and its founder/CEO to be far superior to that of most companies that issue stock options and awards.

In order for Mr. Biglari to receive any incentive payment, our operating businesses must achieve an annual increase in shareholders’ equity in excess of 6% (the hurdle rate) above the previous highest level (the high-water mark). Mr. Biglari will receive 25% of any incremental book value created above the high-water mark plus the hurdle rate. The high-water mark is established when losses cause book value to decline. Our operating businesses must fully recover their prior losses to overcome the high-water mark. Then a hurdle rate is assessed on the book value before Mr. Biglari becomes eligible to receive an incentive payment.

The high-water mark for 2022 was $8,145,000; the computation is as follows.

| | | | | | | | | | | | | | | | | |

| Net income (loss) | | Net income (loss) of investment partnerships | | Net income (loss) excluding investment partnerships |

| 2018 | $ | 19,392,000 | | | $ | 33,240,000 | | | $ | (13,848,000) | |

| 2019 | 45,380,000 | | | 60,773,000 | | | (15,393,000) | |

| 2020 | (37,989,000) | | | (32,506,000) | | | (5,483,000) | |

| 2021 | 35,478,000 | | | 8,899,000 | | | 26,579,000 | |

| Losses included in 2022 high-water mark | | | | | $ | (8,145,000) | |

There was no incentive fee for 2022 because the increase in the Company’s net worth did not exceed the hurdle and the high-water mark.

The Company also holds the majority of its investments by means of limited partner interests in The Lion Fund, L.P., and The Lion Fund II, L.P. (the “investment partnerships”). The investment partnerships are managed by Biglari Capital, a private investment firm founded and owned by Mr. Biglari. As Chairman of Biglari Capital, the general partner of these investment partnerships, he is responsible for their investment activities. The fees paid to the general partner are tied to the performance of the investment partnerships. Mr. Biglari has indicated that the hurdle rate will remain the same even though interest rates have generally declined since the year 2000, when he founded The Lion Fund.

The general partner of the investment partnerships, Biglari Capital, charges Biglari Holdings a performance fee predicated solely on investment gains, not assets under management. Income from the investment partnerships is excluded in the calculation of Mr. Biglari’s incentive compensation under the Incentive Agreement. In other words, there is no “double dipping,” with fees paid at the partnership level and then at the holding company level. The investments in the investment partnerships are more fully described under “Related Person Transactions.”

Mr. Biglari’s incentive compensation is entirely affected by the aggregate profits of the Corporation, much in the way shareholders are affected by its aggregate results in the long term.

Controller

Factors considered by Mr. Biglari in setting Bruce Lewis’s compensation are typically subjective, such as his perception of Mr. Lewis’s performance and any changes in functional responsibility.

Other

Mr. Biglari also sets the compensation for each of the CEOs of Biglari Holdings’ significant operating businesses. He utilizes many different incentive arrangements, with their terms dependent on such elements as the economic potential or capital intensity of the business. The incentives can be large and are always tied to the operating results over which a CEO has authority and control.

Pay Ratio

As required by Section 953(b) of the Dodd-Frank Wall Street Reform and Consumer Protection Act, and Item 402(u) of Regulation S-K, we are providing the following information about the relationship between the annual total compensation of our domestic employees and the annual total compensation of Mr. Biglari, Chairman and Chief Executive Officer.

The median employee compensation was determined using 2022 W-2 wages for all U.S. employees, and equivalent taxable compensation for all non-U.S. employees was excluded. The median employee determination included all domestic employees who were employed during 2022. The median employee compensation was $12,596. Our median compensated employee works part-time. Therefore, the ratio of the Chief Executive Officer’s compensation ($900,000) to that of the median employee (i.e., a part-time employee) was approximately 71 to 1.

Pay Versus Performance

The following table sets forth information concerning the compensation of our named executive officers for the two years ended December 31, 2022, and our financial performance for each such year.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year | | Summary Compensation Table Total for PEO(1) | | Compensation Actually Paid to PEO(1) | | Average Summary Compensation Table Total for Non-PEO NEOs(2) | | Average Compensation Actually Paid to Non-PEO NEOs(2) | | Value of Initial Fixed $100 Investment Based on Total Shareholder Return | | Net Income (Loss) | | Net Income (Loss) Excluding Partnerships(3) |

| | | | | | | | | | | | | | |

| 2022 | | $ | 900,000 | | | $ | 900,000 | | | $ | 1,040,000 | | | $ | 1,040,000 | | | $ | 122.30 | | | $ | (32,018,000) | | | $ | 24,606,000 | |

| 2021 | | 900,000 | | | 900,000 | | | 1,005,000 | | | 1,005,000 | | | 124.61 | | | 35,478,000 | | | 26,579,000 | |

(1) The principal executive officer (“PEO”) listed in the table is Sardar Biglari, Chairman and Chief Executive Officer.

(2) The Non-PEO named executive officer (“NEO”) listed is Bruce Lewis, Controller.

(3) Compensation is primarily linked to net income excluding partnerships.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

During 2022, the Compensation Committee of the Board consisted of Kenneth R. Cooper, Ruth J. Person, and John G. Cardwell. None of these individuals has at any time been an officer or employee of the Corporation. During 2022, none of our executive officers served as a member of the board of directors or on the compensation committee of any entity for which a member of our Board or Compensation Committee served as an executive officer.

COMPENSATION COMMITTEE REPORT

The Compensation Committee of the Board is currently composed of the persons identified below. The Committee has reviewed and discussed with management the Compensation Discussion and Analysis contained in this proxy statement on pages 9, 10, 11, 12 and 13. Based on the Committee’s review and discussions with management, it recommended to the Board that the Compensation Discussion and Analysis be included in this proxy statement.

Submitted by the members of the Committee.

Kenneth R. Cooper, Chairman

John G. Cardwell

Ruth J. Person

AMOUNT AND NATURE OF BENEFICIAL OWNERSHIP

Security Ownership of Directors and Management

The following table shows the total number of shares of our Class A and Class B common stock beneficially owned as of March 7, 2023, and the percentage of outstanding shares for (i) each director and nominee, (ii) each Named Executive Officer, and (iii) all directors and executive officers, as a group.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Title of Class of Stock | | Shares Beneficially Owned | | Percentage of Voting Power of Class A | | Percentage of Aggregate Economic Interest of Class A and Class B |

| | | | | | | | |

| Sardar Biglari | | Class A | | 145,700 | (1) | 70.4% | | 66.2% |

| | Class B | | 1,327,854 | (2) | | | |

| Philip L. Cooley | | Class A | | 744 | (3) | * | | * |

| | Class B | | 7,474 | (4) | | | |

| Ruth J. Person | | Class A | | 51 | | * | | * |

| | Class B | | 511 | | | | |

| Kenneth R. Cooper | | Class A | | 32 | | * | | * |

| | Class B | | 321 | | | | |

| Edmund B. Campbell, III | | Class A | | 27 | (5) | * | | * |

| | Class B | | 275 | (5) | | | |

| John G. Cardwell | | Class A | | — | | — | | * |

| | Class B | | 700 | (6) | | | |

| Bruce Lewis | | Class A | | — | | — | | — |

| | Class B | | — | | | | |

| Directors and executive | | Class A | | 146,554 | | 70.9% | | 66.7% |

| officers as a group (7 persons) | | Class B | | 1,337,135 | | | | |

* Less than 1%

(1) Includes 120,036.7 shares owned directly by The Lion Fund, 25,663.1 shares owned directly by Biglari Capital Corp., and 0.1 share owned directly by Mr. Biglari. Mr. Biglari has the sole power to vote and dispose of the shares beneficially owned by the foregoing. Mr. Biglari disclaims beneficial ownership of the shares that he does not directly own. See also footnote 1 to the table below.

(2) Includes 1,255,998 shares owned directly by The Lion Fund, 71,855 shares owned directly by Biglari Capital Corp., and one share owned directly by Mr. Biglari. Mr. Biglari has the sole power to vote and dispose of the shares beneficially owned by the foregoing. The Class B common stock is non-voting. Mr. Biglari disclaims beneficial ownership of the shares that he does not directly own.

(3) Includes 80.0 shares owned by Dr. Cooley’s spouse. Dr. Cooley disclaims beneficial ownership of such shares except to the extent of his pecuniary interest therein.

(4) Includes 814 shares owned by Dr. Cooley’s spouse. Dr. Cooley disclaims beneficial ownership of such shares except to the extent of his pecuniary interest therein.

(5) Shares held by Mr. Campbell and his wife as joint tenants in common in the Edmund B. Campbell Revocable Trust & Debbie A. Campbell Revocable Trust. Mr. Campbell disclaims beneficial ownership of such shares except to the extent of his pecuniary interest therein.

(6) Shares owned by the John G and Beverly A Cardwell Family Living Trust of 2007, of which John G. Cardwell is a Trustee. Mr. Cardwell disclaims beneficial ownership of such shares except to the extent of his pecuniary interest therein.

Security Ownership of 5% Beneficial Owners

The following table shows, as of March 7, 2023, the number and percentage of outstanding shares of our Class A common stock beneficially owned by each person or entity known to be the beneficial owner of more than 5% of our Class A common stock, which is our only class of voting stock.

| | | | | | | | | | | | | | |

| Name & Address of Beneficial Owner | | Amount and Nature of Beneficial Ownership | | Percent of Class |

Biglari Capital Corp. 19100 Ridgewood Parkway, Suite 1200 San Antonio, TX 78259 | | 145,700 (1) | | 70.4% |

GAMCO Investors, Inc. One Corporate Center Rye, NY 10580-1435 | | 15,689 (2) | | 7.6% |

(1) This information was obtained from a Schedule 13D/A filed with the SEC on June 13, 2022. In aggregate, 120,036.7 shares are owned directly by The Lion Fund and 25,663.1 shares are owned directly by Biglari Capital. Each of Biglari Capital, as the general partner of The Lion Fund and Sardar Biglari, as Chairman and Chief Executive Officer of Biglari Capital, has sole power to vote and dispose of the shares owned by The Lion Fund and Sardar Biglari has sole power to vote and dispose of the shares owned by Biglari Capital. Each of Biglari Capital and Mr. Biglari disclaims beneficial ownership of the shares that he or it does not directly own.

(2) This information was obtained from a Schedule 13D/A filed with the SEC on April 5, 2022. GAMCO Asset Management Inc. reported that it has sole voting and dispositive power with respect to 14,189 shares of Class A common stock. Gabelli Funds LLC reported that it has sole voting and dispositive power with respect to 1,500 shares of Class A common stock.

As of March 7, 2023, Biglari Capital Corp. beneficially owned 1,327,853 shares of our Class B common stock, which is 64.2% of the outstanding Class B shares.

RELATED PERSON TRANSACTIONS

Policy Regarding Related Person Transactions

The Compensation Committee reviews each related person transaction (as defined below) and determines whether it will approve or ratify that transaction based on whether the transaction is in the best interests of the Company and its shareholders. Any Board member who has any interest (actual or perceived) will not be involved in the consideration.

A “related person transaction” is any transaction, arrangement, or relationship in which we are a participant; the related person (defined below) had, has, or will have a direct or indirect material interest; and the aggregate amount involved is expected to exceed $120,000 in any calendar year. “Related person” includes (a) any person who is or was (at any time during the last fiscal year) an officer, director, or nominee for election as a director; (b) any person or group who is a beneficial owner of more than 5% of our voting securities; (c) any immediate family member of a person described in provisions (a) or (b) of this sentence; or (d) any entity in which any of the foregoing persons is employed, is a partner, or has a greater than 5% beneficial ownership interest.

In determining whether a related person transaction will be approved or ratified, the Committee may consider factors such as (a) the extent of the related person’s interest in the transaction; (b) the availability of other sources of comparable products or services; (c) whether the terms are competitive with terms generally available in similar transactions with persons that are not related persons; (d) the benefit to us; and (e) the aggregate value of the transaction.

Investment Partnerships

Since the year 2000, Mr. Biglari has served as Chairman of Biglari Capital, general partner of the investment partnerships. Biglari Capital is solely owned by Mr. Biglari.

Biglari Capital, in its capacity as general partner, receives an annual incentive reallocation for the Company’s investments in the investment partnerships equal to 25% of the net profits above a hurdle rate of 6% over the previous high-water mark. Unlike the typical arrangement in the industry, Biglari Capital does not receive any fees based on assets under management; its fees are predicated solely on investment gains. High-water marks are tracked individually for each partner and for each partner contribution. Biglari Holdings and its subsidiaries have made investments into the partnerships over time, with each investment separately tracked. The capital contributions made in 2020 earned a profit in excess of the hurdle rate, resulting in an incentive fee of $986,561 that year. Based on Mr. Biglari’s recommendation to the Board, which it approved, in 2021 an amendment was made in the partnership agreements to aggregate the accounts so that eligibility for incentive fees would only occur once aggregate losses were recovered. By aggregating all accounts, there will not be an incentive fee payment out of individual accounts until the aggregate high-water mark is satisfied. Thus, there was no incentive reallocation from Biglari Holdings to Biglari Capital in 2021 or 2022. An incentive reallocation to Biglari Capital is determined as of December 31 of each year. There were no incentive reallocations from Biglari Holdings to Biglari Capital during 2017, 2018, 2019, 2021 or 2022.

As of December 31, 2022, the fair value of the Company’s investments in the partnerships was $383,004,000. As stated above, an amendment was made in the partnership agreements so that, unlike most investment limited partnerships, Biglari Holdings would aggregate the prior losses of each of its investments when calculating the high-water mark. As a result, the partnerships would need to recover losses of $221,535,000 before Biglari Capital would be entitled to an incentive fee. Such an arrangement is virtually unheard of in the hedge fund universe, where there is both a management fee and a fee based on a percent of profits; the typical arrangement is a 1-2% management fee of principal paid each year and 20% of the profits, absent a hurdle rate. If there is a hurdle rate, there usually is not a high-water mark, and vice versa. And accounts are almost never aggregated. By contrast, the Board has attempted to create one of the best investment partnership arrangements in the country.

Service Agreement

During 2017, the Company entered into a service agreement with Biglari Enterprises LLC and Biglari Capital (collectively, the “Biglari Entities”) under which the Biglari Entities provide certain business services to the Company, including related personnel, related legal, related proxy contest, related travel, and other related administrative expenses. The Board finds the arrangement to be an efficient form of contracting. The service agreement has a five-year rolling term. The fixed fee of $700,000 per month can be adjusted annually although it has remained the same since its inception and through year-end 2022. The Company paid Biglari Enterprises $8,400,000 per annum in service fees during 2022 and 2021. The Board reviews the costs against the benefits of the service agreement.

The Board believes that shareholders can ascertain the relative benefits by reviewing total general administrative expenses, which have declined since 2016 and the last two years were more in line with those of fiscal 2007. In the fiscal year-end prior to the time present management assumed responsibility, general and administration expenses for the corporation totaled $57.5 million. Over the ensuing fourteen years — that is, since present management took control — six businesses have been acquired through negotiated transactions, ranging from oil and gas to insurance, among other investments. General administrative expenses include the $8.4 million service agreement. Since 2016, the Corporation’s general and administrative expenses have declined.

The service agreement does not alter the hurdle rate connected with the incentive reallocation paid to Biglari Capital by the Company. The Biglari Entities are owned by Mr. Biglari.

Services Provided by Family Members of Mr. Biglari

Shawn Biglari, Sardar Biglari’s brother, is employed as senior vice president of franchise partnerships for Steak n Shake. Shawn Biglari received $289,455 in compensation from the Company during 2022. Ken Biglari, Sardar Biglari’s father, is a consultant to Steak n Shake. Ken Biglari received $160,000 in consulting fees in connection with marketing and international initiatives from the Company during 2022.

Except as set forth above, there are no transactions that required disclosure pursuant to Item 404(a) of Regulation S-K promulgated under the Securities Act.

INDEPENDENT PUBLIC ACCOUNTANTS

Deloitte & Touche LLP has advised us of the following amounts for services for 2022 and 2021.

| | | | | | | | | | | | | | |

| Type of Fee | | 2022 | | 2021 |

Audit Fees(1) | | $ | 985,000 | | | $ | 975,000 | |

Audit-Related Fees(2) | | 70,000 | | | 62,000 | |

Tax Fees(3) | | — | | | — | |

All Other Fees(4) | | — | | | — | |

| Total Fees | | $ | 1,055,000 | | | $ | 1,037,000 | |

| | | | |

(1) Audit Fees include fees for services performed for the audit of our annual financial statements, including services related to Section 404 of the Sarbanes-Oxley Act and the review of financial statements included in our Form 10-Q filings, Form 10-K filing, registration statements, comment letters, and services that are normally provided in connection with statutory or regulatory filings or engagements. Billings not finalized at the time of filing are included in the year paid.

(2) Audit-Related Fees include fees for assurance and related services performed that are reasonably related to the performance of the audit or the review of our financial statements. This includes services provided to audit Steak n Shake’s 401(k) Plan.

(3) Deloitte & Touche LLP did not provide any tax consulting services during the periods.

(4) Deloitte & Touche LLP did not provide any “other services” during the periods.

The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by the independent registered public accounting firm. These services may include audit services, audit-related services, tax services, and other services. Pre-approval is generally provided for up to one year, and any pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. The independent auditor and management are required to report periodically to the Audit Committee regarding the extent of services provided by the independent auditor in accordance with this pre-approval, and the fees for the services performed to date. The Audit Committee may also pre-approve particular services on a case-by-case basis. In each of 2022 and 2021, the Audit Committee pre-approved the services reported above.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee has reviewed and discussed the consolidated financial statements of the Corporation and its subsidiaries set forth in Item 8 of the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2022, with management of the Corporation and Deloitte & Touche LLP, independent public accountants for the Corporation.

The Audit Committee has discussed with Deloitte & Touche LLP the matters required by accounting principles generally accepted in the United States of America, and standards of the Public Company Accounting Oversight Board, including those described in Auditing Standard No. 1301, “Communications with Audit Committees.” In addition, the Audit Committee has received the written disclosures and the letter from Deloitte & Touche LLP satisfying the applicable Public Company Accounting Oversight Board requirements for independent accountant communications with audit committees with respect to auditor independence, and has discussed with Deloitte & Touche LLP its independence from the Corporation.

Based on the review and discussions with management of the Corporation and Deloitte & Touche LLP referred to above, the Audit Committee recommended to the Board that the Corporation include the consolidated financial statements of the Corporation and its subsidiaries for the year ended December 31, 2022, in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2022.

It is not the duty of the Audit Committee to plan or conduct audits or to determine that the Corporation’s financial statements are complete and accurate and in accordance with generally accepted accounting principles; that is the responsibility of management and the Corporation’s independent public accountants. In giving its recommendation to the Board, the Audit Committee has relied on (i) management’s representation that such financial statements have been prepared with integrity and objectivity and in conformity with generally accepted accounting principles, and (ii) the reports of the Corporation’s independent public accountants with respect to such financial statements.

Submitted by the members of the Audit Committee of the Board.

Kenneth R. Cooper, Chairman

Ruth J. Person

John G. Cardwell

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this proxy statement constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and are including this statement for purposes of invoking these safe harbor provisions.

Forward-looking statements involve known and unknown risks, uncertainties, and other important factors that could cause our actual results, performance, or achievements to differ materially from our expectations of future results, performance, or achievements expressed or implied by these forward-looking statements. In addition, our past results of operations do not necessarily indicate our future results.

ANNUAL REPORT

A copy of the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2022, as is required to be filed with the SEC, excluding exhibits, will be mailed to shareholders without charge upon written request to the Secretary of the Corporation at 19100 Ridgewood Parkway, Suite 1200, San Antonio, Texas 78259. Such request must set forth a good-faith representation that the requesting party was either a holder of record or a beneficial owner of the common stock of the Corporation on the record date for the Annual Meeting. Exhibits to the Form 10-K will be mailed upon similar request and payment of specified fees. The Corporation’s Form 10-K is also available through the SEC’s website (sec.gov).

PROPOSALS BY SHAREHOLDERS

Any shareholder proposal intended to be considered for inclusion in the proxy statement for presentation at the 2024 Annual Meeting must be received by the Corporation by November 23, 2023. The proposal must be in accordance with the provisions of Rule 14a-8 promulgated by the SEC under the Exchange Act.

In addition, the Company’s Amended and Restated By-laws contain an advance notice provision requiring that, if a shareholder wants to present a proposal (including a nomination) at an annual meeting of shareholders, the shareholder must give timely notice thereof in writing to the Secretary of the Corporation. To be timely, a shareholder’s notice must be delivered to, or mailed and received at, the principal executive offices of the Corporation not less than 90 days nor more than 120 days prior to the one-year anniversary of the preceding year’s annual meeting. Accordingly, for our 2024 annual meeting of shareholders, notice of a proposal (including a nomination) must be delivered to us no earlier than December 22, 2023, and no later than January 21, 2024. If the date of the annual meeting is more than 30 days before or more than 60 days after such anniversary date, notice by the shareholder to be timely must be so delivered, or mailed and received, not later than the 90th day prior to such annual meeting or, if later, the 10th day following the day on which public disclosure of the date of such annual meeting was first made.

OTHER MATTERS

As of the date of this proxy statement, our Board does not know of any matter that will be presented for consideration at the Annual Meeting other than as described in this proxy statement. As to other business that may properly come before the Annual Meeting, it is intended that proxies properly executed and returned will be voted in respect thereof at the discretion of the person voting the proxies in accordance with his best judgment.

By order of the Board of Directors

SARDAR BIGLARI, Chairman

San Antonio, Texas

March 27, 2023

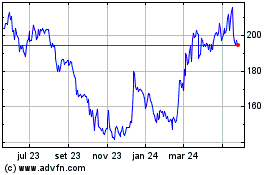

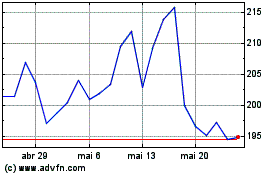

Biglari (NYSE:BH)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Biglari (NYSE:BH)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024