Current Report Filing (8-k)

22 Junho 2023 - 10:27AM

Edgar (US Regulatory)

0000924168FALSE12/31ENERGY FOCUS, INC/DE00009241682023-06-152023-06-1500009241682023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): June 15, 2023

ENERGY FOCUS, INC.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| Delaware | | 001-36583 | | 94-3021850 |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

| | | | | | | | | | | |

| 32000 Aurora Road Suite B | Solon | OH | 44139 |

| (Address of principal executive offices) | (Zip Code) |

(440) 715-1300

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading

Symbol(s) | Name of each exchange

on which registered |

| Common Stock, par value $0.0001 per share | EFOI | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.03 Material Modifications of Rights of Security Holders.

To the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 below is incorporated herein by reference.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

As discussed below, at the Annual Meeting of Stockholders held on June 15, 2023 (the “Annual Meeting”), the stockholders of Energy Focus, Inc. (the “Company”) approved a form of the certificate of amendment (the “Certificate of Amendment”) to the Company’s Certificate of Incorporation, as amended (the “Certificate of Incorporation”), and authorized the board of directors of the Company (the “Board”) to amend the Certificate of Incorporation to effect a reverse stock split of the outstanding shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), at a ratio ranging from any whole number of at least 1-for-2 and up to 1-for-10, with the exact ratio within the foregoing range to be determined by the Board in its sole discretion (the “Reverse Stock Split”).

On June 15, 2023, the Board determined to set the Reverse Stock Split ratio at 1-for-7 (the “Split Ratio”). The Certificate of Amendment was filed with the Secretary of State of the State of Delaware on June 15, 2023, and the Reverse Stock Split became effective at 5:00 pm Eastern time on June 16, 2023 (the “Effective Time”). At the Effective Time, every seven shares of Common Stock issued and outstanding automatically combined into one validly issued, fully paid and non-assessable share of Common Stock. No fractional shares will be issued as a result of the Reverse Stock Split. Any stockholder that would otherwise hold a fractional share as a result of the Reverse Stock Split will be entitled to receive, upon surrender to the exchange agent of the certificate(s) representing its pre-split shares or upon conversion of its shares held in book-entry form, a cash payment equal to the fraction to which the stockholder would otherwise be entitled, multiplied by the closing trading price of the Common Stock on The Nasdaq Stock Market (“Nasdaq”) on June 16, 2023 (as adjusted to give effect to the Reverse Stock Split). The $0.0001 par value per share of Common Stock and other terms of the Common Stock are not affected by the Reverse Stock Split. The Reverse Stock Split will reduce the number of shares of Common Stock outstanding from approximately 19.2 million shares to approximately 2.7 million shares, subject to adjustment for the payment of cash in lieu of fractional shares. The number of authorized shares of Common Stock under the Certificate of Incorporation will remain unchanged at 50,000,000 shares.

The Company’s outstanding options and warrants entitling the holders to purchase shares of Common Stock will be adjusted as a result of the Reverse Stock Split, as required by the terms of these securities. Also, the number of shares reserved for issuance under the Company’s existing 2020 Stock Incentive Plan, as amended, and the Company’s 2013 Employee Stock Purchase Plan will be reduced proportionately based on the Split Ratio.

The Common Stock began trading on Nasdaq on a split-adjusted basis at the opening of trading on June 20, 2023. There will be no change in the Company’s Nasdaq ticker symbol, “EFOI”. Following the Reverse Stock Split, the new CUSIP number for the Common Stock is 29268T508.

The above description of the Certificate of Amendment is a summary of the terms thereof and is qualified in its entirety by reference to the full text of the Certificate of Amendment, a copy of which is filed as Exhibit 3.1 hereto and is incorporated herein by reference.

Item 5.07 Submission of Matters to a Vote of Security Holders.

The Company held the Annual Meeting on June 15, 2023. Set forth below are the four proposals that were voted on at the Annual Meeting and the stockholder votes on each such proposal, as certified by the inspector of elections for the Annual Meeting. These proposals are described in further detail in the Company’s Definitive Proxy Statement filed with the Securities and Exchange Commission on May 1, 2023.

As of April 18, 2023, the record date for the Annual Meeting, there were 19,243,610 shares of Common Stock (entitled to one vote per share) and 876,447 shares of the Company’s Series A Convertible Preferred Stock (entitled to 0.11074 of a vote per share) issued, outstanding and entitled to vote. Shares of Common Stock and Series A

Convertible Preferred Stock representing 67.13% of the voting power of the Company’s stockholders were represented at the meeting.

With respect to the proposals, the results of the voting were as follows:

Proposal 1: Election of Directors:

| | | | | | | | | | | |

| Director Nominees | For | Withheld | Broker Non-Votes |

| Wen-Jeng Chang | 9,594,060 | 922,485 | 2,468,065 |

| Jennifer Cheng | 3,919,240 | 6,597,305 | 2,468,065 |

| K.R. “Kaj” den Daas | 4,255,934 | 6,260,611 | 2,468,065 |

| Jay (Chiao Chieh) Huang | 9,691,075 | 825,470 | 2,468,065 |

| Gina (Mei Yun) Huang | 9,701,856 | 814,689 | 2,468,065 |

| Brian Lagarto | 4,267,535 | 6,249,010 | 2,468,065 |

| Jeffery Parker | 4,258,999 | 6,257,546 | 2,468,065 |

| Stephen Socolof | 3,932,739 | 6,583,806 | 2,468,065 |

The eight Directors listed above were elected to serve until the next annual meeting or until their respective successors are duly elected or appointed.

Proposal 2: Approval of a discretionary amendment to the Company’s certificate of incorporation, as amended, to effect a reverse stock split of the Company’s common stock at a ratio of at least 1-for-2 and up to 1-for-10, with the exact ratio within the foregoing range to be determined by the Company’s board of directors:

| | | | | | | | | |

| For | Against | Abstain | |

| 11,730,677 | 1,239,831 | 14,102 | |

Proposal 3: Ratification of the appointment of GBQ Partners LLC as the Company’s independent registered public accounting firm for the year ending December 31, 2023:

| | | | | | | | | |

| For | Against | Abstain | |

| 9,906,835 | 3,068,055 | 9,720 | |

Proposal 4: Approval, on an advisory basis, of the compensation of our named executive officers:

| | | | | | | | | | | |

| For | Against | Abstain | Broker Non-Votes |

| 7,973,490 | 2,501,004 | 42,051 | 2,468,065 |

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit | |

| Number | Description |

| |

| 3.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Dated: June 22, 2023 | | |

| | |

| | |

| ENERGY FOCUS, INC. |

| |

| |

| By: | /s/ Lesley A. Matt |

| Name: | Lesley A. Matt |

| Title: | Chief Executive Officer |

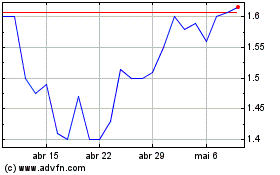

Energy Focus (NASDAQ:EFOI)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Energy Focus (NASDAQ:EFOI)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024